The blockchain industry has experienced remarkable growth, with institutions participating in block validation and staking for returns. Foundry offers staking services to institutional clients, tapping into Maximum Extractable Value (MEV) to optimize returns and benefiting the broader blockchain marketplace. Backed by the Digital Currency Group, Foundry provides security and profitability to staking clients.

Search Results for: Foundry

Unraveling the Myth: Why Bitcoin Miners Sell off their Daily Mining Rewards

“Bitcoin miners sell their daily BTC rewards not due to market distress, but as part of a strategic approach to drive costs down, enhance operational efficiency, and stabilize profits. Strategies are shaped more by managing operational risks, fueling growth, and tactically responding to crypto market fluctuation rather than signals of distress.”

The Emerging Reign of Texas as a Global Crypto Mining Hub: Boom or Bane?

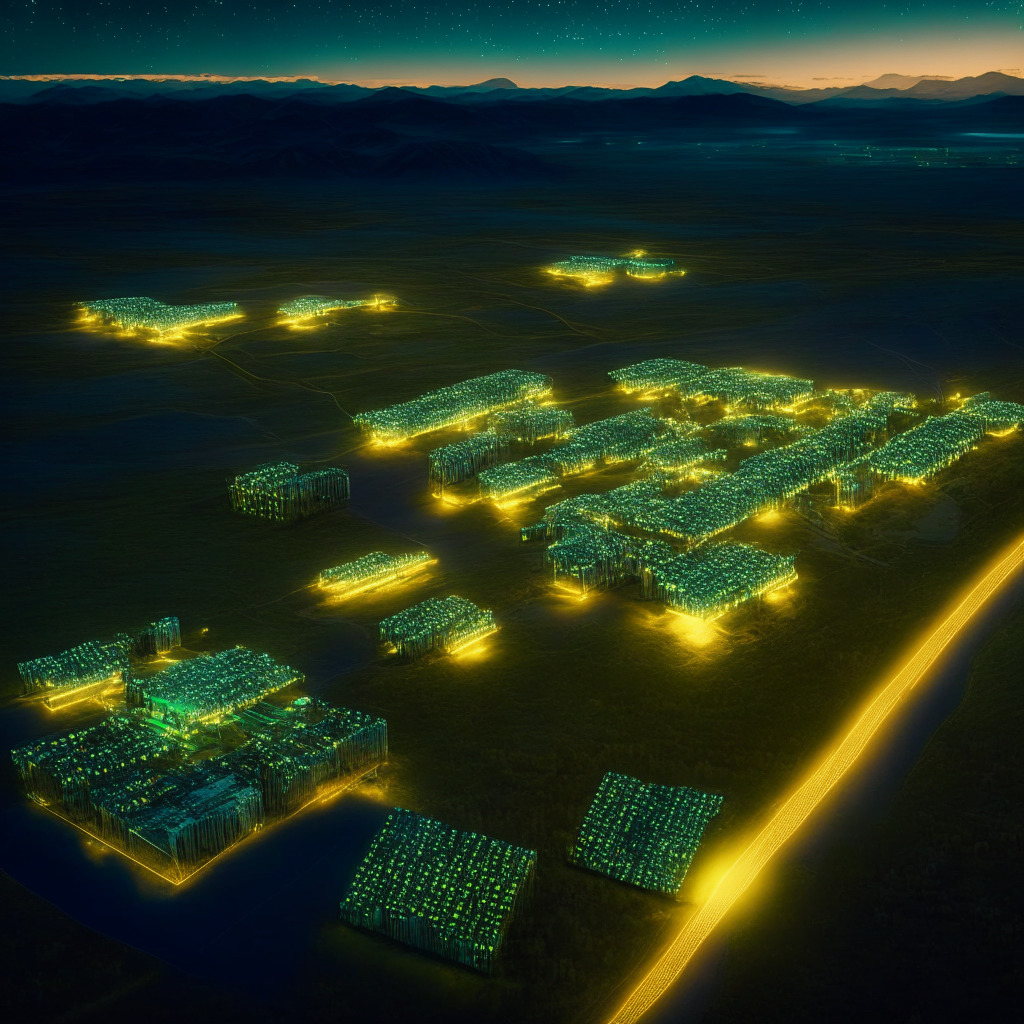

“Cryptocurrency mining involves solving complex mathematical problems known as hashing. Currently, Texas leads in Bitcoin’s hash rate in the U.S. with 28.5%. Interestingly, the state’s regulatory framework and favorable energy prices make it ideal for crypto miners. Despite burgeoning operations, energy consumption, power curtailment, and regulatory policies shape the future of cryptocurrencies.”

Texas Surges Ahead: Altering the Landscape of US Crypto-Mining

“The state of Texas is now claiming a staggering 28.50% of the U.S. crypto-mining hashrate, up from 8.43% at the end of 2021. This rise, attributed to favorable conditions including negative pricing, comes at the expense of states like Georgia, previously a blockchain leader. Meanwhile, Texas’ mining growth draws in leading crypto entities keen on expansion.”

Lone Bitcoin Miner Strikes Gold: Examining The Underdog Win in Crypto’s Expansive Arena

On August 18, a solo Bitcoin miner, with an estimated hash power of 1 PH/s, successfully claimed the complete reward of 6.25 Bitcoins for solving block 803,821 using Solo CKpool mining service. This relatively low-power miner striking it big, despite the dominance of behemoth mining pools, emphasizes the importance of platforms like Solo CKpool that provide opportunities for individual miners.

Power Play in Crypto: Bitmain and Anastasia Digital’s Equity Stakes in Core Scientific

“Bitmain and Anastasia Digital potentially plan to acquire equity stakes in Core Scientific, the world’s second-largest publicly listed bitcoin miner, amid its imminent bankruptcy. Core’s funding for acquiring Bitmain Antiminer units comprises of $23 million cash and $54 million in equity, hinting Bitmain’s first interest in a publicly listed miner.”

Navigating Rough Seas: The Dynamics, Challenges and Future of Bitcoin Mining in a Bear Market

“Bitcoin miners experienced a $184 million windfall from transaction fees in Q2 2023 following a flat 2022. Top public mining companies saw their market cap increase by 257% since early 2023. However, miners are also liquidating Bitcoins to cover operational costs, due to scarcity of external capital and an ongoing bear market.”

Navigating the 2024 Bitcoin Halving: Opportunities and Challenges for Crypto Miners

This article discusses the upcoming Bitcoin halving in 2024, which could pose significant challenges for miners due to rising electricity costs and declining mining rewards. Despite the potential pitfalls, resilience defines this industry as miners strategize to safeguard themselves against halving impacts. The sector’s ability to navigate this path will determine the long-term stability of the crypto ecosystem.

Sabre56’s Bold Shift: From Bitcoin Consulting to Hosting Services and Its Impact

Sabre56 plans to shift from consulting on Bitcoin mining projects to offering hosting services for industry firms over seven years. This strategic move addresses the need for reliable, large-scale hosting services in the Bitcoin mining industry, emphasizing Sabre56’s focus on providing scalable solutions in a dynamic market.

Bitcoin Mining Difficulty Nears 50T: The Impact on Miners and Blockchain Growth

Bitcoin mining difficulty is set to surpass a record 50T, driven by factors like the Bitcoin price rally and the surge in popularity of the Ordinals protocol. Increasing difficulty levels impact miner profitability but also stimulate growth within the network, with transaction fees tripling, benefiting miners’ revenue.

USBTC’s Comeback: Analyzing the Shift in Mining Landscape & its Implications for the Industry

U.S. Bitcoin Corp (USBTC) recently signed multi-year agreements to host 150,000 bitcoin mining machines with major firms like Marathon Digital Holdings, signaling a potential resurgence in the mining industry. However, challenges remain as the industry faces transformations and companies navigate varying levels of success.

Surge in Bitcoin Transaction Fees: Boon for Miners, Bane for Users, Glimpse into Blockchain’s Future

The recent surge in Bitcoin transaction fees due to the Ordinals protocol’s impact on non-fungible and fungible tokens has both positive and negative implications for the mining industry and crypto ecosystem, highlighting the need for innovation and adaptability in navigating future challenges and opportunities.

Bitcoin Mining Difficulty Drop: Relief for Miners or Sign of Uncertain Future?

Bitcoin network difficulty dipped 1.45% after five consecutive increases, providing relief for miners. Despite this, miners still face challenges such as longer block times and a clogged mempool with over 200,000 unconfirmed transactions. Intense competition among mining pools and constant network fluctuations make the crypto mining industry’s future uncertain.

Bitcoin’s Hashrate Hits Record High: Impact on Speed, Security, and the Zettahash Era

Bitcoin’s network achieved an all-time high of 491.15 EH/s hashrate on May 2, 2023, indicating significant computational power supporting the network. This surge in hashrate comes with slower block times and over 240,000 unconfirmed transactions, highlighting the need to address the network’s efficiency. The entrance into the zettahash era raises expectations and debates on balancing the pros and cons of increasing computational power.