In the dynamic world of blockchain and cryptocurrencies, there are beneficiary elements that profit from major shifts, whether these are sparked by positive news or unfortunate events. A recent surge in the Maximal Extractable Value (MEV) rewards for Ethereum validators portrays this situation. These validators seemed to have hit the jackpot following the news of an exploit on the decentralized exchange Curve Finance that set in motion a torrent of transactions on the blockchain.

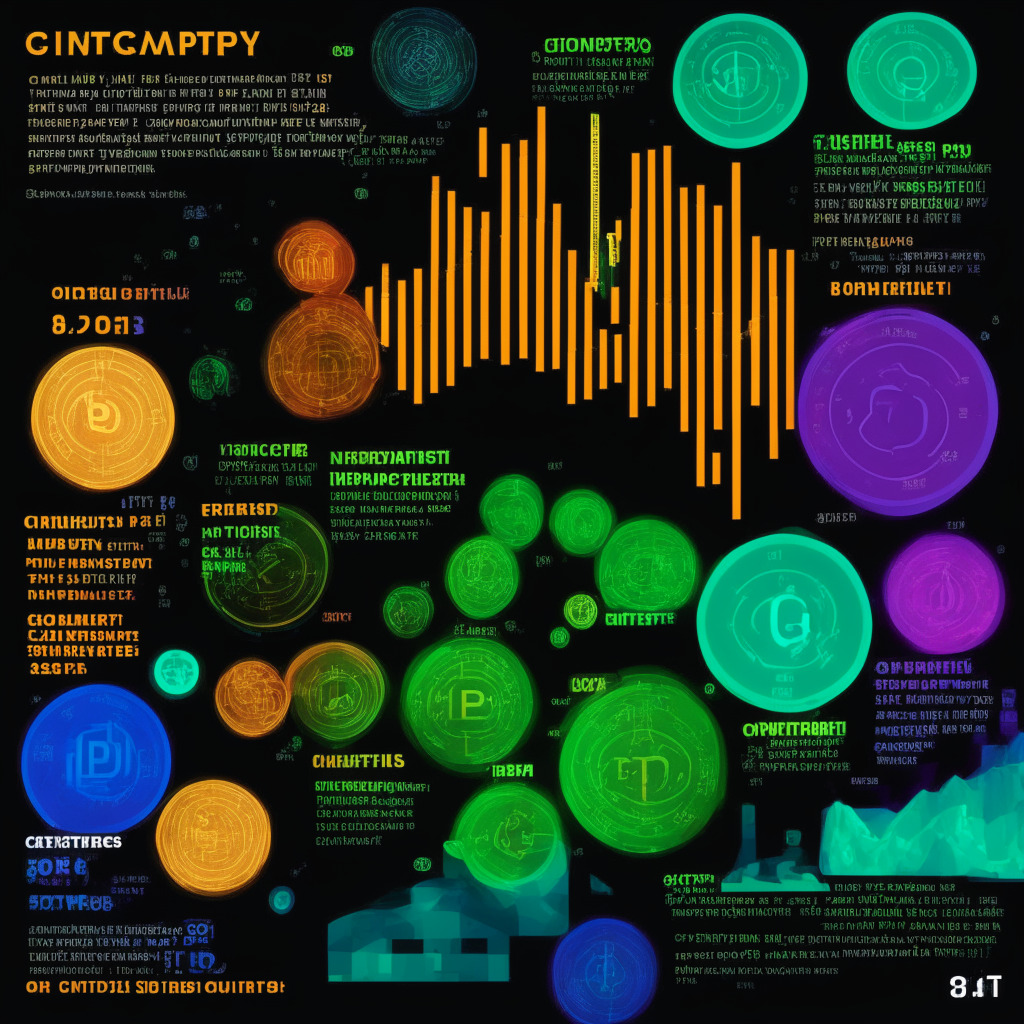

On July 30, MEV on Ethereum recorded its single most profitable day, raking in 6,006 ETH (approximately $11 million) for validators. This sudden increase in profits is attributed to an accelerated rate of transactions resulting from user concerns about their crypto assets’ safety on Curve Finance. Consequently, transaction fees soared, paving the way for a surge in MEV, a form of middleman gains generated from the rearrangement or addition of transactions within a data block.

Acting as a crucial part of trading revenue on Ethereum, MEV slightly resembles arbitrage or front-running observed in traditional markets. When Curve was compromised, causing a drain of over $50 million from key liquidity pools, validators seized the opportunity to tap into hefty profits. This security breach instigated a mass exit, which slashed Curve Finance’s “total value locked” or collateral to $1.7 billion on Monday from over $3 billion the preceding day, according to data provider DeFiLlama.

The sudden flood of transactions culminated in an unprecedented 6,006.23 ETH (roughly $11 million) in MEV rewards being disbursed to Ethereum validators on July 30. Among these, Ethereum core developer Eric Conner spotlighted the highest MEV of 584 ETH (about $1.09 million) in slot 6,992,273.

In the scheme of operations, Ethereum validators primarily accumulate MEV through MEV-Boost, an innovation by research firm Flashbots. Introduced post Ethereum’s Merge last year, MEV-Boost allows validators to ask for blocks from builders, further escalating MEV earnings.

Yesterday’s exploit marked the highest day for MEV rewards alone, says Toni Wahrstätter, an Ethereum researcher and MEV-Boost dashboard creator. However, during the USDC depegging event on March 11, the MEV opportunities were greater owing to elevated transaction fees. These shifts highlight the interconnected nature of blockchain ecosystems, demonstrating how volatility and transitory surges can lead to unintended beneficiaries. This undeniably reiterates the necessity for stringent security measures and constant vigilance within the volatile landscape of cryptocurrency transactions.

Source: Coindesk