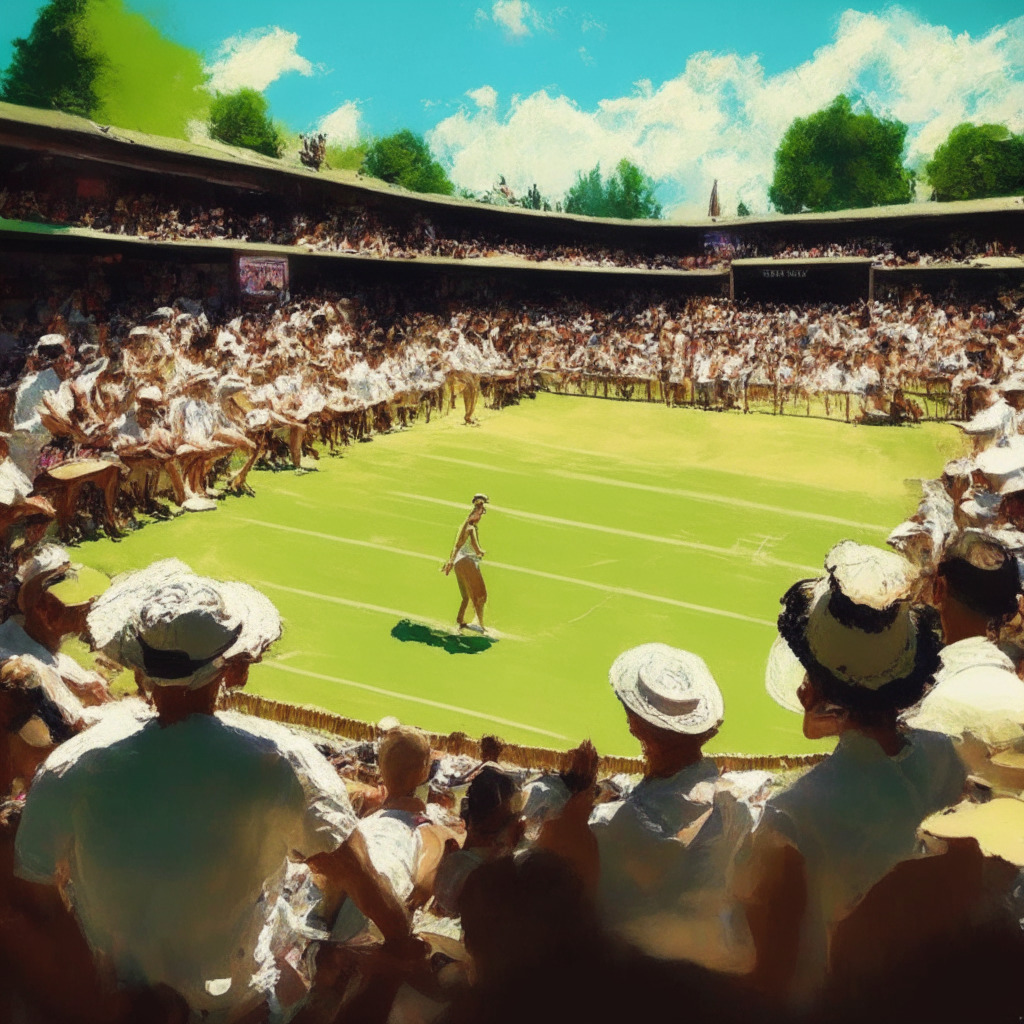

Wimbledon tennis tournament will integrate AI-powered features like commentary and player analysis, providing fans with deeper engagement. Leveraging IBM’s WatsonX technology, AI commentary will generate audio and captions for match highlights, offering insights on key moments and expanding accessibility to diverse matches.

Month: June 2023

Darknet Task Force: Balancing Crypto Crime Fight and Blockchain Innovation

The Department of Homeland Security has formed the “Darknet Marketplace and Digital Currency Crimes Task Force,” an interagency group aimed at investigating crypto and darknet crimes and increasing collaboration. The Task Force will play a crucial role in mitigating criminal activity impact while balancing regulation and innovation in the evolving crypto industry.

Tether Expands to Kava Blockchain: Opportunities, Risks, and Future Implications

Tether is issuing its stablecoin, USDT, on the layer 1 blockchain Kava to boost liquidity across multiple blockchains. The move raised KAVA’s value and expanded Tether’s presence; however, potential challenges include increased competition and a more complex stablecoin market.

Bitcoin Soars 36% Since China’s Prediction of Collapse: Market Resilience Defies Doubts

Amid the bearish market of 2022, the Chinese government claimed Bitcoin was heading to zero. However, Bitcoin has since experienced a 36% increase in value, disproving their predictions. Despite market fluctuations and regulatory challenges, the cryptocurrency’s resilience demonstrates the uncertainty of predicting its future trajectory.

Arpa Network Launch: Revolutionizing Blockchain Privacy or Breeding Ground for Nefarious Activities?

Arpa Network, a decentralized computation protocol, launched on the Ethereum mainnet, introducing enhanced privacy for on-chain activities and expanded use cases such as dapps for lotteries, gaming, and identity management. However, skeptics question if increased privacy could enable nefarious activities but since blockchain is designed for transparency and traceability, this remains to be seen.

Bitcoin’s Unexpected Rally: Unraveling the Mystery Behind Short Liquidations Surge

The digital asset market recently surged by around 8% in just 24 hours, resulting in over 46,000 traders facing liquidations worth $162.05 million. This rally raises questions about the driving factors and the market’s stability, emphasizing the need for thorough market research and informed investment decisions.

AI & Blockchain Revolutionize Parametric Insurance: The dRe Lifecycle Dashboard Debuts

Arbol and The Institutes RiskStream Collaborative have introduced the dRe Lifecycle Dashboard, an AI and blockchain-driven parametric insurance platform. The smart contract-based system automates claims, enhances transparency, and utilizes data from dClimate and Chainlink’s oracle network for parametric loss calculations in severe storm catastrophe transactions. The platform’s adaptability positions it as a game-changer in the insurtech landscape.

Bizarre Bitcoin Spike to $138,000 on Binance.US: Liquidity Crisis or Market Manipulation?

Bitcoin experienced a temporary surge to $138,000 on Binance.US crypto exchange, raising questions about market liquidity and stability. This event highlights concerns over consumer protection, price manipulation, and the need for improved market infrastructure and regulatory oversight in the crypto market.

Terra Luna Classic’s Q3 Ambitions: Opportunities and Challenges in Network Growth

The Joint L1 Task Force (L1TF) has submitted a revised proposal for Terra Luna Classic’s Q3 development, focusing on LUNC and USTC supply reduction, upgrading the Cosmos SDK, integrating Block Entropy AI app chain, and collaborating with external teams. These ambitious plans aim to increase stability and growth but also present challenges for the network.

Beware of Fake Regulatory Bodies: CSA’s Warning to Crypto Investors

The Canadian Securities Administrators (CSA) issued a warning about crypto firms claiming to have obtained authorization from non-existent regulatory organizations in an effort to appear legitimate. The CSA urges investors to independently verify the veracity of these organizations before engaging with crypto firms claiming certification or memberships.

Flash Pump on Binance.US: Bitcoin Hits $138K, Liquidity Concerns Resurface

Binance.US recently experienced a ‘flash pump’ that saw Bitcoin briefly spike to $138,000 on its USDT market, a 400% increase. This anomaly, lasting only a few seconds, raises concerns about the exchange’s ability to provide a smooth trading experience amidst ongoing liquidity struggles and regulatory scrutiny.

The Costly Collapse of FTX Exchange: Unregulated Crypto Systems and Their Pitfalls

The cryptocurrency exchange FTX’s wind-up process accumulates over $200 million in professional fees, reflecting issues in the largely unregulated financial system and lack of basic corporate governance. The expensive proceedings raise concerns for stakeholders and highlight the need for decisive regulation to prevent future failures.

US Bitcoin ETF Race: Invesco, WisdomTree, and BlackRock Battle for Approval

Invesco and WisdomTree have filed submissions for Bitcoin ETFs with the SEC, arguing for the benefits of spot exposure through regulated vehicles. The filings follow BlackRock’s unexpected submission, reviving hopes for Grayscale Bitcoin Trust’s ETF conversion. Approval would mark a major regulatory shift, boosting investor confidence in the cryptocurrency market.

Crypto ETFs: The Battle for Approval Continues Amid SEC Roadblocks

Two U.S-based asset managers, WisdomTree and Invesco, file for spot Bitcoin ETFs, following in the footsteps of BlackRock. Despite concerns over market manipulation and volatility, these applications signal a growing demand for regulated crypto investment vehicles, potentially impacting market shifts and mainstream adoption.

Bankruptcy and Revival: Core Scientific’s Path to Restructuring and Crypto Industry Impact

Bitcoin miner Core Scientific has filed its bankruptcy plan, focusing on revamping its business model after experiencing a boost in liquidity. The company attributes its improved performance to higher bitcoin prices, increased network hash rate, and reduced energy costs. The Chapter 11 bankruptcy plan serves as a vital tool in restructuring the company’s operations.

Chimpzee: Revolutionizing Charitable Giving & Passive Income through Web3 Technology

Chimpzee, a Web3 project utilizing blockchain technology, aims to transform charity contributions while earning passive income. Its ecosystem, featuring interconnected pillars Shop2Earn, Trade2Earn, and Play2Earn, offers users unique opportunities to support climate change awareness, endangered species, and deforestation causes. Chimpzee has already raised $600,000 in presale, donated $15,000, and planted 1,000 trees.

Invesco’s Spot BTC ETF Push: Growth Catalyst or Regulatory Hurdle? Pros, Cons & Conflicts

Invesco submits a new application for a spot Bitcoin ETF, following major players like BlackRock and WisdomTree. The mainstream adoption of Bitcoin ETFs could potentially drive growth in the digital asset space. However, investors should remain cautious and conduct thorough market research before investing, as the market is volatile.

Ethereum Gains 4.8% in Market Recovery: Analyzing Key Factors and Potential Pitfalls

Ethereum price experiences a bullish outlook with a 4.8% gain in 24 hours, alongside a market-wide recovery led by Bitcoin. The pause of interest rate hikes supports risk assets like Ethereum, further bolstered by institutional investors entering the crypto space. Ethereum’s current price sits above key moving averages, hinting at potential short-term gains.

Bitcoin’s Surge: Are We Headed for $30,000? Institutional Interest, EDX Launch & Future Predictions

Bitcoin surges 11% due to the launch of EDX, a new digital exchange, and increasing institutional interest. Prominent investor Cathie Wood predicts a $1 million price target for Bitcoin and expresses confidence in Coinbase. Technically, the Bitcoin (BTC) reaches $30,000 milestone amid a favorable environment.

US Court Awaits SEC Reply: The Impact on Crypto Regulations and Industry Uncertainty

The United States Court of Appeals for the Third Circuit has retained jurisdiction in Coinbase’s pursuit of regulatory clarity from the SEC, demonstrating the importance of transparent crypto regulations. This development marks a potentially pivotal moment for the future of the cryptocurrency industry in the United States, as the forthcoming SEC report could significantly impact the market.

SEC Crackdown on Stablecoins and DeFi: Impact on Market and Bitcoin’s Rising Dominance

The U.S. SEC may soon target stablecoins and DeFi protocols in its crackdown on the crypto industry, potentially impacting Coinbase’s revenue from USDC interest income, according to Berenberg’s research report. However, Bitcoin could emerge as a beneficiary, shifting focus toward Bitcoin-centric investments and companies.

Bitcoin Halving & June 2024 Futures: Preparing for Market Volatility in Crypto World

In anticipation of Bitcoin’s fourth mining reward halving in April next year, Deribit is listing June 2024 expiry futures and options, allowing investors to hedge against market volatility. This decision, driven by investor demand, highlights the importance of effective hedging strategies and showcases the high stakes in the crypto market.

Embracing Purpose Bound Money: Revolutionizing Finance or Inviting Scrutiny?

Singapore proposes a common standard for digital currencies, including stablecoins, tokenized bank deposits, and CBDCs, with contributions from major banks, investors, and global leaders. The Monetary Authority of Singapore’s whitepaper on Purpose Bound Money (PBM) aims to revolutionize the financial landscape by allowing senders to specify conditions and improving settlement efficiency, merchant acquisition, and user experience. However, increased regulatory scrutiny is a challenge to be considered in this rapidly growing digital financial landscape.

National AI Commission Act: Balancing Innovation and Consumer Safety in AI Development

The National AI Commission Act, introduced by U.S. lawmakers, aims to establish a regulatory framework for AI technology by bringing together experts, government officials, industry representatives, and labor stakeholders to provide effective AI regulation, addressing concerns and potential risks associated with AI development and use.

Crypto Payments in French Malls: A Step Towards Mainstream Adoption or Hurdle to Progress?

French real estate firm Apsys partners with domestic crypto payment provider Lyzi, allowing customers to use cryptocurrency for digital gift cards at multiple shopping malls. This collaboration is part of France’s growing interest in adopting and integrating cryptocurrency into daily transactions.

FTX Bankruptcy Legal Fees Skyrocket: Unregulated Crypto Exchanges Under Scrutiny

FTX’s bankruptcy announcement has raised concerns over legal fees surpassing $200 million. The cryptocurrency exchange’s unregulated status and lack of corporate governance contribute to these expenses. Independent auditor Katherine Stadler advises cost-conscious approaches for better results and highlights the need for robust governance structures in the crypto world.

Binance CEO Backs New Exchange EDX: Boon or Threat to Crypto Decentralization?

Binance CEO CZ supports new cryptocurrency exchange EDX, backed by prominent financial institutions like Citadel Securities, Fidelity Investments, and Charles Schwab. EDX plans to initially offer trading in Bitcoin, Ethereum, Litecoin, and Bitcoin Cash, while aiming to launch a clearinghouse later this year.

Grayscale Bitcoin Trust Soars Amid BlackRock ETF Filing: Pros and Cons of Market Competition

Grayscale Bitcoin Trust (GBTC) trading activity soared following BlackRock’s Bitcoin ETF filing, with its share price skyrocketing by 11.40%. As more financial institutions apply for spot-Bitcoin ETFs, Grayscale’s market dominance could be at risk amid competition and substantial fees imposed on traders.

Malicious Crypto Wallet Apps: Apple’s Struggle and User Vigilance in Staying Safe

Apple’s App Store removed a malicious Trezor wallet app after concerns were raised about its potential to steal cryptocurrency. However, other harmful copycat apps still exist, questioning Apple’s vetting process and urging users to remain cautious and rely on official sources for downloading crypto wallet apps.

Bitcoin Soars as BlackRock and Fidelity Eye Crypto: Market Impact and Risks to Consider

Bitcoin’s price surges as Blackrock files for a spot Bitcoin ETF and Fidelity collaborates with Citadel Securities to launch crypto exchange EDX Markets. These developments signal growing institutional interest in crypto, but caution is urged in trading as clear bullish signals haven’t emerged yet.

Bitcoin’s 7% Upswing: Institutional Interest vs SEC Crackdown on ETFs

Bitcoin surges by nearly 7%, fueled by traditional financial institutions’ interest and institutional demand, such as BlackRock’s Bitcoin ETF application and EDX Markets’ upcoming launch. However, the SEC’s past rejections of spot-Bitcoin ETFs still pose challenges for the industry.

HSBC Enters Metaverse: Booming NFTs Attract Banks and Celebrities – Pros and Cons Explored

As NFTs gain traction, major players file patents and explore platforms, including HSBC’s venture into metaverse banking and Queen Productions’ plan to offer NFT-authenticated media. The growing interest and adaptation to emerging NFT and metaverse technologies signal an interconnected world, but challenges and skepticism remain.