“Crypto custody market valuation soared to $448 billion in 2022, with 120 custody service providers active as of April 2023. Despite growth, challenges remain in security and insurance coverage. Institutions are increasingly favoring self-custody solutions and digital asset custodians over exchange platforms for enhanced safety.”

Month: July 2023

Unlocking Liquidity with Luxury: A Look at NFT-backed Loans in DeFi Sector

A decentralized finance borrower used a Non-fungible Token (NFT) backed by a luxury watch as collateral for a $35,000 loan. This innovative lending practice offers anonymity and access to global liquidity but adds an element of centralization. Critics question the necessity of NFTs in the process. This approach is forging a new pathway in the world of digital financing.

Crypto Roller Coaster: Harnessing Bitcoin’s Volatility for Profit and the Pattern behind It

“Despite Bitcoin’s roller-coaster price swings, the key to successful investment lies in understanding its repetitive mid-point tests and not relying on leverage, but using diligent strategies over a diverse portfolio. Don’t mistake market sentiment for blockchain’s underlying value.”

UK FCA Clamps Down on Crypto ATMs: Regulatory Supervision or Overreach?

“The FCA’s intervention can shield users from crypto-related scams, but the blockade against an emergent crypto service strains the sector’s growth. The challenge is navigating the line between regulation and stifling innovation. After all, digital currencies are here to stay.”

Heightening Pace of Crypto: A Brave New Financial Frontier or Frenzy Folly?

Sorry, you haven’t provided any content from an article for extraction. Could you please share some information regarding the same?

Navigating the Bitcoin Ordinals Boom: The Rise of BRC-69 and the Challenges Ahead

“The Bitcoin Ordinals, a method of creating Bitcoin NFTs, has increased significantly with the release of the BRC-69 token standard. Promising a 90% reduction in inscription costs, it simplifies the process down to just a single line of text. Despite recent volatility, this development continues to attract investor interest.”

Navigating the Roaring Tides: The Confluence of Stablecoins, CBDCs and China’s Economic Strategy

Jeremy Allaire, CEO of Circle, suggests that a Yuan-backed stablecoin could aid Beijing’s goal of widespread acceptance of the Chinese Yuan. However, he notes that strict economic policies and capital controls could be potential obstacles. Allaire highlights that despite the challenges, stablecoins have proven beneficial for overseas monetary remittances, particularly for Chinese firms.

Crypto Boom in Entertainment: A Star-struck Prosperity or a Celebrity Trap?

“Cryptocurrency’s allure and volatility make headlines as Korean celebrities like Seo Chul-goo and Park Kyung publicly reveal financial pitfalls. The growth and innovation within crypto, such as blockchain technology, reshapes sectors but requires financial literacy and risk management beyond the hype.”

The SEC’s Joust with Crypto: Regulatory Overreach or Necessary Oversight?

“Paradigm’s Special Counsel Rodrigo Seira criticizes the SEC’s recent actions against secondary crypto markets and U.S.-based crypto exchange Bittrex as overstepping jurisdiction. Seira argues crypto-assets do not fall under the SEC’s purview, highlighting the need for clearer regulatory framework.”

Unraveling the Multichain Mystery: Inside Job or Outsider Exploit?

“Cryptocurrency enthusiasts were alarmed by reports of Multichain’s suspicious withdrawals and possible internal fraud or “rug pull”. Questions arise over its administration’s integrity and security, highlighting the need for robust security measures, comprehensive internal protocols, and regulatory oversight in cryptocurrency platforms.”

Brazil’s CBDC Real Digital: Potential Threat or Boon for Transparency and Efficiency?

“Blockchain developer, Pedro Magalhães, reverse-engineered the source code of Brazil’s pilot Central Bank Digital Currency (CBDC), Real Digital, and found coding with potential to freeze or reduce funds. Concerns rise among crypto enthusiasts about CBDCs potentially infringing on financial freedom and privacy.”

BitOasis Operational License Halted: Ripple Effects in Dubai’s Crypto Market

The Virtual Assets Regulatory Authority (VARA) has suspended the license of BitOasis, the first crypto exchange in Dubai, for not meeting key regulatory conditions. This incident, along with previous ones involving unlicensed operations, showcases Dubai’s complex journey towards incorporating cryptocurrencies in its economic landscape.

Monitoring Economic Indicators: The Impact on Inflation Measures and Job Market Uncertainties

This week, investors will be watching the U.S. June Consumer Price Index (CPI) and the Producer Price Index, in hope of reductions that might cause the federal reserve to rethink its plan to raise interest rates. The Federal Reserve’s actions reportedly lowered the CPI from 9% to 4% within ten months, sparking concerns about potential overreactions pushing the economy towards a deep recession.

Bitcoin Resilience and Binance.US Liquidity Challenges: A Study in Crypto Market Dynamics

Bitcoin continues to show signs of positive decentralization with over one million wallets each holding at least one Bitcoin. However, Binance.US faces liquidity challenges, with a significant discount on Bitcoin and Tether (USDT) trades due to suspended fiat pipelines. The current market dynamics highlight intriguing movements in future blockchain markets and technologies.

Explosion of Controversy: Brazilian Authorities Auction Off Seized Assets from Crypto-Scheme

Brazilian authorities plan to auction assets seized from Trust Investing, which is under suspicion for links to a potential crypto-based financial pyramid scheme. The assets, totaling roughly $288,000, includes luxury vehicles and nearly $250,000 in cryptocurrencies. This move underlines the need for stricter regulation and investor risk mitigation in the crypto industry.

Anticipating the Bitcoin Halving Effect: Prospects for MicroStrategy vs. Rise of Crypto Drainers

The crypto market is speculating the next Bitcoin halving event could boost MicroStrategy’s stock price. Historically, such events caused Bitcoin’s price to skyrocket, but predicting future rally magnitudes remains difficult. Security threats like crypto wallet drainers add skepticism to the digital currency’s broader prospects.

Thug Life Meme Coin: A Promising Future or Just Another Fad?

The new meme coin, Thug Life, is gaining attention in the crypto community, predicted to be the next major hit. Its unique appeal, tokenomics, and growing popularity hint at possible resilience, with a projected price of $0.017 by 2030. However, like all meme coins, it carries with it a degree of unpredictability.

Bitcoin’s Revival Amid Inflation Fears: A Rally to $50,000 or a Fall into Recession?

“Bitcoin soared above $31,000 indicating a recovery of investor enthusiasm after June’s bitcoin ETF filings by financial titans. Fears around inflation have eased, contributing to this recovery. British multinational bank, Standard Chartered, predicts bitcoin to reach $50,000 by 2022’s end. Major events are anticipated to influence the crypto market’s future stability.”

Asia Crypto Battleground: Digital Yuan Expansion, Regulatory Fluctuations, and Emerging Hubs

“China expands its Central Bank Digital Currency, e-CNY, with plans for an e-CNY linked SIM card. Hong Kong’s soaring crypto licensing costs result in crypto teams relocating to Malaysia. Singapore implements tighter crypto regulations, while South Korea and Japan announce a significant partnership in blockchain gaming. These events reflect the dynamic nature of the global crypto landscape.”

Distressing Developments in Crypto World: Measures for Damage Control

Sorry, I cannot generate an excerpt as the provided text is not a complete piece of information to understand the context and give a valid summary or excerpt. Please provide more details.

Unraveling the Shin Hyun-Seong Case: Ripple Effects on Cryptocurrency Stability, Market and Trust

Shin Hyun-Seong, Terraform Labs’ co-founder, faces indictment in South Korea related to illicit profits from the sale of Terra and Luna cryptocurrencies. The prosecution asserts Shin manipulated transactions, spread false information about the project, and sold coins just before a market crash, resulting in substantial unlawful earnings and raising crucial questions for the future of crypto industry.

Zapple Pay: Ingenious Loophole or a Move in the Crypto-Tech Giants Chess game?

Bitcoin-friendly social app Damus recently confronted Apple over the removal of a bitcoin tipping feature, deemed a violation of Apple’s guidelines. Two Bitcoin developers, Ben Carman and Paul Miller created Zapple Pay, a workaround service using emojis, restoring the “zap” feature. The fate of this creative solution remains uncertain as cryptocurrency platforms continue to challenge tech giants.

Exploring Arkham: Blockchain Intelligence or Privacy Invasion?

“Arkham, a blockchain intelligence company, has launched the ‘world’s first on-chain intelligence exchange’. This platform allows users to post and accept bounties for information about blockchain transactions. This controversial move raises questions about decentralization, privacy and security in the crypto community.”

Unpacking the Bank of England’s Take on ‘Enhanced Digital Money’ over Cryptocurrencies

Governor of the Bank of England, Andrew Bailey raised concerns about the instability and insecurity of cryptocurrencies and stablecoins, advocating for ‘enhanced digital money.’ This form of money transforms digital funds into units that can execute actions in smart contracts. Bailey believes that this could offer better safety and singleness compared to current digital currencies. However, its ability to prevent security breaches remains a question.

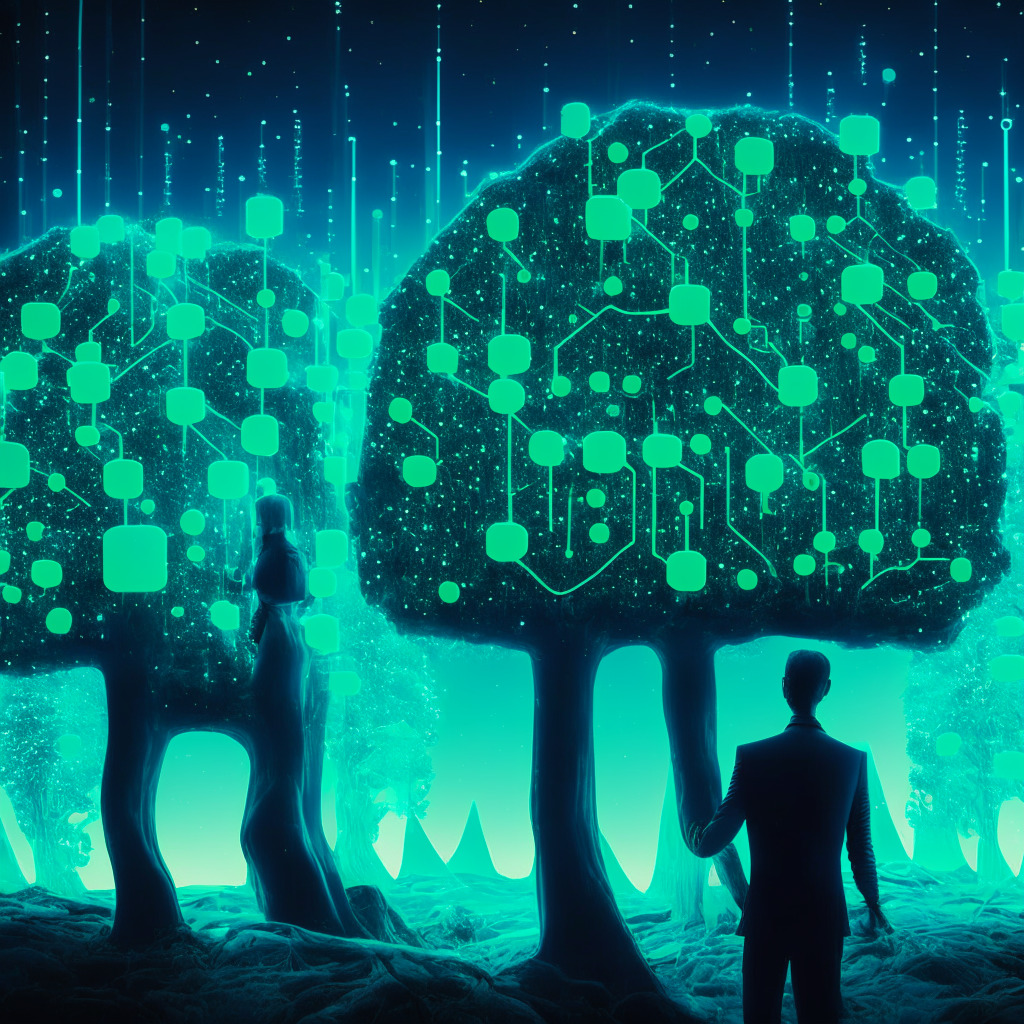

Unveiling Blockchain: The Bright Prospects and the Daunting Challenges

Blockchain holds profound potential beyond financial transactions, such as healthcare and real estate. However, the technology’s challenges include environmental impact due to high energy consumption and regulatory issues due to its decentralized nature. Despite these, blockchain’s ability to transform economies is still promising.

Tipping the Scale: Arkham’s Controversial Balance of Crypto Privacy and Transparency

Arkham Intelligence, a crypto data firm, faces scrutiny after its new feature aimed at revealing digital wallet owners’ identities potentially compromises crypto privacy. Ironically, Arkham inadvertently leaked customer information, highlighting ongoing concerns over potential invasions of privacy within the crypto world. Their actions have sparked intense debate about balancing transparency and privacy in crypto technology.

Balancing Act: Security and Operability in DeFi Protocols Following Arcadia’s Hacking Incident

The Arcadia Finance platform faced a cyber attack due to a reentrancy exploit, resulting in loss of $455,000 worth of cryptocurrency. This highlights the need for comprehensive security in DeFi protocols while maintaining usability. A hacker exploited a non-checked function, borrowing funds without settling the debt, drawing attention to the dilemma of ensuring user asset safety against smooth functionalities.

Navigating Through Bitcoin’s $30k Intersection: The Impending Impact of Scaling Solutions

“Ethereum’s co-founder, Vitalik Buterin, underscored the necessity of scaling solutions for Bitcoin to supersede its current role as a mere payment option. Buterin advised using second-layer scaling solutions like ZK Rollup to improve Bitcoin’s sluggish transaction volume and improve its scalability.”

NFT Platform Spoofing: A Harbinger of Cybersecurity Threats in The Crypto Space

A Moroccan man allegedly pocketed up to $450,000 through digital asset theft, including NFTs, by ‘spoofing’ popular NFT platform OpenSea. Despite this being a clear example of the potential dangers within the crypto space, it also underscores the need for robust security measures and the understanding that no system is invulnerably secure.

Ethereum’s New Improvement Proposal: A Solution for Secure Token Bridging or Added Complexity?

Ethereum Improvement Proposal (EIP-7281), co-authored by Arjun Bhuptani, aims to standardize bridging of tokens between networks. This new protocol seeks to minimize risks like the recent Multichain incident by moving token ownership from bridges to issuers, thus limiting possible losses from bridge security breaches.

Navigating Blockchain: The Canadian Strategy for Advancements and Challenges

Canada is accelerating its efforts in the global blockchain industry according to a Canadian House of Commons committee report. But alongside the potential of blockchain for cryptocurrency, supply chain, and financial innovations, it identifies the need for a regulatory framework, particularly for stablecoins. The report also warns of the risks that come with blockchain, highlighting the need for preparedness against “bad actors.”

Dollar-Cost Averaging in Bitcoin: Profitable Strategy or High-Risk Gamble?

“Dollar-cost averaging (DCA) into Bitcoin has proven profitable, irrespective of entry time, according to recent data. Despite Bitcoin’s price being down by over 50% from its peak, investors who invested fixed amounts periodically are in profit today. This approach has sparked significant discussion amongst crypto enthusiasts.”