ARK Invest and Glassnode propose a new Bitcoin economic analytics framework, Cointime Economics, introducing coinblock – a measure considering time held in Bitcoin custody. Critics argue it complicistically outweighs veteran hodlers against newcomers, possibly confusing traditional users. Despite complexities, its future potential remains to be seen.

Search Results for: Glassnode

Bitcoin Halving 2024: Boon or Bane for Miners, and the Ripple Effects on the Blockchain Ecosystem

“Blockchain technology continues to break boundaries as it evolves at a rapid pace. Despite the uncertainty of the upcoming Bitcoin halving event in 2024, the resilience and adaptability of blockchain remain indisputable, making its future exciting.”

UK Politicians Explore Metaverse: The Rising Divergence in Blockchain’s Value and Implications

UK politicians are exploring the potential implications of Web3 technology in reconstructing the internet’s framework. However, skepticism around the value of nonfungible tokens (NFTs) rises, as a study reveals most lack monetary value. These diverse perspectives highlight a divergence in perceptions about blockchain’s utility and value.

Bitcoin Ordinals, the Invisible Friend or Foe? Unraveling their Impact on Network Congestion and Market Dynamics

“Ordinals, a method of registering digital content on the Bitcoin network, are seen as disruptive by some. However, analytics firm Glassnode finds little proof that they’re causing network congestion. Despite concerns, these bitcoin ‘pocket fillers’ seem to coexist with other money transfers, leveraging cheap block space without greatly impacting transfer volumes.”

Bitcoin Ordinals: Evaluating Impact on Network Efficiency Amid Rising Concerns

“The recent rise of Bitcoin Ordinals, a data inscription system, has raised concerns about network clogging and its impact on higher-value transactions. Contrary to this belief, a report by Glassnode found that inscriptions only occupy a fifth of Bitcoin’s transaction fees, indicating efficient blockspace use rather than significant displacement. However, Bitcoin Ordinals have amplified the demand for blockspace and operation costs for miners, potentially challenging miners’ profitability.”

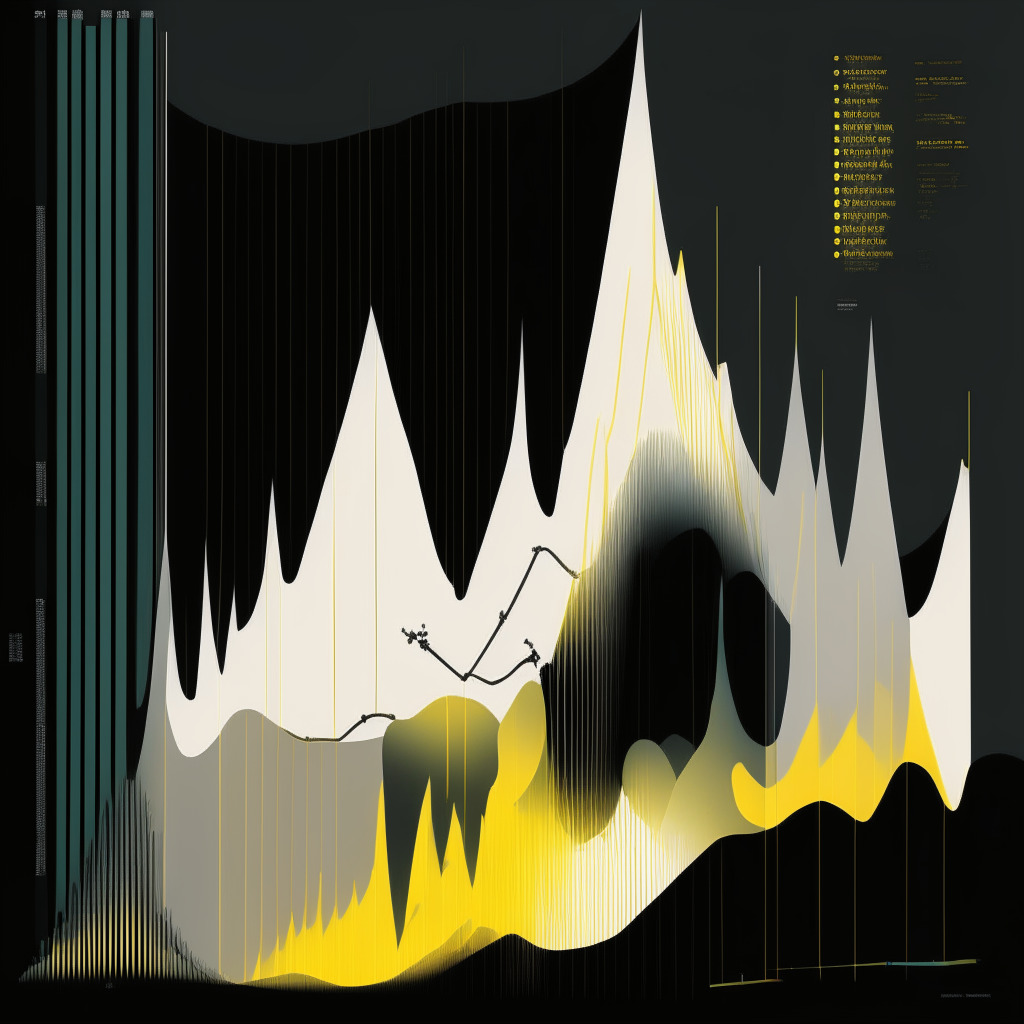

Shifting Dynamics in Bitcoin Market: Calm Before the Storm or a New Stability Era?

Recent data reveals that short-term holders now own less of the available BTC, signaling a market shift towards long-term holding, suggesting potential stability in the cryptosphere. However, these changes in investor dynamics may not favor the remaining short-term players who are currently facing losses.

Unraveling the Panic: Bitcoin’s Short-term Holders Confront Market Volatility

“Cryptocurrency markets are volatile with 97.5% of short-term Bitcoin holders facing losses due to dwindling market support. However, sentiments about the future are mixed: some anticipate falling levels while other optimists foresee a price increase in Q4. Glassnode’s research reveals a widespread sense of panic, but underscores that despite inherent risks, cryptocurrency markets can be exceedingly rewarding.”

Ethereum Protocol Witnesses Impressive Surge: What this Means for Ether’s Future

The Ethereum network recently witnessed an impressive surge in daily active addresses, hitting 1.088 million. This was significantly higher than the usual 300,000-450,000 range. This spike could be the start of a robust on-chain activity trend and could provide a price boost for Ethereum in the future. However, factors like SEC regulations and ETF approvals will influence its course.

Bitcoin’s Sub-$25k Plunge: A Terrifying Dystopia or Promising Opportunity-in-Disguise?

As Bitcoin’s price dipped below $25,000, discussions ensued questioning whether this signifies a discount for investors or an impending disaster. The metric often used to predict price movements and Bitcoin’s inverse correlation with the U.S. Dollar Index showed inconsistencies, leading to speculations amidst a trend of decreasing frequency of Bitcoin transactions. Experts offer varied opinions, from hopeful future prices to cautionary advice, reflecting the unpredictable nature of Bitcoin’s price movements.

Bitcoin under $25K: A Bear Market Abyss or Treasure Trove for Opportunistic Buyers?

“Bitcoin’s recent dip below $25K has been seen as a lucrative buying opportunity by some crypto enthusiasts, despite risks associated with low liquidity and trading volumes. Global market trends and on-chain indicators could support this optimism, but the potential for sellers to flood the market remains a credible threat.”

Riding the Crypto Wave: Promising Altcoins Defy Bitcoin’s Calm and Potential Profits from Presales

Despite Bitcoin’s recent stagnation, newer cryptocurrencies such as BLUI, BONESHI, and KRYDOG are showing promising growth. However, investors should tread carefully, as crypto investing can bring tremendous profit as well as substantial losses. Early investors often get discounted rates but this comes with high risk.

Navigating the Bull-Bear Tug of War: A Dive into Crypto Market Performance

The latest crypto market analysis shows a mixed performance with Bitcoin exhibiting a marginal loss and Ethereum showing a lack of demand. Despite obstacles, Bitcoin’s dormant supply hit a new high, whereas Binance Coin depicts a bearish trend. Contrastingly, XRP attempts a strong rebound, while Cardano and Dogecoin display indecisiveness and cling respectively to specific support levels.

Bitcoin Plunge and Emerging Altcoins: Prospects and Pitfalls in Today’s Market

“The recent increase in Bitcoin’s exchange net flow coincides with a decrease in price, suggesting that long-term holders are selling their reserves. Also, a decline in Bitcoin velocity indicates a weak market. Analysts suggest seeking refuge in altcoins like PARROT, ANUBIS, and SOJU which are showing promising growth.”

Bitcoin Market Uncertainty: Potential Drop to $23K vs Hope for Resilience Above $24,750

“In a potentially volatile market, Bitcoin’s (BTC) stability is under scrutiny, with predictions of a descent to a $23K valuation. Stakeholders raise concerns over BTC’s lower support levels, predicting a swift adjustment if the $25,400 threshold is breached. However, possibilities of a solid rally also emerge, if prices hold above $24,750, indicating the market’s readiness for both downside risks and upside surprises.”

The Grayscale Effect: Cryptocurrency Market Response and Forecast Uncertainty

“Cryptocurrency markets temporarily reenergized after Grayscale’s lawsuit victory against the US Securities and Exchange Commission, yet struggled to sustain gains. Traders seem focused on crypto-specific news, neglecting broader financial trends, indicating the crypto market’s high volatility. Despite the uncertainty, crypto-enthusiasts remain hopeful and persistent in their investment strategies.”

Diving Deep into Bitcoin’s Prospective Price Floor: A Look at $23,000 as Rock Solid Support

Capriole Investments founder, Charles Edwards, hints at a probable Bitcoin (BTC) price fall to $24,000 but sees solid support at $23,000. Edwards’ confidence in this “rock-solid support” and “incredible long-term opportunity” is based on the ‘Electrical Price’ (EP), a concept reflecting the global average miner’s electrical bill per BTC, which currently matches the $23,000 mark. However, potential market uncertainties should not be overlooked.

Bitcoin’s Destiny Amidst Cryptocurrency Tax Reporting: Market Reactions and Concerns

Bitcoin continues to dominate digital currencies despite a minute dip influenced by President Biden’s crypto tax propositions. However, concerns are growing that these proposals may stifle industry growth and innovation. Meanwhile, a new model for Bitcoin valuation based on on-chain metrics offers deeper cryptosphere insights, and Bitcoin’s trading faces significant resistance levels.

Unveiling Cointime Economics: A New Perspective on Bitcoin’s True Economic Worth

“Investment company Ark Invest and security firm Glassnode have presented a new approach to understanding the Bitcoin economy named “Cointime Economics.” The whitepaper describes a measurement system called “cointime”, which seeks to portray Bitcoin’s true value based on its dormancy period. It includes introducing metrics like “liveliness” and “vaultedness” for evaluating Bitcoin’s economic trends.”

Heavy Markets and Unrealized Losses: The Deep Dive into Short-Term Holders’ Crypto Woes

Bitcoin’s short-term holders (STHs) are facing majority unrealized losses, following a 10% price drop, turning 88.3% of the supply held by STHs into losses. The ‘top-heavy’ market scenario has become challenging with potential liquidation by STHs facing losses. The current shift in Bitcoin’s performance narrative, combined with the economic challenges, highlights the importance of understanding the volatile nature of the crypto market.

Bull vs. Bear: An Unending Tussle in the Cryptocurrency Market

The crypto market is caught amidst bullish and bearish forces with Bitcoin, Ethereum, and BNB showing stability despite declining percentages. Data indicates potential buying opportunities, yet advises patience until market correction ends. Interestingly, long-term stake-holders remain unfazed while the crypto community anticipates U.S. Federal Reserve updates for market impact.

Bitcoin Crash: Short-term Holders Counting Losses while Long-term Hodlers Unfazed

“According to analytics firm Glassnode, 88% of short-term Bitcoin investors have seen a drastic reshaping of their expected profitability due to the flash crash to $26,000. Only 11.7% report their investments are still profitable. This market turbulence underscores the need for careful investment strategies and proactive risk management.”

Bitcoin’s Tumble in the Shadow of SpaceX: Evaluating Elon’s Crypto Influence

“A significant downfall in the crypto market, with over $1 billion in liquidations in 24 hours, is allegedly linked with Elon Musk’s SpaceX company and its reported “write down” in Bitcoin value. Amidst this chaotic market condition, the complex interrelation within the crypto universe is emphasized.”

Navigating the Crypto Market: How Current BTC Ownership Trends Influence Global Finance

“Bitcoin speculators currently own the least BTC since its historic high of $69K, indicating market exhaustion. A decrease in BTC price could push short-term holders into a negative balance. Despite risks, long-term investor commitment in Bitcoin remains high, and El Salvador’s adoption of Bitcoin has boosted investor confidence.”

Impending Bitcoin Boom? Examining Market Signals and Global Economic Factors

“A decline in Bitcoin’s short-term holders and record-low volatility could suggest an impending bull market. A recent report indicates this narrow trading range has happened only twice in Bitcoin’s history, prompting speculation about significant market movement. However, these indicators don’t guarantee outcomes with shifting global economic conditions.”

Navigating Through the Bull and Bear Markets: Uncertainties and Predictions for Bitcoin’s Future

“The rise in the U.S. dollar index (DXY) might be an obstacle on Bitcoin’s recovery path. The DXY’s upward trend has likely influenced risky assets negatively, with equities markets seeing a corrective phase. While experts predict Bitcoin consolidation within a specific range, trends in the Ethereum market currently favour the bears.”

Navigating Blockchain: Innovations, Challenges, and the Intriguing Future of Cryptocurrency

“A telling report by Glassnode indicates that long-term crypto holders are showing tenacity, with Coinbase and Binance creating waves in the sector. Coinbase launched its Ethereum layer-2 blockchain, whereas Binance became the first fully licensed crypto exchange in El Salvador.”

Long-term Bitcoin Holders: Guardians of Stability or Harbingers of a Volatility Crisis?

Crypto analytics firm Glassnode reveals that Bitcoin long-term holders now control a historic 14.599 million BTC, accounting for 75% of the circulating Bitcoin. This shift towards long-term holding, contributing to massively reduced price volatility, signals a significant change in Bitcoin’s dynamics.

Dormant Bitcoin: Positive Long-Term Holding or Impending Threat from Financialization?

The latest data reveals that 13.3 million Bitcoins, about 68.54% of the total circulating supply, remained unspent for a year, indicative of a bias towards holding for long-term gains. However, these positive implications must also consider Bitcoin’s increasing financialization, which might disrupt potential market upswing.

Unmoved Bitcoin ushers Attention to Emerging Altcoins: Exploring potentials and Pitfalls

PayPal launched its own stablecoin, PayPal USD (PYUSD), yet Bitcoin’s price remains steady. Potential crypto market outliers like XDC Network, Wall Street Memes Token, Kaspa, XRP20, and Algorand are gaining attention due to their sturdy fundamentals and promising technical analysis. Still, as the crypto market’s unpredictable nature is undeniable, investors should proceed with caution.

Decoding the Drop in Bitcoin OTC Desk Balances: A Signal of Institutional Intervention or Misleading Metric?

The decrease in Bitcoin hoards at over-the-counter (OTC) desks may not necessarily indicate disinterest from institutional investors. The OTC desk balances could reflect bitcoins being bought for clients or clients transferring their BTCs for selling purposes. Balance data may also contain address-labeling errors. Thus, understanding of the crypto market’s nuances is crucial to avoid hasty conclusions.

The Calm Before the Crypto Storm: Analyzing the Impending Volatility Wave

“Cryptomarket maintains a sense of calm with Bitcoin and Ethereum showing little change in price. However, historical data from K33 Research suggests volatility could occur as we’ve seen when Bitcoin’s volatility drops below big traditional players. An analysis of ‘hodling’ trends suggests a potential shift in market dynamics.”

Slowing in Ethereum Gas Consumption: A Spotlight on the Maturing NFT Market

“Data from Glassnode shows a significant drop in Ethereum gas consumption by NFT marketplaces, indicating a possible shift in NFT usage with more individuals choosing to hold their assets. However, this reflects market maturation and growing understanding of technology, rather than decline.”