“The U.S. Department of Justice is considering fraud charges against Binance, potentially impacting the crypto market. Regardless of the outcome, experts suggest the market, due to its resilience and increasing utility, could weather the storm. However, possible Binance asset drain could trigger a market crash, while the outcome could affect Bitcoin’s value trajectory by year-end.”

Search Results for: Binance U.S.

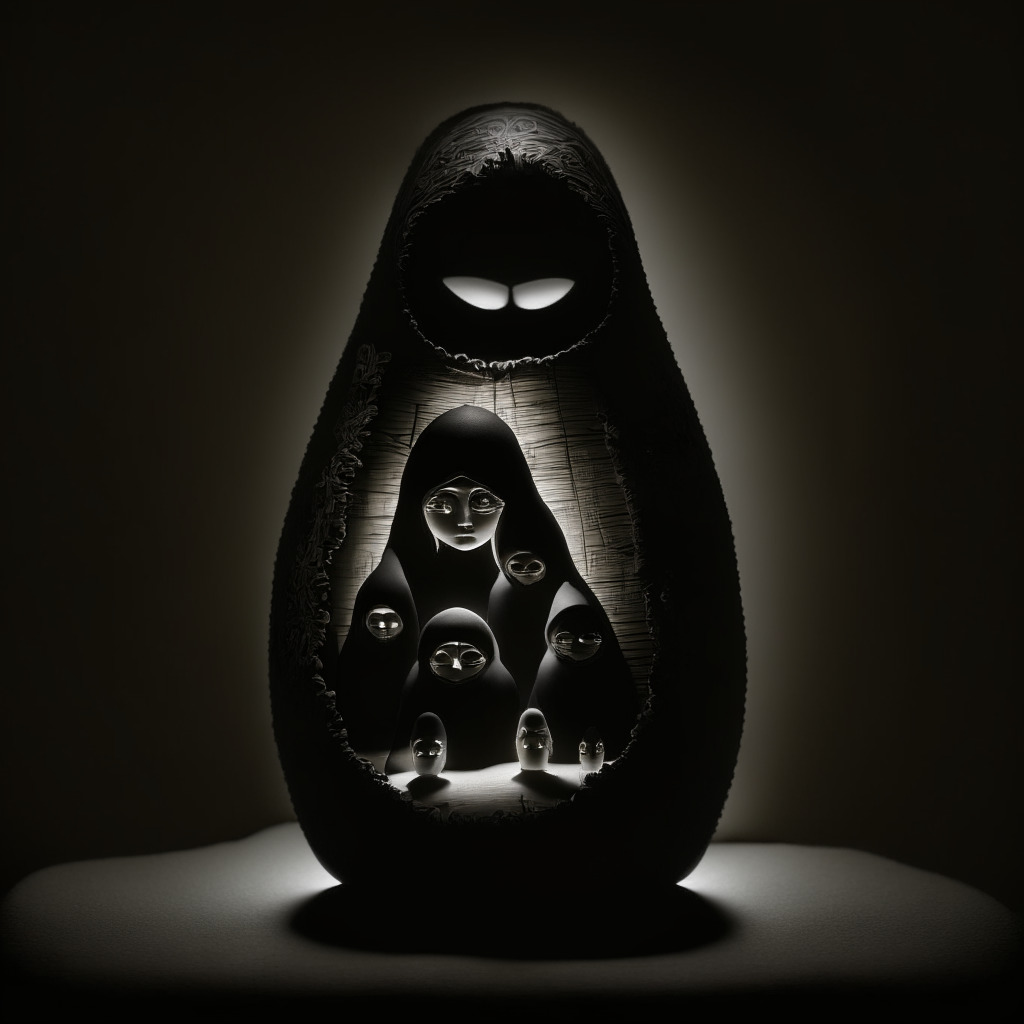

Impending U.S. DoJ Action against Binance: The Possible Catalyst for a Crypto Market Meltdown

The US Department of Justice (DoJ) reportedly deliberates on fraud charges against Binance, one of the world’s largest crypto exchanges. A potential indictment could cause an exodus from Binance, triggering losses and a broader market panic. Authorities are considering fines and deferred prosecution agreements to minimize consumer harm. Binance prepares for potential fallouts by securing assets and maintaining a healthy ratio for mass withdrawals. The incident highlights complexities in the world of cryptocurrencies, with watchful scrutiny on the looming regulatory battle.

Binance’s Potential U.S. Exit: A Catalyst for Crypto Regulatory Clarity?

“Binance, the crypto exchange platform, is considering shutting its US operations amid intensified regulatory scrutiny and allegations of operating as an unregistered securities exchange. This decision is potentially significant for future crypto adoption, regulatory compliance, and the ongoing institutionalization of cryptocurrencies.”

Binance’s Audacious Stand Against U.S. CFTC: A Game-Changer for Crypto Regulations

“Cryptocurrency exchange, Binance, plans to challenge the U.S. Commodity Futures Trading Commission’s lawsuit against it over alleged illegal activities. This audacious move may change the landscape of cryptocurrency regulation within the U.S., setting precedent for future cases and influencing the future of cryptocurrency market.”

Navigating Murky Waters: The Saudi-Chinese AI- Blockchain Venture and Binance’s IRI Commitment Review

Saudi Arabia and China are collaborating to create AceGPT, an Arabic-based AI system designed for Arabic queries. Despite its potential, concerns arise over misuse of sensitive information and neglect of safety checks. Meanwhile, the blockchain Industry Recovery Initiative receives criticism for lack of funding transparency amid falling crypto venture funding.

Binance Exodus: Why Russian Clients are Migrating en Masse to CommEx and Other Platforms

“Binance’s Russian users are progressively moving to new platforms including CommEx and ByBit, evident from decreased p2p transactions. While the migration is linked to US regulatory pressures, the change may indicate a strategic rebranding for more compliant user interaction in crypto market scenarios.”

Binance Axes BUSD Lending Services: A Setback or Smart Strategy?

“Binance is discontinifying its Binance USD (BUSD) lending services, with a full termination of BUSD support planned for 2024. The decision comes after issuer Paxos severed ties with Binance amid litigation with the U.S. Securities and Exchange Commission. Users are now urged to convert their BUSD to other currencies.”

Binance in the Crosshairs of Cybercrime: A Case Study in Blockchain-based Law Enforcement

“Binance, a major player in the crypto world is leading the fight against cybercrime, using blockchain technology to ensure user security. Recently, Binance partnered with CCIB and Thailand’s Royal Police, successfully dismantling significant scams and seizing assets worth millions.”

Legal Clash: Binance, FTX, and the Battle for Crypto Dominance

This lawsuit targets Binance and CEO Changpeng Zhao over allegations of unfair competition and monopoly, claiming Zhao’s actions catalysed the downfall of rival crypto exchange, FTX. The case also examines Binance’s sudden decision to liquidate FTT tokens, Zhao’s misleading claims, and his damaging disclosures on Twitter. Furthermore, it involves the SEC’s scrutiny of Binance.

Navigating Regulatory Tensions: SEC’s Scrutinized Actions Against Binance and the Crypto Future

The SEC’s attempt to enforce stricter regulations around operations of major cryptocurrency exchanges, including accusations against Binance, has sparked debate. Questions are being raised about SEC’s use of lawsuits to change regulations, and its consistent use of the Howey Test for identifying securities. Not all digital assets, including certain stablecoins, believe they should be classified as securities. This situation challenges the crypto community to contemplate the impact of such regulatory actions on the future of cryptocurrency.

Unveiling the Shadows: Binance Russia’s Acquisition by CommEx Raises Intriguing Questions

Binance Russia has been acquired by an obscure firm, CommEx, whose owners’ identity remains a mystery. However, CommEx has been busy building its platform independently while employing several ex-Binance staff. The debate about the real ownership of CommEx continues to heat up due to their adamant secrecy.

Unraveling the Crypto Carousel: SEC vs Binance, and the Circle Defence

The blog post discusses the legal fight between the SEC and cryptocurrency exchange Binance over the classification of digital assets as securities. It also touches on Circle’s argument that stablecoins linked to the U.S. dollar, such as BUSD and USDC, shouldn’t be categorised as securities. The outcome of the legal battle could greatly impact the future of cryptocurrency regulations.

FTX Pioneer Sam Bankman-Fried’s Legal Struggles: Is the U.S. Government Too Stringent on Crypto Leaders?

FTX founder, Sam Bankman-Fried, faces opposition from U.S. authorities for temporary release from jail prior to his trial. Accused with fraud-related charges during his tenure at FTX and Alameda Research, he pleads innocent. This situation casts a shadow over the future of crypto technology.

Binance Coin’s Rocky Path in Light of Regulatory Troubles vs. the Rising Potential of Meme Kombat Token

“Binance Coin (BNB) has increased by almost 2%, despite a previous week’s fall of 2.5% and a worrying 13.5% drop since the new year. Continued regulatory hurdles and exits from various markets make future substantial gains uncertain. Meanwhile, alternative altcoins like Meme Kombat (MK) offer enticing prospects with unique reward systems and betting options. However, crypto investment comes with significant risks.”

Bipartisan Battle for Crypto: A Deep Dive into U.S. Digital Asset Regulation

Senators Kirsten Gillibrand and Cynthia Lummis have introduced a new crypto bill, the Responsible Financial Innovation Act, aimed at addressing regulatory ambiguity in the US cryptocurrency industry. This legislation could shift the oversight of most digital assets from SEC to the Commodity Futures Trading Commission.

Crypto Week Review: Binance vs SEC, Tether Lifeline for Tron and Controversy at FTX

This article explores recent developments in the crypto world, including the SEC’s setback in their investigation into Binance.US, the proposed dismissal of a lawsuit against Binance and its CEO, and delay in repayments by defunct exchange Mt. Gox. Noteworthy is Tether’s decision to authorize $1 billion USDT to the Tron network, a lawsuit against FTX founder’s parents, and Grayscale filing for a new Ether futures ETF.

Unraveling the Binance vs SEC Saga: A Landmark Battle in Crypto Regulation

Binance, Binance.US, and Changpeng Zhao are legally challenging the U.S. Securities and Exchange Commission, arguing it overstepped its bounds. The crux of the conflict lies in the question of whether the SEC has the right to retroactively regulate the emerging crypto markets. Binance contends that the SEC should have established clear crypto sector guidelines before taking legal action. They also challenge the SEC’s attempt to hold them accountable for crypto asset sales dating back to July 2017, during a time of unclear regulatory norms for crypto.

Binance’s Stablecoin Delisting: A Regulatory Avalanche or Necessary Compliance Step?

“Binance plans to delist all stablecoins from its European platform by June 2024, complying with Europe’s tight regulation. The move, following the passing of Europe’s crypto regulation law, MiCA, could significantly impact the European crypto market. Meanwhile, the U.S. grapples with its digital currency dilemma, revealing distinct attitudes towards financial digitization.”

Binance’s Plan to Delist Stablecoins in Europe: A Critical Look at Regulatory Compliance and Market Impact

“Binance, a key cryptocurrency exchange, plans to delist all stablecoins for the European market by June 2024, in adherence to the Markets in Crypto Assets (MiCA) law. This move, expected to impact significantly on Europe’s market, reflects the potential disruptions regulatory changes can cause. Meanwhile, the U.S. resists implementing a Central Bank Digital Currency (CBDC), despite other countries’ pursuits of national digital currency.”

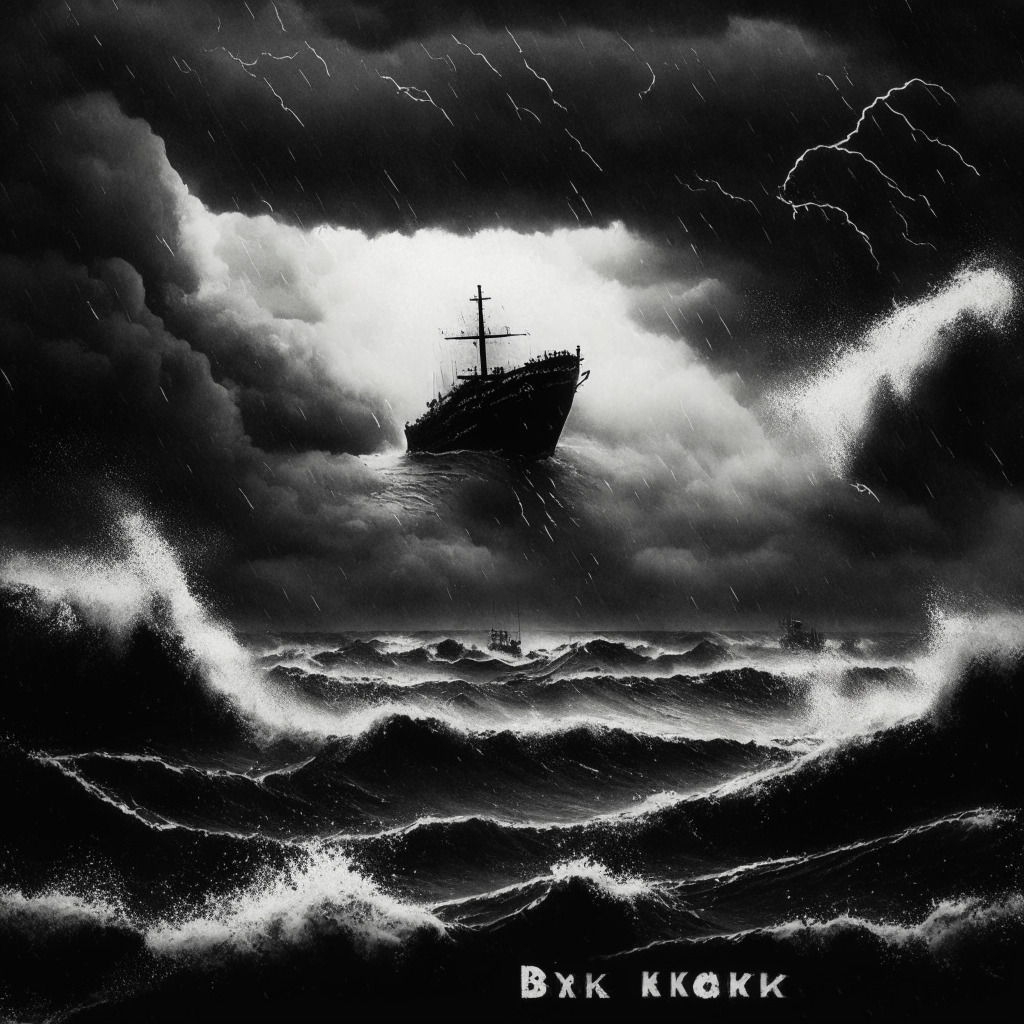

Navigating the Storm: Binance’s Legal Challenges and the Future of Crypto Regulation

Binance CEO, Changpeng Zhao dismisses rumors of Binance.US CEO, Brian Shroder’s departure amidst legal issues involving the SEC and CFTC. He notes Shroder’s significant contributions to the platform’s resilience and growth, despite growing legal and regulatory challenges. Binance.US recently appointed Norman Reed as the new CEO.

Public Disclosure of Binance US documents: A Critical Turn in SEC’s Crypto Regulations Battle

“The conflict around Binance US’s alleged operation of unregistered securities and practice of wash sales has caught community attention. The disclosure of confidential documents by the SEC sheds light on its case, offering insight into the intricate web of U.S. cryptocurrency market regulations, providing a more transparent view of this regulatory battle, and possibly setting a precedent for future U.S. approach to regulating crypto assets.”

Escalating Tensions Between SEC and Binance.US: Pros, Cons, and the Underlying Blockchain Battle

The U.S. Securities and Exchange Commission (SEC) accuses Binance.US and BAM of possibly violating federal securities laws due to their staking, clearing, and brokerage services. The SEC’s concern revolves around Binance.US’ reliance on a custody provider, Ceffu, potentially leading to violations of prior agreements. Binance.US denies any wrongdoing, while regulation pressure continues to increase. This situation illustrates a broader discussion surrounding crypto regulation nuances, transparency, investor protection, and maintaining decentralization.

Sweeping Exits and Legal Challenges: Decrypting the Binance.US Saga

“In the face of increasing legal challenges, two more senior executives have left their roles at Binance.US, following the departure of CEO Brian Shroder. The ongoing regulatory scrutiny has invoked potential investigations by the SEC and DOJ, addressing allegations of unregistered securities operations. These developments underline the escalating cryptocurrency compliance demands and their inevitable impact on market confidence and dynamics.”

Leadership Exodus at Binance US: The Impact of Regulatory Scrutiny on Crypto Giants

Binance US, a major cryptocurrency exchange, has seen multiple high-profile departures amid increasing regulatory scrutiny from the U.S. Securities and Exchange Commission (SEC). Accusations against the company include operating unauthorized platforms and violating commodities laws. These challenges alongside a significant drop in U.S. market share place Binance US at a crucial crossroads.

U.S. Regulatory Hurdles: Driving Crypto Startups Towards Friendlier Shores?

“Ripple’s CEO, Brad Garlinghouse, argues that the U.S. is the worst country for crypto start-ups due to its hesitance towards digital asset innovation. He highlights the UK, Singapore, UAE, and Switzerland as nations nurturing such innovation. Aggressive lawsuits by SEC and CFTC complicate the implementation of crypto regulations in the U.S., possibly inducing a mass exodus of blockchain startups to friendlier jurisdictions.”

PayPal’s Crypto Integration and Binance’s Noble Deed: A Deep Dive into Pros, Cons & Verifiable Progress

“PayPal’s new feature allows U.S. users to convert cryptocurrencies to USD. However, this poses questions due to transaction costs, potential incompatibility with MetaMask, and Bitcoin transactions. Meanwhile, Binance’s generous disaster relief pledge raises issues regarding beneficiary verification.”

Navigating the Regulatory Tug of War: Binance and SEC’s Standoff about the Future of Crypto

“Binance.US has labelled SEC’s call for executive depositions and additional discovery to be overly burdensome and indiscriminate. Accusations allege the CEO of Binance and Guangying ‘Helina’ Chen channeled billions in customer funds through third-party companies, with Binance refuting these claims. The standoff brings scrutiny to SEC’s regulation of the crypto industry, raising concerns about overstepped regulatory boundaries and stifling innovation.”

Navigating Through Binance Exodus, Nasdaq’s AI, and Crypto Industry Legal Drama: What’s Next?

“Binance continues to lose key figures amid regulatory woes, sparking questions about its future, despite CEO assurances. Nasdaq’s first AI-driven order type has SEC approval, signaling a significant technological shift in trading. The crypto industry wrestles with legal issues and regulation debates, highlighting a resilient sector skilled at innovation amid regulatory challenges.”

Navigating the Wave: How Binance Battles Rumors, Regulations and Employee Departure

Binance CEO, Changpeng Zhao, has dismissed rumors about financial instability, insisting the platform has “no liquidity issues.” Despite multiple executive departures, Zhao maintains that all customer funds are secure, pointing to recent crypto industry victories and expansions as positive indicators.

Binance’s Zero-Fee Expansion: A Strategic Move or a Response to Regulatory Hurdles?

“Binance expands its zero-fee trading to Argentine, Brazilian, and South African currency spot trading pairs. This move is seen as an attempt to increase trading of prominent cryptocurrencies against mentioned fiat currencies, despite confronting legal and regulatory hurdles, especially in the U.S. and Europe.”

Resignation Reverberations: Unraveling the Impact of Leadership Change at Binance

Mayur Kamat, Global Product Lead at Binance, has resigned, sparking questions about the company’s stability and future. This follows a series of high-profile resignations at Binance, amidst an ongoing U.S. Department of Justice investigation.

Navigating the Gray: Binance, Grayscale, and the Uncharted Legal Landscape of Crypto

“Binance, a leading cryptocurrency exchange, faces possible legal action from the US Securities and Exchange Commission (SEC), potentially linked to violations of sanctions involving Russia. Meanwhile, the SEC and Grayscale experience a landmark clash, highlighting evolving regulatory issues and the role of self-regulation in preserving the balance between financial freedom and investor protection in crypto markets.”