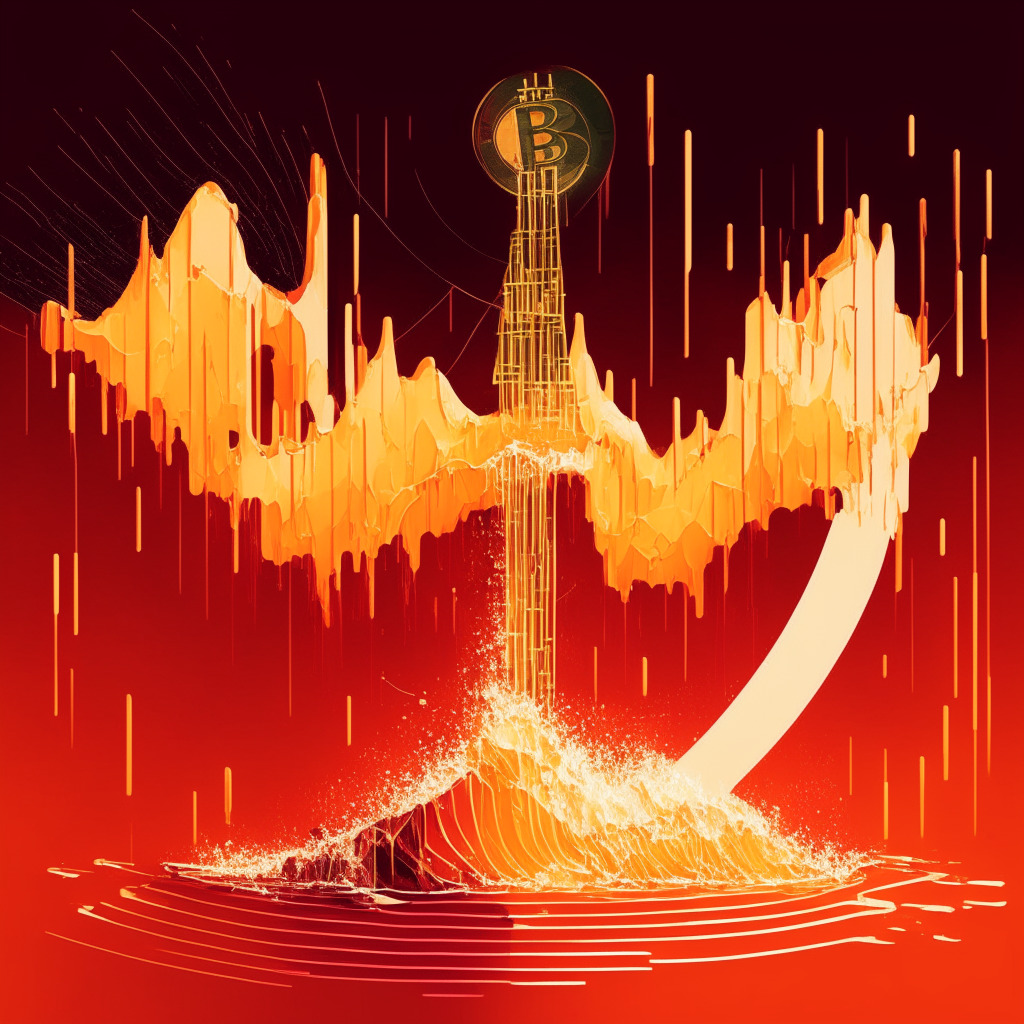

In the constantly fluctuating cryptocurrency landscape, Bitcoin’s trading value has decreased significantly, influenced by big players or ‘whales’ offloading their stocks. With looming regulation tightening, exchanges like Luno are making adjustments to comply. It’s critical to stay informed and back your investments with thorough research and professional insight in this volatile market.

Month: September 2023

Decoding the Potential of a National Fraud Registry: A Shield Against Crypto Scams?

CFTC Commissioner, AdobeChristy Goldsmith Romero proposes a centralized national fraud registry, a one-stop database for regulators to cross-reference misconduct, benefiting investors, law enforcement, and administrations. This registry aims to be a robust deterrent to potential fraudsters and a means to effectively recognize serial offenders.

Navigating Bitcoin’s Rollercoaster: Understanding Price Fluctuations and Their Implications

“This balanced view of the BTC market nuances elucidates the complexities that go hand in hand with the future of blockchain. It’s clear that, with soaring highs and plunging lows, this promising technology can still be a potential minefield.”

Finoa’s Innovative Step: Bridging DeFi and Regulatory Institutions with FinoaConnect

The Berlin-based cryptocurrency firm Finoa is launching FinoaConnect, a proprietary wallet integration allowing its clients to access handpicked decentralized finance (DeFi) platforms and web3 applications. This development aims to reframe the relationship between DeFi and regulatory institutions, offering a secure, regulated solution for institutional investors keen to engage with these technologies.

Ethereum Co-founder’s SIM Swap Attack: An Alarm for Crypto Security Measures?

Ethereum co-founder, Vitalik Buterin fell victim to a “SIM swap” attack, losing over $691,000 due to a fraudulent NFT promotion. The incident has shed light on the security flaws associated with phone numbers being linked to social accounts. Decentralized identity control systems could potentially offer a solution to this escalating issue.

Crypto Sneak Attack: How One User Commandeered 21,877 Wallets in a Masterful Sybil Assault

“A complex Sybil attack was recently executed on zkSync, a layer-2 scaling solution for Ethereum, enabling the aggressor to gain control over 21,877 wallets. This carefully planned attack highlights the increasing occurrence of Sybil attacks in the crypto world, posing significant threats to airdrops and raising concerns about the security and integrity of the rapidly evolving crypto market.”

Crypto Saga: The Mashinsky Case, Legal Frameworks, and Impacts on Industry Innovation

“Alex Mashinsky, former top brass of crypto lender, Celsius, faces charges of fraud and manipulation of the CEL token’s price. This case brings into focus whether 20th-century laws can effectively pursue 21st-century cryptocurrency cases, suggesting a need for legal framework expansion.”

Deciphering China’s Crypto Future: A Step Beyond USD Dependence?

Chinese scholar, Huang Qicai, suggests digital currencies could stimulate a global transition from USD dependence, potentially leading to a “world currency multi-polarization”. Key nations like China, Russia and Brazil are making significant strides in digital currencies, hinting at a potential change in global monetary governance.

International Success in Cryptocurrency Fraud Prevention: A Detailed Analysis

In a joint international effort, law enforcement bodies have successfully taken down a fraudulent investment scheme, BCH Global Ltd. Thai authorities and Homeland Security Investigation apprehended five individuals behind this scam, which cheated around 3,280 investors of approximately $76 million. The fraudulent scheme promised swift, substantial returns through investments in gold and digital tokens, USDT.

Exploring the Metaverse Divide: East Booms while the West Wanes?

Sandbox co-founder Sebastien Borget emphasizes the booming metaverse market in Asia, despite seeming decline in the West. He is set to launch Lion City, a virtual neighborhood in the Sandbox metaverse, hinting potential geographical shift in metaverse utilization. This article also introduces the dynamic NFTs developed by Apple, possibly tipping the metaverse industry balance.

Security Chaos in Crypto: Unpacking the $41M Stake Heist and Crypto’s Million Dollar Losses

The article discusses the aftermath of a $41M cryptocurrency heist, with the responsible anonymous hackers gradually transferring stolen funds to different digital wallets. Through multiple related incidents, the piece raises alarms about substantial security concerns within the crypto industry and highlights the potential of AI in identifying threats.

Banana Gun’s BANANA Token Plunge: A Case for Re-evaluating Crypto Auditing Practices

“The newly launched Banana Gun’s token, BANANA, fell by over 99% within three hours due to a bug in the token’s contract. Despite identifying the flaw, the incident raised concerns about the reliability of AI-powered systems for auditing and writing code, prompting a reevaluation of conventional auditing processes. Meanwhile, the rise of bot-enabled trading systems highlights an undercurrent of risk despite their convenience.”

Navigating the Regulatory Tug of War: Binance and SEC’s Standoff about the Future of Crypto

“Binance.US has labelled SEC’s call for executive depositions and additional discovery to be overly burdensome and indiscriminate. Accusations allege the CEO of Binance and Guangying ‘Helina’ Chen channeled billions in customer funds through third-party companies, with Binance refuting these claims. The standoff brings scrutiny to SEC’s regulation of the crypto industry, raising concerns about overstepped regulatory boundaries and stifling innovation.”

Stablecoin De-Pegging: A Deep-Dive into USDC and DAI Performance versus USDT and BUSD

“Analysts reveal ‘de-pegging’ is more common in stablecoins USDC and DAI compared to Tether and Binance USD. While stability ideally requires good governance, collateral and reserves, market confidence and adoption, USDT has shown steadiness despite mainstream scrutiny.”

Navigating the Digital Wave: Zodia Custody – The Future of Crypto Asset Custody in Singapore

“Zodia Custody, an arm of Standard Chartered, is providing digital asset custody services to financial institutions in Singapore in response to the burgeoning demand for secure crypto solutions. This expansion, spearheading fintech investments, signals crypto’s deepening roots in the financial world.”

Straddling Digital and Traditional Finance: Zodia Custody’s Expansion and the Regulatory Dance

“Zodia Custody, a subsidiary of Standard Chartered, now offers digital asset custody services in Singapore, anticipating growing investment as regulations evolve. This move, along with its current registrations in U.K., Ireland, Luxembourg, and a pending application in Japan, signifies its global ambitions in the cryptocurrency sphere. Balancing regulatory respect, innovation, and stakeholder interests is crucial.”

Reviving BIP-300: A Game Changer or Threat to Bitcoin’s Success?

The Bitcoin community is revisiting BIP-300, a Bitcoin Improvement Proposal, that suggests using sidechains to allow BTC to move onto separate blockchains within the Bitcoin network. While some praise the proposal’s potential benefits, like choosing blockchain security models, others express concerns about inadvertently encouraging scams and drawing unwanted regulatory attention. This underscores a bigger question about the future of Bitcoin.

Ethereum Co-founder’s Twitter Breach: An Eye Opener on SIM-swap Attacks, Crypto Security & Lessons Learned

“Ethereum co-founder Vitalik Buterin’s recent Twitter account breach resulted from a SIM-swap attack. This hacking method bypasses two-factor authentication, revealing a glaring weak link in our security: our phone numbers. The event highlights the risks associated with using phone numbers for authentication, urging the need for improved security practices to safeguard crypto investments.”

Expert Battle in FTX Founder’s Legal War: Implications on Future Cryptocurrency Regulation

“In the case involving FTX Founder Sam Bankman-Fried, the DOJ argues proposed defense witnesses lack necessary expertise. The defense’s proposed expert witnesses, however, cover a range of expertise, from data analytics to law and may challenge DOJ’s testimonies, if needed. The case raises questions about law enforcement’s future interference in cryptocurrency matters.”

Investing in Blockchain Growth: The Rollout of Bitget’s EmpowerX Fund and its Implications

Bitget, a leading crypto derivatives platform, has launched the Bitget EmpowerX Fund, a $100 million investment pool dedicated to enriching its ecosystem and investing in entities that could significantly boost its growth. This initiative reflects Bitget’s strategy to enhance its services, aiming to meet the evolving demands of crypto users worldwide.

Crypto Regulation: Is Gensler’s Staunch SEC Stance Justified or Not?

“SEC Chair, Gary Gensler, asserts that crypto assets are securities to be regulated by the SEC, despite recent legal disputes. He believes most crypto assets meet the Howey Test, a legal criterion determining if an asset is a security. Crypto companies and courts debate the future direction of crypto regulation.”

AI-Centric Crypto Projects: The Future is Here, Navigating Opportunities and Risks in the Blockchain Universe

“AI-driven crypto projects like Render, Fetch.ai, and yPredict offer more than just crypto market stability amidst uncertain economic times. They solve real-world problems, integrate advanced technologies, and nudge the crypto and AI sphere forward, improving functionality and solving practical issues.”

Navigating the Crypto Storm: FTX Fallout, Market Turbulence & Hidden Opportunities

“The cryptocurrency market faced increased volatility following revelations from FTX, a bankrupt crypto exchange with significant holdings. These developments sparked fears of potential asset liquidation flooding the market. Despite this turbulence, select producers, such as Wall Street Memes, Kaspa, Monero, Bitcoin BSC, and Bitcoin Cash, continue to show promising technical outlooks and robust fundamentals.”

Exploring the Probability of Marking Digital Ruble Tokens: A Double-Edged Sword for Russian CBDC

The Russian Central Bank potentially explores “marking” digital ruble tokens to track CBDC transactions, allowing close monitoring of funds usage. This suggests super-traceable tokens could be a reality soon, although there are cautionary notes around the required balance between regulation and autonomy in digital currency.

Heavy Hitters Form Crypto Freedom Alliance in Texas: Pathway to Clearer Digital Asset Regulations

“The newly formed Crypto Freedom Alliance of Texas, comprising key crypto entities, aims to promote clear regulations for digital assets in Texas through education. The initiative emphasizes the challenges of legal jurisdiction for Decentralized Autonomous Organizations (DAOs) and advocates for crypto-friendly tax laws and reshaped banking regulations.”

Riding the Bitcoin Rollercoaster: Fluctuating Market Dynamics and Future Projections

“Bitcoin’s live price is approximately $25,090, demonstrating a notable fluctuation with a dip close to 3% in its value within the last day. This is due to a stark downtrend, breaking a triple bottom support, indicating a bearish trend. However, future of Bitcoin remains uncertain, suggesting a rally towards $26,400 and possibly as high as $46,000.”

Arbitrum’s Fall: Unraveling the Possible Causes Behind its 14.5% Price Drop

Arbitrum, a leading layer-2 Ethereum solution, faces a downturn marked by a 14.5% token price plunge, decreased decentralized application activity, and a dip in total value locked (TVL) to $1.6 billion. This suggests potential investor uncertainty amidst growing competition and declining network usage, casting doubt on ARB’s future unless it successfully boosts transaction volumes and expands its user base.

Understanding the Impact of Big Crypto Transfers during Market Downturns

Significant amounts of Bitcoin, Ethereum, and Arbitrum’s ARB token were recently moved to crypto exchanges by firms like Jump Trading, Wintermute, and Abraxas Capital amidst a market downturn. While such on-chain movements could signal intent to sell, they may also provide necessary liquidity between exchanges, as integral to market maker operations.

Clash of Titans: SEC’s Gensler’s Crypto Apprehensions and the Ongoing Crypto-securities Law Drama

U.S. Securities and Exchange Commission Chair, Gary Gensler, stands firm on his belief that most crypto tokens likely qualify as investment contracts under the law, making them subject to securities laws. Despite recent court decisions favoring crypto entities like Ripple, Gensler remains focussed on the noncompliance of the crypto sector with these laws, fuelling ongoing crypto-securities law conflicts.

Ethereum, Solana, and $BTCBSC: The Blockchain Battle Royale and the Tense Market Future

In this high-stakes world of blockchain technology, Ethereum competes with newcomers for dominance. Amid market volatility, Solana commands investor attention despite a bearish trend and uncertainties. Meanwhile, Binance Smart Chain secures admiration due to rapid transaction processing and low fees as Solana’s future hangs in balance. Despite market uncertainties, informed decisions and risk assessment are advised for navigating the digital asset realm.

Navigating Through the Cryptosphere: Recognizing Scams in the New Era of Digital Currency

Despite heightened security in the decentralized financial world, scams persist. A recent significant hoax involves a counterfeit ‘GBTC’ token giveaway impersonating the Grayscale Bitcoin Trust. The fake account’s blue checkmark, which was previously a trust signal, has compounded the confusion, emphasizing the need for heightened awareness and rigorous security checks among users.

Blockchain’s Potential Role in AI Authentication and Its Legal Challenges in the US

“U.S. Rep. Tom Emmer suggests that blockchain technology could play a key role in authenticating AI-generated data, marking a significant intersection for blockchain and AI. Additionally, he signals potential policy distractions on digital assets, urging for innovative strides rather than legal controversies in cryptocurrency policies.”