“Sam Bankman-Fried, former FTX CEO, faces a trial for allegedly misleading customers about the financial health of his company. The trial explores FTX’s business practices, its relationship with subsidiary Alameda, and highlights the complex issues of regulating a rapidly evolving global crypto industry.”

Search Results for: Crypto Com

Dutch Crypto Companies Battle Regulatory Fees: A Win for Blockchain or a Barrier to Growth?

The Dutch court has ruled against the Dutch Central Bank’s (DNB) imposed fees on crypto companies for anti-money laundering compliance, stating a violation of EU law. While the DNB argued that the industry should shoulder these costs, crypto firms believed these fees hindered the growth of the Netherlands’ digital currency sector.

SIM-Swapping Attacks on Crypto Communication Platform: A Case Study on Friend.tech

“Friend.tech, a crypto-oriented platform, has suffered a series of SIM-swapping attacks resulting in stolen digital assets. Industry firm, Manifold Trading, projects around $20 million of friend.tech’s total $50 million could be exposed to similar threats due to existing protocol setup.”

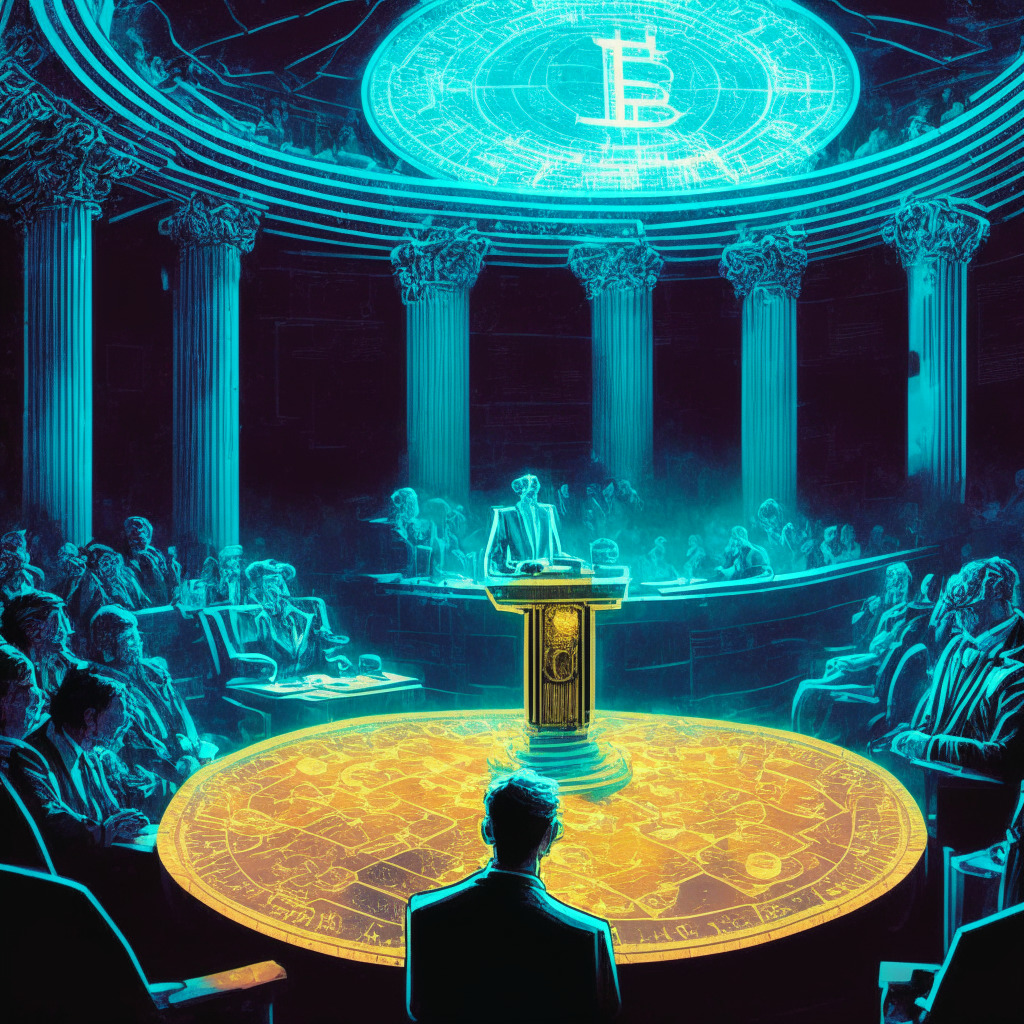

The FTX Drama: How Crypto Complexity Can Challenge Real-World Justice

This article discusses the challenging role of explaining the complex crypto world in the ongoing court case against Sam Bankman-Fried, ex-CEO of FTX. It portrays the differing trial strategies regarding how to present cryptocurrency, from simplifying it with analogies to intensifying its intricacies.

Sygnum Singapore’s Digital Breakthrough: Unpacking the Pros and Cons of Singapore’s Sieve-Like Crypto Compliance

Sygnum Singapore, a subsidiary of the Swiss-based crypto bank, has secured its Major Payment Institution License from the Monetary Authority of Singapore. The license enables Sygnum to provide regulated digital payment token brokerage services, breaking previous transaction limits, and paving the way for potential expansion into Asia-Pacific markets.

The Baffling Surge in Ethereum Gas Fees: Binance’s Role and the Crypto Community’s Reactions

The Ethereum network recently experienced a drastic surge in gas prices due to 140,000 transactions directed towards a Binance wallet, leading to extensive costs for users. This resulted in the Ethereum network momentarily being the largest gas user and Binance losing around 530 ETH ($840,000) in gas fees.

SEC Chair Gensler’s Cry for Crypto Compliance: Beneficial Oversight or Harmful Limitation?

SEC Chair, Gary Gensler, warns that compliance issues in the crypto industry could not only damage individual investors, but risk destabilizing the broader financial system. He calls for no overhaul, but believes current laws can address these issues.

Regulatory Turbulence in the Digital Seas: Navigating Through the Storms of Crypto Compliance

In the realm of digital assets, regulatory storms pose unprecedented challenges. From accusations against Tornado Cash co-founder, Roman Storm, to the turbulent experiences of former CEOs Alex Mashinsky and Sam Bankman-Fried; and Grayscale firm contesting SEC’s regulations, the unpredictable nature of this digital sea implores for a smart navigation strategy to avoid being swept into the unknown abyss.

Crypto Commodities: Bitcoin and Ether and their Legal Status in US Courts

U.S. District Court Judge Katherine Polk Failla recently referred to Ether and Bitcoin as “crypto commodities,” dismissing a lawsuit against decentralized exchange Uniswap. The legal classifications of cryptocurrencies continue to vary, with other digital currencies such as XRP classified as a security. Amidst conflicting views, U.S. lawmakers are yet to determine whether SEC or the CFTC will have authority over digital assets. Specialists suggest these legal classifications are crucial for creating a more organized and regulated crypto environment.

Dancing on Shifting Sands: Crypto Companies Adapt Amid Regulatory Obstacles and Market Developments

“The crypto industry is witnessing significant developments like Coinbase and Circle’s consortium dissolution, Binance.US’s collaboration with MoonPay, and customer withdrawal issues on the main Binance platform. These changes highlight the dynamic adaptations adaptive to changing regulations, representing both intriguing possibilities and cautionary tales for the industry.”

Crypto Crime Investigation Training Surge in Ukraine: A Move Towards Global Crypto Compliance?

Ukrainian law enforcement officers are being trained by European Union officials in crypto crime investigation, highlighting the Ukrainian government’s dedication to aligning its crypto policies with those of Brussels. The sessions focus on tracking crypto transactions and identifying their participants, given the potential misuse of these transactions for illegal activities. This aligns with the BEB’s focus on combating financial crime in the crypto industry.

Caught in the Crosshairs: Titan Global Capital and an Expensive Lesson in Crypto Compliance

The US Securities and Exchange Commission (SEC) accused Titan Global Capital Management of deceiving investors regarding cryptocurrency offerings, leading them to part with over $1 million in a settlement. This instance underscores the SEC’s increased focus on regulatory compliance within the digital assets industry, potentially indicating impending tighter regulations affecting customer custody and information accuracy for cryptocurrency firms.

Crypto Community’s Internal Upheavals: Layoffs, Regulatory Confusion, and Billion-dollar Flash Crashes

“The cryptosphere is grappling with fundamental discords and minor tribulations. Beyond technical issues, it deals with the anxieties of those invested in it – its quintessentially human aspect. Amid all this chaos, we long for the simplicity amidst complex strife, mirroring crypto’s ambition to simplify finance while wrestling with its complexities.”

Clash of the Titans: Crypto Community vs U.S. Treasury in Tackling Anonymity and Regulation

“Regulation in the crypto world came under scrutiny after a lawsuit backed by Coinbase challenged the U.S. Treasury Department’s sanctions on Tornado Cash, a crypto transaction platform. Despite uproar from the crypto community, a judge ruled that the Treasury acted within its powers, escalating the ongoing tension between crypto advocates and regulatory bodies.”

Bankruptcy of Crypto Custodian Prime Trust: A Wake-Up Call for the Crypto Community

“The bankruptcy filing of crypto custodian Prime Trust has revealed the importance of community vigilance in the crypto space. Prior suspicions about the trust’s instability grew after it declared bankruptcy with liabilities of up to $500 million, raising questions about perceived trustworthiness and accountability of custodians and exchanges.”

Skeptical Voices: Rapper Post Malone and US CBDCs Debate Stir Crypto Community

American Rapper Post Malone expressed skepticism about the potential Central Bank Digital Currency, associating it with increased government control. The duo highlighted risks including growing state control, potential loss of citizen’s income and potential impacts on social credit scores and behavioral control. Such concerns have sparked discussions in the crypto community.

Y00ts’ Tectonic Shift: From Polygon Back to Ethereum, Stirring the DeGods and Crypto Communities

Top NFT collection, y00ts, has announced its intention to migrate away from Polygon and return a $3 million grant, aiming to align with DeGods community. The move, offering a timeline soon, has sparked various reactions within the crypto community.

Navigating Online Hazards: Phishing Scams Pose Threat to Crypto Community and Market Trust

“In a bold phishing scam, Blockchain Capital’s Twitter was hijacked with the hackers constructing a sham giveaway to exploit the public. The incident, echoing recent FBI warnings about scams in the crypto and NFT space, underlines the importance of robust cybersecurity in the increasingly mainstream world of crypto technology.”

In Search of Originality: The Unconventional Approach of Lea Thompson in Crypto Communication

Lea Thompson, known as Girl Gone Crypto, disapproves the repetitive “breaking” news tweets on crypto, opting for engaging commentary and humor. Her unique approach, offering her followers refreshingly unconventional content, has largely contributed to her growing popularity within the crypto community.

Abracadabra’s Abrupt Solution: 200% Interest Hike and Its Mixed Reactions in Crypto Community

“Abracadabra Money, a cross-blockchain lending platform, proposes a rate hike to counterbalance its CRV exposure risks by increasing its outstanding loan interest rate by 200%. This is in response to recent exploits that exposed Abracadabra to significant CRV risk, leading to a liquidity crisis.”

Crypto Competition Uptick: Web3 Wallet Suku vs Twitter’s Vision for Crypto Payments Integration

Web3 wallet Suku is integrating with Twitter to allow users to easily send digital currencies and non-fungible tokens (NFTs). It aims to simplify the crypto onboarding process, bypassing the need to connect a wallet. Furthermore, Suku plans to integrate with other social media platforms, striving to create a decentralized payment system that works across various platforms. Despite the challenges, crypto payments on social media are on a promising trajectory.

Brian Brooks Joins Hashdex: A Coup or a Concern for the Crypto Community?

“Brian Brooks, former Comptroller of the Currency under the U.S. government and CEO of Binance.US, joins Hashdex board of directors. His vast experience in financial regulation and crypto industry attracted Hashdex CEO Marcelo Sampaio. Brooks predicts crypto assets will revolutionize global industries.”

Rise and Fall of Thodex: A Study in Crypto Compliance and Importance of Robust Regulations

“In the turbulent world of blockchain, the case against Thodex’s CEO Faruk Fatih Özer underscores the crucial need for compliance and clear regulations. With investors suffering losses near $2 billion, this serves as an urgent reminder for stringent laws governing blockchain technology. Can existing laws suffice or should they evolve with this fast-paced digital realm?”

High-Stakes Drama: Crypto Company Nexo in a Legal Battle Over a Mysterious $12m Wallet

The high-profile cryptocurrency platform, Nexo, is involved in a complex legal case with its co-founder Georgi Shulev, over a reported missing $12 million hardware wallet. The dispute centers around a lost Ledger hardware wallet, account freezing, and crypto value loss, reflecting the challenges of controlling digital assets and security in the decentralized blockchain world.

Twitter’s Rate Limitations: The Impact on Crypto Communities and the Emergence of Decentralized Alternatives

“Twitter’s decision to place severe rate limits has led to a significant limit on shared information. Reports indicate a drop of over 60% in the number of tweets indexed by Google. This change has consequences for industries, especially cryptocurrency, as Twitter is used heavily for information dispersion. Decentralized Twitter rival, Mastodon, is seeing unprecedented growth, while Twitter competitor, Threads, prepares for launch.”

Making Waves: Binance’s Battle to Change Crypto Compliance Perception

Binance, the world’s largest cryptocurrency exchange, is striving to break the perception of the crypto industry’s non-compliance. With a comprehensive compliance team including former law enforcement officers, regulators and crypto and banking experts, they actively combat potential financial crimes, monitor international regulatory developments and maintain customer due diligence. Despite facing legal challenges, Binance continues its rigorous compliance efforts.

Suspension of Shiba Inu Burn Twitter Account: Crypto Community Questions Transparency

The Shiba Inu Burn Twitter account, known for engaging the crypto community and updating on SHIB burn rates, was unexpectedly suspended. This has raised concerns about Twitter’s moderation transparency and ignited speculation on the impact on Shiba Inu coin’s performance.

Defamation Lawsuit and Justice Tokens: Do They Benefit Crypto Communities or Raise Skepticism?

OPNX files a defamation lawsuit against Mike Dudas and introduces Justice tokens (JT) to support crypto communities affected by defamation. However, concerns arise over JTs’ proclaimed lack of intrinsic value and challenges in proving reputational damage.

Unmasking False Crypto Companies: Navigating Canada’s Surge in Bogus Service Providers

The Canadian crypto sector has seen a surge in companies falsely claiming authorization, with some even affiliated with counterfeit regulatory organizations. Investors should verify platform legitimacy and stick to CSA-registered trading platforms to avoid falling prey to crypto scammers.

SEC vs Ripple Lawsuit: Unpredictable Outcome and Divergent Crypto Community Opinions

The Ripple vs SEC lawsuit reveals contrasting opinions within the crypto community, reflecting the unpredictable outcome of the case. As the verdict approaches, pro- and anti-XRP factions express their views, challenging investors navigating current market conditions. Conduct thorough research before committing to cryptocurrency investments.

Terra Co-Founder’s Passport Scandal: Legal Lessons for the Crypto Community

The Montenegro Basic Court found Terra co-founder Do Kwon and former CFO Han Chang-joon guilty in a passport forgery case, raising questions on crypto regulation, legal system intersection, and ethical concerns over investment-granted citizenship. The crypto community is urged to prioritize security and operate within regulatory boundaries.

Crypto Community Rallies to Fund Investigator’s Defamation Defense: Trust vs Legal Influence

The crypto community, including Binance and Justin Sun, has donated over $1 million in stablecoins and tokens to blockchain investigator ZachXBT for his legal defense against defamation charges filed by NFT trader MachiBigBrother. The case highlights the importance of independent investigators, the strong bond within the crypto community, and the potential risks crowdfunding might bring to legal proceedings.