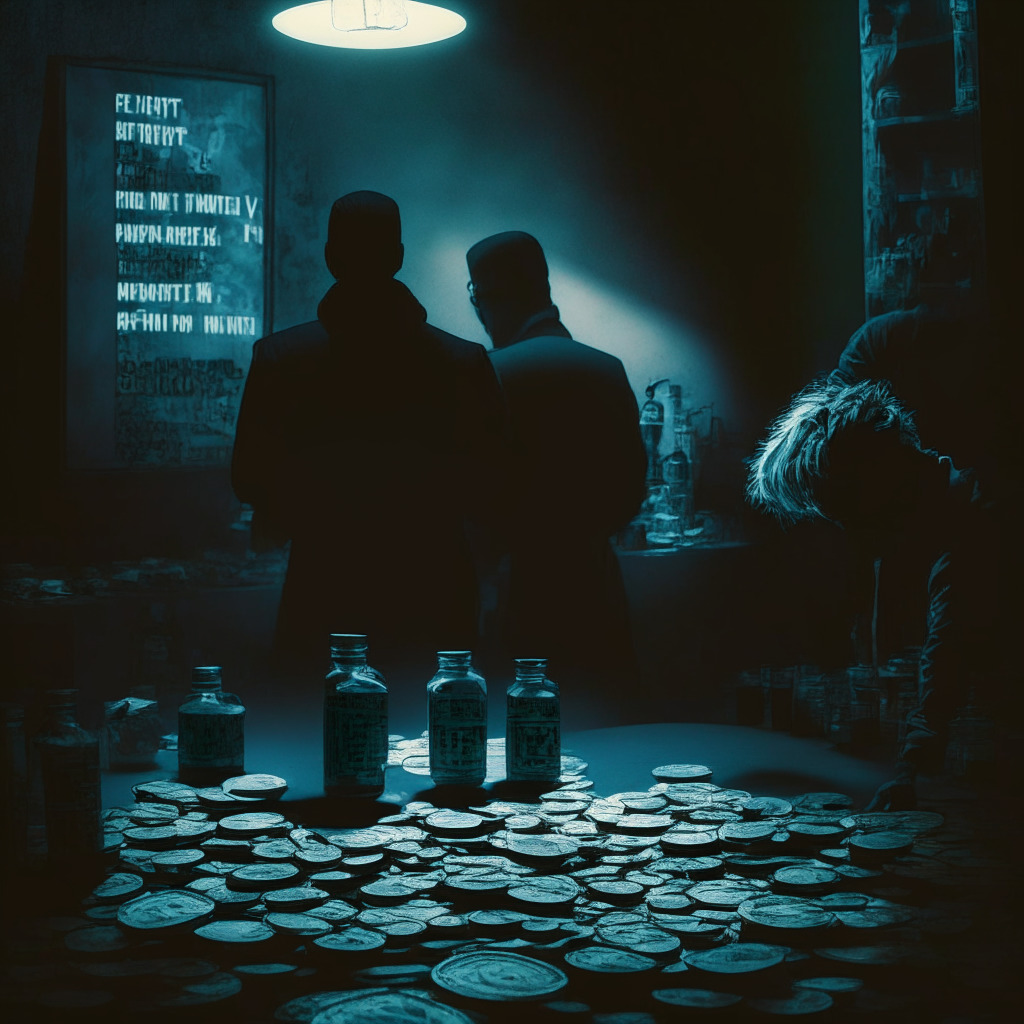

In a recent Senate hearing, U.S. Sen. Elizabeth Warren (D-Mass.) brought to light the connection between cryptocurrency and the Chinese fentanyl trade, emphasizing the need for legislation to dismantle this dangerous linkage. According to data provided by research firm Elliptic, over 90 Chinese businesses offer to ship fentanyl precursors, with the majority accepting cryptocurrency as payment.

Elizabeth Rosenberg, the U.S. Treasury Department’s assistant secretary for terrorist financing and financial crimes, testified that bitcoin payments and cryptocurrency wallets are increasingly being used by illicit drug organizations. The allure of cryptocurrencies for these criminals lies in the element of pseudonymity it provides.

Fentanyl, an opioid 100 times more potent than morphine according to the Drug Enforcement Administration (DEA), has become the leading cause of overdose-related deaths for individuals aged 18-45. The chemicals needed for the production of this lethal drug often originate in China before traversing multiple borders to reach users in the US.

Senator Warren has proposed the Digital Asset Anti-Money Laundering Act as a potential solution for halting cryptocurrency payments involved in the fentanyl trade. The bill is set to be reintroduced in the current Congress. Warren strongly believes that implementing effective legislation can help disrupt the flow of funds to those dealing in the dangerous drug.

While the senator’s intentions to curtail the fentanyl trade are commendable, some may argue that focusing solely on cryptocurrency’s role in this issue overlooks other means of financing utilized by criminals. Traditional banking methods are not exempt from being used for such transactions, potentially shifting the blame disproportionately onto the blockchain and cryptocurrency sector.

Moreover, the push for stringent regulation in the cryptocurrency space has the potential to stifle innovation and discourage industry growth. It is crucial to strike a balance between ensuring the safety and security of users while promoting a thriving ecosystem for blockchain technology and digital assets.

On the other hand, it cannot be denied that cryptocurrencies have enabled a new level of anonymity in financial transactions, inadvertently providing an avenue for illicit activities. Implementing sensible regulations to curb the use of digital assets for criminal purposes is necessary to maintain the legitimacy and integrity of the industry.

In conclusion, while the connection between cryptocurrency and the fentanyl trade is a cause for concern, careful consideration must be given to the potential consequences of widespread regulation on the blockchain and digital asset sector. Striking the right balance between safeguarding against criminal activities and fostering innovation will be key to realizing the full potential of this transformative technology.

Source: Coindesk