A question that has set the crypto world abuzz is: how much farther can Bitcoin tumble? The price of the primary cryptocurrency has sunk to one-month lows, with little sign of upward momentum in sight. Market participants and traders are nervously eyeing the downturn, many of them projecting further losses on the horizon. Despite a brief show of strength, skepticism remains high, with pessimistic predictions stealing the spotlight in what is becoming a turbulent macroeconomic week for crypto and risk assets.

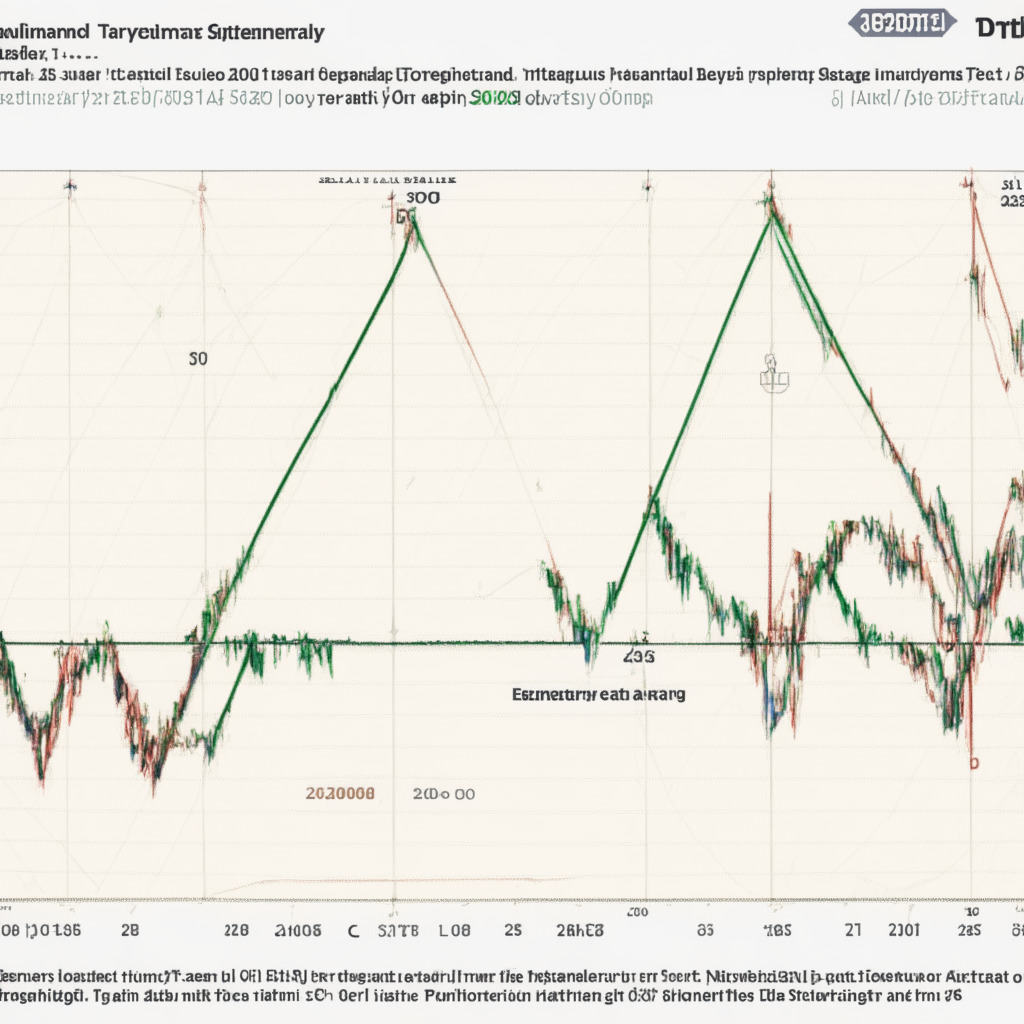

One respected trader in the crypto world is anticipating a further dive into the buy liquidity, with potential lows around $28,500. Possible relief might be on the way first though, with a bounce back to $29,400 being predicted, highlighting the turbulent and unpredictable nature of the crypto market.

Meetings between sell-pressure, bear markets, and traders could potentially drag Bitcoin as low as $27,000, a low enough threshold to deter even the most tenacious long entries. Packed with tumultuous potential, the journey down is anticipated to be punctuated with bidding at crucial price points — at $29,200, $28,500, and $28,000.

The trading floor has been fraught lately with adverse factors, leaving the excited chatter around Bitcoin sounding silent and remote as market players steer clear of what they see as risky waters. Yet, the moving averages persist as significant markers, with the 200-week and 21-week at $27,130 and $28,200, respectively, seen as crucial thresholds.

However, scepticism exists on how low Bitcoin will ultimately sink. Some of the direst projections suggest lows that dip well into the tens of thousands, with the $20,000 mark not entirely discounted. These bearish outlooks, while alarming, add necessary balance to an often overly optimistic market perspective, ensuring that no viewpoint, no matter how seemingly unlikely, goes unheard.

Yet, in the capricious world of cryptocurrencies, it is wise to prepare for any conceivable outcome. Today’s bearish market could unexpectedly pivot, leading to a surge of bullish enthusiasm. Alternatively, the bearish predictions could play out, and Bitcoin could sink lower, reminding us all of the high-risk, high-reward nature of the crypto market. Therefore, during these unstable times, crypto enthusiasts should remember to stay informed, make sound decisions based on rigorous research, and always be prepared for the unexpected.

Source: Cointelegraph