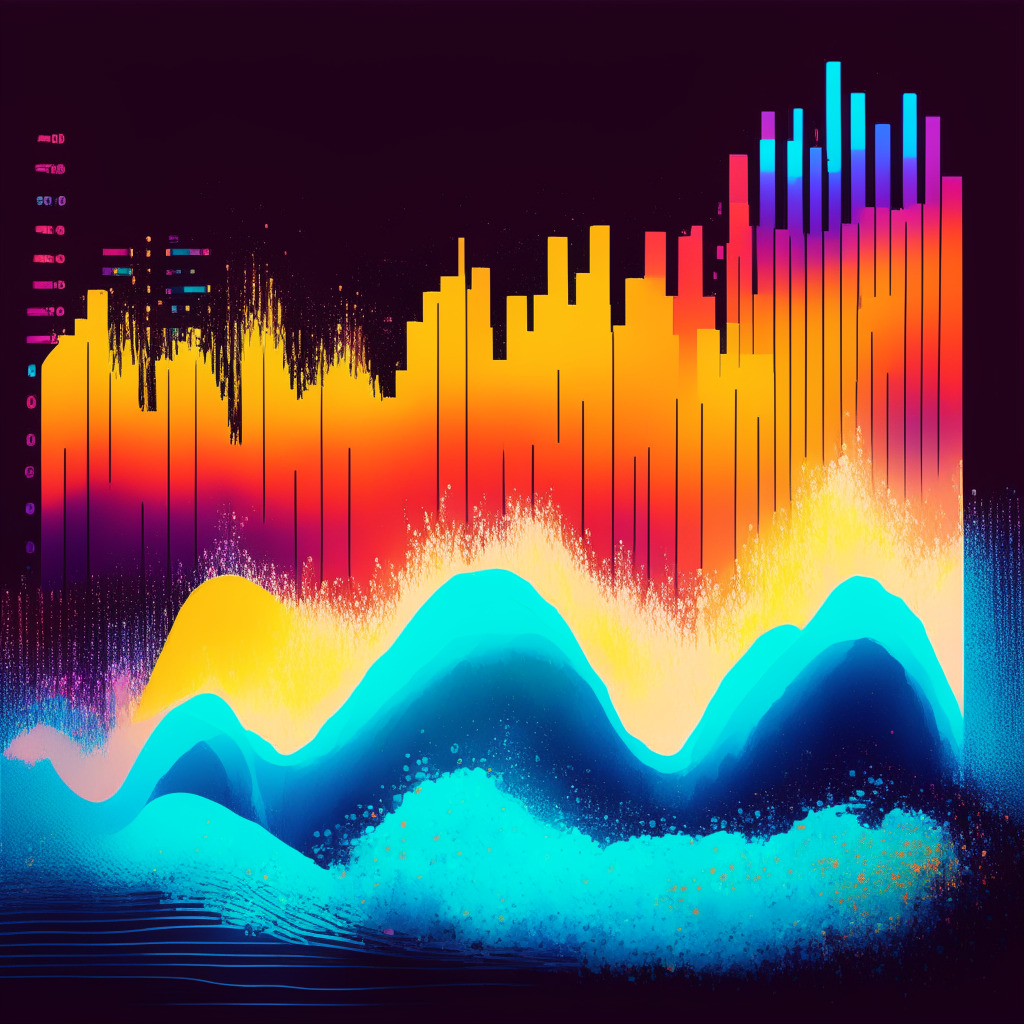

“The recent increase in Bitcoin’s exchange net flow coincides with a decrease in price, suggesting that long-term holders are selling their reserves. Also, a decline in Bitcoin velocity indicates a weak market. Analysts suggest seeking refuge in altcoins like PARROT, ANUBIS, and SOJU which are showing promising growth.”

Day: September 1, 2023

Robinhood’s $605.7M Share Reclaim: Unraveling The Complex Tale of Bankruptcy and Legal Challenges

Robinhood’s $605.7 million share buyback agreement reclaims shares seized by the US government amid FTX’s bankruptcy—a move linked to SBF’s legal challenges and potential market shifts. It also underscores the intertwined nature of corporate separations, bankruptcy, and legal challenges in the crypto sector.

Ripple vs SEC Showdown: Debating XRP Token’s Status and Impact on Crypto Landscape

In Ripple’s ongoing legal tussle, their legal representatives dismissed an appeal by the US SEC on the status of its XRP token. This dismissal is based on a July court ruling stating the XRP token did not majorly qualify as a security for retail sales. The expected jury trial date for this lawsuit is set for 2024, suggesting potential long-term implications for Ripple and the broader crypto industry.

Revising Crypto History: Runefelt’s Battle between Reality and Attraction Law

Crypto influencer Carl “The Moon” Runefelt, previously claimed to be a co-founder of cryptocurrency payment platform Kasta, but now insists that he was simply an investor. His sudden change of stance about his involvement and re-purported non-operational role, sparks questions about reliability in the volatile and fast-paced crypto industry.

Digital Rupee and Yes Bank Integration: A Gateway to Mass Adoption or a Breeding Ground for Risks?

“The digital rupee’s integration with Yes Bank’s app UPI extends its reach to millions of merchants in India, potentially driving its mass adoption. However, concerns regarding security, volatility and regulation of cryptocurrencies remain, alongside increasing competition. Despite these challenges, digital currencies showcase resiliency with digital rupee transactions worth $134 million reported within two months.”

Fusing AI and Classic Analytics: A Look into yPredict’s Revolutionary Forecasting Approach

“yPredict, a new project under development, aims to revolutionize financial forecasting by blending traditional analytical methods with modern AI technologies. It intends to democratize predictive analytics by introducing a subscription-based Prediction Marketplace, transforming financial data scientists’ earning platform and unlocking new market potential.”

Exploring the Ripple Vs SEC Showdown: A Study in Crypto Regulation Controversy

In its ongoing battle with the Securities and Exchange Commission (SEC), Ripple refutes claims for federal intervention and maintains that its systematic XRP sales did not violate securities law. This dispute shines light on potential future challenges and complexities in crypto regulation.

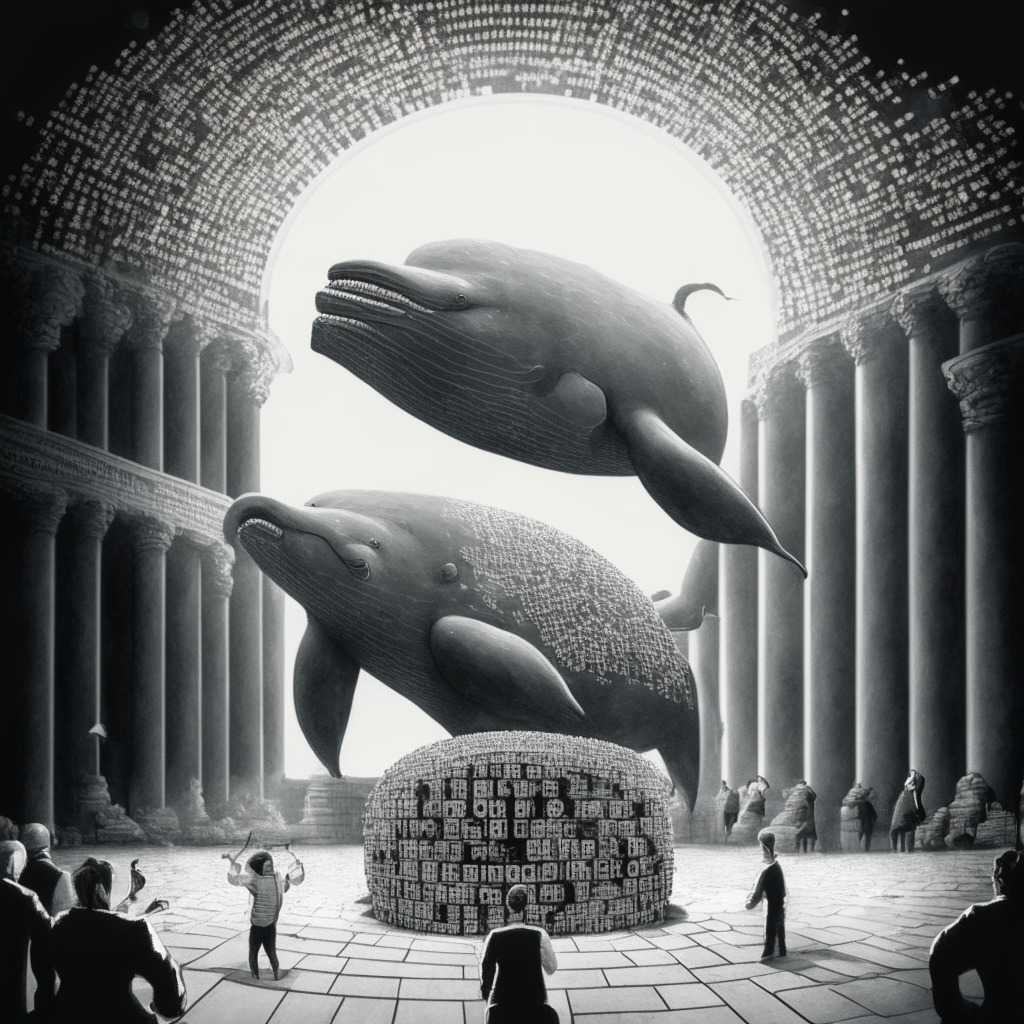

Bitcoin Whales Expanding Their Wealth Despite Price Slumps: Breakthrough or Breakdown?

“Bitcoin ‘whales’ have significantly boosted their stakes, increasing assets by $1.5 billion in late August. This growth occurred despite a slump in BTC’s price, suggesting increased optimism among institutional investors. This follows a court resolution pushing for Grayscale to list a spot Bitcoin exchange-traded fund (ETF) in the U.S.”

Jump Crypto Specialists Leave to Found Douro Labs: A Strategic Shift or Split in the Blockchain Scene?

Innovative blockchain project Douro Labs, established by ex-Jump Crypto specialists, aims to solve scaling issues within Pyth Network – a blockchain-based Oracle data service instrumental in orchestrating crypto, equity, and FX data across multiple blockchains. This marks a significant shift within the volatile digital trading landscape.

Using Bitcoin’s Lightning Network for Offline Transactions: The Future or a Fallacy?

“LNMesh, a Florida-based startup, proposes the use of Bitcoin’s Lightning Network for transactions without internet. The solution utilizes local mesh networks for devices to connect directly, allowing for off-chain Lightning payments across nodes in an offline manner using Raspberry Pi computers.”

Navigating Bitcoin’s Recent Dip: Analyzing Market Reactions and Future Predictions

Bitcoin sees a 4.6% retreat, stirring market interest in buying the dip. Its current circulating supply is nearing its capped total capacity. However, despite a bearish trend, If Bitcoin successfully breaks the $25,400 barrier, significant potential resistance may appear at $25,900 while a bullish crossover could aim towards $26,400 or $27,000.

The DeFi Dilemma: Balancing Game-Changing Innovations with Rigorous Security

“Decentralized finance (DeFi) protocols are reshaping sectors but facing security complexities as shown by the Balancer protocol losing $900K due to a flagged vulnerability. Despite challenges, DeFi’s consistent innovation and adaptability demonstrate resilience. Yet, escalating security incidents suggest a need for more rigorous measures.”

Riding the IOTA Wave: Evaluating Investment Potential Amidst Crypto Fluctuations and Rising Newcomers

IOTA, a cryptocurrency, has recently been showing modest growth, sparking speculation about potential significant investments. Despite challenges, technical indicators hint at continued investor interest. Meanwhile, new entrant Launchpad XYZ aspires to simplify Web3 processes. However, careful evaluation is advised due to inherent high risk in cryptocurrency investments.

Kentucky’s Cold Shoulder to Cryptominers: Climate vs Crypto Economy

“Kentucky’s Public Service Commission rejected a proposal from Ebon International for discounted energy rates for a cryptocurrency mining facility. The decision was welcomed by environmental advocacy groups warning of increased environmental and fiscal burdens from large-scale crypto mining operations.”

Navigating Cryptocurrency Market Volatility Amid Regulatory Decisions: A Bull vs. Bear Perspective

“Cryptocurrency market performance can heavily depend on regulatory decisions. Despite the uncertainty generated by SEC’s postponement on Bitcoin ETFs, analysts remain optimistic about approval in 2023. However, this dependency could render the crypto market vulnerable to damaging downturns and potential manipulation.”

The New ‘Crypto-politics’: Pros and Cons of Accepting Cryptocurrency Donations in Political Campaigns

“Florida’s Governor, Ron DeSantis, plans to announce the acceptance of crypto donations for his 2024 campaign, an interesting turn from traditional funding. However, cryptocurrency donations introduce complexity regarding traceability and potential misuse. The political landscape’s inherent unpredictability combined with cryptocurrency’s volatility invite intriguing consequences.”

Decoding the Future of MakerDAO: Might Solana be the Answer?

Rune Christensen, co-founder of MakerDAO, proposes the platform’s future blockchain should be built using Solana’s codebase, citing its high-speed performance. Despite support for the idea, community members raise questions about the research backing this proposal, suggesting alternative solutions might exist.

Rollbit Coin’s Bull Run: Short-lived Triumph or a Path to Greater Heights? Exploring Launchpad XYZ’s Web3 Ambitions

“Rollbit Coin (RLB) has soared over 800% since July, hitting an all-time high of $0.2131 on August 2. However, its consistent resting at the 20-day EMA and dampened trading volume may imply faltering bullish momentum. Meanwhile, Launchpad XYZ, a Web3 ecosystem, aims to bridge cryptocurrencies, gaming hubs, decentralized exchanges, and more, offering long-term engagement opportunities for crypto enthusiasts.”

Genesis Bankruptcy Fallout: A Battle of Crypto Titans Over Fairness and $3.4 Billion Liabilities

Genesis, a crypto lender facing bankruptcy, is being accused by creditors, including Gemini and Digital Currency Group, of manipulating bankruptcy proceedings with their proposed settlement. The settlement, seen by some as giving preferential treatment to certain creditors, includes Alameda Research receiving $175 million from Genesis’s assets. Critics argue it deviates from acceptable Chapter 11 protocol.

Warren Buffett vs. Bitcoin: Is the Oracle of Omaha’s Strategy Outdated in the Crypto Age?

“Even though Bitcoin saw a price surge of 683% in the year following Buffett’s critical comments on non-productive commodities, Bitcoin’s performance unmatched the returns from Berkshire Hathaway’s pertinent stock holdings. The consistent outperformance of Bitcoin’s price against Berkshire Hathway’s shares encourages investors to view Bitcoin as a viable alternative store of value.”

Navigating the Chessboard: Will the SEC Finally Approve Bitcoin ETFs?

Former SEC commission chair Jay Clayton believes approval of Bitcoin spot ETFs is “inevitable”. Despite recent delays in SEC decisions surrounding Bitcoin ETF applications, Clayton emphasizes this extended review doesn’t signal denial, but a need for thorough regulatory review in a volatile market. However, market demands and global crypto ETF approvals increase pressure.

Navigating Stormy Crypto Seas: How BTC Slump Could Spur Market Resurgence

“The cryptocurrency market dips as BTC slumps towards a two-week low. However, experts suggest this downside risk could hold potential favoring points for traders. On-chain monitoring suggests possible losses in September, but a surprise rally could also take place, proving the market’s volatility.”

Empowering Africa with Cryptocurrencies: Challenges and Potentials

The crypto world, particularly Africa, faces challenges in widespread adoption due to lacking infrastructure and education. However, Christian Duffus, founder of Fonbnk, is optimistic for favorable crypto regulations and the development of local decentralized applications to promote unique solutions and possibilities.

Infamous Chisel vs Blockchain Innovation: A Tug-of-War in the Crypto Space

“The Russian malware, Infamous Chisel, is presently threatening cryptocurrency wallets and exchange applications, specifically targeting Brave browser, Binance and Coinbase exchanges, and Trust Wallet. The malware provides persistent access to infected Android devices, constantly extracting valuable information. Alchemy’s recent support for Base opens new opportunities for blockchain development.”

The Surging Interest in CYBER: Market Trends and The Risks Involved

The crypto token CYBER, created by CyberConnect for use in a Web3 social network, has recently garnered significant interest, causing its value to increase exponentially. However, this presents a considerable risk, echoed by the transient lifespan of similar market upswings in the bearish crypto ecosystem. Traders are paying up to 2000% annualized in fees to buy CYBER on margin, demonstrating the potentially volatile nature of such investments.

Shaking Foundations: China’s Cryptocurrency Dichotomy & Future Implications

“A Chinese court affirms that digital assets, despite their virtual nature, bear economic value and are hence perceived as legal holdings protected by law. This opens questions about China’s policies on public and private cryptocurrencies and the future of digital assets.”

Robinhood’s Bold Move: Acquiring 55 Million Apprehended Shares from Former FTX CEO

“Cryptocurrency trading platform, Robinhood, acquires over 55 million shares, previously held by ex-FTX CEO, Sam Bankman-Fried, for about $606 million. The purchase, already approved by Robinhood’s board, extends shareholder base and consolidates control but raises potential future legal complications.”

Ethereum’s Market Struggle: An Unsteady Path to Growth or a Descent to Depths?

“Ethereum’s price is struggling to push past the $1,750 mark, prompting fears of further losses. However, hopes remain for a breakthrough at $1,700, possibly leading to $1,800. However, resistance at these levels may force Ethereum to find support at lower price points.”

Unraveling Ronaldinho’s Alleged involvement in a $1.2 Billion Crypto Tragedy: Lessons for Digital Safety

Former soccer star Ronaldinho Gaucho is implicated in a cryptocurrency pyramid scheme involving company 18k Ronaldinho Comércio e Participações Ltda. Accusations include deceiving investors with promises of 2% daily return rates. Ronaldinho refutes these claims, citing name misuse in company establishment.

Unveiling Polygon’s Open Source Developer Stack: Scalability Promise vs. Skepticism

Polygon’s new open-source sidechain developer stack is set to power Layer 2 solutions on Ethereum, backing its commitment to the evolution of the Ethereum ecosystem. Key to this advancement is the integration of zero-knowledge proof technology, considered critical for the scaling of the Ethereum blockchain. However, critics raise concerns about potential inefficiencies and differing architecture.

Robinhood’s Controversial Stock Buyback: The Future of Crypto Regulation or threat to Decentralization?

“The share repurchase agreement that Robinhood has recently agreed with the U.S. Marshal Service might have ramifications on government control in cryptocurrency. While this agreement could offer more investor protection and market longevity, critics worry about potential disruption to the principles of cryptocurrencies – primarily decentralization and immunity from governmental manipulation.”

Harnessing AI in HR: The Power-Packed Potential and Unseen Pitfalls

“AI is revolutionizing HR, improving efficiency in talent acquisition and retention while predicting potential turnover. However, challenges such as data privacy, algorithmic biases, and reliance on technology remain. The goal is to supplement human expertise, focusing on understanding people’s aspirations and building trust, aided by bespoke AI solutions.”