The Reserve Bank of India (RBI) is planning to increase daily retail Central Bank Digital Currency (CBDC) transactions from an average of 18,000 to one million by the end of 2023. RBI is also encouraging banks to facilitate e-rupee compatibility with Unified Payments Interface via QR codes for seamless transactions.

Search Results for: Digital Rupee

India’s SBI Leaps into Digital Realm: UPI Integration with Digital Rupee, A Step into the Future

“India’s largest public sector bank, SBI, has integrated UPI with the Digital Rupee, enabling 300 million UPI users and 500 million merchants to enhance their digital transactions. The ‘eRupee by SBI’ application potentially fuels secure and rapid exchanges, increasing national digital currency usage in regular transactions. However, the excitement around cryptocurrencies remains muted within the Indian government.”

Digital Rupee and Yes Bank Integration: A Gateway to Mass Adoption or a Breeding Ground for Risks?

“The digital rupee’s integration with Yes Bank’s app UPI extends its reach to millions of merchants in India, potentially driving its mass adoption. However, concerns regarding security, volatility and regulation of cryptocurrencies remain, alongside increasing competition. Despite these challenges, digital currencies showcase resiliency with digital rupee transactions worth $134 million reported within two months.”

Blockchain Roundup: NFTs’ Record Low Royalties, Phishing Attacks, Digital Rupee and Yuan Adoption, Danish Crypto Regulations and More

June 2023 marked the lowest level of NFT royalties, yet 342 projects raked in royalties over $1M, and twenty crossed the $10M threshold. In other news, RBI is in talks with 18 countries for adopting the digital rupee for cross-border transactions, and Saxo Bank has been ordered to offload its crypto asset portfolio due to regulatory concerns.

India’s Digital Rupee: A Cross-Border Game Changer against Dollar Deficiency

The Reserve Bank of India’s digital rupee initiative aims to simplify trade for countries with scanty US dollar reserves, potentially boosting India’s exports. This fast and cost-effective cross-border payment system could provide an economic solution for nations struggling with dollar deficiencies.

India’s Digital Rupee: CBDC Revolution or Privacy Concerns? Pros and Cons Explored

The Reserve Bank of India (RBI) progresses towards implementing the Digital Rupee, a central bank digital currency (CBDC), aiming to onboard one million users. RBI’s pilot program expands, promoting interoperability between CBDC QR codes and India’s Unified Payments Interface. Challenges like privacy and data security must be addressed to maintain trust.

Riding the Digital Wave: Reliance Industries, Blockchain & CBDCs – Bold Innovation or Risky Move?

“Reliance Industries Ltd. plans to venture into blockchain platforms and central bank digital currencies with its new entity, Jio Financial Services. Despite possible risks and uncertainties, the company aligns with India’s digital financial future, emphasizing security and regulatory adherence.”

Global Digital Currency Race: Stablecoins Threat or CBDCs Safety?

“The race for global digital currency dominance has stablecoins and Central Bank Digital Currencies (CBDCs) in the lead. However, Rabi Sankar, Deputy Governor of the Reserve Bank of India, warns that stablecoins could pose significant policy sovereignty risks for certain nations.”

The Gathering Momentum of Central Bank Digital Currencies: Promise and Uncertainty

“Recent research reveals 93% of central banks are actively looking into Central Bank Digital Currencies (CBDCs). Despite this interest, 68% claim they aren’t ready to release their own digital currency soon. Emerging markets, aiming for financial inclusion, lead CBDC adoption.”

India’s e-Rupee Advancements: Boon or Bane for the Nation’s Financial Landscape?

India’s Reserve Bank is advancing its efforts in developing a digital rupee, with satisfactory results from two central bank digital currency test projects. Although this initiative holds potential to transform India’s financial landscape, concerns regarding technology, implementation, and security must still be addressed.

India’s ₹2000 Note Withdrawal: Impact on Crypto and Rise of Digital Currencies

India’s financial landscape is changing as the Reserve Bank of India (RBI) withdraws ₹2000 denomination banknotes from circulation, while the country explores central bank digital currency (CBDC) with the E-Rupee Pilot Project. This raises questions about the impact on the burgeoning cryptocurrency market and the coexistence of CBDCs and cryptocurrencies in a more inclusive financial system.

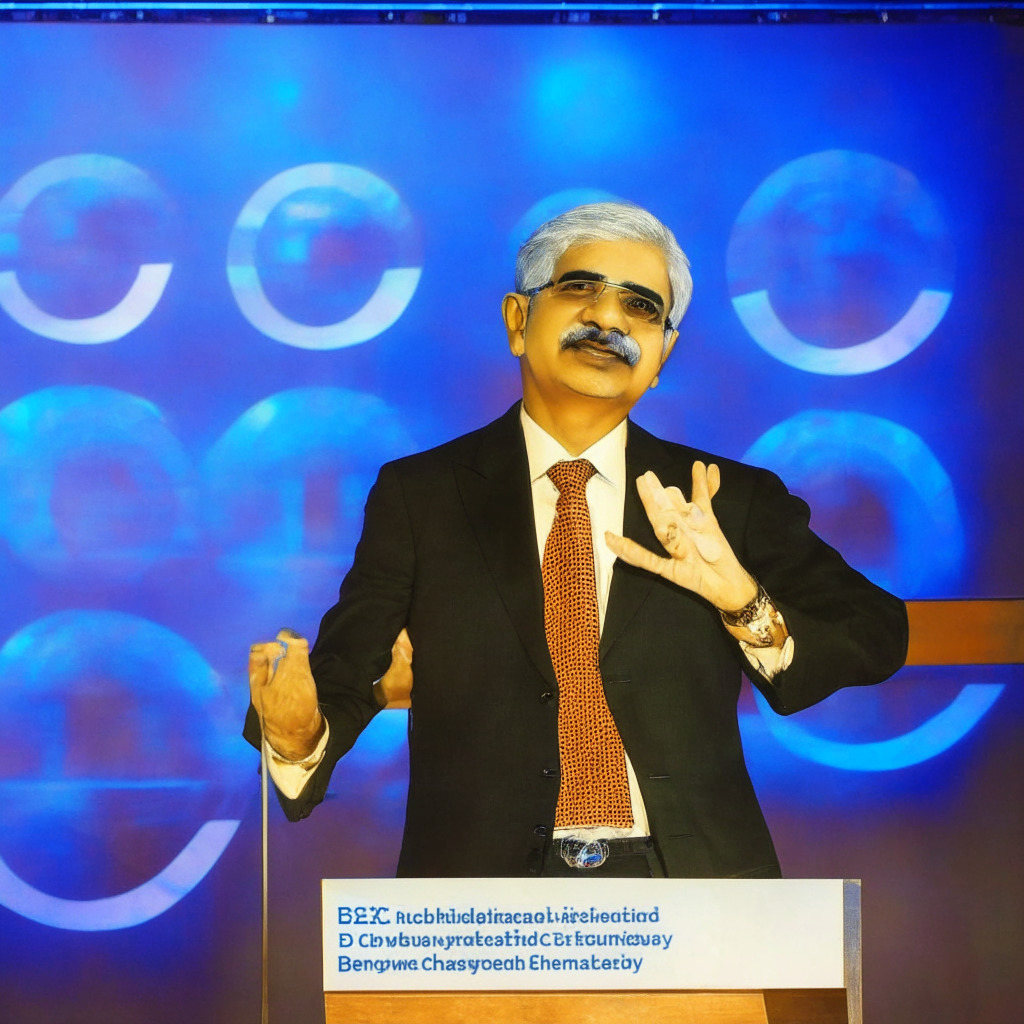

Unleashing the Power of CBDCs: India’s Approach to Revolutionizing Global Finance

Reserve Bank of India’s Governor, Shaktikanta Das, emphasized the transformative potential of Central Bank Digital Currencies (CBDCs) in a recent G20 TechSprint Finale address. He outlined their potential to revolutionize international payment landscape by reducing costs and increasing transparency. India, currently testing its own CBDC, engages in comprehensive data collection and analysis for future policies. They also invite innovative solutions for cross-border CBDC platforms.

India’s Blockchain Future: Ambani’s Gamble on Blockchain and CBDCs – Opportunities and Pitfalls

Mukesh Ambani’s Jio Financial Services (JFS) is promoting blockchain adoption and exploring central bank digital currencies (CBDCs) to aid digital inclusivity and financial growth in India. JFS aims to deliver blockchain-based products while ensuring utmost security, regulatory compliance, and customer data protection.

India’s Imprint on Global Crypto Legislation: A Leaning Tower or A Firm Stance?

India, the current G20 chair, has recently supported a globally aligned legislative framework for digital assets. Amid potential global regulations, India is pushing for a better understanding of the impact of digital currencies on emerging economies. However, it also highlights potential scams in economies with lax cryptocurrency regulations, enforcing the need for a globally aligned regulatory structure.

Anticipating Ripple Lawsuit Outcome: Market Reactions and Implications for the Crypto Future

The Ripple lawsuit Summary Judgement has generated immense interest, with the final ruling potentially by the end of 2023. Ripple’s management remains optimistic, anticipating a decision by year’s end. As the wait continues, XRP price has recovered significantly, and the lawsuit’s focus shifted to the documents related to the Hinman speech.

Six Samurai’s Bold Proposal: Reviving Terra Luna Classic and Impact on LUNC Market

The Six Samurai, a group of LUNC holders, presented a joint governance proposal for Terra Luna Classic, aiming to revive its ecosystem. Their Q3 spend proposal involves migration, Cosmos SDK updates, and listing on analytic tools. Despite optimism, remember to conduct thorough research before investing in the unpredictable cryptocurrency market.

India’s Plan for Crypto Tokens on Native Web Browser: Progress or Roadblock?

India plans to integrate crypto tokens into its upcoming native web browser, a move propelled by its Ministry of Electronics & Information Technology. This initiative aims to foster developer ingenuity and wider crypto adoption, despite facing regulatory challenges. A prominent feature will be digitally signing documents using crypto tokens within the browser.

Stablecoins: A Tethered Threat or Necessary Innovation? Unwinding the Global Debate

“Stablecoins potentially infringe on nations’ policy sovereignty and present more benefits to robust economies like the US and Europe. They pose an economic and socio-political challenge, and also risk amplifying the dollar’s power. International sentiment points towards a need for stricter stablecoin regulation to ensure financial stability.”

Cryptocurrency Adoption Amid Global Economic Unrest: Analyzing Pakistan, Nigeria, Turkey, and Japan

The cryptocurrency adoption landscape is evolving, with countries like Pakistan, Nigeria, Turkey, and Japan experiencing increased interest in digital assets to combat inflation, currency instability, and centralized financial control. Widespread adoption of decentralized digital assets may be imminent as cryptocurrencies offer insurance and hedge qualities amid global economic challenges.

Pakistan’s Crypto Dilemma: Government Ban vs Soaring Adoption Rates

Pakistan’s government hardens its stance on digital assets, with the Minister of State for Finance announcing that cryptocurrencies will “never be legalized.” Amid Financial Action Task Force concerns, the State Bank of Pakistan and the IT Ministry work on banning cryptocurrencies despite their growing popularity, as annual crypto trading volume reaches $25 billion.