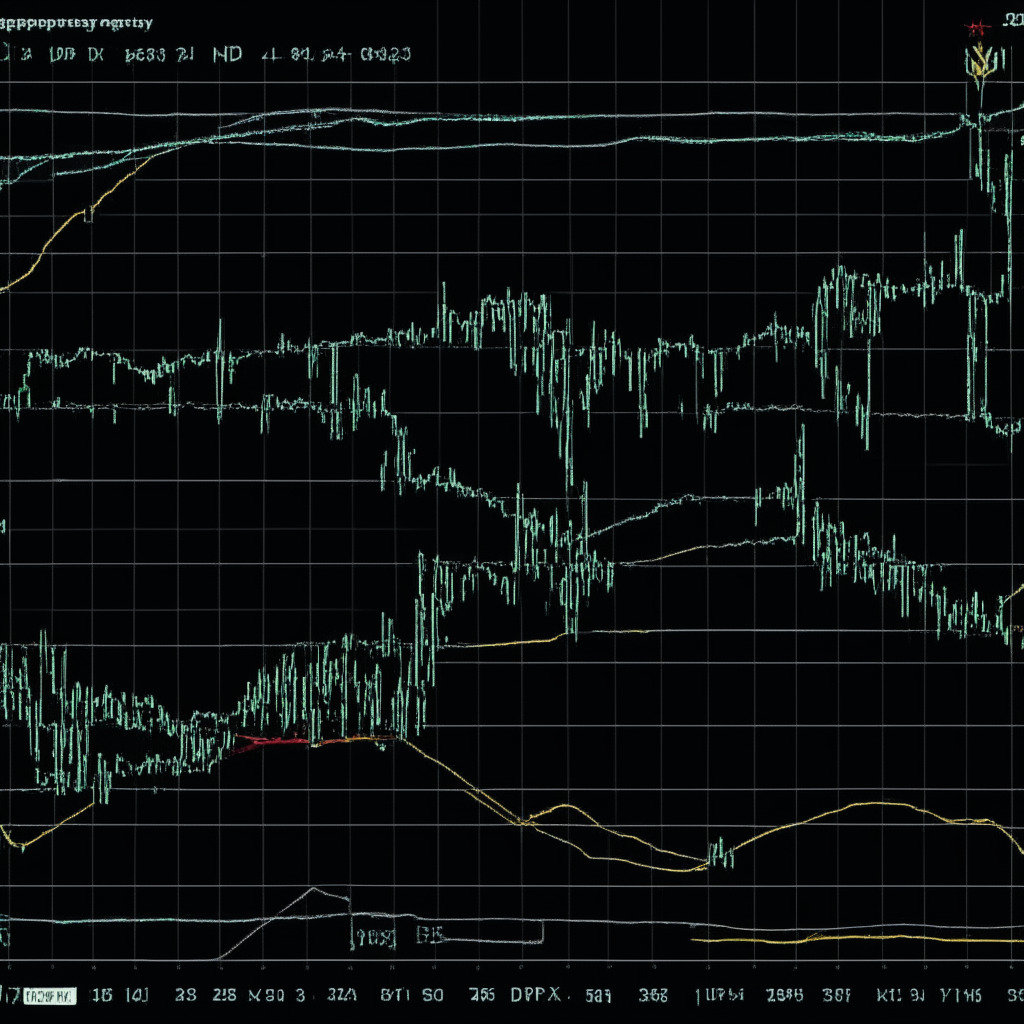

The cryptocurrency market has experienced a surge in the past few days, primarily driven by the excitement around the possibility of Bitcoin spot ETFs from financial giants such as BlackRock. Despite Bitcoin’s recent plateau at around $30,180, the enthusiasm resulting from these potential ETFs sparked a wave of optimism amongst investors.

Cryptocurrency custodian BitGo recently terminated its acquisition of rival Prime Trust, resulting in a brief dip in Bitcoin’s price. However, with growing concerns about central banks’ strategies to address inflation and their impact on economic growth, the appeal of cryptocurrencies seems to be increasing. Edward Moya, senior market analyst for foreign exchange market maker Oanda, believes that Bitcoin needs to maintain its momentum in the coming days to ensure that investor interest remains strong.

Meanwhile, Ether followed a similar path, briefly dropping due to the BitGo announcement but ultimately regaining its position to trade near the $1,900 threshold reached on Wednesday. Other major cryptocurrencies, such as ADA and DOT, also experienced slight increases in their values.

Though the Bank of England decided to raise interest rates by 50 basis points (bps), investors appeared to dismiss this move, instead focusing on the potential growth and opportunities within cryptocurrency markets. Federal Reserve Chair Jerome Powell’s reaffirmation of the bank’s intention to raise interest rates later this year also seemed to have little impact on the crypto sphere.

Bob Baxley, CTO of DeFi infrastructure provider Maverick Protocol, highlights a narrative shift that could propel the digital asset industry forward. The likelihood of a Bitcoin ETF being approved, in conjunction with increasing interest from traditional finance heavyweights, signals potential growth and expansion within the digital asset industry.

In the coming months, Ethereum’s performance will also be a noteworthy aspect to observe, as the ecosystem continues to experience significant growth. With the rapid development of decentralized finance (DeFi), non-fungible tokens (NFTs), and new applications on layer-two solutions, the cryptocurrency market appears to be garnering more attention and support from both traditional finance and broader investor communities.

While the ongoing optimism around spot Bitcoin ETFs and the burgeoning developments in the cryptocurrency market showcase its potential, investors should remain cautious. It is essential for Bitcoin and other major cryptocurrencies to continue their momentum in order to sustain and build on this newfound enthusiasm. The uncertainty and volatility that often accompany digital asset markets necessitate a balanced approach towards investment and an awareness of the potential risks involved.

Source: Coindesk