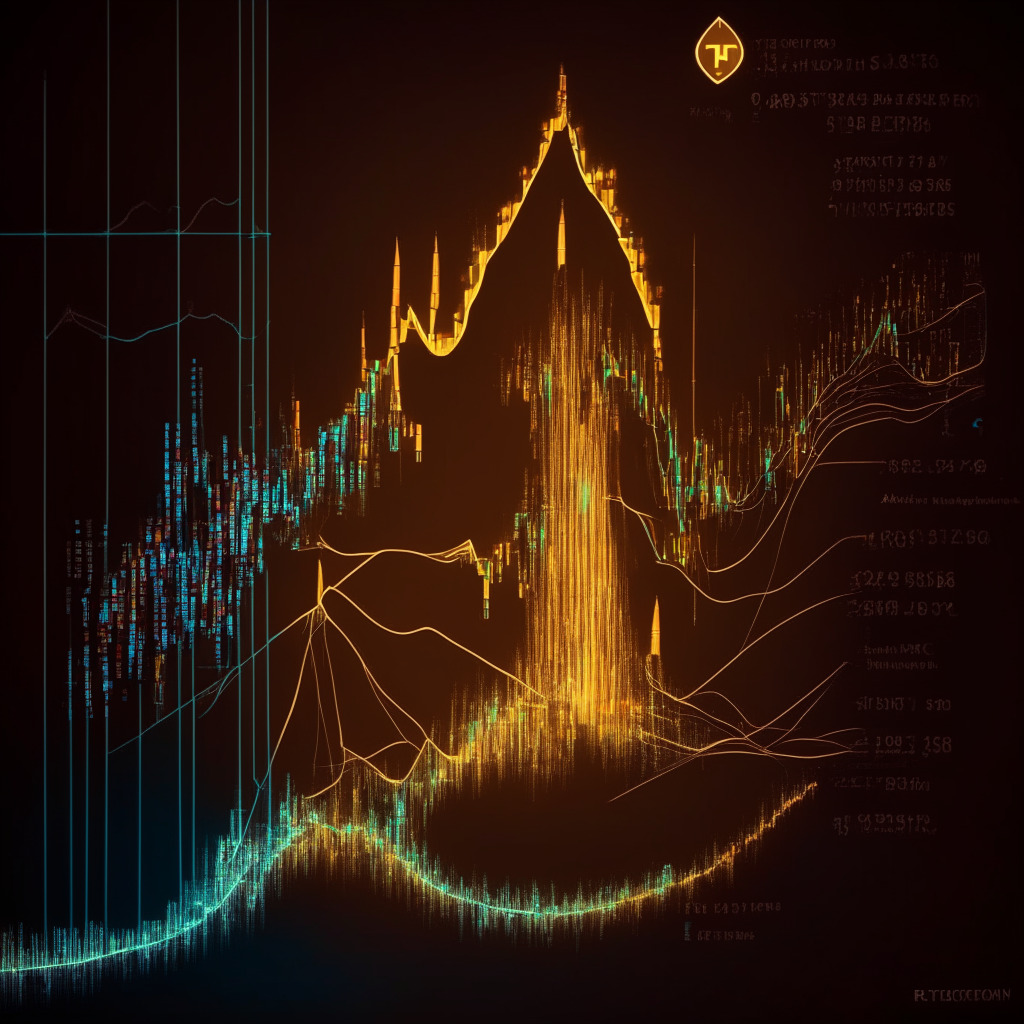

The recent market correction over the past two months has seen the Ethereum price retrace to the long-anticipated support trendline. From a peak of $2138, Ethereum plunged to a low of $1627, marking a loss of 23.5%. However, this retracement was accompanied by decreasing volume, suggesting that sellers aren’t particularly committed and that a bullish reversal may be more likely. With adequate demand pressure, the Ethereum price could resume its previous recovery, providing an ideal dip opportunity for traders.

Currently governing Ethereum’s long-term bullish trend is an ascending support trendline. Accumulation at this critical trendline indicates an upcoming recovery in the Ethereum price. Furthermore, the intraday trading volume in Ether stands at $5.8 billion, representing a 37.5% loss.

On the weekly time frame chart, the Ethereum price displays a long-tail hammer candle at the ascending trendline. This rejection candle signifies active accumulation by buyers, pointing to a higher possibility of a bullish reversal. Moreover, the entire correction phase remained above the 50% Fibonacci retracement level, which bodes well for the overall uptrend’s health. In the past, when prices retested this dynamic support, significant recoveries occurred, especially in January and March.

As a result, the expected bullish reversal could ignite a new recovery cycle that could push prices above $2138. Traders who are interested in entering this dip should place a close stop-loss below the hammer wick at $1625. For those who prefer safer trading, they can enter at the breakout of the immediate resistance at $1775. A retest of the dynamic support trendline could revive the bullish momentum in Ethereum’s price and end the current correction. Investors purchasing at this support can anticipate sustained growth above $2138, although they will encounter resistance at the $1775 and $2000 levels. Contrarily, if Ethereum breaks down below the support trendline, the bullish outlook will be invalidated, and prices could fall back to the $1400 mark.

In terms of technical indicators, a bearish crossover between the Moving Average Convergence Divergence (MACD) and the signal reflects the aggressive influence of sellers. Therefore, a $1775 breakout is necessary to confirm a bullish reversal. Additionally, with Ethereum’s price above the 200-day Exponential Moving Average (EMA), the long-term growth outlook for the cryptocurrency remains bullish.

As always, it’s essential to conduct thorough market research before investing in cryptocurrencies. The opinions expressed here are subject to market conditions, and the author or publication holds no responsibility for any personal financial losses incurred.

Source: Coingape