The price of Bitcoin is showing signs of gaining momentum as the market anticipates the US Nonfarm Payroll data release. Investors and traders are closely observing this economic indicator, which is expected to significantly impact the market. The recent surge in Bitcoin’s price suggests growing optimism among market participants, who anticipate positive outcomes from the upcoming release.

The May Non-Farm Payroll Report’s forthcoming release has caught the cryptocurrency market’s attention, as the Bureau of Labor Statistics forecasts fewer jobs added than the previous month. This could have implications for the US dollar and, consequently, Bitcoin’s value. If the actual number exceeds the forecast, it could positively impact the US dollar, leading to downward pressure on Bitcoin’s value due to their indirect relationship. The market is also eagerly awaiting the release of the Unemployment Rate and Average Hourly Rate for May, as these factors will further influence the US dollar’s value.

Even with a 44% decline in mining profitability over the past year, cryptocurrency mining companies continue to build and increase their production. For example, American Bitcoin mining company CleanSpark recently purchased 12,500 new Antminer S19 XP units for approximately $40.5 million, at a price below the market average. This acquisition has coincided with the all-time high level of Bitcoin mining difficulty, which has added further pressure on BTC miners already grappling with the growing use of artificial intelligence in mining operations. CleanSpark’s expansion efforts underscore the company’s commitment to Bitcoin mining and provided a modest boost to BTC prices during the early trading hours of Friday’s session.

Meanwhile, the US Commodity Futures Trading Commission (CFTC) is reassessing its risk management regulations, particularly in light of the high-risk nature of advanced technologies such as AI, cloud services, and digital assets. Commissioner Christy Goldsmith Romero proposed modifications requiring companies to be prepared for crypto volatility and the associated risks of holding clients’ digital assets. As digital assets integrate with banks and brokers, the potential risks associated with brokers holding clients’ property in stablecoins or other digital assets could introduce unique and unknown risks.

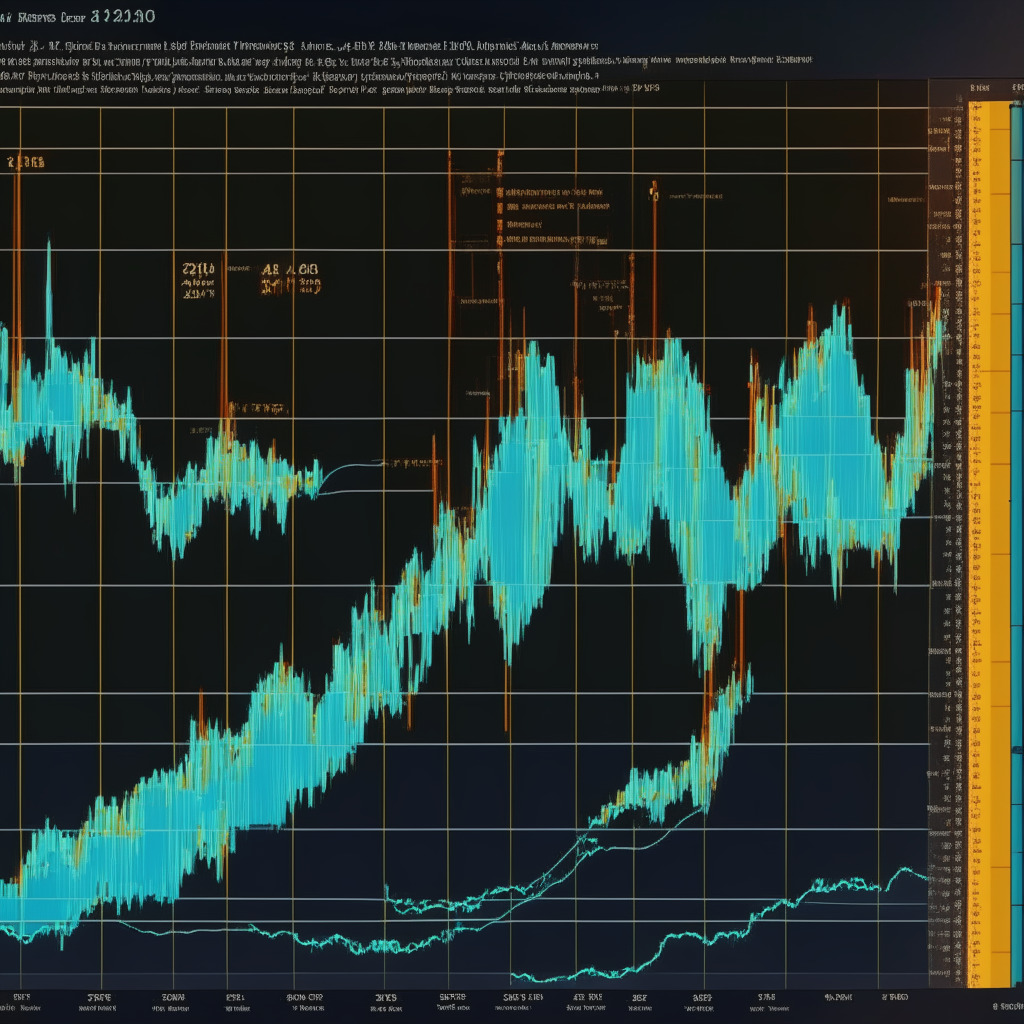

During the Asian session on Friday, Bitcoin bounced back from the 26,620 level, signaling bullish momentum. This rebound is consistent with previous predictions for Bitcoin’s price movement. Currently, Bitcoin is likely to face resistance around the 27,275 level, which aligns with the previously established 61.8% Fibonacci retracement level. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators suggest a high likelihood of sustained upward momentum on shorter timeframes. However, a downtrend line on the daily timeframe may limit Bitcoin’s upward movement around the 27,275 level. A decisive breakthrough above this trend line could set the stage for further gains towards the 27,499 level and $28,000.

Source: Cryptonews