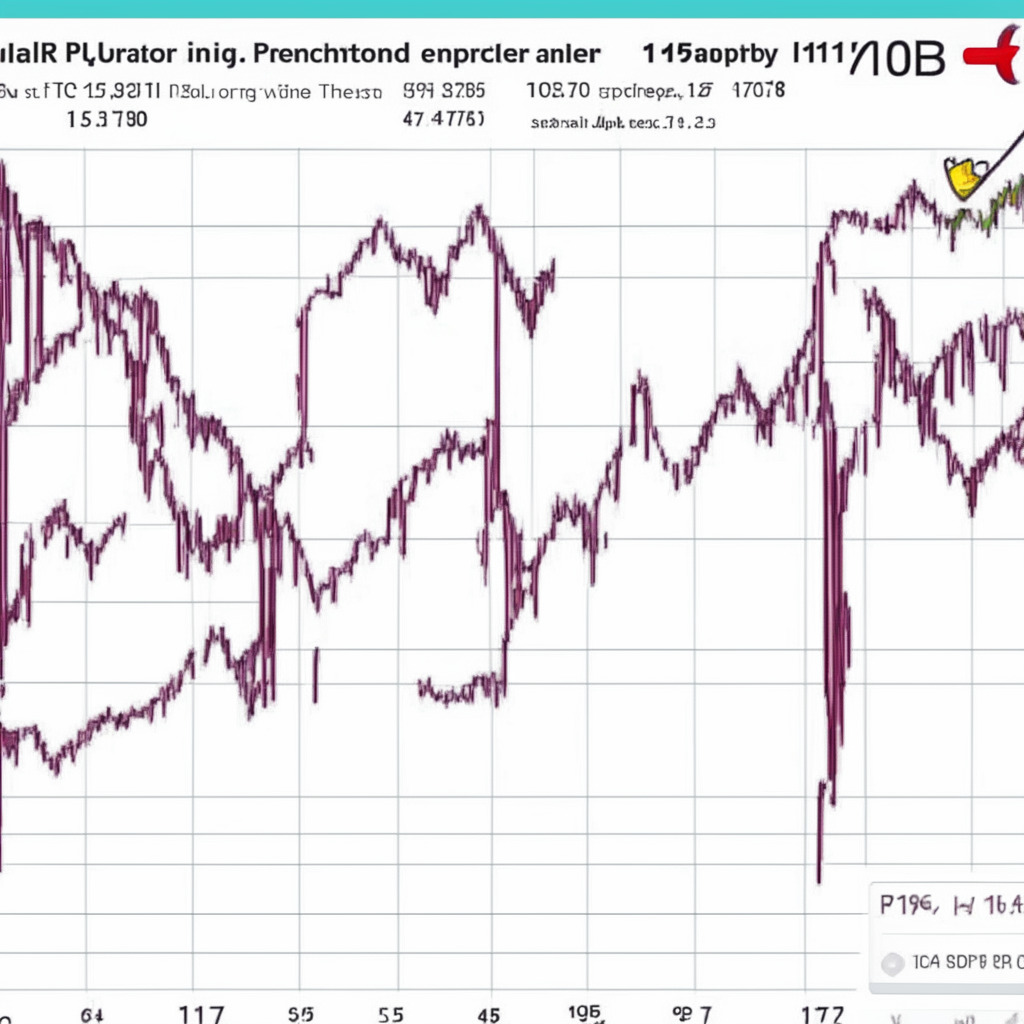

The recent bearish outlook in the crypto market has caused the Ethereum price to decline by 9.3% since last week, slipping below the monthly support of $1775-1765. This swift descent indicates that Ethereum could further plummet to a long-anticipated support trendline at $1651. Nonetheless, there is a minor obstacle at the $1700 psychological support, suggesting that a short-lived consolidation may be possible. Moreover, Ethereum’s co-founder has identified three key transitions for the network’s growth, which are worth keeping an eye on.

Analyzing the Ethereum price daily chart, it appears that the coin’s value could oscillate between $1775 and $1700 before the next significant move. The upward trendline could offer long-term buyers pullback opportunities. In contrast, the intraday trading volume in Ether stands at $5.07 billion, reflecting a modest 0.14% gain.

Following a bearish breakdown below $1765 support on June 10th, Ethereum’s price encountered instant support at $1700. The daily chart showcases a lower wick rejection at this level, signifying that demand pressure may be increasing. Consequently, the Ethereum price could experience a minor relief rally to retest the recently breached $1775 support as potential resistance.

This trading range between two pivotal chart levels may trigger minor consolidation before resuming the current downtrend. If traders encounter significant supply pressure at $1775, a fall to lower the trendline could take place within the next couple of weeks.

A retest at the dynamic supply will decide whether Ethereum is prepared for a bullish comeback or if sellers could extend the correction phase. In the midst of the current negative sentiment regarding altcoins, a downward approach seems more plausible for Ethereum. The coin’s price might see a brief consolidation due to demand pressure at the $1700 support level, but the overall downtrend could eventually push the price down to $1650, where it may find support from the long-standing trendline.

The daily Relative Strength Index (RSI) slipped into the oversold territory, indicating that selling activity has reached an extreme and consolidation might stabilize the price action. On the other hand, the daily Average Directional Index (ADX) rose by 21%, suggesting that the bearish trend has enough strength to lead to further corrections.

As always, it’s crucial to conduct thorough market research before investing in cryptocurrencies, as the presented content may include the author’s personal opinion and is subject to market conditions. Neither the author nor the publication holds any responsibility for personal financial loss resulting from investment decisions.

Source: Coingape