Fintech platform GenTwo, known for securitization, has raised $15 million in a Series A funding round led by Point72 Ventures, announces the firm. This event raises intended expansion to international presence, promising a significant impact on the global fintech landscape.

Year: 2023

Ethereum-based Wallet Scams: The Dark Side of Crypto Convenience or Heightened Awareness Call?

“Scammers exploit MetaMask’s reputation by redirecting users to fake websites via official government website URLs. Unwary users link their MetaMask wallets to these hoax sites, inadvertently giving fraudsters control over their assets. Despite MetaMask’s efforts, such scams have left crypto enthusiasts questioning their holdings’ security.”

KEB Hana Bank Seizes Future of Blockchain with BitGo Partnership: A Dive into South Korea’s Digital Asset Market

South Korea’s KEB Hana Bank partners with BitGo, a leader in crypto custody and security, to offer digital asset custody services from 2024. The partnership is expected to enhance consumer protection and trust in South Korea’s digital asset market and improve the quality of Hana Bank’s digital asset custody operations. The collaboration also aims to capitalize on blockchain security technology, backed by BitGo’s recent funding of $100 million.

Rethinking Crypto Taxation: Japan’s Blockchain Future Amidst Regulatory Complexities

Japan’s Financial Services Agency is looking to change its tax code related to digital assets, potentially eliminating annual tax on unrealized cryptocurrency gains. Advocates argue this could stimulate business and aid blockchain startups, but critics cite possible manipulation and volatility.

The Paradox of Rate Hikes: Federal Reserve Tactics, BitMEX Perspective and the Emergence of the AI-Crypto Ecosystem

In a keynote at Korea Blockchain Week, Arthur Hayes, the founder of BitMEX, argued that Federal Reserve’s tactics to combat inflation could inadvertently fuel economic growth. He also predicted the potential of AI companies and a significant asset bubble resulting from the convergence of AI, crypto, and money printing.

Global Cryptocurrency Regulations: A Joint Venture by the FSB and IMF- Taking Crypto Mainstream

“The Financial Stability Board (FSB) and the International Monetary Fund (IMF) are working to align global cryptocurrency regulations. The move, prompted by India, aims at addressing the risks associated with cryptocurrencies, and includes potential macrofinancial risks to both developed and emerging markets.”

Federal Reserve Impacts on Bullish BTC and Ethereum’s Centralization Struggles

Arthur Hayes, former CEO and co-founder of Bitmex, anticipates a response to the BTC bull market within six to twelve months. This expectation is connected to the Federal Reserve’s $25 billion program meant to stabilize the U.S. banking system. Meanwhile, Ethereum faces challenges around the centralization of nodes and scalability.

Understanding the Implications of Bitcoin’s Overbought Downturn: A Comprehensive Analysis

“Fairlead Strategies predicts an “overbought downturn” for Bitcoin (BTC), hinting at decelerating upward momentum. This correlates with Bitcoin’s continuous inability to surpass the “cloud resistance” at approximately $31,900. Historically, similar downturns precede notable price peaks. Despite this, a long-term neutral bias is suggested by the MACD histogram.”

G20 Summit Ignites Discussion on Global Crypto Regulations: Pros, Cons and Consequences

India’s Finance Minister, ahead of the G20 summit, substantiates ongoing discussions on worldwide crypto regulations as a primary concern. The upcoming release of a document detailing a comprehensive plan for regulating cryptocurrencies adds to the debate, with skeptics questioning the proposed framework’s ability to fully capture all associated risks.

Bitcoin’s Rough September: The Impact of Regulatory Delays and Inflation Worries

Bitcoin’s value declines amidst regulatory delays and macroeconomic concerns linked to a rising US budget deficit. Despite regulatory setbacks, positive outlook on a potential Bitcoin ETF remains. Australian “Digital Assets (Market Regulation) Bill 2023” undergoes examination, aiming to balance innovation and consumer safety in the digital asset ecosystem.

Ethereum’s Tug of War: Struggling Between Node Centralization and Ultimate Scalability

Ethereum is battling with the issue of node centralization, with much of its network activity verification reliant on centralized services like AWS. Ethereum’s co-founder, Vitalik Buterin, has indicated that true decentralization, achievable through “statelessness” and operability on affordable hardware, is a key part of Ethereum’s long-term roadmap, despite the technical challenges anticipated.

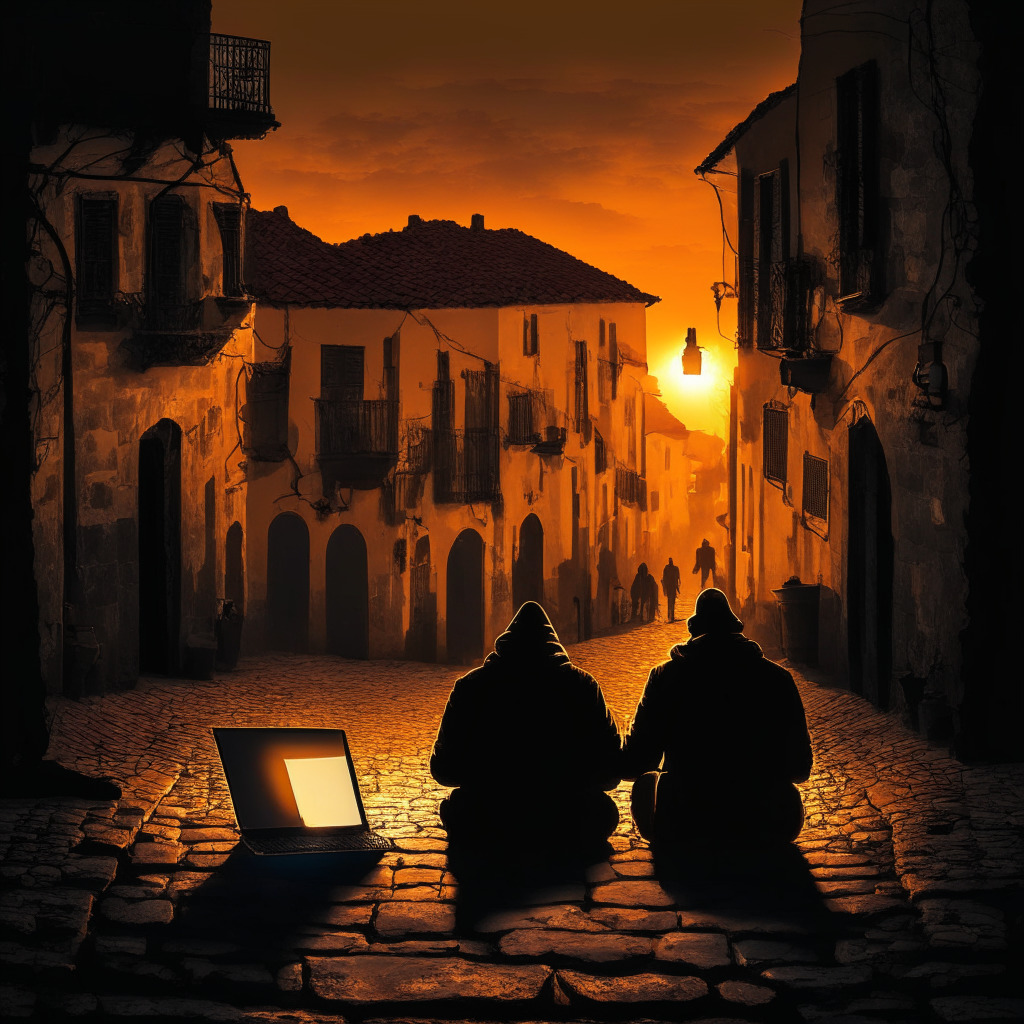

Crypto Scams Surge in Portugal: The Lure of Quick Profits and the Perils of Trusting Strangers

Two Portuguese citizens lost over $312,000 to a sophisticated cryptocurrency scam, lured by the promise of quick profits. As crypto scams double over the past two years in Portugal, the government plans to tax crypto-related gains at 28% in 2022.

Swyftx’s Earn and Learn Initiative: A Futile Effort or a Step Towards Secure Crypto Future?

Australian crypto exchange Swyftx has launched an “Earn and Learn” initiative that rewards users for completing courses about common cryptocurrency scams. This program is part of an effort to increase crypto knowledge and safety, and reduce individuals’ vulnerability to crypto fraud. Despite criticism, the exchange believes that education is key to safer and more informed participation in the volatile crypto market.

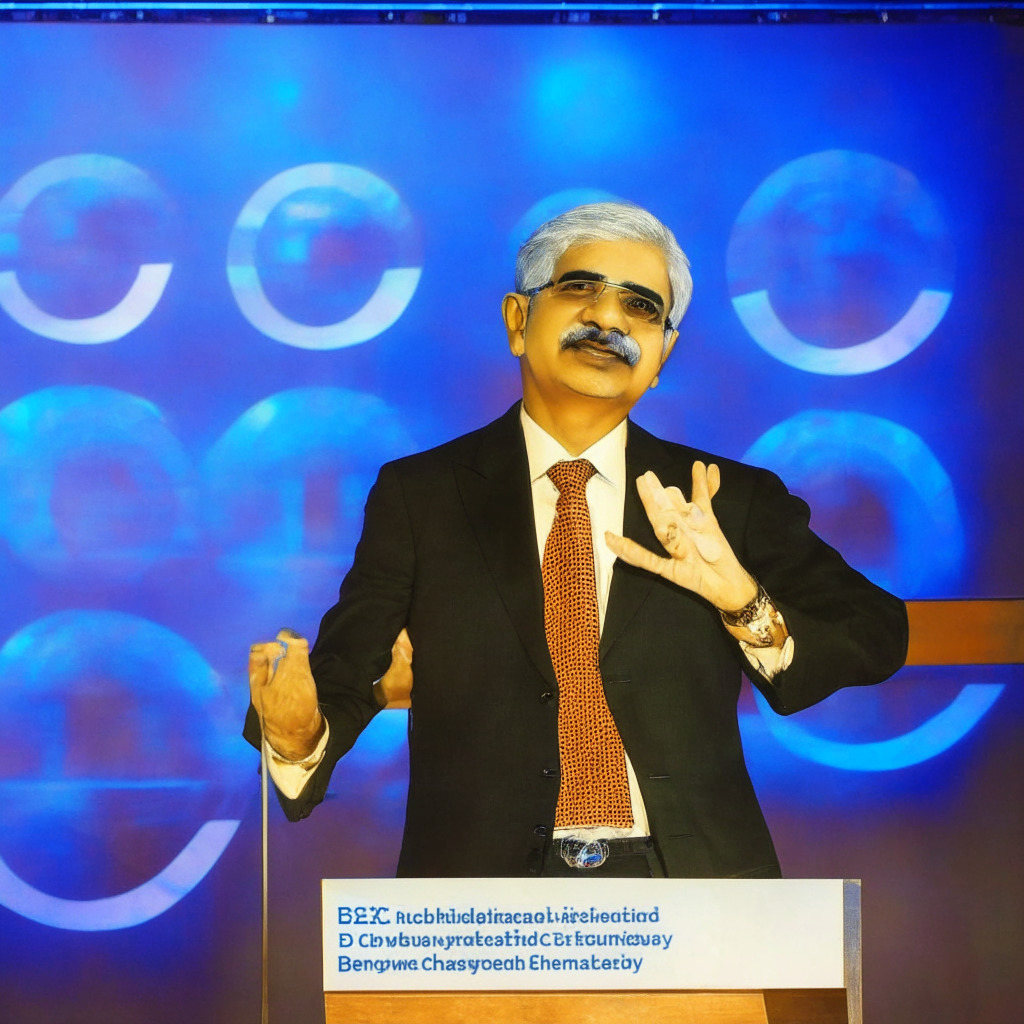

Unleashing the Power of CBDCs: India’s Approach to Revolutionizing Global Finance

Reserve Bank of India’s Governor, Shaktikanta Das, emphasized the transformative potential of Central Bank Digital Currencies (CBDCs) in a recent G20 TechSprint Finale address. He outlined their potential to revolutionize international payment landscape by reducing costs and increasing transparency. India, currently testing its own CBDC, engages in comprehensive data collection and analysis for future policies. They also invite innovative solutions for cross-border CBDC platforms.

Chronicle’s Leap Forward: Lower Gas Fees, More Networks and Integrity Questions Unanswered

“Chronicle, the second-largest oracle provider, is set to expand its services to other networks, thereby introducing more competition to the oracle landscape. The Chronicle Protocol aims to reduce gas fees by 60% envisioning higher platform utilization and maintaining uncompromised data integrity with data origin monitoring user dashboards.”

Navigating the Crypto Landscape: Will Singapore’s President Bring Change or Continuity?

“Former finance minister Tharman Shanmugaratnam’s presidency bears ambiguity for Singapore’s crypto space. His skepticism yet hands-off approach towards cryptocurrencies provide a glimmer of optimism. The question looms; will his policy commitments hold amid crypto’s volatility and increased regulatory pressure?”

The Micro Revolution in Bitcoin Mining: Pocket-Sized Devices Against Industry Secrecy

Micro Bitcoin mining devices are small, cost-effective tools that aim to defy the secrecy and exclusivity associated with Bitcoin mining. Bitmaker’s devices, costing around $3, offer accessibility and transparency, fostering understanding and community participation in cryptocurrency despite limited profitability. These innovations symbolize a step towards democratization and decentralization in the crypto world.

AI-Powered Scams: The New Era of Cyber Threats Plaguing the Crypto World

“Artificial intelligence (AI) is driving increasingly sophisticated digital scams threatening cryptocurrency organizations, warns Richard Ma, co-founder of Web3 security firm, Quantstamp. By mimicking corporate functions and engaging in credible dialogues, AI aids in successfully executing large-scale scams, particularly posing a high risk for the crypto sectors. Constant vigilance and secure internal communication platforms are key for cybersecurity.”

Solana’s Irresistible Appeal: Bucking the Crypto Outflow Trend Despite Stagnant Prices

“Despite broader crypto market outflows, Solana has sustained consistent inflows for the past nine weeks. While promising developments provide a bullish sentiment, a disconnection between investment inflows and price performance presents a sobering counter-narrative. Risks exist within the crypto spaces, such as hacking episodes.”

Harnessing the Power: The Intersection of AI and Cryptocurrency in Cronos Labs’ $100M Program

“Cronos Labs is looking for eight innovative crypto startups to join their $100 million accelerator program, aiming to marry artificial intelligence (AI) with crypto. Blockchain developers are leveraging the growing interest in AI to accelerate the growth of the digital economy, projecting AI and cryptocurrency as the next critical turning point.”

Fostering the Future with CBDCs: Bank of China and Meituan Go Beyond E-Commerce

“Bank of China and Meituan are strategically collaborating to boost their Central Bank Digital Currency (CBDC) capabilities, venturing into CBDC-powered corporate services and potential offline and non-smartphone accessible use of the digital yuan. Despite the promising blockchain future, hurdles like digital divide, regulatory issues, and security concerns could arise.”

Unraveling The Stake Crypto Casino Hack: Speedy Recovery vs Security Concerns

Stake, a crypto casino, recently experienced a high-profile hack, with an alleged $41M stolen from its hot wallets. Despite this, Stake resumed all services in under five hours, raising questions about transparency during security breaches and adequacy of current security protocols.

Unraveling the Tax Conundrum in the Metaverse: A Closer Look at Virtual Economies and Policies

Harvard legal scholar, Christine Kim, proposes a shift in tax principles for the ‘metaverse’. Economic activities involving virtual assets could be considered taxable. She outlines models for tax collection, accounting for potential resistance and discusses possibilities for taxing unrealized gains. Managing tax evasion and accurately valuing new assets are identified as challenges.

HelbizCoin Scandal: Unsettling the Crypto ‘Regulation-Free’ Ethos or Securing Investment?

The class-action lawsuit against the creators of HelbizCoin centers on fraudulent promises and price manipulation, adding complexity to cryptocurrency regulations as the coin is classified as a security under federal law. This case could broadly impact the relationship between national laws, international jurisdictions, and global networks, potentially leading to stricter regulations and reshaping the crypto-market.

The European Digital Euro: Monetary Sovereignty Amidst Rising Private Sector Dominance

“The digital euro, a central bank digital currency (CBDC) proposed by the European Commission, is seen as a new paradigm for preserving monetary sovereignty. It would ensure Europeans maintain access to a public payment option, countering the dominance by private payment services’ standalone solutions. However, its implementation requires a balance between fostering innovation and preserving economic stability.”

Grayscale’s Bitcoin ETF Approval: A Pivotal Moment or a Narrow Victory?

The U.S. Court of Appeals Circuit Judge has granted Grayscale Investments’ request to convert its Bitcoin Trust into a listed Bitcoin exchange-traded fund (ETF). But as the industry hails the decision as a victory, it’s worth questioning the real implications for the crypto industry and the broader acceptance of crypto ETFs in the future.

Bulls vs Bears: Bitcoin’s Volatility Playing Field and the Rising Stars of Crypto Market

“Bitcoin’s price saw high volatility last week, with a divergence between price action and momentum indicators that hints at a possible trend reversal in the offing. However, the cryptocurrency is still threatened by a possible 4% slump. Meanwhile, POW, TOTO, and Chainback are making headway in the crypto market. However, the caveat in this high-risk asset class remains – careful analysis and informed decision-making are key.”

UK’s New Crypto Rules: Balancing Financial Security and Innovation

The UK’s Financial Conduct Authority now requires Virtual Asset Service Providers to gather and validate information on crypto transactions, even beyond local jurisdiction. This regulation, known as the Travel Rule, aims to counter money laundering and terrorist financing, yet raises concerns regarding privacy and curbing innovation within the growing crypto industry.

Blockchain Future: Balancing the Pitfalls and Potentials of a Digital Revolution

“Blockchain technology offers potential benefits like improved transaction speed, efficiency, and security. However, the future of these systems faces challenges like regulatory interventions, cyber threats, and market volatility. Despite these issues, blockchain and cryptocurrencies hold significant revolutionary potential in our financial systems.”

Hong Kong’s Crypto-Friendly Landscape: OKX Eyes Regulatory License & Emerging Market Dynamics

OKX, a digital asset exchange, seeks to acquire a Virtual Asset Service Provider License (VASP) amid Hong Kong’s crypto-friendly environment. With full licenses already granted to HashKey and OSL, OKX intends to onboard 100,000 to 200,000 users in its initial year of trading services. The city’s progressive stance toward crypto could position it as a “test net” for mainland China following China’s total crypto ban.

Cryptocurrency Regulation: An Autocratic Approach or the Need of the Hour?

The SEC’s potential favoritism towards traditional banking applications from BlackRock and Fidelity has raised concerns. Following the recent Grayscale case, comments from legal expert Felix Shipkevich suggest the SEC’s controversial regulation methods may unduly affect smaller crypto institutions while benefiting larger firms.

Gary Gensler and the Crypto Conflict: A Shift from Advocacy to Regulation

Gary Gensler, Chair of the Securities and Exchange Commission (SEC), has adopted a circumspect approach towards cryptocurrencies since his appointment, voicing concerns over potential systemic risks. Amid criticism, he increased his legal actions against prominent industry players like FTX, Binance, and Coinbase. However, a recent judgement favoring Grayscale could compel SEC to reconsider its regulatory rigidity towards the crypto market.