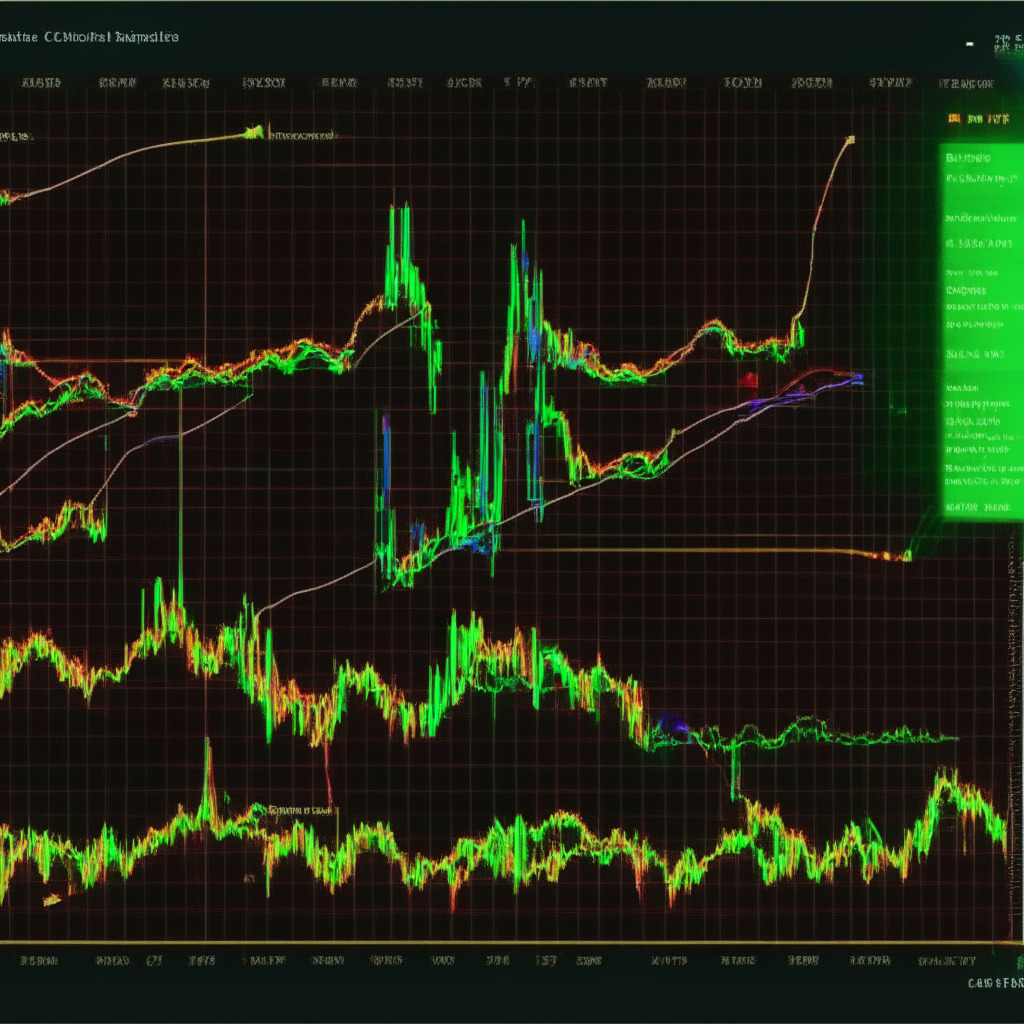

The crypto sphere was abuzz recently when BTC三TH rose to a staggering 700% shortly after its highly anticipated listing. This meme coin ascended to an intraday high of $0.00005066 before retracting as a result of profit-taking. However, despite the downturn, BTC三TH maintains a solid ground, up by an admirable 448.83% amidst the volatility brought on by its listing.

The key indicators for the coin suggest a period of consolidation before any further trends. The currency is currently trading between its 20 and 50 EMA, displaying a sense of stability despite its turbulent inception. No party holds the reins at present, and the continuation of the upward trend solely depends on a potential retest of the RSI50.

The hurdles BTC三TH faces mainly lie in its 5-minute 20 EMA and FiB 0.382 level. Breaching these barriers may see the coin ascend once more. However, failing to remain above the 5-minute 50 EMA and Fib 0.5 level could spell disaster.

On a broader perspective, there are concerns about the overall crypto market. To counter the downturn in investor sentiment, eyes are on new projects that offer returns in the absence of significant crypto price volatility.

An emerging contender is Bitcoin BSC (BTCBSC), advocating itself as a ‘Bitcoin derivative’. The project, based on the Bitcoin network, offers tokenomics similar to Bitcoin with a fixed total supply of 21 million tokens. Yet, it sets itself apart through the proof-of-stake consensus mechanism and integration with BSC. This enables BTCBSC to operate with lower transaction fees and faster confirmation times.

The merits of holding BTCBSC tokens are twofold. Firstly, it rewards token holders with a yield on their investment without being solely reliant on price appreciation. Additionally, it diminishes selling pressure by promoting long-term holding of tokens. The sustainability of growth is encouraged through majority of token distribution via staking rewards.

Furthermore, BTCBSC is currently hosting a public presale. This, and its staking model, undeniably prove attractive for those hoping to reap yields on their crypto holdings. At the same time, caution is advised given the high-risk nature of cryptocurrency.

Source: Cryptonews