“VC funding for crypto startups has dropped to a three-year low, with a significant shift towards early-stage ventures. Despite challenging market conditions causing a lean funding period, strategic financing rounds have risen. The U.S leads with 54% of all active VC investors.”

Search Results for: Crypto Tony

Divisive Lines: How SEC’s Gensler Grapples with Criticisms & Questions on Crypto Oversight

Gary Gensler, SEC Chair, recently faced criticism over cryptocurrency market monitoring. Critics accused him of stifling markets with excessive regulation, promoting a “woke” agenda, and lacked certainty in classifying Bitcoin. The future of cryptocurrency regulation remains a divisive topic among industry participants and lawmakers.

Gary Gensler’s Regulatory Tightrope: Balancing Innovation and Regulation in Cryptocurrency

The SEC under Gary Gensler’s leadership has been accused of regulatory overreach, hampering the U.S. capital markets. While many criticize the lack of clear regulations around cryptocurrencies and other novel financial instruments, Gensler refrains from concrete classification, highlighting the complexity of these emerging issues.

The Dance of Crypto Regulation: Analysis of Hong Kong Stability and German Innovation

“In the blockchain and cryptocurrency domain, global jurisdictions are striving to balance innovation fostering and investor protection. With Hong Kong and Germany as examples, this article emphasizes the importance of stability, transparency in regulation, and innovative dynamism for robust crypto markets.”

Innovation Drought in Crypto: The Impact on Venture Capital and the Silver Lining Ahead

“In the crypto space, dwindling trading volumes and lack of groundbreaking innovations are leading to reduced venture capital support. However, this may spur growth and new discoveries. Amid market volatility, startups should focus on profitability and adaptability while innovating with new technology.”

Bitcoin’s Slump Below $26,000: Macroeconomic Factors and The Uncertain Future of Cryptocurrencies

Bitcoin’s recent slump mirrors an overall downturn in the crypto market, influenced by stricter monetary policies aimed at curbing inflation. Despite these challenging conditions and financial uncertainty, the potential introduction of US Bitcoin and Ether futures exchange-traded funds could provide a robust catalyst for the industry.

Rousing the Crypto Market from Slumber: Potential Catalysts on the Horizon

Analysts suggest potential market shifts like spot Bitcoin exchange-traded funds, PayPal’s stablecoin, and an Ethereum upgrade could disrupt the crypto market inertia. Despite recent lethargy, there are anticipations of rekindled enthusiasm due to increased institutional acceptance of cryptocurrencies and indicators of future crypto adoption.

Venture Capital in Crypto Startups: Tackling High Rewards, Risks and Evolving Strategies

“High-profile VCs advise focusing on exclusive clientele and well-designed, marketed airdrops for boosting startup traction in the crypto market. Varying views exist on influencer marketing and ICOs, with emphasis on adaptability due to rapidly evolving regulations and market conditions.”

Revolutionizing Crypto Transactions: Mutiny’s Web-Based Bitcoin Wallet Pushes Boundaries

Bitcoin wallet startup, Mutiny, released a beta version of self-custodial Lightning wallet that bypasses app distributors like Apple and Google. The firm addressed Bitcoin product censorship by launching Zapple Pay, enabling Bitcoin tipping and continuous upgrades without app store restrictions. Besides this, the wallet aids in liquidity management and includes a social tipping feature via the Nostr Wallet Connect protocol.

Bitcoin Resilience and Binance.US Liquidity Challenges: A Study in Crypto Market Dynamics

Bitcoin continues to show signs of positive decentralization with over one million wallets each holding at least one Bitcoin. However, Binance.US faces liquidity challenges, with a significant discount on Bitcoin and Tether (USDT) trades due to suspended fiat pipelines. The current market dynamics highlight intriguing movements in future blockchain markets and technologies.

SEC vs Crypto: Sandbox COO Debates Token Regulation and Implications for the Industry

Sabastien Borget, COO of The Sandbox, addressed concerns over the SEC’s enforcement in the crypto world, following lawsuits against Binance and Coinbase involving unregistered securities. Borget disagrees with the SEC’s categorization, asserting it doesn’t affect The Sandbox’s daily operations.

Debate on CBDCs and Crypto’s Role in Dark Web Drug Trafficking: A New Congressional Duel

As the debt ceiling deadline nears, crypto-focused bills address Central Bank Digital Currencies (CBDCs) and cryptocurrencies’ role in dark web drug trafficking. Concerns over privacy and potential legal issues arise from retail CBDCs, while bipartisan bills call for increased transparency and harsher penalties for dark web trafficking.

Bitcoin’s Future: $23,000 Dive or Steady Recovery? A Complex Crypto Market Analysis

Bitcoin’s recent spike above $28,000 has begun to fade, with downside targets at $23,000. Traders remain wary of a full correction, while others warn against dismissing the recent uptick. The current market situation presents a complex picture for Bitcoin traders and enthusiasts, with various interpretations of future movements.

Cryptocurrency Trading Addiction: A Growing Concern in a Volatile Market

Cryptocurrency trading addiction is a growing concern due to the market’s volatility and 24/7 trading potential. Recognized as similar to gambling addiction, it’s defined as the persistent compulsion to trade despite negative consequences. Treatment options include customized plans and residential programs, emphasizing self-awareness and healthy boundaries for recovery.

Bitcoin Awaits Breakthrough Amidst Mixed US Unemployment Data and Dollar Strength

“As Bitcoin’s price reached $29.3K, amidst mixed U.S. unemployment data and a strengthening dollar, the market displayed resilience. Financial markets react to these shifts, indicating an extremely dynamic crypto environment, with enthusiasts envisioning potential rebound opportunities despite the uncertain economic landscape.”

Evil Pepe Coin: Surging New Player in the Dynamic Meme Coin Market

“Evil Pepe, a new player in the meme coin market, experienced a 100% price surge minutes after listing on Uniswap. Given the original Pepe coin’s astronomical gains, there’s expectation for Evil Pepe’s similar rise. Despite its high-risk nature, its transparency, commitment, and support by high-profile influencers have attracted significant attention and investors.”

Future BTC Fluctuations: Optimism or Caution Amid Declining U.S Inflation?

“Despite potentially favourable market conditions, Bitcoin’s price action only registered a slight boost. Reputed analysts suggest U.S inflation is under control, contributing to crypto market stability. However, Bitcoin’s volatility remains unaffected, stuck within the range of $29,000 to $29,500. Various successful traders predict a likely downturn. Hence, investors must make judicious decisions, understanding the associated risks.”

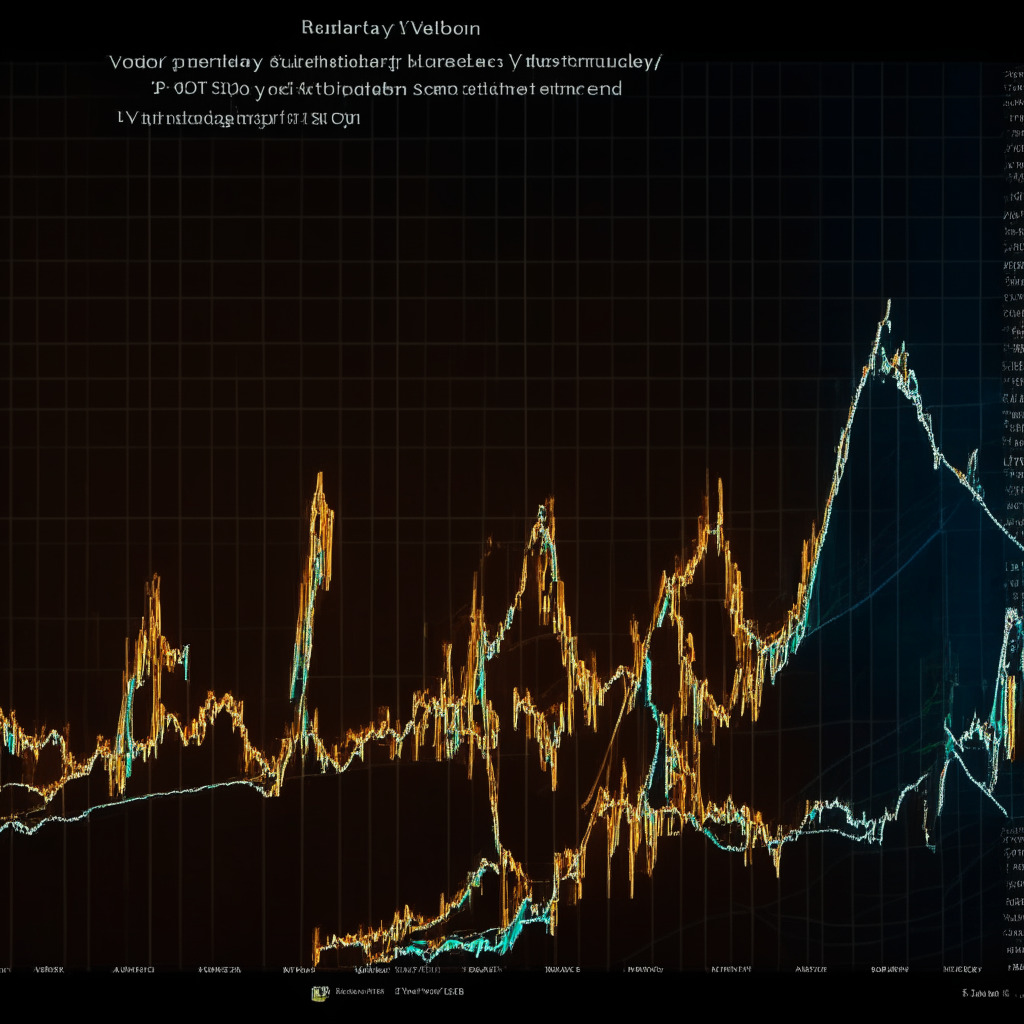

Bitcoin’s Shaky Footing: A Dive to $19k or a Bullish Run Ahead?

“Bitcoin stands at a watershed moment, expecting significant price alterations. The crypto market monitors fluctuations below $30k, concerned about a substantial decline. The upcoming seven days add to this volatility as the US Federal Reserve’s decision on interest rates could trigger significant Bitcoin’s price changes. Stakeholders wait, ready to capitalize on Bitcoin and crypto market’s direction.”

Fidelity’s Bitcoin ETF Pushes BTC Above $31K: Bullish Future or Short-Lived Rally?

Bitcoin price surges above $31,000, driven by rumors of Fidelity Investments filing for a Bitcoin spot-based ETF. Analysts anticipate possible surge to $38,000 if price holds between $32,000-$33,000. Despite skepticism, the overall sentiment leans towards a bullish trend.

Bitcoin Bulls Eye $35,000 While ETFs Gain Traction: Analyzing Market Drivers

Bitcoin bulls hold onto the $30,000 level as BTC price consolidates after a recent rally, with sentiment high for a potential rise to $35,000. Increasing interest in crypto assets and Bitcoin ETF filings, along with the upcoming 145,000 BTC options expiry on June 30, are key market events to watch.

Bitcoin’s $28K Dip: A Golden Entry Point or Par for the Course? Debating Pros & Cons

Bitcoin traders anticipate a potential $28K retracement as BTC price retains 20% gains, with expectations of a modest correction offering lucrative entry points for long positions. The current price performance and volatility align with historical trends, suggesting upcoming dip-buying opportunities.

Breaking $27.5K: BTC Surges Amid Deutsche Bank Custody, ETF Applications, and Market Resilience

BTC reached new highs at $27,55 level, following Deutsche Bank’s application for a crypto-assets custody license. Despite the excitement, market participants remain cautious, and the long-term impact of these developments on Bitcoin’s price action is uncertain.

Critical 200-Week Moving Average: The Next Big Move for Bitcoin Explained

Bitcoin price hovers around the critical 200-week moving average at $26,500, causing traders to remain cautiously optimistic. The market awaits a clear trend influenced by factors such as the U.S. dollar index and global economic conditions, impacting the future of Bitcoin and the broader crypto ecosystem.

Will Bitcoin’s Bullish Surprise Emerge If $26,000 Holds? Debating BTC’s Future Movements

Bitcoin dipped to $26,519, but traders expect a bullish surprise if it doesn’t breach $26,000. Crypto Ed believes BTC could bounce back to $27,500, while Tedtalksmacro notes favorable macro conditions. Market participants remain cautiously optimistic as both bulls and bears maintain a stalemate.

Floki’s Price Surge: Can It Overtake Pepe Coin After Chinese Exposure?

Floki price saw a double-digit increase after appearing on Chinese television during the World Table Tennis Championships, gaining massive exposure in the Chinese market. As its market cap reaches over $330 million, Floki could potentially overtake Pepe, another popular meme coin.

Ideal Bitcoin Breakout Conditions Clash with Correction Fears: Navigating the Uncertain Market

Bitcoin remains in a narrow range amid market uncertainty and fears of a deep correction. Meanwhile, discussions arise on blockchain’s potential role in improving trust in AI through transparency, decentralization, and tamper-proof data management.

Navigating Bitcoin’s Volatility: Support Levels, Scam Wicks & Whale Inactivity Conundrum

Bitcoin traders closely watch support levels amid concerns about the market’s future after a “scam wick” led to a two-month low. As the weekend commenced, analysts identified the critical $26,500 milestone for considering long positions but expressed skepticism due to the Binance order book’s state and lack of bid liquidity.

Bitcoin’s Struggle: Are We Heading for $30K or Plunging Below $25K?

Bitcoin’s recent price decline and cautious market sentiment raise questions about its short-term trend. Investors are selling at a loss, while regulatory uncertainty and technical issues affect demand. However, US buying pressure on Coinbase suggests potential recovery. Monitoring market indicators and thorough research are crucial for investment decisions during this uncertain period.

Bitcoin at $27K: The Struggle of Bulls, Macro Indicators, and a Golden Cross Clash

As Bitcoin (BTC) heads toward $27,000, bulls struggle to regain support amid weak market disposition. However, cautious optimism arises from positive macroeconomic indicators, such as the U.S. PPI and unemployment data, hinting at a possible pause in June rate hikes.

Bitcoin’s Uncertain Short-Term Fate: Examining Market Indicators and Upcoming CPI Data

As Bitcoin’s short-term outlook remains uncertain, traders anticipate the May 10 US CPI data release to potentially bring market volatility. However, conflicting perspectives on BTC’s price action and underlying uncertainty call for investor caution and thorough research when considering varying opinions, indicators, and macroeconomic influences at play.

Bitcoin’s Limbo Phase: Evaluating Bullish Breakouts vs. Bearish Declines Amid Market Volatility

The cryptocurrency market faced volatility on May 6, with Bitcoin (BTC) experiencing a 3% drop within hours. Despite these downmoves, BTC remains caught in a familiar trading range, leaving market participants frustrated. Traders and analysts anticipate either a bullish breakout towards $32,000 or a decline towards $24,000, reflecting the unpredictable nature of the cryptocurrency market.

Unraveling the Mystery of Pond0x: A Trailblazing Decentralized Exchange or a Skillful Scam?

“Decentralized exchange Pond0x has surpassed $100 million in trading volume, amidst concerns of scam operations involving its PNDX token. Allegedly directing Ethereum gained through its token launch to a non-refundable contract and displaying a risky transfer function, the platform’s credibility is under intense scrutiny. Pond0x’s future remains uncertain amidst these controversies.”