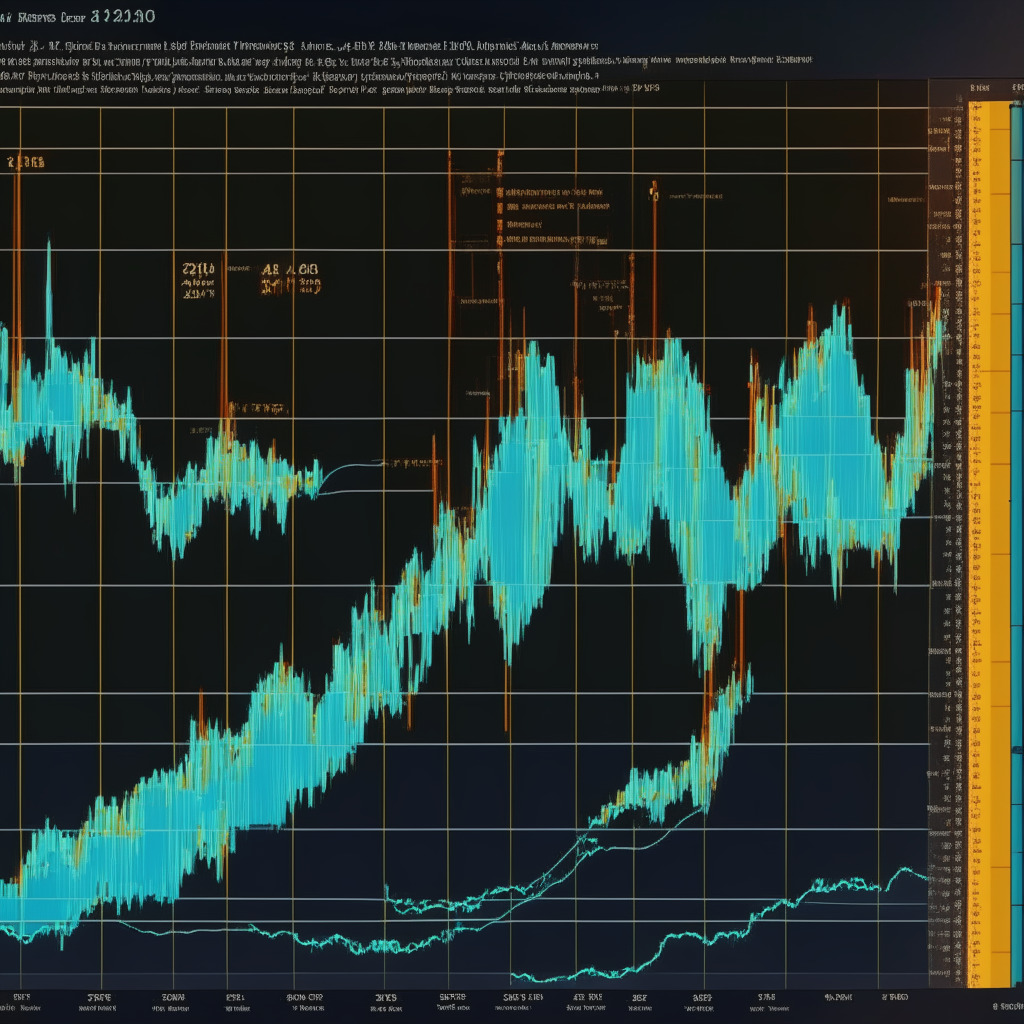

Bitcoin’s market dominance index has come close to surpassing 50% amid the recent altcoin market downturn. On June 13, the Bitcoin Dominance Index (BTC.D) reached 49.29%, slightly down from its 14-month high of 49.66% established just two days prior. This surge in Bitcoin dominance comes after the United States’ Securities and Exchange Commission’s (SEC) lawsuit against the crypto exchanges Binance and Coinbase. The commission accused many leading altcoins, including Cardano and Solana, of being “unregistered securities.”

Bitcoin’s market share typically rises during times of high market stress, as traders view it as a less volatile, non-stablecoin crypto asset compared to most cryptocurrencies. For instance, during the height of the banking crisis in March 2023, Bitcoin’s dominance versus altcoins also rebounded to 50%. There are also other factors suggesting that Bitcoin’s dominance could grow further to finally break 50%, such as DWF Labs reportedly sending millions of dollars worth of non-Bitcoin tokens to exchanges.

However, not everyone is bullish on Bitcoin’s dominance. Some analysts argue that the altcoin market may have bottomed once again, and Bitcoin will be unable to break the 50% mark. Chart technicals suggest that Bitcoin’s dominance could indeed drop in the coming weeks as altcoins rebound. Most notably, BTC.D has failed to close decisively above the 50%-mark since April 2021.

On the other hand, a breakout in Bitcoin’s dominance will be key for reaching levels not seen in over two years. For example, analyst Crypto Rover sees a classic bullish continuation setup with 52% being the next major hurdle if such a scenario unfolds.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Source: Cointelegraph