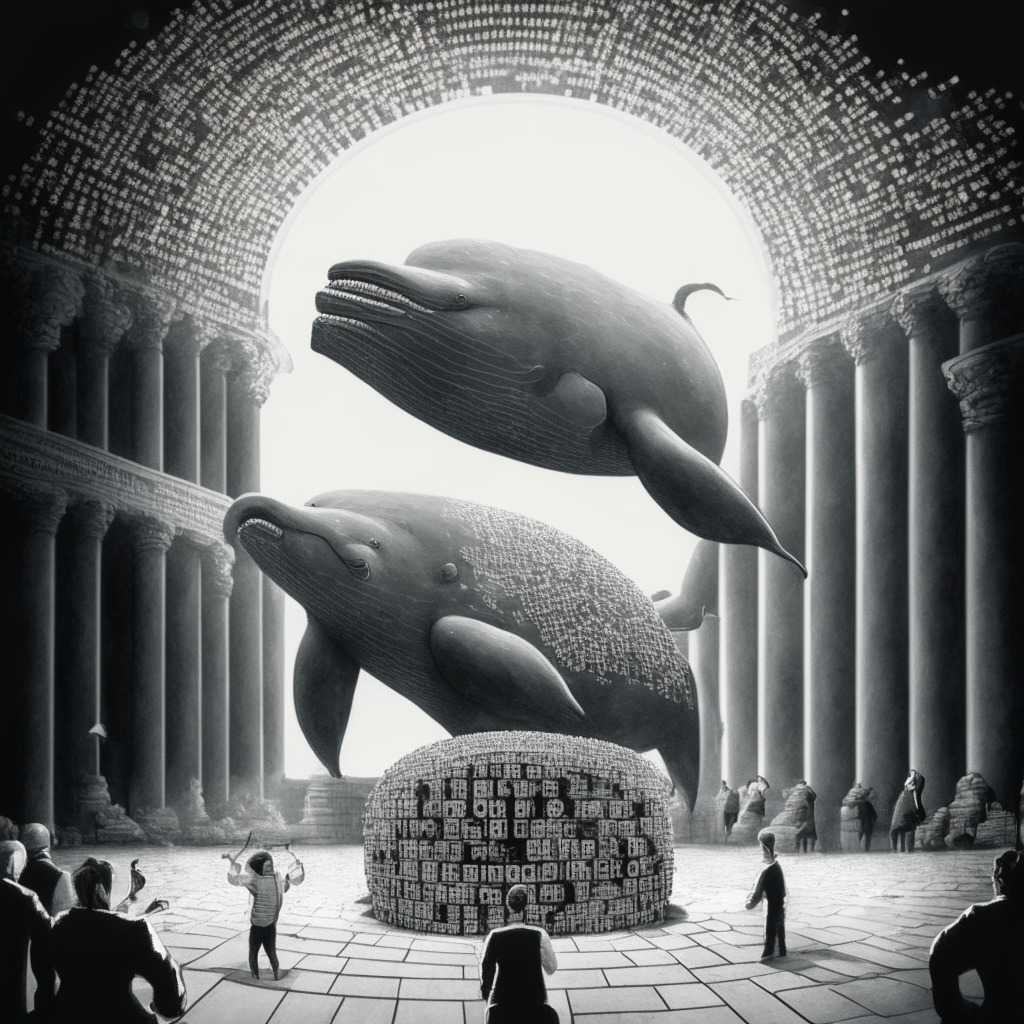

In recent weeks, large Bitcoin (BTC) holders—known in the crypto sphere as “whales”—significantly boosted their stakes, somewhat ignoring the perceived weakness in price performance. Crypto analytics firm IntoTheBlock presents data indicating that entities owning a minimum of 0.1% of Bitcoin’s supply (valued over $500 million) magnified their assets by an impressive $1.5 billion throughout August’s latter fortnight.

Interestingly enough, this growth coincided with nearly non-existent inflows into centralized exchanges. This suggests that these accumulations result from organic purchasing demand rather than triggered merely by funds shifting to exchange addresses, according to Lucas Outomoro, IntoTheBlock’s research head.

Most seasoned crypto followers would intimately understand that whales—those who yield vast quantities of a digital capital—wield considerable influence on the markets. Their buying and selling habits can substantially sway market movements, making their practices another pivotal instrument for anticipating market trajectories.

These notably large acquisitions transpired during a phase where BTC’s price fell to its lowest in two months but recovered due to a critical court resolution advocating for Grayscale to list a spot Bitcoin exchange-traded fund (ETF) in the U.S.

The accumulation began post-August 17, following a more than 10% dip in BTC, bringing it below $26,000. This marked its lowest recorded price since June, according to the data given by IntoTheBlock. Further, the court verdict favoring asset manager Grayscale against the U.S. Securities and Exchange Commission (SEC) prompted whales to increase their holdings. The ruling directed the SEC to relook its decision to deny the conversion of the $14 billion Grayscale Bitcoin Trust into a more-preferred spot Bitcoin ETF.

This move gets translated by analysts as a breakthrough towards the listing of the first spot BTC ETF in the U.S.—a significant step to drive Bitcoin to broader investor classes. Nonetheless, despite the temporary lift, Bitcoin slid back to below $26,000 on Friday, negating all gains from the brief rally sparked by the Grayscale ruling.

Notwithstanding the sluggish price trend, this current surge in accumulation implies the burgeoning optimism amongst institutional investors surrounding Bitcoin. This inference appears particularly true as the critical decisions on Bitcoin ETFs approach, said Outomoro, suggesting exciting times laying ahead for the cryptoverse.

Source: Coindesk