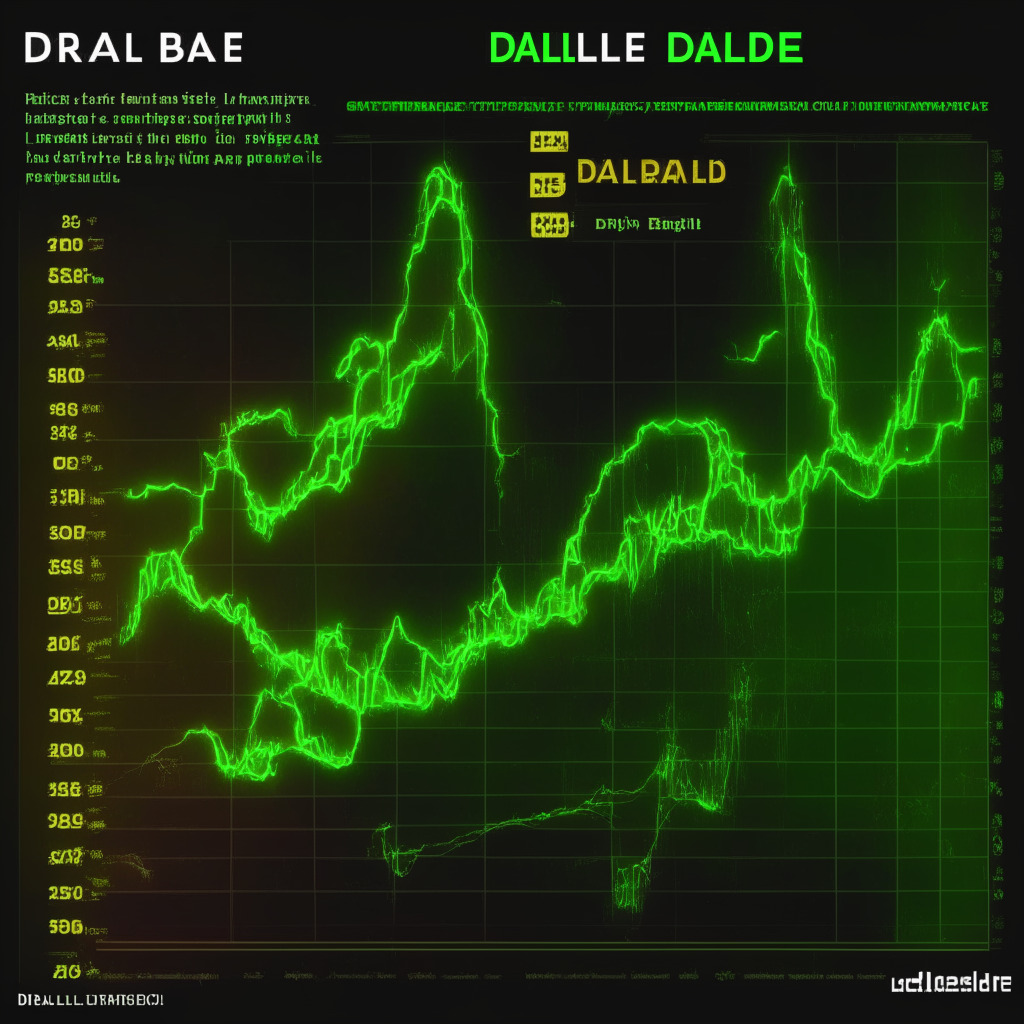

The supply of Bitcoin held on exchanges has reached a significant threshold, arguably reminiscent of late 2017, when we saw the cryptocurrency hit an all-time high. According to Glassnode, less than 12% of Bitcoin’s total supply currently resides in exchange wallets – a figure not seen since mid-December 2017. This is a notable shift in Bitcoin supply dynamics that seems to favour bulls, but may also signal a larger economic trend.

What could this mean? Bitcoin supply dynamics have long been scrutinized to forecast price changes. An analyst, without disclosing his name, argued that the aforementioned shift may pioneer the trajectory towards “true price discovery”.

True price discovery is an interesting concept. It signifies a market situation where the price of an asset reflects all the available information, leading to a transparent and fair market value of the asset. In theory, it’s a positive development for the market, as prices are more reflective of underlying economic factors rather than speculative behaviour. However, it’s crucial to note that true price discovery is an ideal and fleeting state in real-world markets due to the constant influx of new information and human behaviour.

While exchange balances are on the decline, the number of Bitcoin “whale” entities has seen an increase. There has been an uptick of about 40 new whales, those with the largest wallet balances, since late April. The motivation behind this migration from exchanges to wallets is unclear, though some speculate it may be due to increased control and safety reasons.

Despite the exodus from exchanges, one exception is mining pool Poolin, which continues to send substantial amounts of BTC to Binance – an otherwise unusual behaviour considering the current trend.

As we observe these dynamics, it’s essential to consider the broader picture. The world of blockchain and Bitcoin is only one slice of the financial ecosystem. For example, the Near Protocol’s treasury witnessed a decline to $900 million, led by a fall in their native NEAR tokens’ price.

Whether these intriguing Bitcoin dynamics signal imminent bullish momentum or just a transient trend remains to be seen. The market’s complexity and variable factors demand a measured approach to such analysis, with room for divergent perspectives. As ever, participants are encouraged to conduct their own research and consider multiple viewpoints when making decisions in the crypto sphere.

Source: Cointelegraph