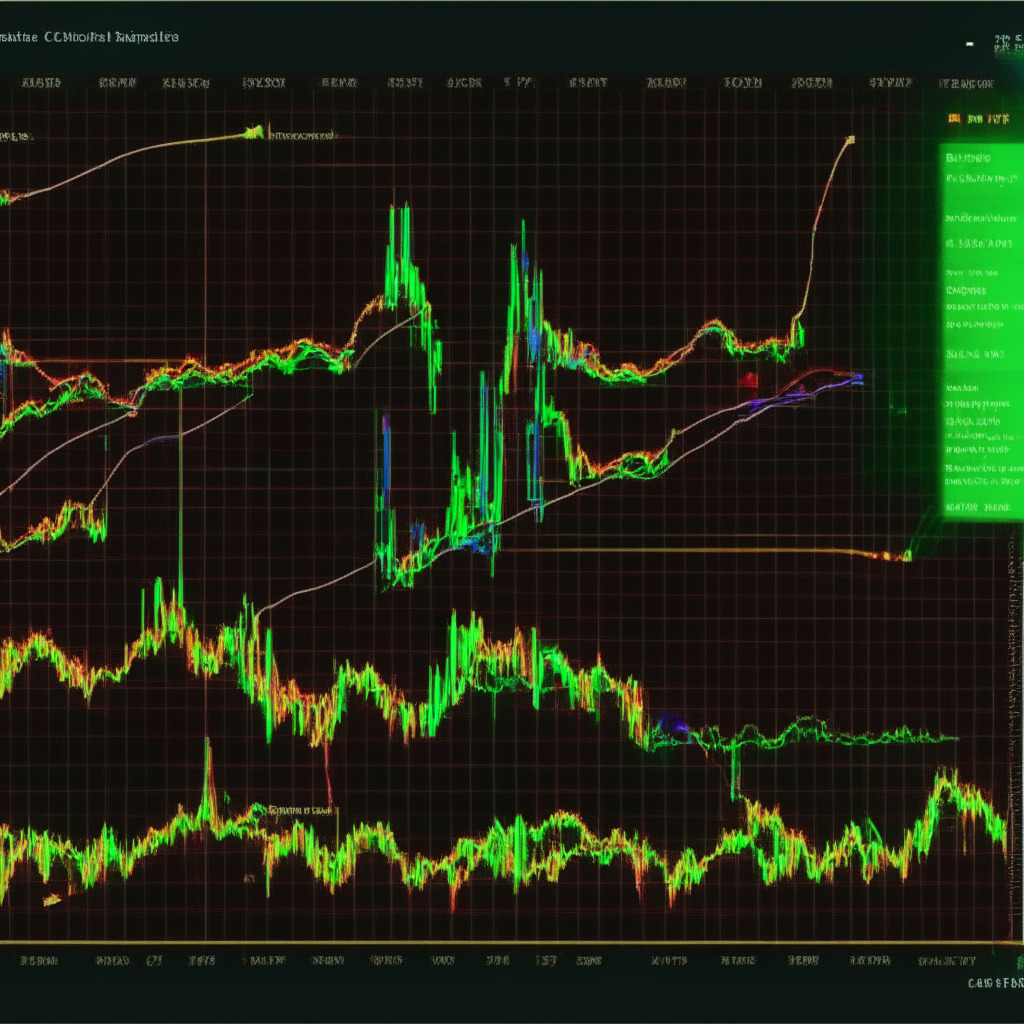

The Render token price in the daily time frame chart recently showed the formation of a rounding bottom pattern. This pattern often suggests a bottom formation in an asset and the beginning of a new uptrend. As the price action reflects a series of new higher highs and higher lows, it seems that buyers have regained trend control, which might lead to a sustained recovery rally. This development is worth noting, especially since the top 3 AI crypto coins that may follow Nvidia‘s price rally in June 2023 have already made headlines.

A long-coming trendline has been governing the ongoing recovery rally in Render coin. After a recent resistance breakout at $2.45, the path has been set for a 24% rally. Interestingly, the intraday trading volume in RNDR has been reported at $131.5 billion, indicating a 37% gain. This breakout has offered buyers a strong foundation for continuing the bullish recovery rally.

Following a minor retest, the coin price bounced back from the $2.45 flipped support and surged 8.3% higher to reach its current price of $2.67. If the uptrend continues, buyers may push the AI crypto 24% higher towards hitting the next significant resistance of $3.3, followed by $4.3 and $6.5.

On the other hand, occasional pullbacks may be used by potential buyers as an opportunity to accumulate this coin using the ascending trendline. The formation of the rounding bottom pattern has put the RNDR price on a steady recovery path, and the recent breakout from the last swing top of $2.45 suggests buyers are eager to achieve higher chart levels. If the bullish momentum persists, there might not be any major resistance until the $3.3 mark.

In terms of indicators, the upper band of the Bollinger Band challenges the upside, projecting aggressive bullish momentum. Simultaneously, a steady rise in the weekly Moving Average Convergence Divergence (MACD) indicator signifies an established uptrend in the Render coin.

It’s crucial for investors to conduct thorough market research before investing in cryptocurrencies, as the presented content represents the author’s personal opinion and is subject to market conditions. Neither the author nor the publication holds any responsibility for individual financial losses.

Source: Coingape