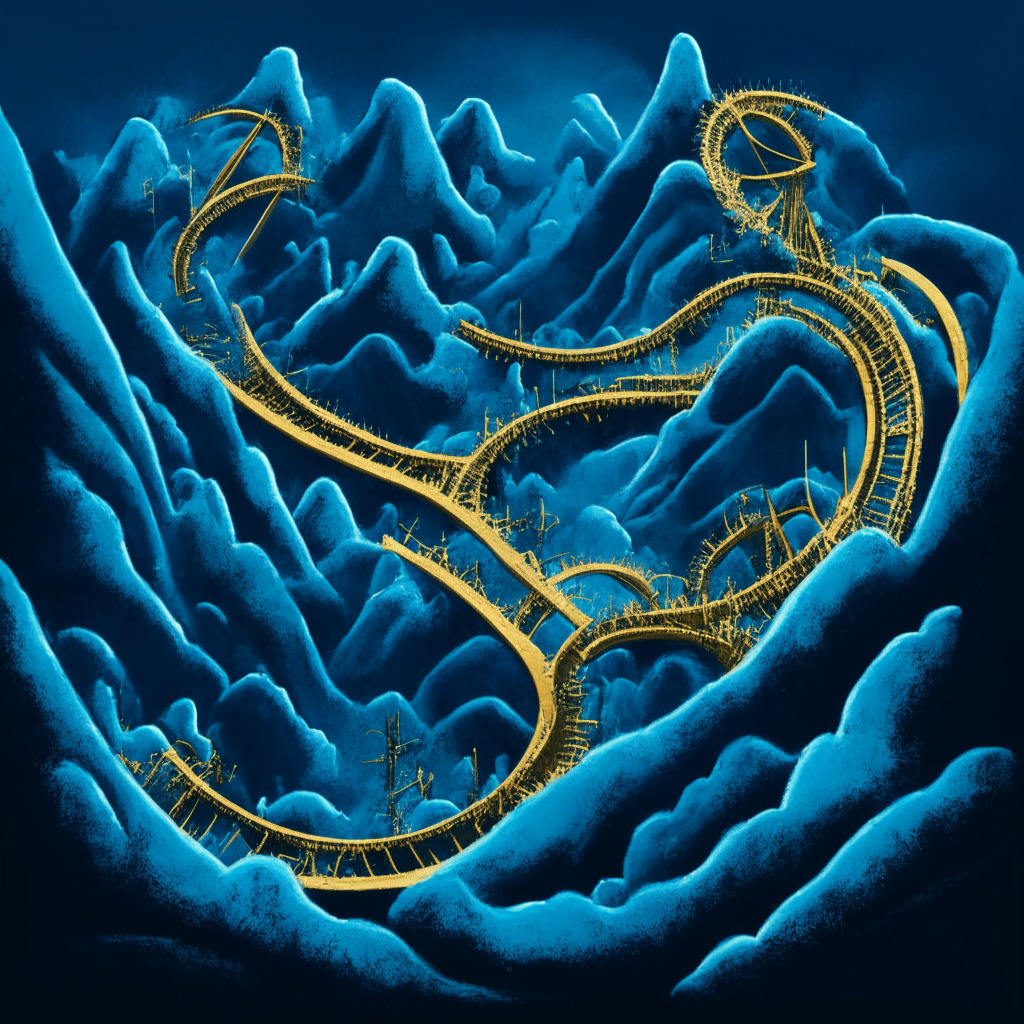

The cryptocurrency giants, Bitcoin and Ethereum, stand steady experiencing minor fluctuations roundabout 1%, trading around $26,500 and $1,600 comparatively. The lack of wild price swings, potentially due to the moderated trading volume, instigate a strong anticipation of a breakout amongst investors and analysts.

The price stability seems to be in sync with the indecisive sentiments indicated by the Fear & Greed Index, possibly contributing to neutral trading bias widespread in the crypto market.

Currently, Bitcoin is priced at $26,557 with a modest decrease by 0.31% over the past day. Despite the slight depreciation, it maintains its dominant presence on CoinMarketCap, backed by a sizeable market capitalization of approximately $517.69 billion. The accessible circulating supply is nearing its predefined cap of 21 million coins.

In light of recent developments, Bitcoin’s market sensitivity has risen. Bitcoin’s price drop beneath the $26,650 mark indicates a move towards the immediate support level of $26,300. If this trend perseveres, Bitcoin’s next target could potentially be the $25,511 mark. On the other hand, surpassing the $27,000 might steer Bitcoin towards $27,500.

Ethereum, on the flip side, is trading around $1,593 with an appreciable gain of less than 0.10% over the prior 24 hours. It upholds its position as the second-best asset on CoinMarketCap, with an impressive market capitalization of $191 million.

The ETH/USD pair indicates a volatile trading pattern, facing immediate resistance at $1,600 and support around the $1,575 mark. If ETH breaches the $1,600 mark, the following resistance could be around $1,625, with a stronger barrier near the double-top pattern of $1,660. However, a decline beyond the $1,575 mark could direct Ethereum’s price towards the $1,535 mark.

The future scene of the cryptocurrency market in 2023 is the key point of interest for many. Digital asset enthusiasts are getting the head start by checking out the top 15 alternative cryptocurrencies and ICO projects that are poised to make the difference.

All these analyses, however, are only part of the bigger picture. It’s crucial that investors maintain a diligent approach before entering the volatile crypto market. The crypto market can offer considerable opportunities, but it’s also fraught with considerable risks. Remember, the crypto projects discussed in this article are not financial advice but just an interpretation of the current market trends.

Source: Cryptonews