The Bored Ape Yacht Club (BAYC) NFT collection is witnessing a drop in floor price, sparking debates about its value. Despite this, some argue the decreased price could invite new members, emphasizing that an NFT’s value extends beyond its price tag to encompass rarity and cultural significance.

Month: July 2023

FTX and the Fallen Deal with Taylor Swift: A Tale of Trust and Transparency in Blockchain

Revelations suggest that the now-defunct cryptocurrency exchange FTX pulled out of a $100 million tour sponsorship deal with Taylor Swift. Amidst liquidity crises and failure to fulfill customer deposits, former CEO Sam Bankman-Fried faces charges of misusing customer funds for personal investments. Despite bankruptcy proceedings, FTX shows ‘substantial progress’ in financial recovery, yet unresolved issues question blockchain technology’s promised trust and transparency.

Cardano’s ADA Bullish Run and DeeLance’s Potential: A Look at the Future of Crypto Investments

“The staking coin ADA, tied to Cardano, clings to its $0.28 support amid global crypto fluctuations. Despite a 7% fall from its $0.30 peak, a bullish trend offers hope for a robust bull run. The Cardano blockchain’s growing DeFi ecosystem, resilient against FUD, sees the Total Value Locked in USD form exceed $200 million. However, regulatory uncertainty in the US looms.”

Navigating the Future of Blockchain: Polygon’s Leadership Changes and Technological Shifts

Polygon Labs, known for its innovative blockchain efforts, has initiated strategic leadership changes, aligning with their transition towards “Polygon 2.0”. Devoting efforts to unifying Polygon chains via a “coordination layer”, they also plan to upgrade their legacy “PoS” chain for a compatibility with zero-knowledge proofs, advancing their commitment to confidentiality of transactions while bearing potential complexities and security risks.

Evaluating Bitcoin Cash’s Performance: Is it Too Late to Invest?

Bitcoin Cash (BCH) has observed a slight recovery, potentially due to its inclusion in EDX Markets. Although it has underperformed compared to its peak prices, current speculations hint at a new crypto bull market which could lead to impressive performance for BCH. Preconditions before investing include careful study, portfolio diversification, and consideration of high-risk, high-reward ventures such as crypto presales.

Unraveling Gemini’s Fraud Allegations Against DCG: Implications for Crypto Regulations

The prominent cryptocurrency exchange Gemini is taking legal action against Digital Currency Group and its CEO, alleging “fraud against creditors”. Gemini claims huge amounts of cryptocurrency and U.S. dollars were misleadingly lent and aims to recover lost funds. These events emphasise the need for transparent, robust regulations in the crypto industry.

Unveiling the Future of Blockchain: Sega’s Pause, Bitfinex’s Recovery, DAO Halts and Innovations in Bitcoin’s Lightning Network

“Sega withdraws from blockchain gaming to avoid content devaluation. Bitfinex recovers more stolen assets from the 2016 hack. BarnBridge DAO halts all activities due to SEC’s investigation. Lightning Labs introduces tools for AI and Lighting developers. Moreover, AFME calls for DeFi’s inclusion in MiCA regulatory framework.”

Gemini Vs Genesis: A Tale of Trust, Transparency and Regulatory Challenges in Crypto Sphere

“The Gemini-Genesis incident emphasizes transparency importance in crypto financial transactions and exposes vulnerabilities in the current regulatory framework. This reflects the balancing act between progressing financial freedom and respecting monetary regulations in a world where the stakes are high.”

Spot Bitcoin ETFs: Game Changer or Overhyped Buzzword? Debating JP Morgan’s Analysis

JP Morgan’s recent report suggests that the approval of a spot Bitcoin ETF by the SEC may not significantly affect the crypto asset’s price or adoption, based on lukewarm interest from institutional investors and modest performance of other Bitcoin products.

How Celebrity Endorsements are Shaking Up the Crypto World: A Tale of Fame Vs. Regulation

“Celebrities like Tom Brady face backlash and potential legal issues due to their endorsements of now-defunct crypto exchange FTX. Regulatory bodies are scrutinizing undisclosed promotions of crypto tokens, attempting to balance security regulations with the lure of stardom in the crypto universe.”

Riding the Wave of Bitcoin’s Historic Peak: Ark Invest Report Unveils ETF Era Prospects

“Almost 70% of the circulating Bitcoin supply hasn’t moved for a year, hitting a historic peak, according to Ark Invest. They also report institutional interest in Bitcoin is rising. Despite rejections by SEC, the prospective launch of a new Bitcoin ETF creates bullish market anticipation.”

How Ecoterra Is Blending Blockchain & Sustainability: Promises and Challenges

Ecoterra, an eco-friendly crypto project, achieved $5.9 million in presale investment, aiming to address climate change, forest depletion, and waste management. It employs blockchain technology and a recycle-to-earn model to incentivize eco-friendly activities, rewarding participants with $ECOTERRA tokens. It also offers carbon offset programs and a recycled material marketplace.

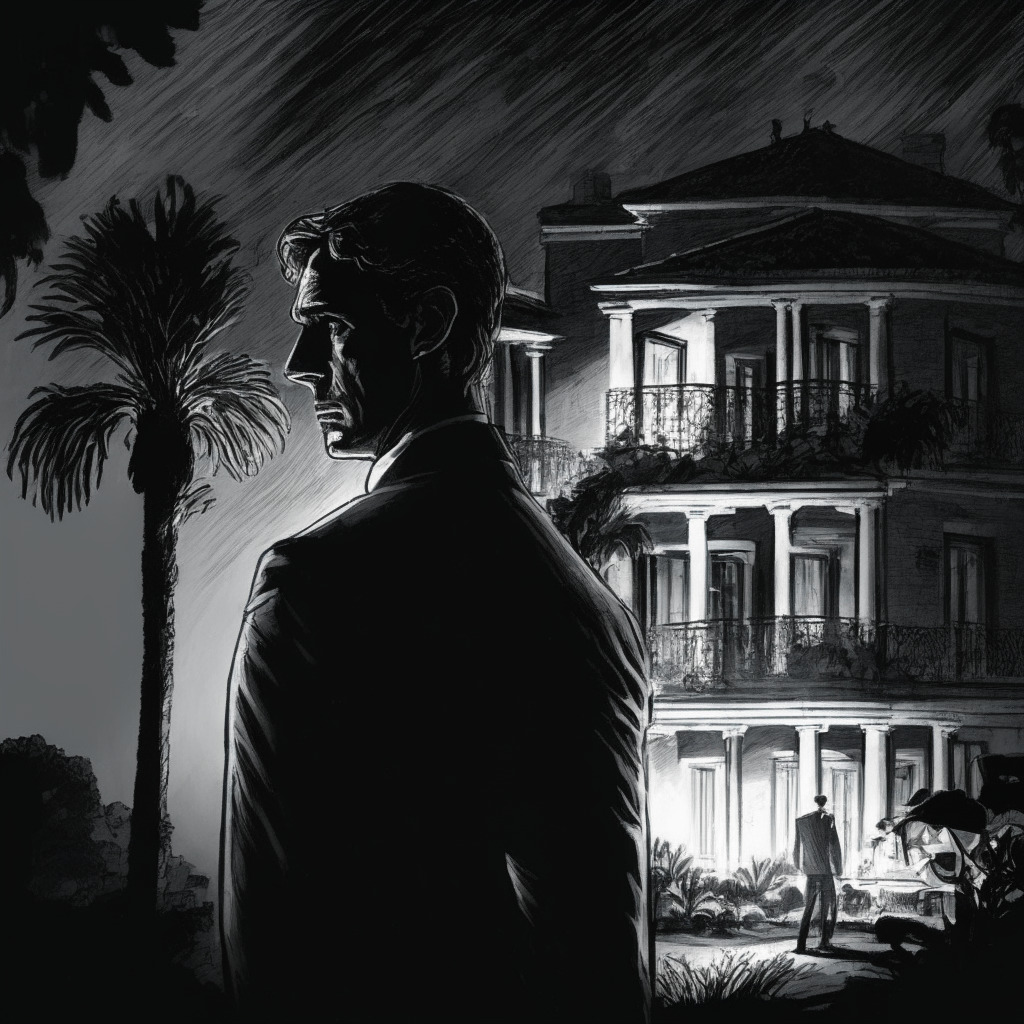

Navigating the Regulatory Minefield in Crypto: Unraveling the Bachiashvili Bitcoin Saga

“The escalating saga around George Bachiashvili and his alleged misappropriation of $39 million worth of Bitcoin highlights the tightrope of regulatory compliance in the crypto world. The case accentuates the need for robust, unbiased, and clear regulations in cryptocurrency and blockchain applications, imparting confidence to investors and fostering industry growth.”

Unveiling the Bitcoin Paradox: Sailing Towards Financial Freedom or Facing Unforeseen Headwinds?

“Natalie Brunell, former investigative journalist turned Bitcoin enthusiast, sees Bitcoin’s trustless nature as a way to greater economic freedom. With a balanced view on potential highs and pitfalls, she anticipates a six-figure price for Bitcoin and plans to accumulate more before it peaks. She sustains an intrigue in the unfolding Bitcoin ETFs, especially those proposed by traditional financial institutions, considering both the opportunity of an on-ramp for investors, and the potential challenges it might impose on Bitcoin’s independence from conventional financial systems.”

Bitcoin-On-Wheels: An Unusual Journey Across Europe Unraveling Crypto Acceptance

“Ariel Aguilar’s Bitcoin-themed van journey across Europe, known as ‘La Bitcoineta’, reveals the rift between acceptance and scepticism around Bitcoin. The varied reactions, from applauds in Switzerland to disinterest in Spain and Portugal, underscore the region-dependent acceptance levels of cryptocurrencies.”

Shibarium Launch by Shiba Inu Dev Team: A Blockchain Revolution or a Power Play?

“Shibarium, a project led by the Shiba Inu development team, is anticipated to go live next month. The launch aligns with Shiba Inu’s third-year anniversary. Shibarium’s capabilities will be exhibited at the Blockchain Futurist Conference, also sponsored by Shiba Inu’s ecosystem.”

Cryptocurrency Market Reacts to US Job Gains Miss: Link to Inflation and Fed Policy Decisions

The U.S. added 209,000 jobs in June, below the expected 230,000, causing a slight increase in Bitcoin’s price. Despite the jobs miss ending a 14-month trend of exceeding market anticipations, the overall robust job market places the Federal Reserve in a predicament with the unemployment rate dropping and inflation lingering above target.

MiCA Regulations and Decentralized Finance: An Uncertainty in Europe’s Crypto Legislation Future

“The recent exclusion of decentralized finance (DeFi) and nonfungible tokens (NFTs) from the upcoming Markets in Crypto Assets (MiCA) regulations has raised concern in the blockchain industry. MiCA, a comprehensive crypto legislation, has notably omitted DeFi and NFTs, alarming industry participants.”

Decentralized Social Media: Empowering Users or Opening Pandora’s Box?

“DeSo is a decentralized social media system built on blockchain technology, aiming to counteract issues with traditional social media platforms. By keeping user identities, content, and networks on-chain, DeSo proposes a platform where content ownership mirrors Bitcoin’s security. However, such systems can often lack moderation, potentially leading to cyberbullying, misinformation, or misuse.”

Off-Chain Data Storage: Avail’s Solution to Ethereum’s Costly Transactions and the DA Problem

“Avail, a data storage and verification project from the Ethereum ecosystem, introduces a new ‘data attestation bridge.’ This technology could significantly reduce data storage costs on Ethereum by offloading data storage to layers 2 and 3, alleviating high transaction fees associated with posting data on the Ethereum main blockchain.”

Opening Pandora’s Box: The Intricacy and Implications of a Bitcoin ETF Approval

A Bitcoin ETF approval could potentially introduce billions to the financial democratization that cryptocurrencies offer, offering a hedge against traditional fiat currency depreciation. However, risks involve volatility and significant potential losses, requiring cautious investor understanding of complex technology.

Dissecting the Fantom Heist & Thug Life Token Surge: A Paradoxical Crypto Landscape Explained

The recent hack on Fantom’s Multichain bridge resulted in a $126 million loss, causing software confidence to plummet. In contrast, Thug Life Token’s high level of decentralization provides investor assurance. Yet, despite promising advancements, blockchain technology remains vulnerable to exploitation, highlighting the need for secure, foolproof frameworks.

SEC’s Scrutiny on DeFi – A Step Towards Security or Stifling Innovation?

The US SEC has begun investigating DeFi protocol BarnBridge, resulting in a contraction of BarnBridge’s BOND tokens by over 10%. This has raised questions among crypto enthusiasts about the future of DeFi platforms and the increasing regulatory scrutiny they face.

Clash of Tech Titans: Musk Versus Zuckerberg in Social Media Supremacy Battle

“The clash between Elon Musk and Mark Zuckerberg pertains to claims of intellectual property rights infringement regarding Meta’s release of Threads, a replica of Twitter’s platform. This controversy underscores the importance of balancing innovation and protecting the intellectual property rights within the tech sector, while maintaining ethical practices amidst competition. This serves as a reminder that the path to technological supremacy should be paved with fair practices.”

BlackRock’s Bitcoin ETF and the Shifting Crypto Landscape: Winners, Losers, and Unfazed Entities

“BlackRock’s application for a Bitcoin ETF heralds the rise of institutional investment in crypto. Decentralized finance (DeFi) remains steady, while zkSync, zkEVM, and Starknet zero-knowledge (ZK) protocols race for dominance. The security tokens market, proliferated with tokenized securities, remains controversial while growing steadily.”

Meme Tokens Faceoff: Zuck Coin’s Meteoric Rise Vs. Wall Street Memes’ Solid Footing

“Cryptocurrency market has seen over 130% surge in Zuck Coin, an astonishing 30k% gain since its debut. However, its quick rise raises caution for strategic investment. Wall Street Memes (WSM), a robust alternative, shows potential for sustained growth within crypto communities.”

Crypto Exodus: Why are US-Based Blockchain Firms Looking Overseas?

Galaxy Digital CEO Mike Novogratz suggests the crypto industry’s flourishing future requires the US’s active participation. However, the current unfavorable regulatory environment is forcing crypto firms to consider operations overseas, seeking a balance between compliance and business growth. Key companies like Coinbase are expanding services globally, highlighting the need for clearer US crypto regulations.

Federal Scrutiny of Kraken’s Former CEO: A Brief on Crypto Sphere’s Latest Turmoil

Jesse Powell, co-founder of Kraken crypto exchange, is under investigation by federal authorities examining allegations of meddling with computer accounts and emails linked to a non-profit. Despite these accusations, neither Kraken nor Powell’s involvement with the exchange are under scrutiny.}

Emerging Legislative Storm: Namibian Crypto Regulations and Their Potential Impact

Namibia’s National Assembly is taking steps towards regulating cryptocurrencies and their service providers, with penalties for non-compliance including a N$15 million fine or 10-years jail. The proposed legislation establishes a Regulatory Authority aimed at safeguarding consumer interests, preventing market manipulation and fostering innovation in virtual assets.

Binance Exodus & Legal Battles: Examining Crypto Exchange Under Fire

“Amid a tightening regulatory environment, key figures from Binance have stepped down, escalating concerns over the crypto exchange’s compliance. Accusations against Binance include deceptive practices, money laundering, and sanctions violations, with lawsuits already in motion. These challenges underscore the importance of robust regulatory compliance in the crypto industry.”

Navigating the Paradox: Nigeria’s Approach to Taxing Cryptocurrency Despite Regulatory Uncertainty

“Nigerian authorities plan to implement a 10% tax on digital assets, including cryptocurrencies, stirring concerns among industry participants. Stakeholders question this premature move while commercial banks are barred from facilitating cryptocurrency transactions, highlighting complexities in the nation’s stance towards digital currencies.”

Multichain Exploit Sees $130 Million Go Missing: A Cautionary Tale for Crypto Bridging Services

“Reports from Multichain developers confirm an exploit that affected $130 million in user tokens, urging users to halt any use of its service. The news affected Multichain’s MULTI tokens that dropped 13% within 24 hours. Bridge-based crypto exploitations have reportedly caused the disappearance of an estimated $2.66 billion in the last few years.”