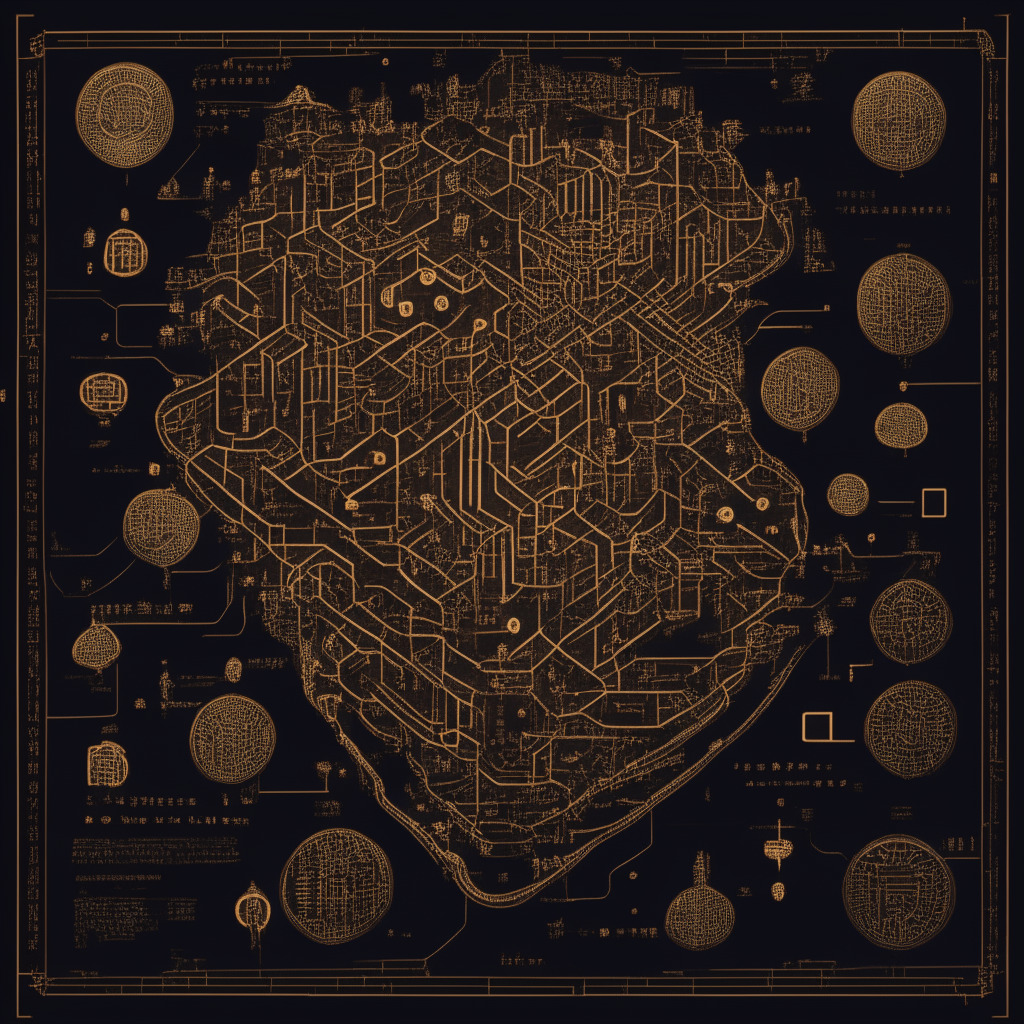

The Bank for International Settlements (BIS) along with four European central banks – the European Central Bank, Banque de France, Deutsche Bundesbank and Nederlandsche Bank, have launched a novel Proof-of-Concept (PoC) system, Project Atlas, to trace global cryptocurrency asset movements. This strategic move with the BIS aims to monitor both on-chain and off-chain transactions on public platforms including Bitcoin.

Project Atlas aspires to revamp how financial authorities manage crypto assets and their issuers by tracking international asset movements. The novelty of Atlas lies in its data fusion capability. It integrates data from crypto exchanges (off-chain data) with data sourced from public blockchains (on-chain data). With its advanced data vetting function, it provides tools for a more accurate assessment of the economic significance of these markets.

While decentralized finance (DeFi) sees growth, the consequent regulatory challenges are also increasing. Instances of system abuses by unscrupulous parties and overall industry failures are partly due to the lack of vital data for authorities. Atlas aims to be a game changer in this regard by employing a thorough analytical framework to dissect data for the global central bank community.

An intriguing aspect of the matter is the precarious balance of widespread crypto adoption and regulatory oversight. Major financial institutions such as the International Monetary Fund (IMF) and the Financial Stability Board (FSB) express concern that adoption without sufficient regulation could undercut government policies.

The value of Atlas is accentuated by the fact that, despite numerous blockchain intelligence websites providing insights on crypto transactions, the data they offer is frequently limited to plain trading and lacks customization to cater to regulatory requirements. Transactions involving crypto and DeFi are notoriously tricky to trace and utilize compared to traditional financial assets, creating even more uncertainty and risk regarding regulatory oversight.

Another crucial point that needs attention is the lack of transparency in gathering information across multiple chains. The technique is often cloaked in secrecy, leaving central banks with a lesser chance of acquiring the required data. This scenario is aggravated by the propensity of bad actors and certain industry executives to manipulate the market, potentially exaggerating key data like transaction volumes and thereby gaining an unfair advantage.

In this dizzying whirlpool of complexities, the importance of Project Atlas cannot be overemphasized as it furnishes central bank regulators with the requisite tools to ensure a safer investment landscape, thereby reducing the risk of fraudulent activities.

Source: Cryptonews