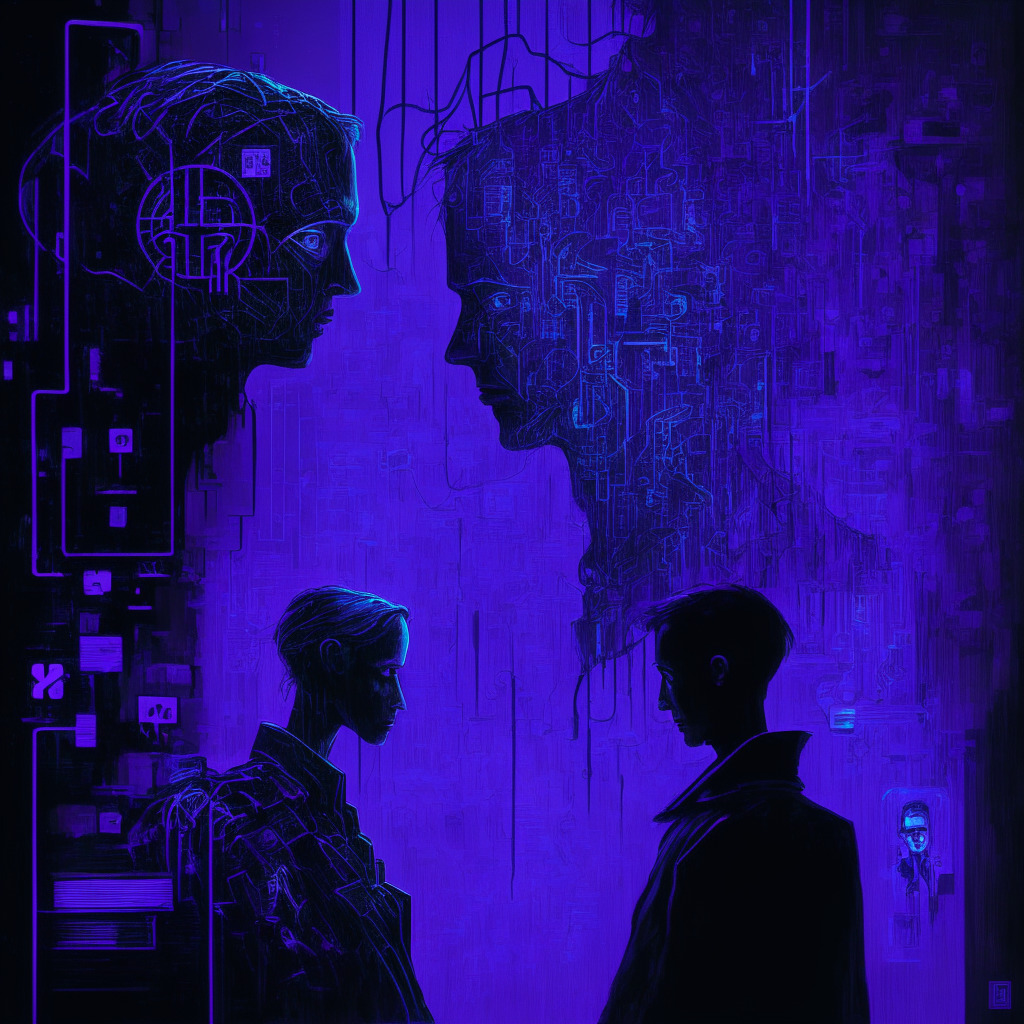

Ethereum’s co-founder, Vitalik Buterin, has responded to the recent launch of Worldcoin’s decentralized human identity verification system. These identity solutions, including Worldcoin, Proof of Humanity, BrightID and more, are being developed due to the growing difficulty of distinguishing between humans and AI-operated systems. They argue that bots pose a serious threat to human relevance and utility, inducing the need for digital human verification.

Buterin expresses that this proof of personhood is integral to tackling rampant issues such as spam and centralization of power, hinting at the advantages of a decentralized landscape. He also underlines the key obligations of systems similar to Worldcoin, emphasizing privacy, accessibility, transparency, and security. Furthermore, he notes the threat of riches concentrating in the hands of a few, including potentially hostile governments, in the absence of adequate personhood proof protocols.

While acknowledging the importance and potential of these systems, Buterin seems to harbor reservations. He highlights the significant concerns that encompass these solutions, including potential threats to privacy, questions of accessibility, a degree of centralization within the Worldcoin foundation, and overall questions of system security. Buterin ends by calling for community accountability, checks and balances, and robust auditing in these mechanisms.

Despite recognizing potential pitfalls, Buterin believes there is currently no perfect model for proof of personhood. In his vision, the ideal approach could be a hybrid of three different methods. He realizes the weight of designing such systems and sympathizes with the architects faced with this challenging task.

The reception of Worldcoin and its human identity verification system will mark a critical turning point in how we navigate the increasingly intertwined realms of humanity and artificial intelligence. It’s becoming apparent that the advent of technology, especially blockchain and AI, necessitate an ecosystem where humans and machines can coexist without one posing a threat to the other.

With regard to cryptocurrency’s disruptive potential, a UK carpet retailer’s move to adopt Bitcoin has stirred dialogue. Against the background of stagnating UK banking interest rates and high inflation, the retailer’s shift to Bitcoin as a potential capital reserve points towards the cryptocurrency’s potential as an asset with the highest potential for capital growth.

While curiosity or disbelief surrounds such a move, it reflects a solution to traditional banking problems that several small businesses may be quietly contemplating. Amid a shaky economic climate, Bitcoin offers a bold option for safeguarding and growing company reserves. However, with the exciting potential of such decisions comes the need for caution and responsibility.

The crypto landscape is precarious, and the truths of today may well become the fictions of tomorrow. Points of contention continue to be the decentralization of power, proof of personhood, and the balance between human and artificial intelligence. As we look ahead, it is critical to navigate these tensions while embracing the potential of blockchain and crypto.

Source: Cointelegraph