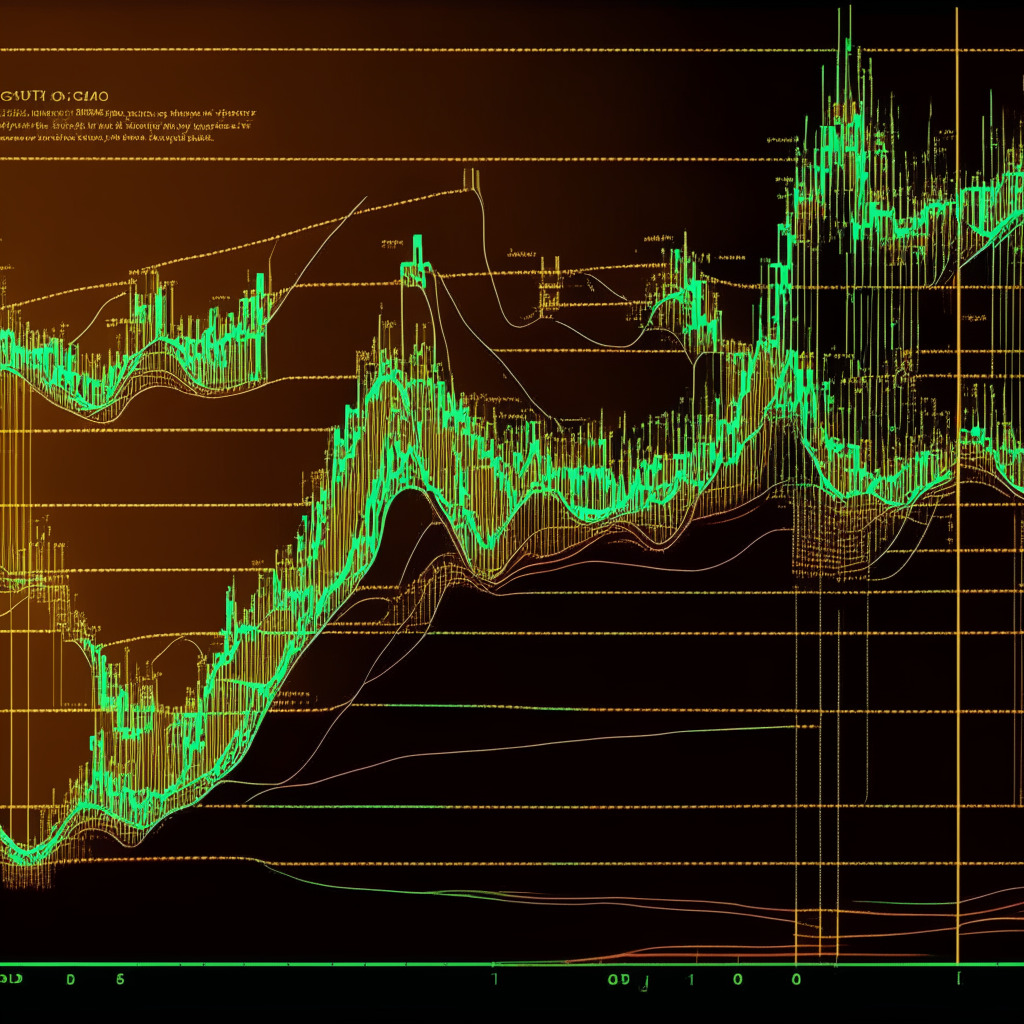

Over the past three weeks, the ADA price has demonstrated several attempts from sellers to breach the long-standing support trendline. However, each of these attempts has been unsuccessful, suggesting that buyers are aggressively accumulating at the rising support. This trendline is part of a daily chart pattern referred to as the parallel channel, which has previously triggered a substantial upswing following a reversal from the lower trendline.

The Cardano price is likely to continue its long-term uptrend as long as the channel pattern remains unbroken. However, the 200-day EMA slope is edging closer to the overhead resistance of $0.38, presenting an additional challenge for buyers. The intraday trading volume in ADA is $218.5 million, marking a 7.2% loss.

As the daily RSI slope makes higher highs, the rising buying pressure during the ongoing accumulation phase becomes apparent. Conversely, short-term trends for Cardano are still bearish, as indicated by the red films projection in the Supertrend.

A bullish engulfing candle formed at the ascending support trendline after an intraday gain of 3% in Cardano price, emphasizing the active buying at this support level. As long as this support trendline remains unbroken, coin holders can maintain a bullish outlook on ADA. A successful bullish reversal from the trendline that flips the near resistance of $0.38 would provide additional support for buyers, potentially leading the price towards the next supply zone at $0.42.

However, if the price breaches the bottom support with a daily candle closing and sufficient volume, the ADA price might experience a significant correction. As the Cardano price continues to linger above the support trendline, buyers can seize more opportunities to accumulate at discounted prices. These purchasing activities could increase the likelihood of a bullish reversal, potentially triggering a new bull cycle within the channel pattern. The first target for this fresh recovery cycle is predicted to be $0.42.

The analysis provided here should be taken into consideration along with individual market research before investing in cryptocurrencies. The author and the publication hold no responsibility for any personal financial losses. The market condition is subject to change, and the presented content reflects the personal opinion of the author.

Source: Coingape