The French Central Bank highlights the potential of a wholesale central bank digital currency (wCBDC) to improve the safety, settlement certainty, and efficiency of cross-border transactions. It reports successful tests of wCBDC paradigms based on distributed ledger technology (DLT) and foresees benefits for native digital and tokenized assets. The bank also emphasizes the need for energy-efficient solutions amidst global sustainability concerns.

Search Results for: French Central Bank

Central Banks and Blockchain: A New Monetary Order or a Balancing Act?

Denis Beau, the first deputy governor of Banque de France, advocates Central Bank Digital Currencies (CBDCs) as the future of the global monetary system. However, he acknowledges the potential risks of crypto technologies. He believes that CBDCs need to focus on cross-border payments and invites a partnership between public and private sectors for efficiency. Beau proposes that CBDCs follow established models from the Bank for International Settlements and International Monetary fund. Despite skepticism, project collaborations like Project Mariana indicate the ongoing exploration of CBDCs and blockchain technology.

CACEIS Registers as Digital Asset Provider: Balancing Decentralization and Regulation in France

Credit Agricole’s CACEIS, a joint venture with Santander, recently registered as a digital asset services provider in France. The European Union has adopted the Markets in Crypto Assets (MiCA) framework, aiming to establish comprehensive regulations for cryptocurrencies in Europe, implementing environmental safeguards, supervisory provisions, and consumer protections. French market demonstrates openness to digital assets while balancing decentralization with stricter licensing requirements.

CACEIS Bank Enters Crypto Custody: Balancing Adoption and Decentralization

CACEIS, the asset servicing branch of Crédit Agricole and Santander, has been registered by the French Financial Markets Authority to provide cryptocurrency custody services, joining major financial institutions like Societe Generale’s Forge and AXA Investment Managers under advanced crypto regulatory frameworks.

Bank of Japan’s CBDC Pilot: Global Trends and Privacy Concerns Clash

The Bank of Japan’s CBDC initiative report reveals 11 countries have introduced a central bank digital currency, while 18 others are in the pilot stages. Amid growing global interest, concerns about privacy and regulatory challenges persist as nations explore CBDCs’ potential in the future of finance.

French Bank Raid Exposes Flaws: How Blockchain Can Alleviate Fraud and Tax Evasion

The French fraud and money laundering case involving major banks highlights the challenges of determining shareholders responsible for paying taxes on dividends. Blockchain technology could offer a solution, providing a transparent, verifiable, and immutable single source of truth for capital markets, streamlining operations, reducing fraud, and enhancing trust and regulation.

Crypto Regulation vs Innovation: DoJ Case & France’s CBDC Vision Unveil the Blockchain Dichotomy

“DoJ asserts that absence of specific US crypto regulation does not invalidate criminal charges against Sam Bankman-Fried, former FTX CEO. Existing laws against misappropriation of customer assets still apply. This situation highlights imbalances in current crypto regulations, where extant laws can yield harsh punitive consequences in new situations.”

Digital Euro Debate: Bridging Monetary Gap or Disrupting Financial Systems?

The digital euro, or “Cash+,” is considered a necessary step for central banks in an increasingly digital society. Central and commercial banks are encouraged to collaborate for better e-commerce by adopting a digital euro, bridging the gap between traditional central bank money and electronic transactions.

France: The New Crypto Haven Amid US Regulatory Turmoil? Pros and Cons Explained

France is attracting crypto businesses seeking refuge from regulatory uncertainty in the United States. French regulations provide predictability and stability for crypto companies, with approximately 74 registered firms and potential to increase to 100 ahead of MiCA regulations in 2025.

CBDCs: A Cornerstone for Future International Monetary System & the Tokenization of Finance

The Banque de France views central bank digital currency (CBDC) as a crucial component for the new international monetary system, enhancing cross-border payments. It’s being considered from an international perspective right from the outset. Two potential development pathways include building interoperability with legacy systems and creating regional or international platforms for CBDCs.

Crypto Collision: As Binance Hits Regulation Wall, Is a New Era Dawning for Cryptocurrencies?

“The decentralised nature of cryptocurrencies is colliding with regulatory restrictions, as evidenced by Binance’s recent challenges. Big payment providers like Paysafe are halting operations, reflecting the global shift in the crypto industry towards greater regulatory scrutiny. However, it remains unclear whether this increased regulation will help or hinder the market’s organic growth.”

Battleground CBDC: A Bipartisan Struggle Shaping Cryptocurrency’s Future in the U.S.

The House Financial Services Committee introduced three bills halting the Federal Reserve’s considerations towards a Central Bank Digital Currency (CBDC). Republicans expressed fears over the potential impact on traditional banking and the suspense it could cast on the stablecoin market. Democrats, however, pushed for continued CBDC exploration, reminding of its potential benefits in global economic competition. The Federal Reserve reaffirmed its cautious approach towards CBDC, emphasizing concerns over a stablecoin issuance without federal control.

CBDC Anti-Surveillance State Act: Preserving Financial Privacy in the Age of Digital Currencies

U.S. Representative Tom Emmer, with the support of 49 other Republican representatives, reintroduced the CBDC Anti-Surveillance State Act to prevent unjust financial surveillance through retail central bank digital currencies (CBDCs). Advocates contend such government-sanctioned currency must respect financial privacy, individual freedom, and market competitiveness.

Navigating Crypto Regulations: The CBDC Anti-Surveillance State Act and the Privacy Debate

“Regulation of cryptocurrencies and the blockchain technology is a pressing topic, with concerns about privacy and government surveillance. The ‘CBDC Anti-Surveillance State Act’, reintroduced by Rep. Tom Emmer, aims to limit unelected authorities in issuing a central bank digital currency (CBDC), fearing it could be used as surveillance resources.”

Regulating Crypto and AI: Balancing Technological Innovation with Global Cooperation

“The G20 nations emphasize the need for responsible growth and use of AI, recognizing the potential of crypto assets and digital currencies in fostering a digital world. They propose a global crypto framework to navigate challenges like data protection, potential biases, and human oversight, advocating for a more homogeneous approach in the disjointed global landscape.”

Fostering Global CBDC Adoption: China’s Dynamic Push at the Asian Games

“China is pushing for digital yuan adoption at the upcoming Asian Games. This event aims to showcase the central bank digital currency (CBDC) on an international platform. Attendees within pilot zones can buy tickets using the official CBDC app, marking a first for major sports events in China. This initiative is seen as a potential accelerator for broader digital currency adoption.”

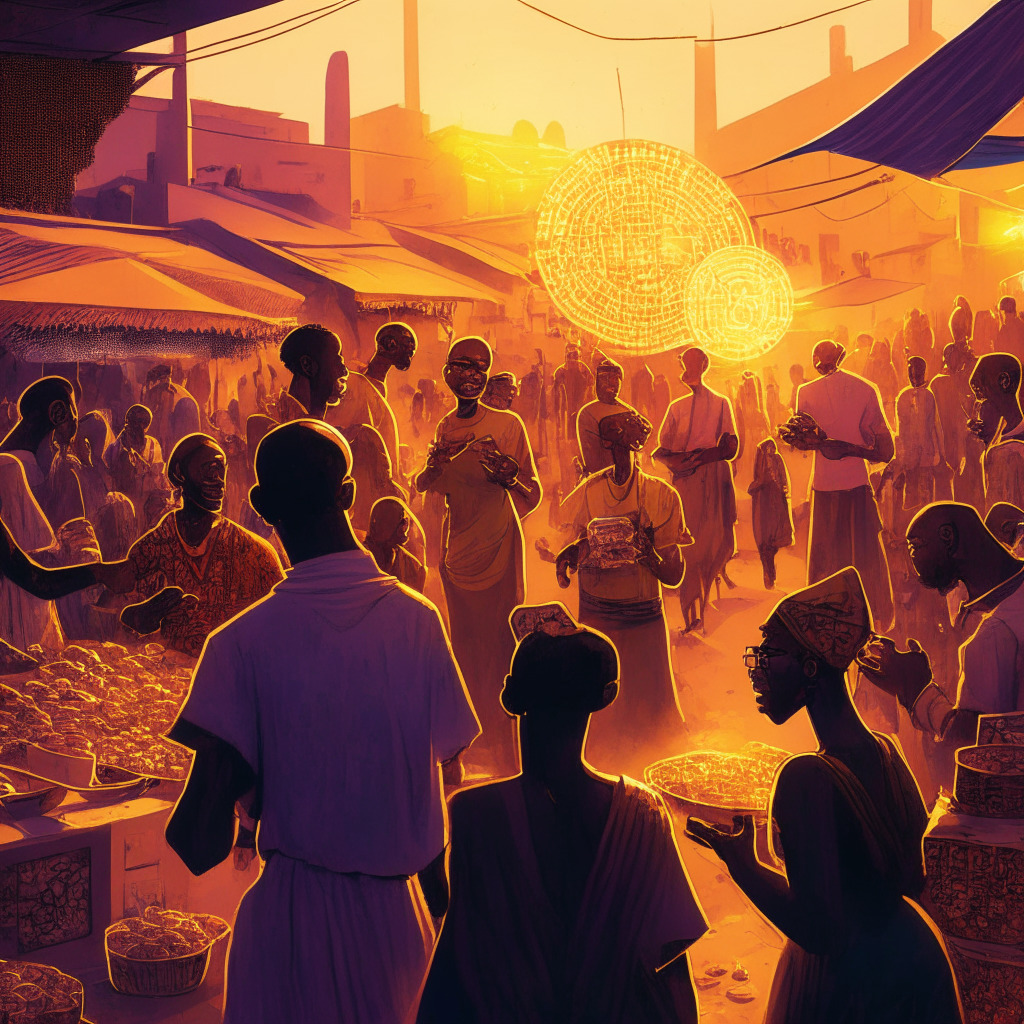

Blockchain and Cryptocurrencies: A Rising Force in West Africa Amid Economic Dissatisfaction and Potential Pitfalls

“Blockchain technology, particularly Bitcoin, is gaining traction in West Africa, thanks to education efforts and dissatisfaction with regional monetary policies. However, the journey towards adoption is filled with opportunities and potential pitfalls, emphasizing the need for careful navigation and robust education.”

Global Ripple Effect of Crypto Regulations: Innovation versus Protection

The article focuses on recent developments related to crypto legislation, controversy surrounding Worldcoin’s data collection practices, Russia’s progress with a central bank digital currency, and Binance retracting its crypto custody license application in Germany. The central issue revolves around the challenge of balancing innovation and public protection in international blockchain regulation.

Navigating DeFi: Atlendis Flow Bridging Crypto and Fiat, a Template for Future Blockchain Adoption

“French DeFi project Atlendis, recently secured a €1M loan and a crypto services provider license, setting a precedent for future regulatory guidelines. Atlendis now targets real-world assets and fintech companies, facilitating crypto-to-fiat transactions, and opening blockchain opportunities to non-crypto businesses.”

Cryptosphere Weekly Roundup: Market Fluctuations, Sec Regulations, and Wallet Safety

“In a tumultuous week for the cryptosphere, signs of a five-quarter drop in crypto investment emerged, yet developments like Neon EVM’s unique offering to build Ethereum applications on Solana, showed promise. Amidst market fluctuations, regulatory pressures and unique crypto innovations, this sector’s dynamics continue to surprise, underscoring the importance of wallet safety in navigating the digital ocean.”

Forge: France’s First Licensed Crypto Provider – A Market Equalizer or Monopoly?

Forge, a Societe Generale subsidiary, is now France’s first licensed crypto provider. The company can custody, buy, sell, and trade digital assets for legal currency. However, the stringent approval process favors traditional banks, causing concerns over market fairness. This development underscores the balance between crypto business growth and regulatory prudence.

Under Regulatory Scrutiny, Binance Cedes Ground to Coinmerce: An Unsettling Preview of Crypto’s Future

“Binance is transferring Dutch clientele to competitor Coinmerce amid regulatory pressure. Binance, non-compliant with Dutch regulatory authorities, was penalized $3.6 million for non-adherence to norms. This situation highlights increasing complexities in the global crypto landscape as technology, markets, and regulations converge.”

Bitcoin Surpasses $30,000: Factors Influencing the Rally and Future Predictions

Bitcoin surpasses $30,000 threshold for the second time this year, with altcoins like Stacks showing impressive gains. Institutional participation, such as BlackRock’s ETF application and CACEIS Bank’s crypto custody services, indicates a possible shift in traditional finance’s approach to digital assets, fueling optimism for the future of cryptocurrencies.

Expanding Crypto Trading on Tel Aviv Stock Exchange: Pros, Cons, and Global Regulation Debate

The Tel Aviv Stock Exchange plans to allow nonbanking member customers to trade cryptoassets, expanding authorized activities. Meanwhile, the IMF and FSB aim to develop a coordinated global crypto regulation approach. In other news, private investment firm ABO Digital launched, supporting the digital asset space, and Push Protocol revealed a group chat feature for its Web3 messaging app.

Crypto Market Recovering Amid Regulatory Tensions: Binance vs SEC and CBDC Evaluations

The crypto market shows signs of recovery as the U.S. inflation rate cools and the Fed abstains from raising interest rates. Leading cryptocurrencies report nominal gains, while Binance faces legal battles with the SEC. Key events this week include discussions on central bank digital currencies and support for a draft bill to regulate cryptocurrencies, indicating that regulatory debates play a crucial role in shaping the future of the crypto market.

Binance’s Dutch Exit: Impact on Crypto Ecosystem and the Struggle for Legitimacy

Binance exits the Dutch market after failing to secure a virtual asset service provider license, halting new user registrations and ceasing trading on July 17. This raises questions about the broader impact of increased regulatory scrutiny on the crypto space and signifies a shift in the struggle for greater crypto acceptance and legitimacy.

Young Crypto Influencer’s Rise and the Potential Shift of the Global Market to Europe

Owen Simonin, a.k.a Hasheur, educates the French population about cryptocurrencies through his popular YouTube channel with over 624,000 subscribers. He believes France and Europe can play a crucial role in the global crypto market, amidst recent crackdowns by US regulators.

Exploring MakerDAO’s $1.28B Bet on Real-World Assets: Boosting Yield or Risky Undertaking?

MakerDAO’s community voted to open the BlockTower Andromeda vault, aiming to invest up to $1.28 billion in short-dated U.S. Treasury bonds using overcollateralized DAI stablecoin. This reflects efforts to diversify reserve assets, generate higher yields, and integrate crypto with traditional financial markets.

Bipartisan Battle Against CBDCs: Financial Privacy vs Global Adoption in 2023

US lawmakers introduced a bipartisan bill aimed at preventing the Federal Reserve from issuing a central bank digital currency (CBDC), citing concerns over financial privacy and surveillance. Despite opposition, global interest in CBDCs remains strong, with various countries planning pilot testing in 2023.

Bipartisan Efforts to Regulate Stablecoins: Finding Common Ground in Crypto Legislation

Two distinct stablecoin bills from US House Financial Services Committee reflect differing perspectives among Democrats and Republicans. Despite differences, lawmakers aim to reach a bipartisan agreement for effective regulation of the burgeoning stablecoin market while protecting consumers and investors.

Stablecoin Regulation Debate: US Lawmakers’ Divide and the Future of Digital Dollar

The US House Financial Services Committee’s digital assets panel debated on stablecoin regulations, highlighting divides between Republican and Democratic ideas. Both parties do align in addressing risks to consumers and maintaining the US dollar’s role in global commerce. Lawmakers are paying heightened attention to stablecoin regulations and wider crypto topics, marking progress in US oversight of the industry.

BNP Paribas Connects Digital Yuan Wallets: Integration Breakthrough or Power Shift Concern?

BNP Paribas connects digital yuan wallets to bank accounts, enabling corporate clients to access e-CNY via the Bank of China’s system. This could facilitate seamless transactions but raises concerns over China’s financial power and privacy issues.