“The notorious co-creator of the crypto scam OneCoin, Karl Greenwood, received a 20-year prison sentence, highlighting the importance of regulation and investor protection in cryptocurrencies. Cryptocurrencies’ integrity depends on the technology they’re built on and the people running them. This serves as a potent lesson for those navigating the rapidly evolving financial landscapes.”

Month: September 2023

Navigating the Dips: SOL’s Bearish Trend Amidst FTX Dissolution and Opportunities Beyond

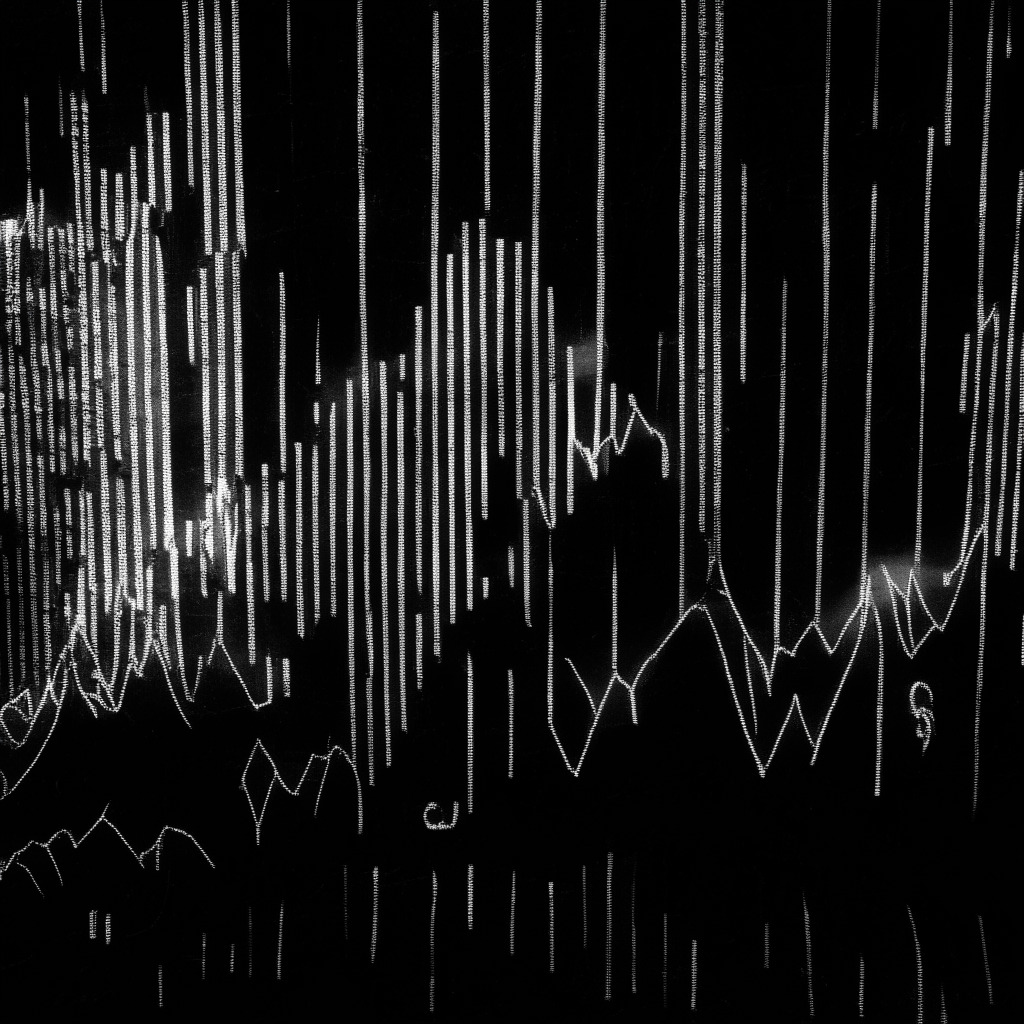

The Solana (SOL) cryptocurrency recently experienced a dip of around 2% after a distressed exchange, FTX, was granted permission to commence dissolving its $3.4 billion in digital assets. Despite not immediately unloading all assets, this situation brings an increased sell pressure within the crypto market, affecting SOL due to the exchange’s substantial stake in the blockchain.

Proposed DCG-Genesis Deal: A Lifeline for Gemini Earn Users or Crypto Regulatory Alarm?

Gemini Earn users could recover between 70%-90% of their cryptocurrency holdings due to a proposed agreement between DCG and Genesis. This agreement averts a Chapter 11 case. The recovery amount represents the soaring appreciation of digital currencies – “$85,000 for BTC and $8,500 for ETH.” However, the deal still requires creditor approval.

Navigating Bankruptcy: How Crypto Exchange FTX Plans to Leverage $3.4 Billion in Digital Assets

Judge John Dorsey has permitted FTX, a bankrupt crypto exchange, to sell and invest its $3.4 billion crypto assets to pay off creditors. FTX’s strategy involves hedging its assets to lower risk and staking digital assets for low risk returns. They also aim to leverage expert knowledge in navigating the volatile crypto market.

Navigating the Crypto Tempest: Rise of Rollbit Coin and the Wall Street Meme’s Crypto Venture

“Despite market downturns, Rollbit Coin (RLB) has seen a 10% uptick and 35% recovery, indicating possible bullish return. The coin boasts on-chain growth, ample space for increases with rising ETH, ERC-20, and SOL deposits. The case for Rollbit reaching the coveted $1 mark remains dubious amidst competition, but optimism abounds due to its popularity within transparent, secure Web3 gambling platforms.”

FTX’s Potential $3.4bn Liquidation: Boon Or Bane For The Crypto Market?

“FTX, a renowned cryptocurrency exchange, is considering liquidating up to $3.4 billion in digital assets, causing speculation about market impacts. To prevent panic selling, FTX is providing private updates to U.S. Trustees and creditor committees on planned sales.”

Unraveling the Upgrade: Cosmos Hub’s Liquid Staking and its Implications for ATOM Stakeholders

“Cosmos Hub has introduced an upgrade, bringing in a liquid staking module for ATOM stakeholders. This eliminates the previous 21-day lock-in period after unstaking, allowing staked ATOM to be used in the Cosmos DeFi ecosystem. This change could free over $400 million of ATOM for liquidity purposes, potentially boosting staked ATOM within Cosmos-run protocols. However, the upgrade also implies adjustments in inflation rates and brings new limitations for ATOM holders in liquid-staking.”

Regulatory Scrutiny vs Technological Advancements: Navigating the Complex Crypto Landscape

Despite regulatory challenges and hacking threats, the crypto sphere continues to innovate, with enhanced privacy, user experience, and transaction efficiency. As Ethereum plans a major transformation and Ripple maintains its legal standing, the tokenized assets market could reach $16 billion by 2030. However, effective regulation remains vital to safeguard all stakeholders.

Unveiling the Renaissance of Asia in Cryptocurrency’s Tech Arena: A Paradigm Shift or the Prelude to a Tech Rivalry?

“Ethereum co-founder, Vitalik Buterin, highlights Asia’s increasing mastery over blockchain technology, evident in its active participation in developing ‘account abstraction’ or ERC-4337. This shift towards technical involvement in the blockchain from Asian contingents marks a significant change in the global blockchain landscape.”

Regulatory Maze: Stoner Cats NFT Scandal and the Lessons for the Crypto World

Stoner Cats 2 LLC (SC2), the creators of the animated series Stoner Cats, has faced charges from the U.S Securities and Exchange Commission for conducting an unregistered offering of crypto asset securities as nonfungible tokens (NFTs). The case underlines the importance of operating within legal regulations, even in the rapidly evolving world of blockchain and cryptocurrencies.

Navigating Uncharted Waters: US Dollar Inflation, Ethereum’s Rise, and the Promise of New Coins

“Ethereum’s blockchain foundation, Ether (ETH), exhibits recovery with a recent 5% rise from low figures and a $1530 valuation. Despite a near-term unfavorable outlook, the prospects of future ETF approvals and ETH’s adoption rate suggest potential growth, even towards a $10,000 mark.”

Bitcoin’s Sub-$25k Plunge: A Terrifying Dystopia or Promising Opportunity-in-Disguise?

As Bitcoin’s price dipped below $25,000, discussions ensued questioning whether this signifies a discount for investors or an impending disaster. The metric often used to predict price movements and Bitcoin’s inverse correlation with the U.S. Dollar Index showed inconsistencies, leading to speculations amidst a trend of decreasing frequency of Bitcoin transactions. Experts offer varied opinions, from hopeful future prices to cautionary advice, reflecting the unpredictable nature of Bitcoin’s price movements.

Sam Bankman-Fried’s Detainment: An Indicator of Crypto’s Legal Challenges and Future Resilience

“Regulations continue to be a hot topic in cryptocurrency. This week, developments surround the high-profile case of Sam Bankman-Fried, founder of the once $32 billion dollar-valued cryptocurrency exchange, FTX. His ongoing legal battle serves as a reminder of the turbulent legal waters of the crypto universe.”

Unraveling the Complex Connection: Interest Rates and Cryptocurrency Volatility

“The U.S Treasury’s increased borrowing is causing speculation about the impact on digital asset prices. Investors may find Bitcoin appealing in a low interest rate regime, pushing up their prices. However, high conventional interest rates could have the opposite effect. Furthermore, fluctuations in interest rates can influence overall market sentiment, leading investors towards safe haven assets.”

Navigating the SEC-Bitcoin ETF Tension: Unmasking the Comprehensiveness of Crypto Diversification

“Multi-asset crypto portfolios deliver superior diversification characteristics when compared to single-token concentration. Broader scope and relative value active management opportunities across Crypto sectors can capitalize on the numerous fundamental uses of blockchain technology rather than relying solely on giant players like Bitcoin and Ether.”

Coinbase Embraces Lightning Network: A Leap towards Expedited Blockchain Transactions

Coinbase’s CEO, Brian Armstrong, has confirmed plans to integrate the Lightning Network – a Bitcoin-based payment system that promises faster transaction processes – into their services. Armstrong’s support for Bitcoin and this integration reaffirms his stance on Bitcoin being “the most important asset in crypto.”

Crackdown on NFTs: SEC Targets Stoner Cats 2 for Unregistered Securities Allegations

“The Securities and Exchange Commission targeted Stoner Cats 2’s NFT project for allegedly amassing $8 million through unregistered sales. The company purportedly linked the show’s success to its NFTs’ value, sparking investors’ profit expectations and resulting in accusations of unlawful offerings. Amidst an ongoing crackdown, this highlights the need for stricter regulatory frameworks in the NFT world.”

Ethereum’s New Holesky Testnet: A Step Towards Optimized Network Scalability and Enhanced Testing

Ethereum is set to unveil a new testnet, Holesky, which promises larger capacity than its existing networks, Sepolia and Goerli. The new testnet aims to address potential scaling issues and accommodate more extensive testing for Ethereum’s growing developer community. Named after a Prague train station, Holesky’s significant size would provide a realistic environment for infrastructure and core protocol upgrade testing, targeting to enhance Ethereum’s resilience against unexpected obstacles.

Navigating the Future: Exploring Recent Advances and Challenges in Blockchain and Crypto Industry

“BNB Chain developers launched opBNB’s mainnet, aiming to address blockchain’s congestion and high transaction costs. Nansen presented an AI-powered upgrade of its platform to track suspicious trades and monitor transfers. Ripple plans to hire internationally due to regulatory dissatisfaction. Telegram and TON Foundation announced a self-custodial crypto wallet, TON Space, while Opera launched a non-custodial stablecoin wallet in Africa.”

Blending Traditional Finance with DeFi: MetaComp’s Bold Game-Changer in Singapore’s Financial Scene

“MetaComp, Singapore’s digital asset platform, combines traditional finance with decentralized finance, allowing customers to purchase traditional securities with stablecoins. Despite some skepticism due to crypto volatility, the firm believes that fiat-pegged cryptocurrencies will penetrate the real economy.”

Exploring the Upsurge in VET Trading and the Prospect of Investing in Launchpad XYZ’s LPX Token

“VET is seeing increased trading activity following Coinbase’s announcement of support. Market predictions suggest a shift in trend, though downside risk remains. Meanwhile, investors are exploring opportunities on AI trading platform Launchpad XYZ, whose native token $LPX is attracting investor interest.”

Adapting to Crypto Winter: Alchemy’s New Affordable Payment Plan for Tech Developers

Blockchain infrastructure provider, Alchemy, has introduced a new affordable payment plan, “Alchemy Scale Tier,” aimed at providing financial relief to developers building applications for blockchains amid the economic pressures of the crypto market. Offering flexible pricing, the plan encourages continued development despite ongoing market turbulence.

Crypto Exchange Rebrands Stir the Pot: Huobi Becomes HTX Amidst Market Confusion

“Huobi, a notable crypto exchange, is rebranding to HTX, leading to parallels with FTX, a defunct exchange, and sparking scrutiny. Despite suspicions, the company denies any legal troubles. Simultaneously, BNB Chain employs Optimization’s rollup technology for opBNB, aiming to enhance scalability and security.”

The Rollercoaster Ride of DAOs: Marvel of Decentralization or Havoc Waiting to Happen?

“Decentralized autonomous organizations (DAOs) manage a massive $17.2 billion in value. However, DAO governance is filled with numerous failures, underlining the need for improved DAO infrastructure and governance. Challenges of balancing decentralization and efficient product-market fit persist. Tools like Senate and Goverland aim to integrate DAO voting into single platforms, enhancing participation.”

OpBNB’s Public Launch: Evaluating BNB Chain’s L2 Scaling Solution and its Effect on the Ecosystem

“BNB Chain’s Ethereum-compatible L2 has gone public after successfully testing its Optimism-powered layer 2 scaling platform. Aimed at providing lower gas costs and faster transactions, it displayed potential but not without some concerns, such as the week-long fund lockup during verification checks. Despite potential drawbacks, BNB Chain’s progress towards a swift, secure, and economical opBNB platform is laudable.”

Transformation or Tumult? Huobi’s Unexpected HTX Rebranding Sparks Fierce Reactions

Huobi, a renowned digital asset exchange, is undergoing a rebranding on its 10th anniversary to HTX. Amid heated discussion among crypto enthusiasts, this rebranding collaboration with blockchain security entity, CertiK, seeks to upgrade its existing infrastructure and marks the next phase in its transformative growth.

The Onslaught of Real World Assets: Pros, Cons and Impact on the Existing Blockchain Landscape

“Real World Assets (RWAs) are tangible properties making their foray onto the blockchain. Most prominent assets represented are real estate, private credit, gold and treasuries. RWAs can be purchased via a marketplace, with their value fluctuations mirroring mainstream market assets. Challenges include market movements, regulations, and fragmentation, but the potential benefits are substantial.”

Emerging Crypto Landscape in Asia: Boon or Bane for Institutional Adoption?

“Institutional adoption of digital assets in Asia is on the rise due to improved regulatory clarity, with key adopters including South Korea, Hong Kong, Japan, and Singapore. However, progress varies across countries. Despite hurdles, the digital asset market’s infrastructure has noticeably strengthened, indicating increased market maturity.”

Navigating Crypto Markets Amid Inflation Surges: A Roller-coaster Journey of Speculation and Risk

“The rising inflation and its potential impact on economic policies rattled crypto markets, leading to price volatility in Bitcoin. Despite the uncertain climate, some market participants remain optimistic, viewing risk, volatility, and speculation as essential lifelines of the crypto markets. However, due diligence remains a critical tool amidst these uncertainties.”

Unlocking Insolvency: How a New Remuneration Scheme from DCG could Revolutionize Digital Asset Recovery

Gemini Earn users might recover almost all claims due to a proposal by the Digital Currency Group (DCG). This plan, which may result in a 70-90% recovery for creditors, involves the use of digital assets, but also raises concerns about cryptocurrency market volatility. The proposal’s success crucially depends on approval and renegotiation of a significant loan. Despite potential risks, it signifies a monumental step in tackling insolvency in the digital currency sector.

Inflationary Tales: Core CPI’s Impact on Bitcoin and Emerging Economic Trends

“The core CPI showed a gain of 0.3% against an expected 0.2% increase, marking a downward yearly trend to land at 4.3%. This suggests that, despite the surge in headline inflation, if the downward trend in core inflation continues, it could dispel fears of runaway inflation.”

Bankruptcy and Redemption: Gemini Earn’s Potential Recovery amidst Crypto Market Turbulence

“A proposed remuneration deal for retail creditors of the Gemini Earn program promises a possible recovery of 95-110% of their claims. The payout is contingent on an agreement within diverse Genesis creditor groups and the final form of the agreement.”