“Robert F. Kennedy Jr., a Bitcoin supporter, announced his independent candidacy for presidency. Among his platforms is a positive stance on cryptocurrencies, including campaign finance via Bitcoin, tax exemptions for Bitcoin investors, and potential backing of the U.S. dollar with Bitcoin.”

Search Results for: Bitcoin

Surging Snorlax Token and the New Prospects of Bitcoin Minetrix: A Crypto Landscape Redefined

The latest buzz in the crypto market surrounds the explosive +500% growth of Snorlax token (SNOR), despite global risk concerns. However, the risk factor is equally significant. Meanwhile, Bitcoin Minetrix (BTCMTX), the first-ever tokenised Bitcoin cloud mining platform, is gaining considerable interest. It promises a secure mining solution, decentralising profits to individual investors. Despite such promising trends, crypto investing involves high risks.

Navigating the Crypto Market’s Intensity: The Rise of Bitcoin Dominance vs The Plight of Altcoins

“Bitcoin’s dominance over other altcoins has reached a three-month high, resulting in uncertainty for altcoins and potential short opportunities for traders. Experts suggest that Bitcoin could climb towards $35,000-$40,000 if it breaches the $28,000 barrier. However, market stability remains relative, with every investment carrying a degree of risk.”

Crucial Crypto Updates: The Bitcoin Slump, Crypto Aid Israel and The Rise of BitVM

Bitcoin’s value hovers at $27,653 as Robert F. Kennedy Jr, a crypto enthusiast, vies for presidency as an independent, proposing the reinforcement of the US dollar with Bitcoin among other assets. Cryptocurrency organizations, including Fireblocks, offer aid in the midst of the Israel crisis, suggesting possible integration of crypto in traditional finance systems. Robin Linus unveils BitVM, potentially importing Ethereum-level smart contracts to the Bitcoin sphere.

Smart Contracts on Bitcoin: The Future of Blockchain or an Overreaching Gamble?

The recent “BitVM: Compute Anything on Bitcoin” white paper by ZeroSync’s project lead, Robin Linus, proposes a new way to implement complex off-chain smart contracts on Bitcoin. Based on a Turing Complete system, this method would broaden Bitcoin’s operations to include applications like tactical games verification, bridging BTC to foreign chains, and constructing prediction markets.

Bitcoin’s Relentless Pursuit: The Conflict of $28,000 Amid Evolving Market Dynamics

“Bitcoin, despite market caution due to the Israel-Hamas tension, persists near the $28,000 valuation mark. Although overall crypto market value declined, Bitcoin’s stability was underpinned by robust US job figures. Israel’s involvement in Bitcoin-related endeavours may impact Bitcoin and other cryptocurrencies during a potential regional fallout.”

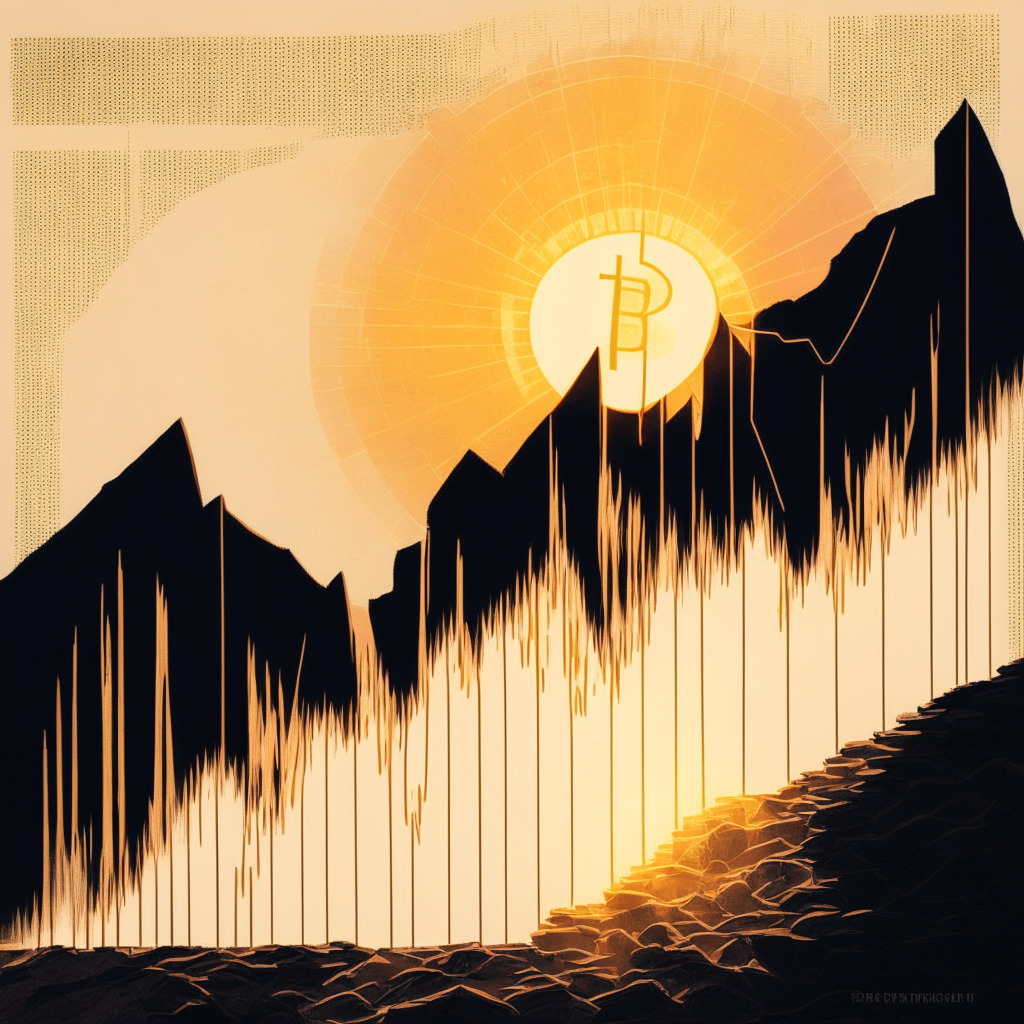

Stalling Bitcoin: Unpacking the Surprising Lethargy in Q3 Despite Favorable Fundamentals

Despite promising developments in the crypto universe, Bitcoin underwent an 11.1% loss in Q3, perplexing investors. Other assets also witnessed declines due to high inflation and potential recession fears. Nevertheless, Bitcoin’s robust YTD performance of a 65% increase provides hope for its future despite recent hurdles. Future geopolitical events might also trigger favorable trends for Bitcoin.

Bitmain’s Struggle but Hive’s Triumph: A Tale of Two Bitcoin ASIC Companies

Bitcoin ASIC manufacturer Bitmain has paused October salary payouts for its employees due to struggles to achieve net positive cash flow. This decision includes a 50% pay cut and elimination of standard bonuses and incentives. Amid financial troubles, Bitmain’s survival relies on concrete financial recovery strategies.

Digital Asset Market Boom: A Spotlight on Bitcoin, Ethereum, and Solana Amid Regulatory Uncertainty

The digital asset market recently observed a significant increase, with product inflows reaching $78 million, marking the highest rise since July. A surge was also seen in exchange-traded products, growing 37% in a week. Bitcoin experienced a notable boost, while Ethereum’s growth remains slower. Surprisingly, altcoin Solana recorded substantial outflows, yet maintains popularity. Interestingly, a majority of last week’s inflows originated from Europe due to its clearer regulatory framework.

Cloud Mining Revolution: Bitcoin Minetrix Success Amid MineLabCoin Concerns

“Bitcoin Minetrix raked in $822,000 from investors by introducing the concept of tokenizing Bitcoin cloud mining. However, concerns of legitimacy occur as cloud mining has often faced fraudulent incidents. Bitcoin Minetrix’s Ethereum level smart contract handling system offers a safer platform for investors.”

Solana’s Potential Rally Despite Price Slump: New Kid on the Block, Bitcoin Minetrix

“Despite a recent 2.5% decrease, Solana’s price is standing tall with a 129% raise year-to-date, making it a top-performing crypto. The coin exhibits encouraging indicators and a likely breakout, bolstered by its unwavering uptime and private transaction capabilities. Meanwhile, Bitcoin Minetrix is gaining traction.”

Unraveling the Bitcoin Minetrix: Revolutionary Opportunity or Overhyped Concept?

“Bitcoin Minetrix, the pioneering tokenized Bitcoin cloud mining operation, offers an innovative approach to the crypto community, boasting a presale of over $500,000 and 1224% Staking APY. It introduces non-transferable mining credits to reduce theft risks and works to democratize crypto experience, especially for retail investors.”

Unveiling the Future of Bitcoin: OpenAI’s Endorsement, Putin’s Dollar Shift Concerns and Price Trends

The CEO of OpenAI, Sam Altman, praises Bitcoin for its potential to combat corruption due to its independence from government control. He and Joe Rogan express concern over US handling of cryptocurrency regulation and central bank digital currencies. Despite recent price dips, Altman and Rogan remain hopeful for Bitcoin’s future due to its limited supply and decentralized mining. However, they caution that like all investments, cryptocurrencies are volatile and risky and require careful research and strategy.

Bitcoin’s Stability Amid Geopolitical Instability: An Unusual Crypto Market Behavior

Bitcoin’s price remains steady at $28,000 despite global geopolitical instability, unlike gold, oil, or the U.S. dollar which have experienced turbulence. Anticipation mounts over future volatility as Bitcoin’s reaction to unfolding geopolitical crisis and potential economic fluctuations remains uncertain.

Decoding The Future: Blockchain, Bitcoin, and the Fear of Centralized Digital Currencies

“Blockchain technology and cryptocurrencies are transforming financial infrastructures, providing a decentralised exchange method. Cryptocurrencies like Bitcoin could pave the way for a transparent, corruption-free global currency. However, concerns about government control, environmental impact, and the implications of Central Bank Digital Currencies (CBDCs) are also emerging.”

Bitcoin’s Resistance at $28K: A Market Hurdle or Prelude to a Surge? Plus, The Dark Shadows in Crypto Exchanges

In the Bitcoin market, $28K stands as a significant resistance level that lacks the robust bid needed for conversion to support. Amid global unrest, optimistic forecasts suggest Bitcoin surpassing $30K. Blockchain industry trustworthiness is questioned following allegations of investor fraud against a prominent cryptocurrency exchange’s former CEO. Notably, the crypto world’s decentralized nature doesn’t fully shield it from unscrupulous practices.

The Great Bitcoin Tug-of-War: Will It Breach the $28,500 Threshold or Retreat?

Bitcoin displays impressive tenacity, standing at $27,973 with market capitalization of $545.69 billion. From a technical perspective, crucial price points include resistance at $28,350 and support at $26,630. While the Relative Strength Index suggests slight bearish sentiment, the Bitcoin forecast remains predominantly bullish, provided it maintains above the $27,500 mark. However, the crypto market’s volatility calls for careful strategy adjustment.

Bitcoin Forecast: Poised for a Bull Run toward $28,435 by Mid-October

“Bitcoin might hit a promising valuation of $28,435 by mid-October, a prospective 9% climb with the recent Nonfarm Payroll data showing boosted job positions. Bitcoin trades at $27,922, indicating a 4% raise over the past week, with a robust 24-hour trade volume exceeding $13 billion.”

Unraveling the Link Between the US Economy and the Bitcoin Bull Run

“The four-hour timeframe sheds light on promising price action for Bitcoin, showing a soaring labor market in the cryptocurrency domain. The current Bitcoin price stands at $28,000, demonstrating a robust 24-hour trading volume of around $12.63 billion, reflecting an overall bullish sentiment.”

Navigating Risk-Reward in Crypto: Bitcoin’s Resilience vs Shitcoin Volatility

“Bitcoin shows determination to climb back over the $28,000 limit, despite an initial drop following the release of robust U.S job figures. Anticipation of continued ascension within the primary uptrend is palpable, potentially triggering swift move back above $30,000, with an accelerated 7-8% gain.”

Impending Bitcoin and Ether Options Expiry: Treading the Fine Line of Caution and Optimism

“A notable Bitcoin options expiry event involving roughly 14,000 contracts, valued around $400 million, is set for October 6. With a ‘max pain’ point at $27,000, and a near even split between long and short positions, this event could significantly influence the market. Alongside, 200,000 Ether options contracts also expire, potentially altering the market dynamics.”

Bitcoin’s Resilience Amidst US Job Reports and Interest Rate Changes: A Deep Dive

The world’s premier cryptocurrency, Bitcoin, experienced price fluctuations following a strong US jobs report for September. With the US economy’s progression, experts foresee two possibilities: a higher interest rate from the Federal Reserve, and maintaining these rates for a longer period. Consequently, Bitcoin showed a minor plunge before bouncing towards a 3% rise from its session lows. There seems to be a growing acceptance towards higher interest rates among Bitcoin investors, showcasing the currency’s resilience.

Bitcoin Fluctuations and the Market Response to U.S. Job Data: A Seismic Dance of Crypto and Economy

The crypto market’s recent volatility is linked to the U.S. jobs data and potential interest rate hike by the Federal Reserve. Bitcoin and other cryptos reacted disruptively, with rapid price shifts influenced by macroeconomic indicators. It highlights the necessity of a nuanced understanding of wider financial systems for crypto enthusiasts, as unwarranted shocks from global markets test the resilience of digital assets.

Rocketing Through Blockchain: The Ascent of Blinky Red Ghost and The Innovation of Bitcoin Minetrix

“Blinky Red Ghost (BLINKY), a DEX-launched token, surged over 500% creating a buzz in the crypto market. It owes its success to a $100,000 airdrop to early backers. Meanwhile, Bitcoin Minetrix presents retail investors a secure opportunity to share in mining revenues via their Stake-to-Mine model.”

Ethereum’s Tussle with Resistance & Bitcoin Minetrix: New Cloud Mining Trend

“Ethereum’s marginal drop by 0.2% with a current standing 2.5% higher than two weeks ago suggests remaining uncertainty in the cryptocurrency market. Deepening ties with PayPal and Visa provide a boost, yet its breakthrough capacity remains unsure due to global financial stability.”

Bitcoin’s Market Momentum: Bold Forecasts, El Salvador’s Mining Move and the Potential of ETFs

“Former BitMEX CEO foresees Bitcoin’s price surging to approximately $70,000 in 2024, propelled by potential financial disruptions and an anticipated Bitcoin halving event. Meanwhile, El Salvador launches its maiden sustainable Bitcoin mining pool, and BlackRock nears approval of a Bitcoin ETF – potentially triggering a $650 billion surge in crypto asset management.”

Forecasting Bitcoin’s Future: Market Movements, ETF implications, and Cyber-security Enhancements

The Bitcoin community anticipates the outcome of the US job data with hopes of a surge in Bitcoin’s value. A potential gamechanger is the SEC’s expected approval of a Bitcoin Exchange-Traded Fund (ETF), which could attract significant investments and raise Bitcoin’s prices. However, maintaining vigilance is essential as Bitcoin’s value may fluctuate in the coming days.

Nervous Wait: Bitcoin Stalls Ahead of US Jobs Data, Meme Coins Grab Spotlight

“Bitcoin (BTC) deflected from the $28,000 mark once again, as the US jobs data release this Friday looms. Higher yields on risk-free assets could impart pressure on crypto prices. Amidst this, traders are exploring less liquid meme coin markets for better trading opportunities.”

Harnessing Volcanoes for Bitcoin: El Salvador’s Pioneering Lava Pool Project and its Global Implications

“El Salvador introduced the Lava Pool project, merging renewable geothermal energy with cryptocurrency mining, in a strategic blend of Volcano Energy’s infrastructure and Luxor Technology’s expertise to counter environmental concerns of digital currencies. It signifies El Salvador’s determination to integrate Bitcoin into its power infrastructure, becoming the first geothermally driven Bitcoin mining pool in the country.”

Navigating Bitcoin’s Tough Road to $30,000: Exploring the Underlying Challenges

Bitcoin’s struggle to surpass $28.5K is attributed to factors such as failed launch of Ether futures ETFs, US Federal Reserve’s economic concern, a dip in Bitcoin’s core trading metrics, and dwindling faith in the prospect of a spot Bitcoin ETF. The path towards $30,000 appears uncertain.

Disrupting the Bitcoin Mining Industry: Unpacking the Bitcoin Minetrix Project

“Bitcoin Minetrix has emerged as a potential game-changer in the field of tokenized Bitcoin cloud mining. Their Stake-to-Mine paradigm offers users the opportunity to mine Bitcoin by staking tokens, resulting in a redistribution of mining profits from corporates to retail investors. This approach provides a high yield return, offering both access and inclusivity to the Bitcoin mining process.”

Navigating the Tumultuous Seas of Bitcoin: The Untold Tale of Dips, Spikes, and Hope

“Bitcoin’s recent dip to $27,431 has sparked alert among enthusiasts for potential new local lows. Expert analysis remains mixed, with bullish optimism pinned on a claim above 200-Week MA and bearish views sustained by ongoing uncertainty beneath 21-Week MA. Traders anticipate the challenging $30,000 resistance, while recommending diligent research to navigate the innate investment and trading risks.”