“The Winklevoss-owned Gemini withdrew roughly $280 million from Genesis Global just prior to a withdrawal freeze and bankruptcy filing. With legal battles involving Genesis, Gemini, and their parent company DCG, this situation highlights the need for tighter cryptocurrency regulations.”

Search Results for: Genesis

Unearthing the Bitcoin Enigma: Hal Finney’s Enigmatic Role in Blockchain’s Genesis

This article discusses speculation around Hal Finney’s involvement in creating Bitcoin, his use of zero-knowledge proof systems, and rumors of him being Satoshi Nakamoto. The mystery of Bitcoin’s creation and Finney’s role remains ambiguous and unsolved.

Crypto Clash: Gemini vs Digital Currency Group Over Genesis’ Alleged Bankruptcy Recovery Mirage

“The discord arises between Gemini and Digital Currency Group (DCG) over alleged deceptive bankruptcy recovery plans for Genesis, a crypto lending entity. Though DCG proposes remuneration almost equal to initial investments, Gemini contests it, leading to legal battles. Genesis owes considerable debt to Gemini, which DCG suggests repaying in two tranches over seven years.”

Genesis Closes Crypto Derivative Trading: An Isolated Incident or A Wider Market Trend?

Genesis, an arm of Digital Currency Group, is halting its cryptocurrency spot and derivative trading business due to the ongoing bear crypto market. This follows their bankruptcy filing earlier this year, presenting another setback for the company. The decision prompt questions about its motives and future.

The Volatility Conundrum: Genesis Crypto Lending Halts Trading Amid Regulatory Challenges

Genesis, a crypto lending firm, has halted its crypto trading services citing business reasons. This move underlines the volatile nature of the crypto market and the strain it puts on trading platforms. Despite recent issues, the dedication to innovation in turbulent times suggests a promising future for digital currency.

Surprising Shutdown of Genesis: A Wake-Up Call or Strategic Shift in Crypto Trading?

Genesis, a prominent player in the crypto-trading market, has halted all trading operations, affecting both US and international spot and derivatives trading. This closure indicates potential turbulence in the crypto-trading sphere or a strategic shift in company direction.

Proposed DCG-Genesis Deal: A Lifeline for Gemini Earn Users or Crypto Regulatory Alarm?

Gemini Earn users could recover between 70%-90% of their cryptocurrency holdings due to a proposed agreement between DCG and Genesis. This agreement averts a Chapter 11 case. The recovery amount represents the soaring appreciation of digital currencies – “$85,000 for BTC and $8,500 for ETH.” However, the deal still requires creditor approval.

Genesis Global Capital’s $600 Million Legal Battle with Digital Currency Group

Genesis Global Capital (GGC) filed legal actions against Digital Currency Group (DCG) and its international arm, DCGI, to retrieve unpaid loans of around $620 million, consisting of approximately 4,550 Bitcoin. Amidst a looming debt of $3.5 billion, GGC demands full repayment plus interest and late fees. After various scuffles, both parties have agreed to pause the legal actions, further complicating the scenario.

Cryptocurrency’s Legal Maze: Understanding the Tangled Case of Genesis Global Capital’s Bankruptcy

“Cryptocurrency lender Genesis Global Capital (GGC) seeks to recoup a reported $600 million in overdue loans from Digital Currency Group (DCG). This case underlines the complex regulatory challenges, including loans against fluctuating assets and open versus fixed-term agreements, faced in our burgeoning crypto industry.”

Crypto Loan Conflict: Genesis Demands $600 Million Payment from Digital Currency Group

Genesis Global Capital has filed lawsuits against Digital Currency Group (DCG) and its international affiliate for alleged unpaid loans exceeding $600 million. Genesis contends that DCG attempted to convert the credit into “Open Loans” without agreement, thus breaching the loan agreements. This situation further emphasizes the complexity of crypto-related loan agreements and the potential need for clearer regulations.

Genesis Global Trading Halts Crypto Spot Trading: Strategic Move or Market Response?

“Genesis Global Trading is suspending its crypto spot trading services from September 18, mirroring an industry shift towards derivative trading and exchange-cleared avenues. This strategic move is also seen as an adaptation to increasing regulatory scrutiny in the crypto industry.”

Ethereum Layer 2 Outage and Genesis Spot Trading Discontinuation: Probing the Crypto Landscape

In its first significant mishap, Ethereum Layer 2 network, Base, experienced an outage halting new block production. Despite quick repair and recovery, concerns about the reliability of such newer networks have been raised. The future of blockchain may be promising, but these newer platforms must work on technical robustness and gaining users’ trust. Meanwhile, Genesis Global Trading announced the voluntary cessation of its spot trading services, reflecting the stiff competition and constant evolution in the crypto market.

Genesis Global Trading Closure: Waving Goodbye to Crypto Spot Trading or Just a Temporary Glitch?

“US-based Genesis Global Trading is voluntarily terminating its crypto spot trading service for business reasons, impacting market dynamics. However, the crypto world’s resilience is shown by the continuing service of GGC International and the recent revelation that there are over 40,000 crypto millionaires worldwide, demonstrating the sector’s growth and wealth creation potential.”

Unraveling Genesis Global Trading’s Unexpected Exit: A Strategic Move or Crypto Collapse?

“Genesis Global Trading’s spot crypto trading platform plans to cease operations by September 18, with all trades to be settled by September 21. The somewhat unanticipated move is made for a ‘business reason’, potentially hinting at a reassessment of Genesis’s business model in the volatile crypto market. Though disconcerting, such shifts often indicate innovation and market evolution in the crypto-verse.”

Genesis Bankruptcy Fallout: A Battle of Crypto Titans Over Fairness and $3.4 Billion Liabilities

Genesis, a crypto lender facing bankruptcy, is being accused by creditors, including Gemini and Digital Currency Group, of manipulating bankruptcy proceedings with their proposed settlement. The settlement, seen by some as giving preferential treatment to certain creditors, includes Alameda Research receiving $175 million from Genesis’s assets. Critics argue it deviates from acceptable Chapter 11 protocol.

Controversy Clouds Genesis Global Capital’s Bankruptcy Settlement with FTX

Bankrupt crypto lender, Genesis Global Capital, is under scrutiny regarding its proposed $175 million settlement with FTX, accused of manipulating the bankruptcy process through vote-buying. Genesis’s future, and the recovery of creditors’ funds, now lies in the hands of Bankruptcy Judge Sean Lane.

Gemini Challenges Genesis’ Bankruptcy Resolution – Doubts Over Debt Assurances Roil Crypto Markets

Crypto exchange Gemini objects against Genesis’ bankruptcy resolution proposal, arguing it lacks detail and adequate assurances to major debtors. This comes after Gemini took legal action against DCG for non-payment of debts. Gemini and other creditors demand transparency and effective solutions in this complex bankruptcy case.

Bankruptcy Battle: Gemini and Genesis in a Clash over Resolution Prospects

“Crypto exchange Gemini is contesting Genesis’ proposed bankruptcy resolution, citing lack of specifics and unsatisfactory assurances for key creditors. Gemini, along with the Fair Deal Group and the Ad Hoc Group of Genesis Lenders, questions the plan’s clarity and comprehensiveness, highlighting Genesis’ unsettled debts and its capacity to execute a sustainable plan.”

Genesis Bankruptcy Woes: Gemini’s Doubts and DCG’s Debts Cloud Crypto Markets

The Fair Deal Group and Gemini express skepticism over Genesis’s proposed bankruptcy resolution, citing lack of substantial details and concerns about the company’s ability to implement a feasible plan. The situation calls for greater transparency and stronger financial practices within the crypto markets.

Insufficiency Claims Surround Genesis’ Bankruptcy Settlement: A Muddled Affair in Crypto Lending

“The proposed settlement agreement on the bankruptcy of cryptocurrency lender, Genesis, has met resistance. Some lenders argue that the agreement, offering 70%-90% recoveries, neglects fiduciary duties to maximize creditor recoveries. Concerns also emerge about non-consensual third-party releases, wherein non-debtor parties are absolved from liability without consensus from all potential claimholders.”

Genesis Global Capital Bankruptcy: Uncertain Future Amid Creditors’ Resistance and DCG’s Proposal

The futurity of the defunct lender Genesis Global Capital (GGC) is under scrutiny due to concerns raised by creditors over a $1 billion debt. A deal by parent company, Digital Currency Group (DCG), to repay the liabilities has been criticized since it potentially allows DCG to evade future obligations. This controversy underscores the unpredictable, high-stakes nature of the crypto lending realm.

DCG’s Tentative Settlement: A Ray of Hope or a Drop in the Ocean for Genesis Creditors?

Digital Currency Group (DCG) has potentially resolved with Genesis creditors, proposing a 70-90% reimbursement. Genesis, DCG’s lending subsidiary, owed its top 50 creditors nearly $3.5 billion. DCG’s repayment strategy includes settling approximately $328.8 million through two-year term loans and $830 million using a seven-year term loan. However, the validity of DCG’s plan depends heavily on market fluctuations and the settlement details.

Decoding the ZTX Genesis Home Mint: A Leap towards Next-Gen Metaverse Governance

ZTX, the South Korean metaverse platform, is set to launch its ZTX Genesis Home Mint, strengthening ties with OpenSea. ZTX, facilitated by the ZEPETO mobile platform, enables users to engage in an open-world 3D platform, including socializing, gaming, and even virtual governance. The upcoming Genesis Home Mint offers incentives for early supporters and offers digital assets known as District Homes.

Unraveling the Complex Crypto Legal Battles: Genesis and FTX’s $175M Settlement

“The ongoing legal battle between crypto company Genesis and Alameda Research, a subsidiary of FTX, now has a potential resolution – FTX’s Alameda Research can now claim $175 million from the bankrupt Genesis estate. This case highlights the complex intertwined crypto-financial structures and the significant impact of impending regulation and litigation resolution on the broader blockchain community.”

Genesis Global’s Bankruptcy Tango: Stakeholders, Creditors, and Deadlines in the Cryptocurrency World

Genesis Global Holdco’s bankruptcy case nears its endpoint with heightened uncertainty around a conclusive deal. Key stakeholders are intensely lobbying for a bankruptcy exit plan despite opposition. In a parallel development, an agreement to settle disputes in their bankruptcy cases has been reached with now-bankrupt crypto exchange, FTX.

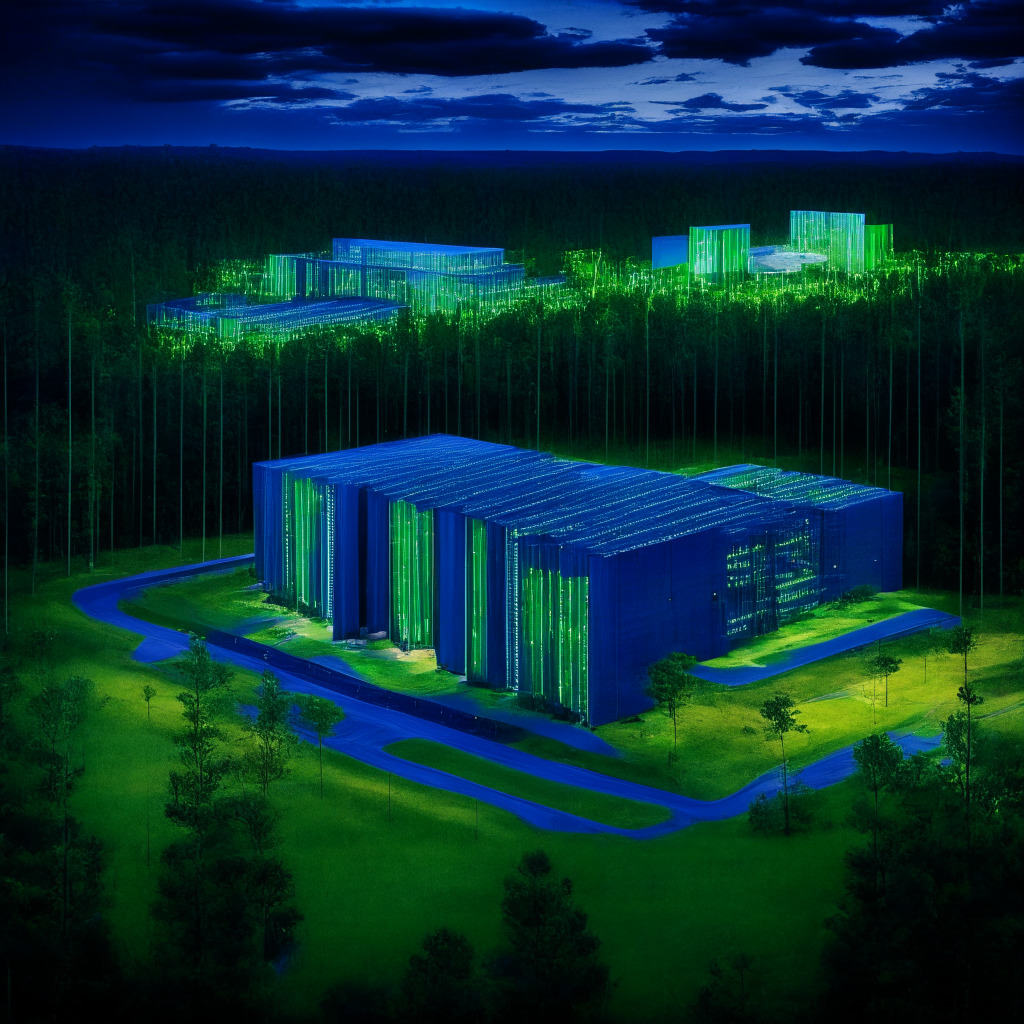

Bitcoin Mining Giants Take the Green Leap: Genesis Digital Assets Expands in South Carolina

Genesis Digital Assets (GDA) inaugurated three eco-friendly data centers in South Carolina, contributing to over 2% of the total Bitcoin network hash rate. These expansions notably utilize local energy resources, strengthen local energy grids, and align with GDA’s clean energy ethos, potentially leading crypto mining towards a more sustainable, eco-friendly future.

Crypto Giant’s Expansion: Genesis’ New Data Centers and the Push for Eco-Friendly Mining

Genesis Digital Assets has expanded their cryptocurrency mining operations with three new data centers in South Carolina, marking its strategic move into the North American market. CEO, Andrey Kim, emphasizes the company’s aspiration for industry leadership in environmentally-friendly Bitcoin mining.

Bankruptcy Battles in Crypto: The Fierce Legal Clashes between FTX, Genesis, and Gemini

“FTX and Genesis, entangled in bankruptcy disputes and accusations, have reportedly agreed to a settlement. Court documents revealed FTX’s debt to Genesis as $226 million, while another claim states Genesis Global owed FTX $2 billion. The disputes and their scale reveal the challenging road ahead for setting cryptocurrency regulation norms.”

Bankruptcy and Blockchain: FTX Vs Genesis Case Study & Its Impact on Crypto Regulation

The recent bankruptcy settlement between FTX exchange and Genesis crypto lender has sparked numerous conversations about the financial implications of blockchain technology and its regulations. This case highlights the need for a stronger, transparent regulatory framework for cryptocurrencies to ensure fair play whilst encouraging innovation.

Blockbuster Crypto Settlement: Analyzing the FTX and Genesis Agreement Saga

Crypto firms FTX and Genesis may settle their agreement in ongoing Chapter 11 bankruptcy cases, potentially resolving their conflicting claims. This case reveals the volatile nature of the blockchain industry, emphasizing the need for sound legal and financial practices in crypto transactions.

Gemini Vs Genesis: A Tale of Trust, Transparency and Regulatory Challenges in Crypto Sphere

“The Gemini-Genesis incident emphasizes transparency importance in crypto financial transactions and exposes vulnerabilities in the current regulatory framework. This reflects the balancing act between progressing financial freedom and respecting monetary regulations in a world where the stakes are high.”

The Fate of Digital Asset Lender Genesis and the Billion-Dollar Offer on the Table

Cameron Winklevoss, co-founder of Gemini, has proposed a $1.5 billion offer in Genesis’ bankruptcy restructuring process. This follows a profound impact on Gemini customers with an estimated $900 million stuck in Genesis’ Earn program. Genesis has until August 2023 to file a resolution plan.