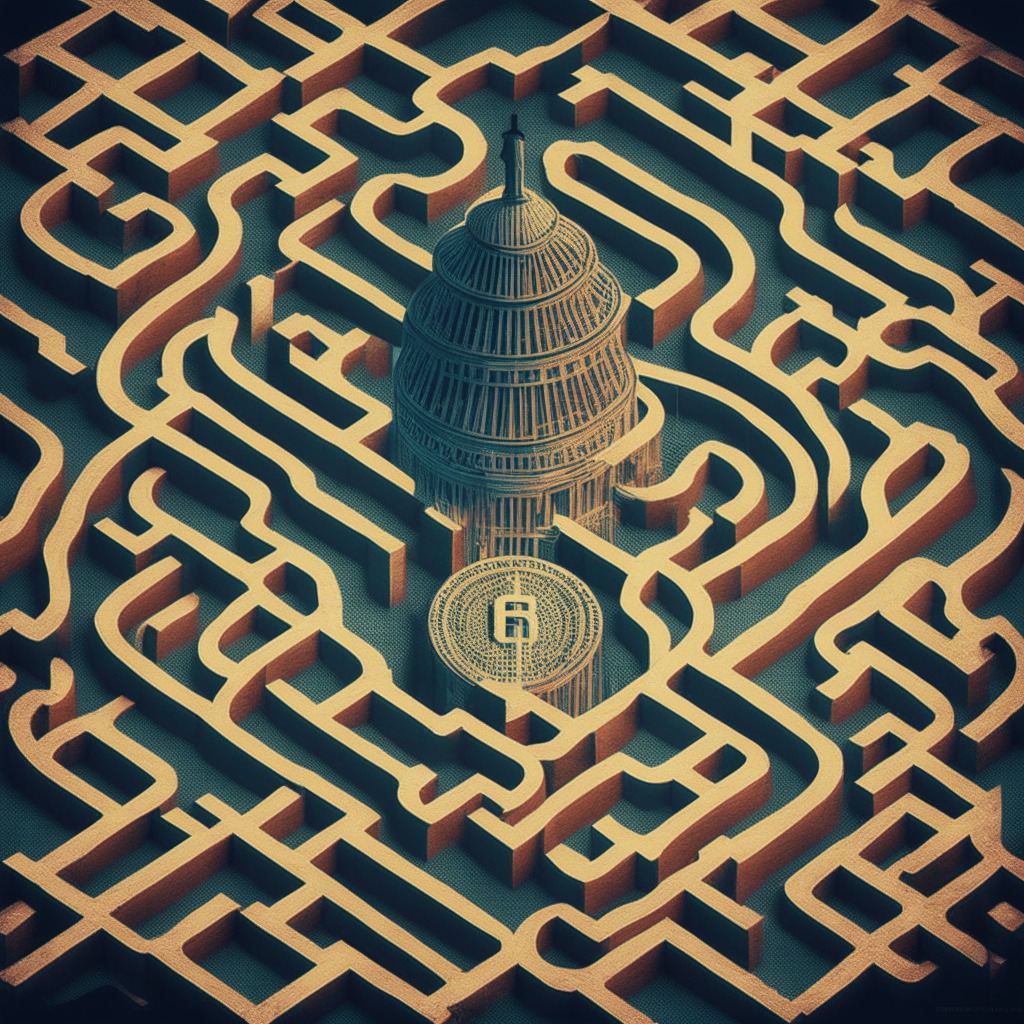

The cryptocurrency regulations landscape is evolving rapidly, which is evident from the recent legal actions against well-known exchanges Coinbase and Binance by the US Securities and Exchange Commission (SEC). Both cases illustrate the growing importance of regulatory compliance in the crypto space and how unclear guidelines may leave businesses navigating a labyrinth of complexities.

At a recent House Agriculture Committee hearing, Coinbase’s Chief Legal Officer Paul Grewal discussed the company’s past efforts to register with the SEC. Shockingly, their attempts to engage with the regulator in a dialogue were met with silence. “We were simply dismissed with no response or any counter proposal or ideas coming back from the SEC,” Grewal remarked.

The SEC’s lawsuit against Coinbase alleges that the exchange’s operations, which include its trading platform and staking rewards program, violate securities laws. As a result, the agency claims that Coinbase should have registered as an exchange, broker, or clearing agency. This legal action, which comes only a day after charging Binance, highlights the regulator’s heightened focus on crypto oversight.

In addition to the SEC’s crackdown, a multi-state task force consisting of 10 US states has launched a coordinated regulatory effort against Coinbase. Alabama, for example, claims that Coinbase’s staking rewards program does not comply with state registration requirements, further complicating matters for the exchange.

Coinbase CEO Brian Armstrong publicly criticized the SEC’s “regulation by enforcement approach,” noting that it is detrimental to American innovation. He further suggested that court intervention to gain clarity on regulatory requirements might be necessary to resolve these issues.

On the one hand, it’s imperative for companies like Coinbase to follow regulatory rules for the long-term success and stability of the cryptocurrency market. Strict enforcement can help protect users and maintain a level playing field. In other cases, it may discourage malicious actors from using crypto platforms for nefarious purposes.

On the other hand, the current approach to regulation seems to leave companies like Coinbase grappling with uncertainty. This can hinder innovation and growth within the industry, as businesses spend their resources navigating complex, and sometimes unclear, regulations rather than focusing on delivering innovative products and services.

It’s evident that there’s a growing need for clear guidelines and regulatory frameworks that provide certainty for both established businesses and newcomers to the crypto space. By fostering dialogue and collaboration between the industry and regulatory bodies, stakeholders can work together to strike a balance between driving innovation and ensuring compliance in the fast-evolving world of blockchain and cryptocurrencies.

Source: Cryptonews