Cryptocurrency prices witnessed an upward movement on Tuesday as traders’ faith in the Federal Reserve’s decision to refrain from raising rates grew stronger following the release of a key inflation gauge. The Consumer Price Index (CPI) displayed a 4% rise in the 12 months through May, meeting economists’ expectations, as reported by the Bureau of Labor Statistics (BLS).

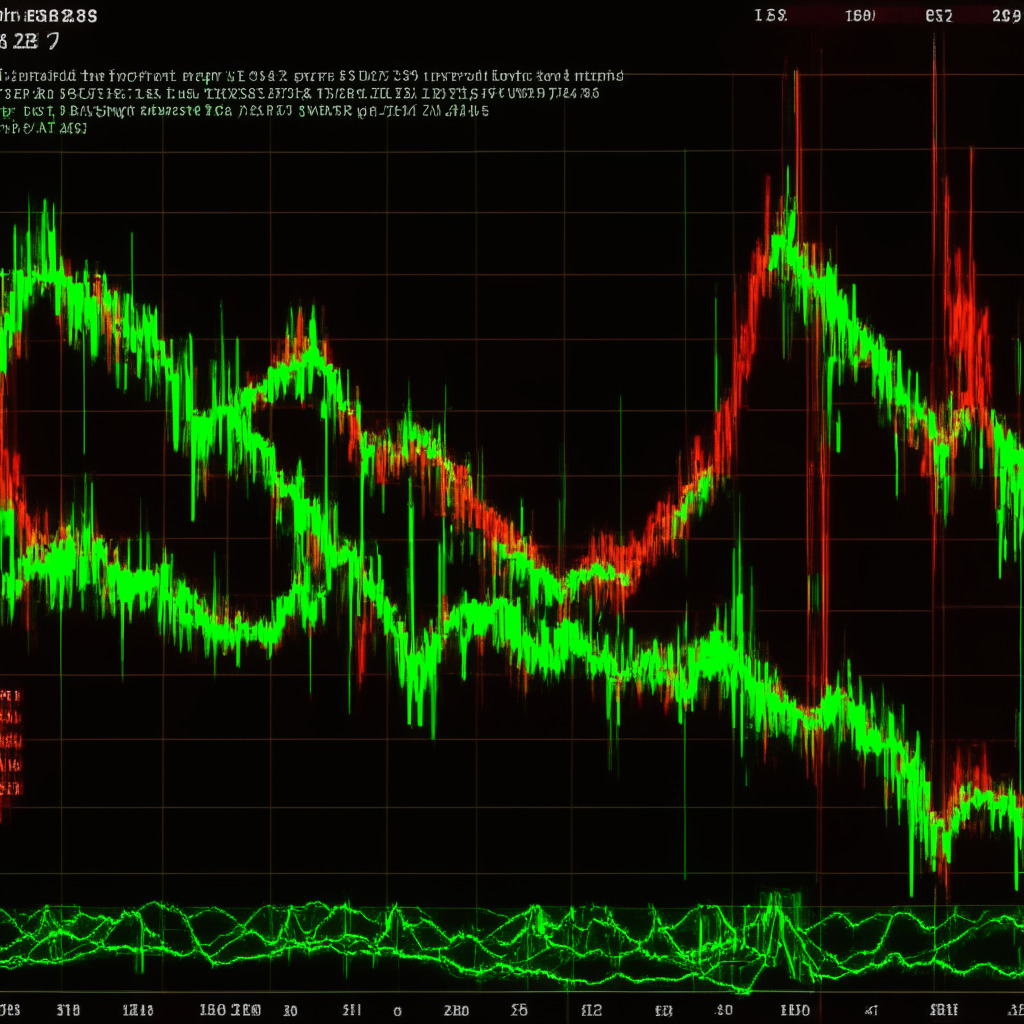

Digital assets like Bitcoin and Ethereum experienced an increase shortly after the report’s release, with Bitcoin surging by 1.4% to $26,300 and Ethereum by 0.8% to $1,760 over the past day. Prominent altcoins such as Polygon, Cardano, and Solana also experienced a growth spurt, with XRP leading the pack by recording an impressive 6.6% daily gain at $0.55.

The Fed has maintained interest rates at near-zero levels throughout 2021, asserting that inflation is temporary while the economy thrives. However, an aggressive campaign to curb inflation commenced in March of last year, leading to the highest interest rate levels since 2007. This shift has resulted in ten consecutive rate hikes geared towards combatting rising consumer prices.

As inflation begins to show steady signs of cooling down, traders anticipate that the Federal Reserve could maintain the current interest rates. The CME Group’s FedWatch Tool reveals a 97% chance that the Fed will sustain steady rates on Wednesday, showing a substantial increase from 75% the day before. This decision would mark the first time in 18 months that the Fed has opted not to tighten its monetary policy.

Rate hikes impact not only the economy but also the prices of a wide range of assets, from cryptocurrencies and stocks to U.S. Treasuries. The rise in interest rates usually causes a dip in risk assets like stocks and cryptocurrencies, as cash reserves and government debt begin to hold more appeal to investors.

Despite the current anticipation, a cautious approach to additional rate hikes may be taken, as indicated by the Federal Open Market Committee Chair, Jerome Powell. Decisions on rate hikes are expected to be dependent on data moving forward, with a speech from Powell scheduled for 2 pm EST on Wednesday after the Federal Reserve announces its next course of action.

This balance between maintaining a thriving economy and controlling inflation showcases the delicate balance needed when it comes to policies addressing interest rates. As the market awaits the Federal Reserve’s upcoming decision, the impact on cryptocurrency prices and investor sentiment remains to be seen.

Source: Decrypt