Crypto enthusiast Richard Heart, real name Richard Schueler, is accused by the SEC of raising $1 billion in unregistered securities offerings and misusing funds intended for his projects, Hex, PulseChain, and PulseX. His alleged luxury purchases with investor funds violated federal securities laws. Amidst this, the SEC is pushing for heightened crypto industry oversight in 2023.

Search Results for: GIS Mining

Texas Bitcoin Mining Boom: Supportive Legislation and State-Level Tug of War

Texas embraces bitcoin mining as legislators pass supportive bills, SB 1929 and HB 591, solidifying the state’s position as a premier destination for the industry. However, future federal-level regulation remains uncertain, with individual states currently leading policy development.

Bitcoin’s Market Momentum: Bold Forecasts, El Salvador’s Mining Move and the Potential of ETFs

“Former BitMEX CEO foresees Bitcoin’s price surging to approximately $70,000 in 2024, propelled by potential financial disruptions and an anticipated Bitcoin halving event. Meanwhile, El Salvador launches its maiden sustainable Bitcoin mining pool, and BlackRock nears approval of a Bitcoin ETF – potentially triggering a $650 billion surge in crypto asset management.”

Navigating Bitcoin’s Tides: Marathon’s Mining Surge, Kraken’s BTC Inflow, and Uzbekistan’s Crypto Regulations

Marathon Digital Holdings exhibited a 16% surge in Bitcoin production in September 2023. However, Uzbekistan introduced stringent regulations on crypto mining, potentially limiting industry growth. Meanwhile, U.S. based crypto exchange, Kraken, recorded its highest Bitcoin deposit activity, possibly indicating future price increases.

Uzbekistan’s Crypto Construct: Mining Regulations Nurture Legitimacy, Stifle Individual Miners

Uzbekistan’s National Agency for Perspective Projects (NAPP) has issued tighter regulations for crypto mining, barring individual miners but providing legal clarity for companies. All mining must be solar-powered and have the necessary licenses. However, privacy-focused cryptos are prohibited. The future impact of these regulations on Uzbekistan’s mining industry remains uncertain.

Riding the Crypto Wave: Bitcoin Cash’s Rising Tide and the Future of Tokenized Mining Platforms

“Bitcoin Cash (BCH) has registered a significant 1.5% gain within 24 hours, and 12% in a week, showing a noticeable shift in whale investors. The crypto’s trading volume skyrocketed from $70 million to nearly $500 million, signaling BCH’s continued upward trajectory with significant buying interest.”

Brazilian Government’s Bold Step: Crypto Mining Bans for Public Servants

The Brazilian state of Santa Catarina is implementing regulatory changes to deter public officials from cryptocurrency mining through the state’s networks. Increased law enforcement surveillance ensures adherence to the new law, which imposes substantial penalties for violators. Amid rising global instances of crypto mining using company resources, this regulation aims to direct workforce resources responsibly and deter misuse.

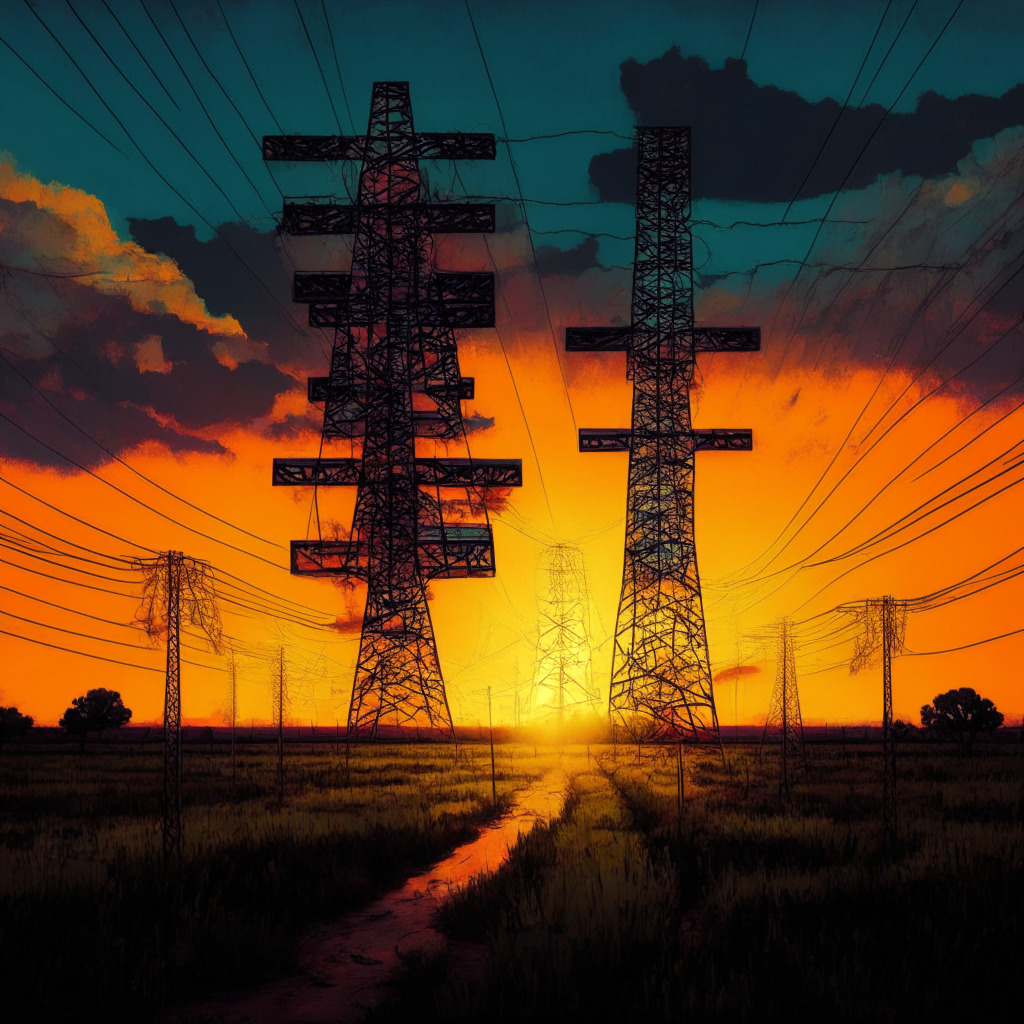

Exploring the Political Spectrum: The Rising Influence of Bitcoin Mining and Cryptocurrencies

Senator Ted Cruz endorses Bitcoin, highlighting its potential in bolstering energy grid resilience—an advantage in emergencies, such as the recent Texas extreme weather. The stance reflects the growing influence of digital currencies, despite potential hurdles and economic turbulence.

Navigating the Bitcoin Mining Reward Halving 2024: A Bullish Trigger or a Bearish Prelude

The global cryptocurrency market is watching Bitcoin’s (BTC) fourth mining reward halving in April 2024 as a potential game changer. The event, which halves the rate of supply expansion, has traditionally led to significant price increases post-halving. However, Bitcoin’s success is also influenced by macro factors like fiat liquidity conditions. Despite current positive trends, the worldwide M2 money supply growth rate is below the critical 6% threshold, leading some to question Bitcoin’s potential performance post-2024 halving.

Laos Electric Company Curbs Crypto Mining Amidst Energy and Environmental Concerns

“Electricite du Laos (EDL) announces a significant cut to crypto mining firms’ operations, due to rising concerns on electricity production & environmental impact. This comes after Laos’ attempt to become a digital assets mining hub following China’s stringent regulation.”

Oman’s Digital Leap: Unveiling Huge Digital Mining Facility in Pursuit of Blockchain Dominance

Oman has launched a $150 million digital asset mining facility, marking a major step in its drive to reduce economic dependence on oil. With 2000 cutting-edge machines, the facility bolsters Oman’s position in digital asset mining and contributes to an overall sector investment of $740 million. As part of this digital transformation, educational programs and business registration directives are also being rolled out.

The Global Disparity in Bitcoin Mining Costs: An Eye-Opener or Misleading Data?

“The disparities in Bitcoin production cost globally are due to varying electricity costs. Mining a single Bitcoin in Italy could cost $208,500, whereas in Lebanon it’s 783 times cheaper. However, only 65 countries are profitable for solo Bitcoin miners considering domestic electricity rates.”

Digital Energy Council: Sustaining Crypto Mining and Shaping Policymaking in Digital Assets

The Digital Energy Council, a group dedicated to cryptocurrency miners, has been introduced as a crucial intermediary for discussions about crypto mining sustainability, and policy advancement with Washington-based policymakers. This initiative prioritizes miners’ interests while ensuring compliance with U.S. energy laws, aiming to promote responsible energy development and national security.

Crypto Mining in the Energy Spotlight: DEC’s Mission to Reframe the Narrative

The newly launched Digital Energy Council (DEC) plans to highlight the positive role of crypto miners in the energy sector. Backed by technology’s flexibility, miners either provide energy during demand or buy excess energy, reducing waste. Despite facing regulatory scrutiny and proposed taxes, the DEC aims to dispel misconceptions around energy use and advocate for crypto miner’s interests, working towards greater recognition of digital asset mining.

Navigating Fiscal Shortfalls: Marathon Digital’s Q2 Results and The Resilience of Crypto Mining Industry

“Despite missing Q2 revenue projections, Marathon Digital sustained minor share price dips, highlighting complex market dynamics in cryptocurrency. Marathon boosted their hash rate and Bitcoin production, while also selling 63% of mined Bitcoins for a $23.4 million profit, navigating both the promise and challenges of crypto realities.”

Harnessing Green Solutions: How Bitcoin Mining Could Drive Us Towards A Carbon-Neutral Future

“Bitcoin mining’s energy consumption has raised environmental concerns. However, recent innovations like flare gas solutions and nuclear energy are promising enhancements. Harnessing flare gas, an underused resource, for mining operations could drive a carbon-neutral era. Further potential lies in microgrids and nuclear power, despite safety and regulatory concerns. All these seek to incentivize blockchain use beyond Bitcoin mining, significantly reducing the industry’s carbon footprint.”

Crypto Regulatory Tug-of-War: An Analysis of Recent Developments & Legislative Initiatives

Senator Jack Reed introduced a bill to strengthen Know Your Customer and Anti-Money Laundering regulations within decentralized finance. Meanwhile, two House committees proposed a bill to clarify regulatory authorities’ jurisdiction over digital commodities. Despite opposition, these developments highlight the need for clearer DeFi regulations and could shape its future trajectory.

Legal Limbo: Examining the Ripple Case and its Impact on U.S. Cryptocurrency Regulation

Recently, judge Analisa Torres delivered a split decision in SEC v. Ripple Labs, implying legal ambiguity surrounding cryptocurrency tokens. She supported Ripple’s sales of tokens on asset exchanges while contesting institutional sales. This inconsistency leads to uncertainty in the crypto market, which can only be addressed by Congress stepping in to establish standardized regulations.

Coinbase vs SEC: The Legal Battle Determining the Future of Crypto Regulation

The pre-motion hearing between Coinbase and the SEC on July 13 could significantly impact the broader crypto industry. Coinbase is likely to dispute SEC’s jurisdiction, arguing that the tokens aren’t securities. The outcome of this legal standoff is set to reverberate throughout the crypto world, potentially reshaping regulations and definitions within the sector.

Binance Exodus & Legal Battles: Examining Crypto Exchange Under Fire

“Amid a tightening regulatory environment, key figures from Binance have stepped down, escalating concerns over the crypto exchange’s compliance. Accusations against Binance include deceptive practices, money laundering, and sanctions violations, with lawsuits already in motion. These challenges underscore the importance of robust regulatory compliance in the crypto industry.”

Russia’s Crypto Conundrum: Navigating Between Bans, Regulations, and a Lucrative Mining Industry

The Russian finance ministry proposes a ban on cryptocurrency circulation, exempting only stablecoin issuers and crypto miners. This comes alongside efforts to legitimise the advanced, yet untaxed and unrecognised, crypto mining sector. The move faces resistance, due to potential confusion caused by unclear definitions and concerns about enforcement among crypto owners.

Crypto.com Gains VASP Registration in Spain: Analyzing Benefits and Drawbacks

Crypto.com received a Virtual Asset Service Provider (VASP) registration from the Bank of Spain, enabling it to offer products and services in the country. This milestone follows a compliance review with Anti-Money Laundering Directive (AMLD) and other financial crimes laws required for MiCA-based VASP licenses. Increased regulations anticipate a more transparent, trustworthy, and robust crypto market.

Merging Giants: Hut 8 Mining & US Bitcoin Corp to Form $990M North American Crypto Powerhouse

Bitcoin miners Hut 8 Mining and U.S. Bitcoin Corp plan to merge, creating a $990 million North American crypto mining giant, Hut 8 Corp. The merger aims to expand revenue, adopt a diversified business model, and capitalize on their financial position.

Abra Hit with Emergency Cease and Desist Order: Examining the Accusations and Impact on Crypto

Cryptocurrency investment company Abra faces an emergency cease and desist order from Texas securities regulators, alleging securities fraud and offering investment products to unaccredited investors. With a partially insolvent status, Abra’s future and the wider cryptocurrency industry may face further regulatory scrutiny.

Binance Cloud Mining Service: Pros, Cons, and Regulatory Challenges

Binance is launching a subscription-based Bitcoin cloud mining service, allowing users to purchase hashrates without investing in equipment. However, due to SEC allegations, the service is unavailable for US investors, highlighting challenges and regulatory uncertainties faced by cryptocurrency exchanges.

Is Tether’s USDT Stablecoin Under Pressure? Examining Unusual Selling Activity

Speculation mounts that Tether’s USDT stablecoin may be under pressure, with liquidity pools on Uniswap and Curve protocols flooded with USDT sellers. A potential USDT depeg could be catastrophic for the crypto economy, raising concerns over its liquidity and stability amidst growing market share.

UK’s FCA Crypto Register Update: Balancing Innovation and Regulation

The UK’s Financial Conduct Authority (FCA) has updated its crypto register, adding Bitstamp and Interactive Brokers, signaling greater regulatory oversight in the expanding crypto market. This development poses both opportunities and challenges, balancing innovation with adherence to anti-money laundering rules. The outcome of the ongoing finance bill debate will determine the future path of cryptocurrency regulation in the UK.

Decline in Crypto Trading Volume on Robinhood: Examining Reasons and Market Uncertainty

Robinhood reported a 43% downturn in crypto trading volume in May, with legalization hurdles and market uncertainty contributing to the slump. The removal of three tokens, ADA, MATIC, and SOL, after SEC scrutiny further adds to the decline. Strong regulations and compliance measures are vital as the industry evolves, for both trading platforms and investors.

Texas Bill Stalling: Implications for Bitcoin Mining and Grid System Sustainability

The Texas SB 1751 bill, aimed at restricting bitcoin miners’ participation in cost-saving grid programs and abolishing tax abatements, has stalled in the state House of Representatives. The stagnation leaves the future uncertain for the burgeoning mining industry in Texas, opening possibilities for further discussions and decision-making regarding the cryptocurrency mining landscape.

Russia’s Shift Towards Private Crypto Exchanges: Examining Implications, Benefits, and Drawbacks

Russia abandons plans for a government-operated cryptocurrency exchange, opting instead to create regulations allowing the private sector to manage exchanges. This reflects the contradictory relationship autocratic governments have with decentralized digital assets while highlighting the inevitability of cryptocurrency adoption and the need for effective regulations.

Crypto Bills in Limbo: Texas Legislature’s Inaction and Its Impact on the Industry

Texas’ regular legislative session closed, leaving cryptocurrency bills unresolved for potentially 19 months. One notable bill, Texas Senate Bill 1751, aimed to eliminate tax breaks for miners and impose stricter energy usage control. Another bill, House Bill 1666, seeks to mandate cryptocurrency exchanges to hold adequate reserves for customer obligations.

Texas Crypto Conundrum: Examining Senate Bill 1751 and Implications for Blockchain Future

The debate surrounding Texas’ Senate Bill 1751 highlights the complexities in regulating cryptocurrencies, emphasizing the need for a balanced regulatory environment that supports innovation, growth, and protects interests while addressing concerns like fraud and money laundering in the crypto industry.