“Cosmos Hub has introduced an upgrade, bringing in a liquid staking module for ATOM stakeholders. This eliminates the previous 21-day lock-in period after unstaking, allowing staked ATOM to be used in the Cosmos DeFi ecosystem. This change could free over $400 million of ATOM for liquidity purposes, potentially boosting staked ATOM within Cosmos-run protocols. However, the upgrade also implies adjustments in inflation rates and brings new limitations for ATOM holders in liquid-staking.”

Search Results for: ATOM

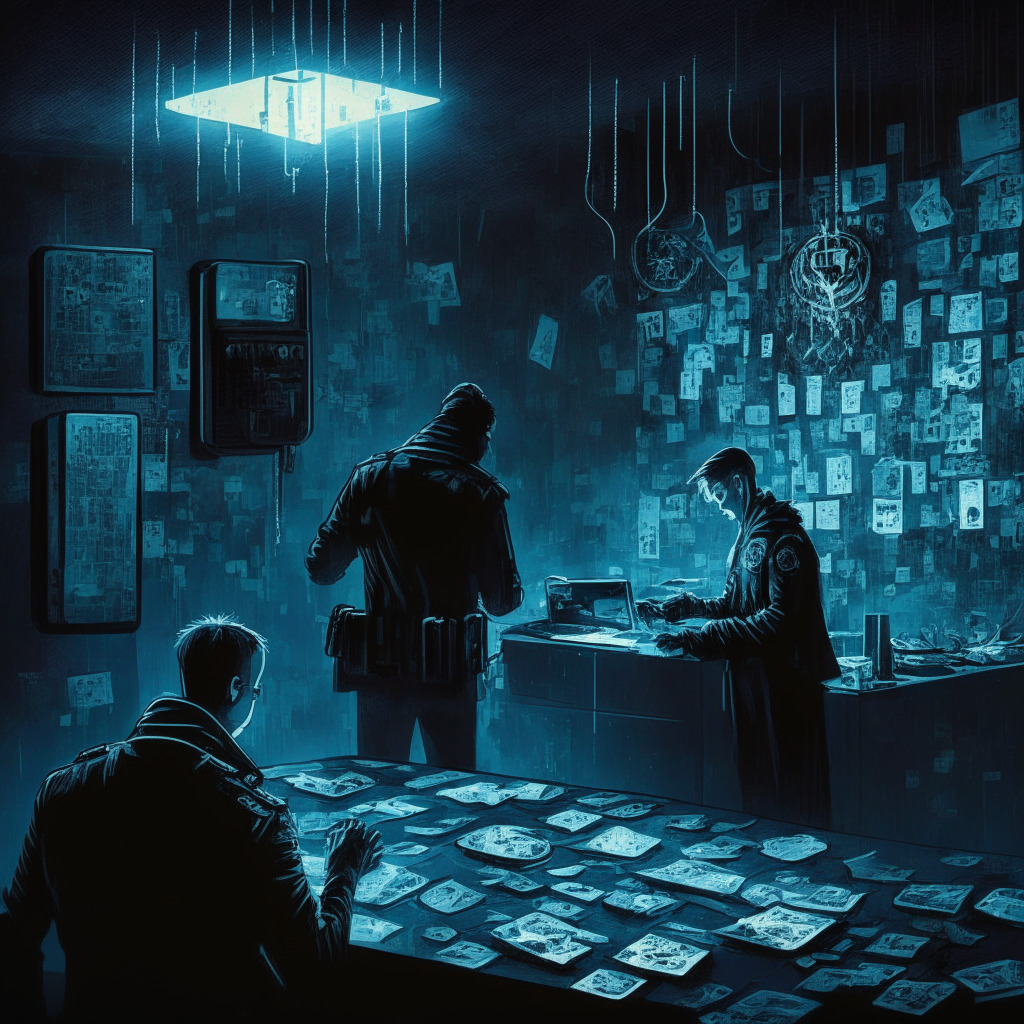

Debating Atomic Wallet’s $100M Breach: A Case of Non-Disclosure or Timing?

A group of high-net-worth investors have filed a class-action lawsuit against Atomic Wallet, alleging improper information disclosure surrounding a security breach that resulted in a $100 million loss. The unclear nature of the breach and lack of comprehensive response from the company has increased investor unease and set a concerning precedent for the cryptocurrency sector.

Atomic Wallet Hack 2023: Unravelling the Crypto Security Dilemma Amid Rising Concerns

“The Atomic Wallet incident resulted in losses of a considerable $100 million, with recent accusations implying a Ukrainian group’s involvement. The breach situation is vague, with potential causes ranging from malware, an internal breach, to a man-in-the-middle attack. This highlights the crypto industry’s insecurity and the need for comprehensive security measures and regulation.”

Anatomy of a Crypto Clash: Gemini’s Battle with The SEC Over Unregistered Securities

“The SEC alleges Gemini’s Earn lending program and MDALA constituted unregistered securities sold to investors, sparking a legal battle that underscores crypto asset regulatory stalemate. This tussle further highlights emerging legal and financial ambiguities looming over the evolving crypto sector.”

Anatomy of a Cyberattack: Unveiling the Multi-Stage Process and Mitigating Future Threats

“Cyberattacks pose major threats in today’s digital world, exploiting vulnerabilities in systems for harmful purposes. These attacks start with reconnaissance, weaponize found vulnerabilities, deliver and install harmful software, then take measures to conceal activity. To mitigate risk, educate on threats and implement robust digital safety measures.”

Unraveling Atomic Swaps: A Leap Towards Decentralization or a Complexity Hurdle?

“Atomic swaps, advancements in the blockchain world, allow peer-to-peer transactions between different cryptocurrencies circumventing intermediaries. However, these can prove complex for beginners, sans fiat-crypto on-ramp, and require specific programming skills. Their potential lies in user’s readiness to navigate these complexities.”

Atomic Wallet Hack: Uncovering Causes, Tracking Funds, and Strengthening Security

Atomic Wallet recently disclosed new details about its June 3 hack, affecting less than 0.1% of its users. The company is working to recover lost funds and collaborating with exchanges and blockchain analysis firms Chainalysis and Crystal. While the total amount stolen remains undisclosed, Elliptic reported a figure of over $100 million, with possible links to the North Korean hacking group Lazarus.

Atomic Wallet Hack: How Hacker Groups Evade Detection Through Chain-Hopping and Mixers

Hackers exploited Atomic Wallet for over $100 million, using THORChain to conceal their tracks by converting stolen ETH to BTC. Connected to the North Korean group Lazarus, these hackers have a history of attacking crypto exchanges and using chain-hopping techniques to launder funds.

Atomic Wallet Breach: $100M Loss Linked to North Korea, Security Protocols under Scrutiny

Elliptic discovered that over $100 million was lost by Atomic Wallet users, with more than 5,500 wallets compromised. The Lazarus Group, allegedly linked to North Korea, is believed to be behind the breach. Dr. Sarah Brown emphasizes the need for advanced security protocols and user vigilance in the crypto market.

Crypto Heist Shocks Community: Atomic Wallet Loses $100M – How to Safeguard your Assets

Atomic Wallet faced a cyberattack resulting in over $100 million in losses, affecting 5,500 crypto wallets. Blockchain analysis company Elliptic attributed the theft to the Lazarus Group and highlighted the crucial need for enhanced security measures and vigilance in the growing crypto market.

Atomic Wallet Hack: Unveiling Security Flaws and $100M Lost to Cybercrime

The Atomic Wallet, with over 5,500 wallets affected, experienced a $100 million hack compromising various cryptocurrencies. Blockchain experts suspect North Korean group Lazarus may be responsible. This marks the increasing vulnerability in the crypto world, highlighting the importance of security features and vigilance when choosing wallets and services.

Atomic Wallet Hack: $35M Laundered, Regulatory Woes, and Emerging Cyber Threats

The crypto world experienced a major security breach as attackers exploited Atomic Wallet and stole $35 million in tokens. As funds move via the OFAC-sanctioned exchange Garantex, the involvement of North Korean hacking group Lazarus is suspected. This incident highlights the challenges cryptocurrencies face for security and regulatory compliance.

North Korean Hackers vs Atomic Wallet: $35M Stolen and Security Concerns Exposed

Atomic Wallet users might have fallen victim to Lazarus hacking group, losing around $35 million in cryptocurrencies. Elliptic identified connections between wallets from this hack and previous Lazarus hacks, as stolen crypto was funneled to the Sindbad.io mixer. The incident highlights the need for better security practices and scrutiny of wallet designs in the crypto ecosystem.

Atomic Wallet Hack & Sinbad Coin Mixer: Anonymity Asset or Threat?

The $35 million Atomic Wallet hack involved stolen funds traced to Sinbad, a coin mixing service popular among North Korean hacker cell Lazarus. Coin mixers provide anonymity in crypto transactions, but their use for illicit activities poses challenges for law enforcement and regulatory measures.

Atomic Wallet Heist: Centralization vs Security & Balancing Convenience with Crypto Safety

The cryptocurrency industry faces another setback as nearly $35 million worth of tokens were stolen from Atomic Wallet, a centralized storage service. This raises questions about security in centralized wallet services and highlights the trade-offs between centralization and security in the crypto space.

Atomic Wallet Security Breach: A $35 Million Lesson in Decentralized Wallets’ Pros and Cons

Atomic Wallet users reportedly lost over $35 million in a security breach, raising questions about the platform’s security infrastructure. With incidents like this becoming common, robust security measures and user awareness of risks are crucial, and striking a balance between security and user control over assets is paramount.

Atomic Wallet Breach: Addressing Cybersecurity in the Growing Crypto Landscape

The recent Atomic Wallet compromises have raised cybersecurity concerns in the crypto world. The platform is working with security agencies, exchanges, and blockchain analytics firms to trace lost funds, highlighting the need for increased safety measures and vigilance within the industry.

Crypto Theft on the Rise: Atomic Wallet Hack and DeFi Exploits – How to Stay Safe

Users of Atomic Wallet reported crypto asset losses and complete disappearance of portfolios. Atomic’s team is investigating the issue. This highlights risks associated with blockchain technology, emphasizing the importance of ensuring safety, security, and educating oneself on secure practices.

Atomic Wallet Security Breach: Examining Trust and the Challenge of Ensuring Crypto Safety

Atomic Wallet, with over five million users, suffered a security breach resulting in users losing funds. On-chain investigator ZachXBT is assisting affected individuals. The breach questions the wallet’s security and highlights the challenge of achieving complete security in the decentralized financial landscape.

Crypto Market Dips: Opportunity or Warning? Uncovering Top Picks Among AI, XLM, ATOM & More

Bitcoin has fallen below $27,000, causing concern for the crypto market’s immediate future. However, some investors are eyeing a potential dip to buy. Despite recent developments, AI, BGB, SPONGE, XLM, YPRED, ATOM, and DLANCE remain strong investment opportunities with solid fundamentals and technical analysis.

COLT vs ATOM vs SHIB Showdown: Analyzing ROI and Risk in the Crypto Market

Collateral Network’s innovative decentralized lending protocol aims to revolutionize the trillion-dollar asset-backed lending market, with the COLT token forecasted to deliver a 3500% ROI. Offering high gains, backed by reliable team and growing community, it warrants attention in the crypto market.

OK Group’s Rebranding: Power Consolidation or Crypto Evolution?

The major crypto operator OK Group plans to unite its ventures under the ‘OKX’ brand, signaling a solidified front in the volatile crypto landscape. The move raises concerns around power consolidation, but the group reassures it will maintain existing regulatory frameworks. The phased rebranding approach and commitment to the U.S. as a key operational base add intriguing nuances to this development.

Bitcoin Awareness Rises in Cuba amid Fears of National Currency Decline

Amid devaluation of the Cuban peso and inflation, the crypto community in Havana, Cuba is turning to Bitcoin due to its relative financial stability. Despite governmental restrictions, Cubans have developed ways to buy and sell Bitcoin, hoping for a more economically secure future.

Blockchain’s Bloodbath: Fathoming the $332 Million September Crypto Wealth Drainage

“September 2023 heralded a significant blow to the crypto world, with a staggering $332 million lost to various exploits, scams, and hacks. The biggest loss, however, came from exploits, causing about $329.8 million damage. High-profile cyber attacks underscore the need for enhanced security in the crypto-ecosphere and highlight the potential misuse of cryptocurrency.”

North Korean Hackers’ $47 Million Crypto Stash: A Glimpse into the Dark Realm of State-Backed Cybercrime

Reports suggest that the notorious North Korean hacking group Lazarus Group has a cryptocurrency reserve worth over $47 million, mostly in Bitcoin, according to institutional crypto platform provider, 21.co. The hacker group’s stash was tracked to 295 wallets identified by the US Government.

Unraveling the Lazarus Group: A Deep Dive into their $47m Cryptocurrency Loot

“The North Korean Lazarus Group, a notorious hacking collective, reportedly has $47 million in cryptocurrencies, the majority in Bitcoin. Despite a surprising lack of privacy coins, their wallets are active, suggesting underreported holdings. Previously implicated in major crypto hacks, their activities question security in blockchain.”

Cryptocurrency Heist: A Wake-Up Call on the Need for Elevated Security Measures in the Blockchain Landscape

A suspicious withdrawal of around $2.7 million worth of cryptocurrencies from Remitano crypto exchange brought to light potential security breaches. The immediate response included Tether halting the movement of drained coins, saving a significant portion of the stolen funds. However, the security issue emphasizes the importance of vigilant security measures in the crypto landscape.

Lazarus Group’s Crypto Heists: A Rising Challenge for Blockchain Security Measures

The recent $41 million Stake crypto platform hack attributed to North Korea’s Lazarus Group has added to growing cyber crime concerns in the crypto world. With a total of $200 million in stolen crypto funds recorded this year, heightened cybersecurity measures are now essential, yet challenging due to the decentralized nature of cryptocurrencies.

Transforming Bond Markets: Tokenization Prospects & Challenges in Hong Kong

The Hong Kong Monetary Authority is exploring the benefits and challenges of tokenizing bonds, a process aligning with existing legal infrastructure and improving operational efficiency via a common Distributed Ledger Technology platform. However, the report cautions that tokenization’s adoption is still in its “infancy”, with obstacles like aligning financial institutions on common solutions and updating legal regulations. This development frames Hong Kong’s shift towards becoming a crypto hub.

Unmasking the Hermit Kingdom’s Crypto Heists: Blockchain Security vs Cyber Criminals

“The digital fortress of cryptocurrencies faces a possible breach by notorious North Korean hacker groups, Lazarus and APT38, suspected of planning to liquidate over $40 million in stolen BTC. North Korea’s increased cyber involvement, amassing $2 billion in crypto loot over five years, raises concerns about the security of the cryptocurrency framework and necessitates vigilance from crypto firms and individual investors.”

Navigating the Crypto Winds: The Highs, Lows and Ambiguities in Blockchain’s Future

“Unstoppable Domains has unveiled Unstoppable Messaging, a product of the Web3 messaging network XMTP. Meanwhile, Binance.US has paired with MoonPay to allow customers to convert USD into tether (USDT) amidst their comeback from a dollar deposit suspension. Despite advancements, cybersecurity challenges persist in the blockchain world.”

Unveiling the eAUD: The Future of Australia’s Digital Currency and Its Challenges

The Reserve Bank of Australia’s (RBA) central bank digital currency (CBDC) project results suggest a potential to enhance efficiency and resilience in the payment system. However, obstacles such as “legal, regulatory, technical and operational considerations” might delay the actual implementation of CBDC in Australia.