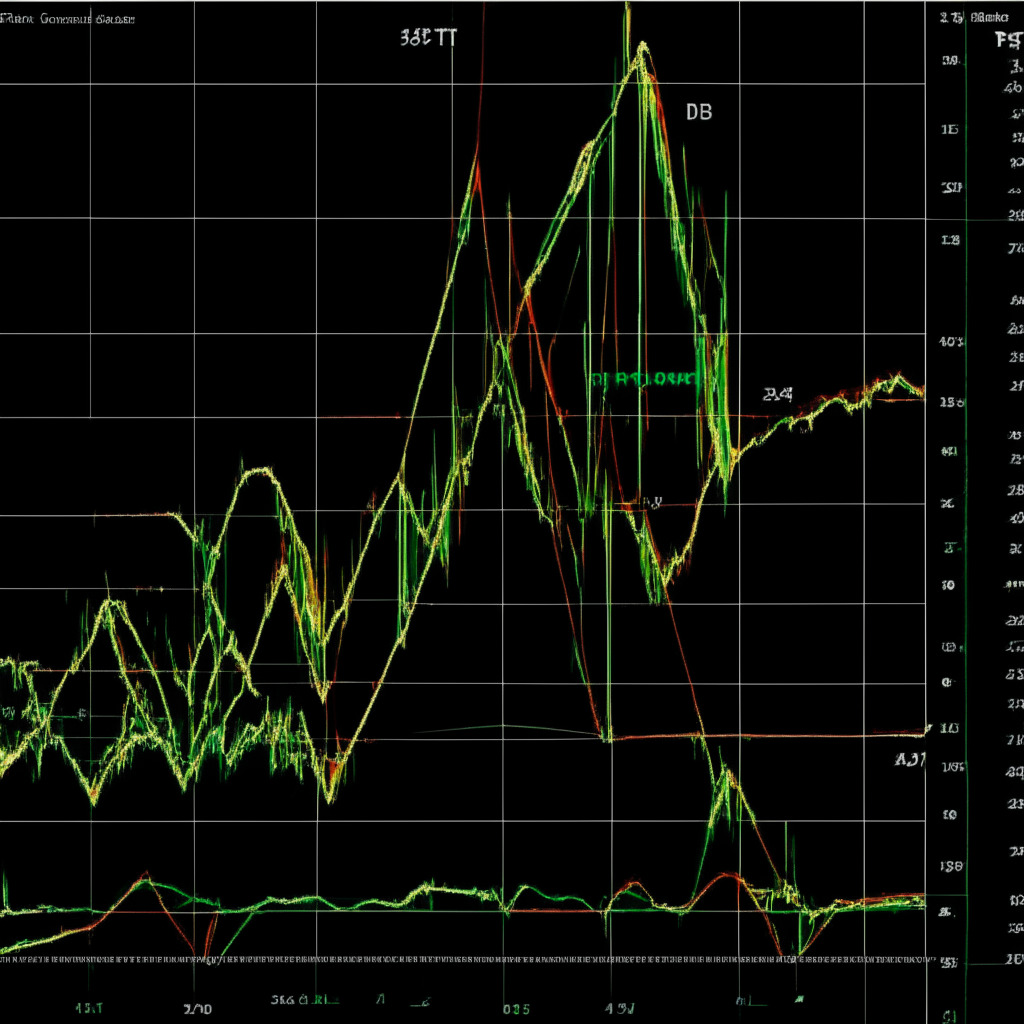

Amid the last three weeks’ consolidation, the LUNC price formed a descending triangle pattern in the 4-hour time frame. While this pattern usually accelerates the supply pressure in an asset, in rare cases, buyers express higher dominance with the breakout out of its resistance trendline. Interestingly, with an 8% price jump today, LUNC price breaks above the overhead trendline with high volume, offering buyers an opportunity to break market uncertainty.

It’s worth noting that a bullish breakout from the $0.000092 mark will set the LUNC price on a quick 10% jump. The intraday trading volume in the LUNC coin is $72 million, indicating a 396% gain. With the high momentum breakout from the triangle pattern, LUNC buyers have an opportunity to kick-start a short-term upswing to the $0.0001 mark

The current resistance level of $0.000094 plays an essential role in preventing buyers’ attempts to rise higher, prolonging the LUNC coin’s consolidation phase. If the price manages to break above this barrier, the LUNC coin could prolong its recovery rally by 10%, reaching the $0.0001 psychological barrier, linked to the resistance trendline of the falling wedge pattern.

However, this potential rally could face significant supply pressure at the $0.000092 resistance level, which might influence the coin’s price to continue sideways. To surpass the $0.0001 mark, the Terra classic coin needs to complete the wedge pattern.

Several technical indicators support this outlook, such as the Exponential Moving Average (EMA) and the Relative Strength Index (RSI). The 200-day EMA hovering near the $0.000092 level increases the resistance power, while a significant upsurge in the daily RSI slope above the 60% mark indicates high momentum buying in LUNC.

Despite the optimistic sentiment, one should consider the potential challenges and risks when investing in cryptocurrencies, such as regulatory actions and market volatility. With recent news of Binance delisting Terra Classic (LUNC) Perpetual Futures Contract, the market may experience a selloff, impacting LUNC’s price.

In conclusion, while there’s currently a high momentum breakout from the triangle pattern, it’s essential to remain cautious and conduct thorough market research before investing in cryptocurrencies, as the market is subject to fluctuations and risks that could lead to personal financial loss.

Source: Coingape