“Bitcoin Cash (BCH) tests the 20DMA support line as trading volume slips 48.19% to $246k. Meanwhile, Bitcoin Minetrix, an emerging Bitcoin cloud mining presale is drawing attention with its Stake-to-Mine model, which leverages token-staking to offer efficient, secure BTC mining.”

Search Results for: Bitcoin Cash

Riding the Crypto Wave: Bitcoin Cash’s Rising Tide and the Future of Tokenized Mining Platforms

“Bitcoin Cash (BCH) has registered a significant 1.5% gain within 24 hours, and 12% in a week, showing a noticeable shift in whale investors. The crypto’s trading volume skyrocketed from $70 million to nearly $500 million, signaling BCH’s continued upward trajectory with significant buying interest.”

Bitcoin Cash Bounces 15% on Grayscale Victory: A Rally Bolstered by Bitcoin or its own Merits?

Following Grayscale’s court victory against the SEC, Bitcoin Cash’s price surged by 15% in 24 hours. The news might prompt further cryptocurrency exchange-traded funds, including a potential BCH ETF, promoting growth in other Bitcoin-related tokens like Bitcoin SV and Stacks.

Bitcoin Cash’s Struggles Amid Downturn: A Chance For Emerging Crypto To Shine?

“BCH, following a 60-day downturn resulting in a 42% loss, trades around $189.30. Amid descending hopes, signs of potential recovery surface as BCH firmly consolidates above $180, charting a possible return to $210. However, risks remain, with a potential drop to $160.”

Tether Discontinues Bitcoin, Kusama and Bitcoin Cash-Based Stablecoins: Impact on Crypto Landscape

“Tether, the issuer of popular stablecoin USDT, discontinues its Bitcoin, Kusama, and Bitcoin Cash-based stablecoins due to low usage. It reflects Omni’s crucial role and considers reinstating Omni Layer version if utility increases. Also, Tether plans to introduce a new Bitcoin-based smart contract system, “RGB”.”

Bitcoin Cash Struggles Amid Market Volatility: Shibie Token Enters the Scene

“Bitcoin Cash (BCH) has recently experienced market decline with its ongoing struggle with the 20-day moving average. Nevertheless, amid its consolidation, a new token, Shibie – a blend of icons Barbie and Shiba Inu, is gaining attention with its inclusivity and marketing drives.”

Bitcoin Cash Struggles to Find Stable Ground While BTC20 Emerges as Potential Game Changer

Despite BCH’s struggling performance and a recent 29% price bleed-out, the newly-emerged BTC20 offers a promising alternative. With a proof-of-stake model that dramatically reduces emissions and a unique long-term holder reward system, BTC20 targets Bitcoin’s pressing issues and aims to create a new generation of Bitcoin holders.

Evaluating Bitcoin Cash’s Performance: Is it Too Late to Invest?

Bitcoin Cash (BCH) has observed a slight recovery, potentially due to its inclusion in EDX Markets. Although it has underperformed compared to its peak prices, current speculations hint at a new crypto bull market which could lead to impressive performance for BCH. Preconditions before investing include careful study, portfolio diversification, and consideration of high-risk, high-reward ventures such as crypto presales.

Bitcoin Cash’s Resilient Climb: A Promising Sign or Misplaced Optimism?

“Bitcoin Cash (BCH) has seen a 200% increase in recent weeks, boosted by its listing on the EDX Markets crypto exchange. Despite being a fork from Bitcoin in 2017, BCH’s recent performance placed it as the third strongest player in top 100 cryptocurrencies. Experts caution against drawing parallels to Bitcoin’s adoption pace, and emphasize the need for diversified investment portfolios.”

BitCoin Cash Traders Face High Losses: A Deep Dive into BCH Futures Market Dynamics

Recent trading activity linked to bitcoin cash (BCH) resulted in the highest losses in over two years, wherein both longs and shorts lost over $25 million on BCH futures. Factors influencing such losses may include shorting interest in BCH, high negative funding rates, and heightened trading activities on South Korean exchanges and new platform EDX Markets.

Bitcoin Cash Outshines Bitcoin: Big Bull Run, Regulatory Speculation, and Market Unpredictability

“June saw Bitcoin Cash (BCH) outperform more mature cryptocurrencies by gaining 171% in a month. This unprecedented success may be linked to reduced regulatory risk perception. Despite fluctuations, overall market performance grew a modest 2.7% suggesting potential future stability.”

Bitcoin Cash Rally vs Launchpad XYZ’s $LPX Potential: An In-Depth Market Analysis

The Bitcoin Cash (BCH) rally continues, with a price surge outpacing other top 100 cryptocurrencies. This follows BCH’s inclusion on EDX Markets, a prominent cryptocurrency exchange. Observers debate whether it’s now too late to invest in BCH, despite a bullish upward trend. Meanwhile, Launchpad XYZ’s native $LPX token attracts attention with promising advances in web3 integration and a successful presale.

Bitcoin Cash Surge: Sustained Growth or Temporary Boost from EDX Listing?

Bitcoin Cash has surged 115.5% in price, reaching $236.6, likely due to its listing on EDX Markets. The rally may lead to an 11.5% increase hitting the $260 mark, but a potential correction phase and resistance level could impede further growth.

Bitcoin Cash Open Interest Skyrockets: Factors and Future Implications Explained

Bitcoin Cash (BCH) open interest has surged to over $400 million, reflecting improved market sentiment and a possible shift in crypto community attitudes. This increase is attributed to network upgrades, the introduction of “CashTokens,” and a significant exchange listing on EDX Markets.

Bitcoin Cash Surges on EDX Listing: Can it Compete with Bitcoin in the Long Run?

Bitcoin Cash (BCH) surged to a one-year high, with a 100% rally in the past week, following its listing on institutional-backed crypto exchange EDX Markets. Renewed attention, trading volume, and social media interest have impacted the price, but its traction remains a fraction compared to Bitcoin.

Exploring Bitcoin Cash’s 75% Surge: Is Institutional Adoption the Key Driver?

Bitcoin Cash (BCH) experienced a 75% price surge and $1.2 billion trading volume increase after its listing on the EDX exchange, sparking investor interest. The 77% growth in open interest suggests optimism about BCH’s potential institutional adoption, liquidity, market demand, and overall value.

Bitcoin Cash Soars on EDX: Start of Institutional Adoption or Overblown Hype?

Bitcoin Cash (BCH) surged 36.5% after being listed on EDX exchange, backed by giants like Fidelity, Schwab, and Citadel. With a 77% rise in open interest, BCH reached its highest value since February, indicating a more optimistic outlook for institutional adoption.

Bitcoin Cash Upgrade vs Bitcoin’s BRC20 Tokens: Clash for Crypto Dominance

Bitcoin Cash’s price surges as it approaches a major mainnet upgrade introducing new features like “CashTokens,” smart contracts functionality, and smaller transaction sizes. This hard fork raises questions about the competition between Bitcoin-based tokens and future dominance of these platforms.

Bitcoin Cash Upgrade: Unleashing Economic Freedom and Scalability vs Ethereum Complexity

The May 15th Bitcoin Cash network upgrade introduces the Cashtokens CHIP, offering economic freedom through UTXO-level token creation and advanced on-chain applications such as higher-security vaults and decentralized exchanges. This results in a user experience comparable to Ethereum, but with better scalability and affordability.

BCH Bull: A Game-Changer for Decentralized Trading on Bitcoin Cash Blockchain

The much-awaited decentralized trading platform, BCH Bull, on Bitcoin Cash’s blockchain is now live in […]

Unleashing the BCH Bull: Bitcoin Cash’s New Decentralized Trading Platform Stomps into the DeFi Arena

Ever since its introduction, the concept of decentralized finance (DeFi) has been a hot topic […]

Crypto Controversies: Tornado Cash’s Legal Troubles, FTX Founder Behind Bars, and Huge Bitcoin Concentration

“The crypto industry is grappling with legal and ethical challenges, whilst showing high-risk, high-reward nature. With recent controversies involving Tornado Cash co-founders, FTX founder, and the parent company of Prime Trust, it’s clear that proper evaluation and risk-assessment are crucial.”

Navigating Bitcoin Transactions through Cash App: A Convenient Tool or a Security Nightmare?

“Cash App, developed by Block Inc, has won popularity for facilitating Bitcoin transactions, with its ‘Auto Invest’ tool easing price volatility. However, limitations exist in Bitcoin-only support and transactional data vulnerability. Also, funds lack FDIC or FSCS insurance, warranting caution.”

Bitcoin’s Turbulent Ride: NFP Data, Cash App Influence and Binance’s New Trading Pairs

“The crypto market is in suspense due to Bitcoin’s performance above $29,000. US Non-Farm Payrolls data could affect Bitcoin’s trajectory. Block Inc’s consistent performance and Binance’s new trading pairs have contributed to Bitcoin’s surge. However, bearish undertones suggest a possible downward trend.”

Warren Buffett’s Cash Move: Potential Impact on Bitcoin Amid Global Recession Fears

Warren Buffett’s move towards cash, indicating a potential stock market crash, and Bitcoin’s high correlation with Nasdaq raises concerns about downside pressure on the cryptocurrency. With a 6% decline in Bitcoin’s price last week and possible rate cuts, investors should closely monitor developments and conduct thorough research before deciding on investments.

Jack Dorsey’s Block Sees Impressive Bitcoin Sales: Analyzing Cash App’s Success and Controversy

Jack Dorsey’s Block reported $2.16 billion in bitcoin sales during Q1, with Cash App experiencing a 25% YoY increase in bitcoin revenue. Despite a decrease in bitcoin’s market price, Block exceeded analysts’ expectations with a 14% increase in earnings per share. However, the fintech’s future growth and long-term stability remain to be seen amid the rapidly expanding cryptocurrency ecosystem.

Stalling Bitcoin: Unpacking the Surprising Lethargy in Q3 Despite Favorable Fundamentals

Despite promising developments in the crypto universe, Bitcoin underwent an 11.1% loss in Q3, perplexing investors. Other assets also witnessed declines due to high inflation and potential recession fears. Nevertheless, Bitcoin’s robust YTD performance of a 65% increase provides hope for its future despite recent hurdles. Future geopolitical events might also trigger favorable trends for Bitcoin.

Bitmain’s Struggle but Hive’s Triumph: A Tale of Two Bitcoin ASIC Companies

Bitcoin ASIC manufacturer Bitmain has paused October salary payouts for its employees due to struggles to achieve net positive cash flow. This decision includes a 50% pay cut and elimination of standard bonuses and incentives. Amid financial troubles, Bitmain’s survival relies on concrete financial recovery strategies.

The Remarkable Ascent of Bitcoin BSC: Stellar Debut or Crypto Roulette?

“Bitcoin BSC, a new crypto, has kicked off on PancakeSwap, surging 50% and securing a market cap of $30m. With 2,310 token holders just after debut and an audited smart contract, it shows promise for future performance, although risks remain high.”

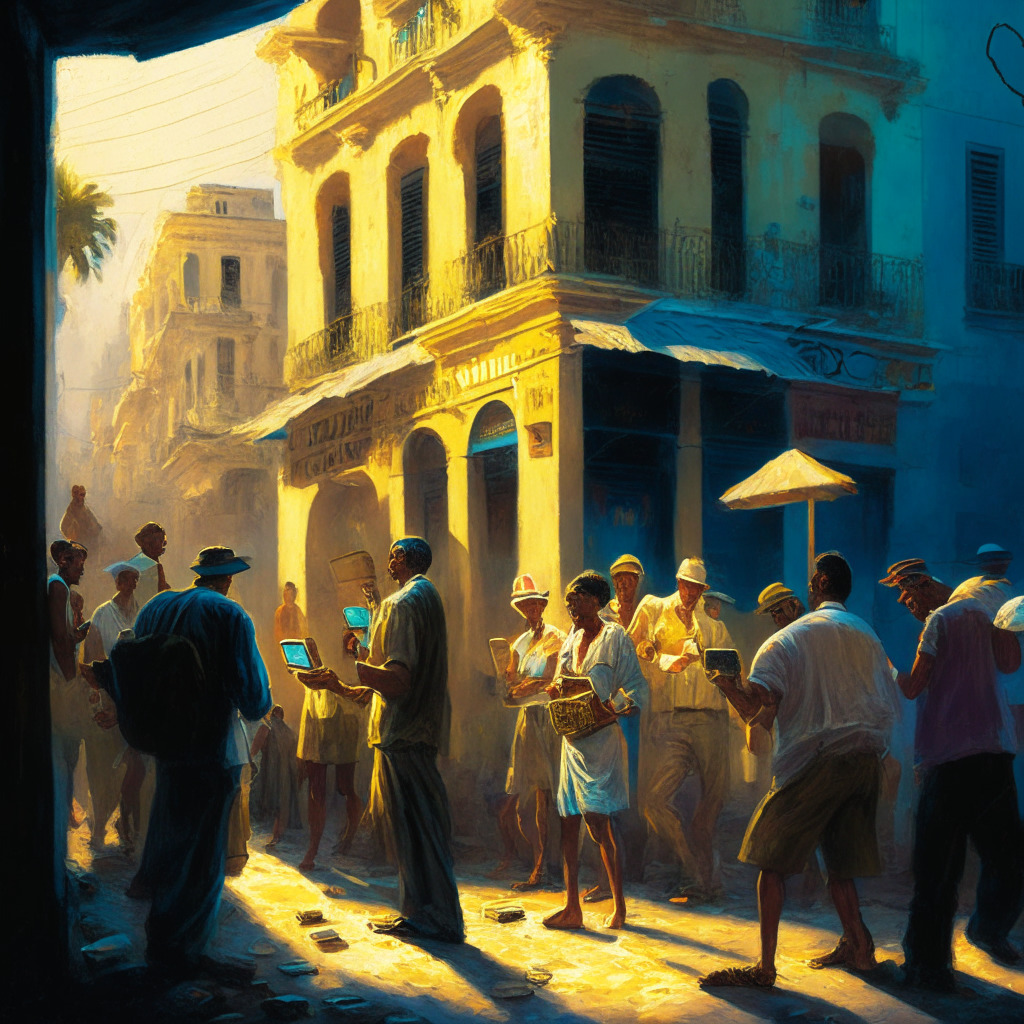

Bitcoin Awareness Rises in Cuba amid Fears of National Currency Decline

Amid devaluation of the Cuban peso and inflation, the crypto community in Havana, Cuba is turning to Bitcoin due to its relative financial stability. Despite governmental restrictions, Cubans have developed ways to buy and sell Bitcoin, hoping for a more economically secure future.

Canadian Bitcoin Mining Firm Soars: Prospects, Profits, and Challenges Ahead

A Canadian Bitcoin mining firm records a surge in productivity, increasing its holdings to 703 BTC, worth approximately $20 million. While the firm encountered challenges like increased network difficulties and unfavorable regulations, it managed to maintain a strong performance, with plans for continual growth amidst the upcoming BTC halving event.

Bitcoin’s Balancing Act: Excitement and Caution in the Face of Market Volatility and Ethereum ETFs

“Bitcoin saw a recent price knock at $28.5K, triggering doubt amongst market observers despite strong market interest. Some traders suggested possibility of ‘upside wick’ fakeout, or sudden price reversal. Meanwhile, upcoming Ethereum Strategy exchange-traded fund by VanEck looks promising, which could offer exposure to cash-settled ETH contracts, amidst cautious vigilance in crypto landscape.”