XRP has seen an impressive 15.5% increase in the past 30 days, leading analysts to predict it could potentially outperform Bitcoin and other major cryptocurrencies this year. However, XRP’s performance hinges on the outcome of Ripple’s ongoing legal battle with the SEC. Ripple’s strong market indicators, coupled with positive developments in the lawsuit, paint a promising picture for XRP’s future in the crypto market.

Search Results for: 2021

Navigating the Cryptostorm: The Rise and Fall of Binance’s Billion-Dollar Recovery Initiative

“Binance’s ambitious Industry Recovery Initiative (IRI), a billion-dollar fund to rescue struggling cryptocurrency startups, has under-delivered. Only $15 million of the declared $1 billion has been deployed amidst regulatory pressures and lack of suitable investment opportunities. However, the initiative retains its significance in the volatile cryptocurrency ecosystem.”

Shiba Inu (SHIB) on the Rebound: October Surge or Market Mirage? BTCMTX in Focus

“Shiba Inu (SHIB) has seen a minor uptick despite recent losses, with analysts suggesting a potential recovery rally. However, falling buyer interest indicates more challenges ahead. On the brighter side, the newly minted Bitcoin Minetrix (BTCMTX) offers potential with its tokenized cloud mining platform, allowing investors to earn by staking tokens.”

Unveiling Binance’s $1B Recovery Fund: Generous Aid or Strategic Maneuver?

“Binance’s $1B cryptocurrency recovery fund, the Industry Recovery Initiative (IRI), has reportedly invested only an estimated $30M since its inception, despite large capital commitment. With growing regulatory concerns, unused funds were moved to Binance’s corporate treasury, raising questions about the effectiveness of such recovery initiatives in the evolving blockchain industry.”

Unwrapping the Saga of Alameda’s USDT Mints & Zimbabwe’s Gold-Backed ZiG Tokens

“Alameda Research has minted over $38 billion in Tether (USDT) tokens in 2021, indicating that the total value of USDT creation surpasses Alameda’s total assets. The inner workings of this process involve benefiting from trade value discrepancies and ensuring USDT’s dollar peg stability. However, this raises ethical concerns for industry watchers.”

Reeling from Scams: Challenges to Crypto Safety in Hong Kong Amidst Web3 Era

The Hong Kong crypto community was victim to a costly phishing scam, with fraudsters impersonating Binance and swindling users out of more than $450,000. Amid rising technology crimes, the local police, through its CyberDefender program, are emphasizing prevention and education about risks associated with the digital universe.

Unraveling Ripple’s Future: Implications of CFO’s Sudden Exit on Crypto Landscape

Kristina Campbell, Ripple’s CFO left the company igniting speculations about Ripple’s future amidst an ongoing SEC lawsuit. Campbell, who significantly impacted Ripple’s financial journey, now serves as the CFO of Maven Clinic. Ripple’s silence over her departure raises questions and could affect investor confidence.

Unveiling the Crypto Controversy: Accountability Amidst Progress, from Bankman-Fried to Future Prospects

This article discusses the current courtroom drama involving former FTX CEO Sam Bankman-Fried, and the potential societal impact within the cryptocurrency world. It also emphasizes the pressing need for regulatory measures and ethical conduct in crypto companies while highlighting promising investment opportunities in cryptocurrency coins.

Navigating Uncertain Waters: Regulatory Influence in Crypto’s Course and Ripple’s Ongoing Legal Drama

“Highlighted is the critical role of regulation in the crypto industry’s evolution, and its capacity to shape future developments. Ripple’s ongoing legal struggle with the U.S. Securities and Exchange Commission exemplifies high-profile regulatory challenges. The delicate balance between fostering innovation and deterring fraudulent practices underpins the crypto sphere’s future.”

Digital Asset Market Boom: A Spotlight on Bitcoin, Ethereum, and Solana Amid Regulatory Uncertainty

The digital asset market recently observed a significant increase, with product inflows reaching $78 million, marking the highest rise since July. A surge was also seen in exchange-traded products, growing 37% in a week. Bitcoin experienced a notable boost, while Ethereum’s growth remains slower. Surprisingly, altcoin Solana recorded substantial outflows, yet maintains popularity. Interestingly, a majority of last week’s inflows originated from Europe due to its clearer regulatory framework.

Unraveling the AnubisDAO Saga: Accountability Challenges and Transparency Paradoxes in Crypto

“The AnubisDAO rug pull, which led to a loss of 13,556 Ether, i.e., $60 million, within 20 hours, has controversially involved Kevin Pawlak, the former head of ventures at OpenSea. While accusations link Pawlak with pseudonymous entity “0xSisyphus”, lack of concrete evidence dims their credibility. This presents pressing issues of accountability and transparency in the unregulated cryptocurrency industry.”

Bitcoin’s Stability Amid Geopolitical Instability: An Unusual Crypto Market Behavior

Bitcoin’s price remains steady at $28,000 despite global geopolitical instability, unlike gold, oil, or the U.S. dollar which have experienced turbulence. Anticipation mounts over future volatility as Bitcoin’s reaction to unfolding geopolitical crisis and potential economic fluctuations remains uncertain.

Komainu’s Milestone Regulatory Approval: A Victory for Progress or Threat to Cryptocurrency Essence?

Komainu, a venture co-founded by CoinShares, Ledger, and Japanese Nomura, has gained substantial regulatory approval in the U.K. as a custodian wallet provider. While this development brings crypto custody services to the U.K. and contributes to the country’s fintech landscape, it also raises concerns about individual privacy rights and the balance between industry regulation and the decentralized nature of cryptocurrencies.

Crypto Chaos: Uncovering the Dark Side of Estonia’s Flourishing Blockchain Sector

An international investigation has uncovered serious financial fraud and money laundering in Estonia’s crypto sector, with over €1 billion being scammed or laundered. Massive infiltration of crypto entities, despite tightened regulations, reveals weak links in the financial chain, highlighting the urgency of navigational caution for crypto investors.

Surging Into Crypto: South Korea’s New Approach to Combatting Insolvency Cases

South Korea’s financial watchdog, Korea Deposit Insurance Corporation (KDIC), has seized virtual assets in insolvency cases, marking their first crypto crackdown. The shift follows regulatory amendments that demand local crypto exchanges to link customer wallets to domestic bank accounts, eliminating anonymous trading while empowering agencies to tackle insolvency. Increased crypto asset seizure is predicted amidst arguments over Korea’s increasingly restrictive crypto policies.

Unraveling the FTX Crypto Exchange Collapse: A Case Study of Regulation Concerns and Fiasco

“Recent events surrounding the bankruptcy of FTX, a crypto exchange, reveal concerns in the crypto industry’s regulation process. FTX’s collapse, potential conflicts with Alameda Research, and lack of shared authority show the importance of adequate information, right due-diligence, and skepticism in investing.”

Layoffs in Crypto Space Amid Market Slump: Temporary Ripple or a Diagnosing Tremor?

“Crypto hardware wallet manufacturer, Ledger, announced a 12% workforce retrenchment due to macroeconomic challenges affecting revenue. Despite a thriving crypto market, a global inflation spike, interest rate increases, and catastrophic events like the Terra ecosystem collapse have caused a significant downturn in the crypto industry, resulting in numerous layoffs.”

Global Crypto Investment: A Path to Improved Living or Regulatory Nightmare?

Crypto users worldwide are increasingly investing in digital currencies in hopes of improving their lifestyle. Survey results indicate varying motivations across different demographics and locations: from funding children’s education to defying trading bans using VPN services. However, tightening regulations and price depreciation have caused a stagnation in some areas. Despite these hurdles, an optimistic outlook remains, as digital assets continue to present a potentially profitable avenue for individual investors.

Venture Capital in Crypto: Riding the Waves of Market Turbulence and Opportunity

“VC funding for crypto startups has dropped to a three-year low, with a significant shift towards early-stage ventures. Despite challenging market conditions causing a lean funding period, strategic financing rounds have risen. The U.S leads with 54% of all active VC investors.”

Artistry Reimagined: How Blockchain Propels the Digital Renaissance by Matt Kane

“Matt Kane, celebrated digital artist and software developer, has reshaped the creative industry through blockchain technology, using it to put forth innovative digital artwork. His work dips into understanding identity through art, marking a dramatic transformation in the digital art space and the unbounded potential of blockchain.”

Shifting Sightlines in Crypto: A Case Study of Newly Released Ether ETFs Vs. Bitcoin Futures ETFs

“After Ether futures-based ETFs debut, crypto analysis firm K33 Research suggests investors might need to shift focus from ETH to BTC due to underwhelming results. Despite excitement, the ETFs didn’t intervene with Ether’s ongoing value decline compared to Bitcoin.”

Cracking the Bitcoin Eggflation Paradox: Exploring the Unusual Buying Power of Cryptocurrency

A recent study shows Bitcoin balances the rising cost of eggs, or ‘eggflation’, more efficiently than the US dollar. Since January 2021, Bitcoin hodlers have had to spend 70% fewer satoshis for egg purchases compared to 58% fewer USD as of August 2023, indicating Bitcoin’s superior buying power.

Bridging Traditional and Digital Finance: Visa’s Pivotal Role and the Future of Crypto Adoption

Visa’s Innovation & Design VP, Akshay Chopra, emphasized the growing role of crypto cards in market activity and everyday transactions in 2021, bridging traditional finance with digital currencies. Recognizing limitations of current financial systems, he proposed blockchain-based alternatives and praised regulatory foresight in places like UAE for embracing crypto-based payments.

Ethereum Futures ETFs Stumbling: Are Investors Leaning towards Bitcoin?

The subdued performances of new Ethereum futures ETFs suggest shifting investor interest back to Bitcoin. Initial trading volume was significantly lower than anticipated, indicating lackluster interest in Ether ETFs. This hints that increased institutional access will only boost buying pressure if significant demand exists, which currently doesn’t seem the case for Ether.

Decentralization Test: The SBF SRM Saga and What It Means For Crypto Authority

“In 2021, Sam Bankman-Fried extended the lockup period for his employees’ SRM holdings, sparking debate about the ethos of decentralization in crypto markets. This controversial move coincided with the rise and fall of the SRM token, further leaving the crypto community questioning the control in decentralized markets, and the tricky balance between regulation and restrictive control.”

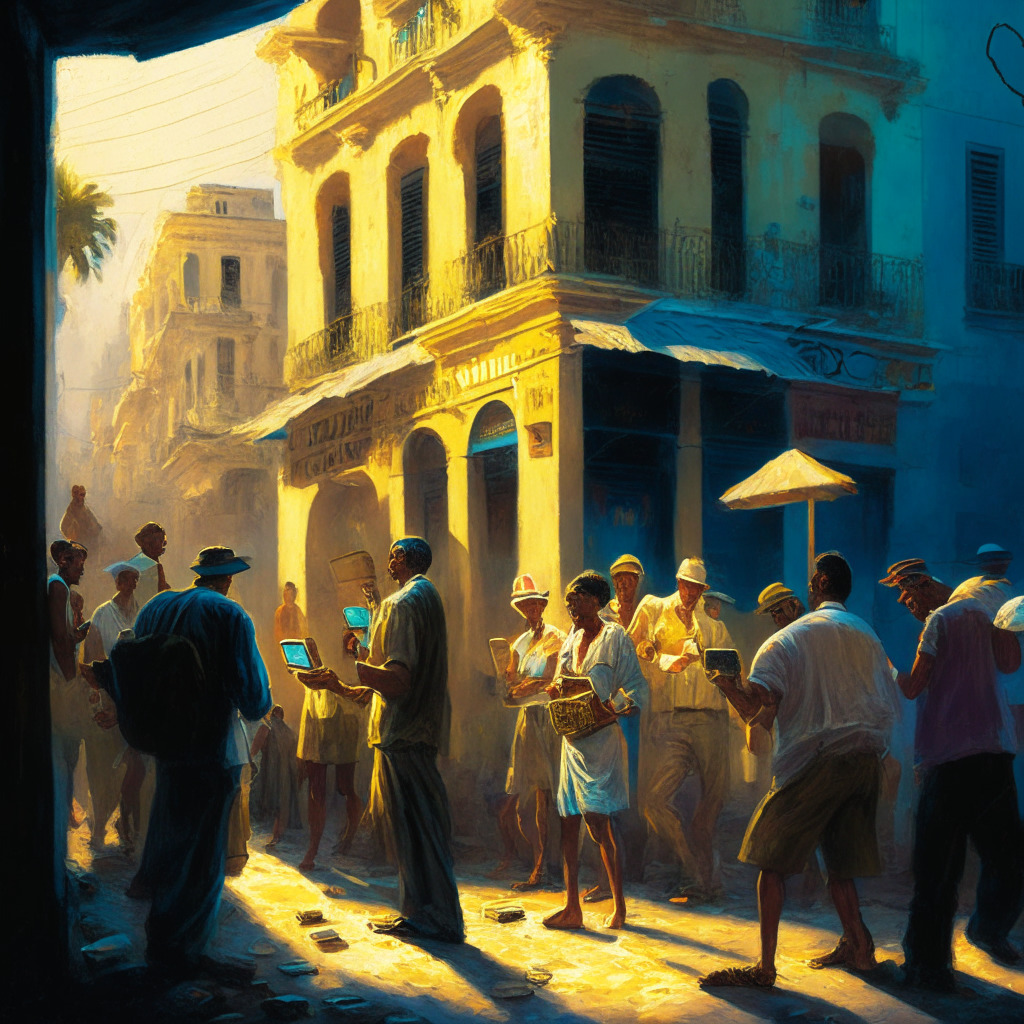

Bitcoin Awareness Rises in Cuba amid Fears of National Currency Decline

Amid devaluation of the Cuban peso and inflation, the crypto community in Havana, Cuba is turning to Bitcoin due to its relative financial stability. Despite governmental restrictions, Cubans have developed ways to buy and sell Bitcoin, hoping for a more economically secure future.

Navigating the High-Stakes Landscape: The Bold Moves of DWF Labs in Crypto Venture Capitalism

“DWF Labs, a crypto investment firm, has made significant strides in token investing, changing industry norms by focusing on token value to projects. Their strategy targets nine macro-categories for risk diversification, concentrating on potential market adoptions and project team success. Investments include TON, EOS, and recent addition, Crypto GPT, as part of their risk mitigation strategy.”

Binance Declines $40 Million Investment Pitch from Ex-FTX CEO: A Retrospective Breakdown

“Binance declined a $40 million investment support for a futures exchange platform proposed by former FTX CEO, Sam Bankman Fried. Despite this rejection, FTX launched their futures exchange independently in 2019. They intersected again in 2021, when FTX, facing liquidity crisis, approached Binance for a potential buyout, which was again refused.”

Unleashing the Bull: Bitcoin’s Prospects Amid Rising U.S Treasury yields and Looming Economic Unrest

Recent developments in the US economy, such as rising treasury yields and national debt, suggest a bullish future for Bitcoin. Former crypto exchange CEO, Arthur Hayes, speculates this could lead to mass liquidity injections, possibly triggering a Bitcoin bull run. However, the volatile interplay between these economic factors also warrants caution.

Ripple’s Major Milestone: Singapore MPI License Amid Regulatory Scrutiny in the US

Ripple Markets APAC Pte Ltd, the Singapore branch of crypto-payment giant Ripple, has received its Major Payments Institution license from the Monetary Authority of Singapore. This permits Ripple to provide digital payment token services, marking a substantial stride towards wider crypto acceptance. In contrast to its regulatory challenges in the US, Ripple’s journey in Singapore has shown regulatory clarity and fostered a secure environment encouraging crypto investigation.

Ardana Lab Debacle: A Tale of High Hopes, Poor Financial Management and Lost Investments

“Ardana Labs promised an innovative stablecoin platform for Cardano, however, the project collapsed due to alleged poor financial management. Xerberus’ analysis suggests Ardana’s executives may have misused project funds, leading to a $4 million loss, emphasizing the inherent risks in new-age Web3 startups.”

East Asia’s Crypto Rebirth: Hong Kong Paves the Way with Progressive Policies

The report by Chainalysis highlights a crypto activity resurgence in East Asia, largely driven by Hong Kong’s crypto-friendly policies. Despite China’s stringent ban on crypto, Hong Kong managed $64 billion in transaction volumes over a year. The city’s regulatory framework for crypto trading and active collaboration with crypto firms could influence East Asian countries to foster a more crypto-friendly environment.