Despite promising developments in the crypto universe, Bitcoin underwent an 11.1% loss in Q3, perplexing investors. Other assets also witnessed declines due to high inflation and potential recession fears. Nevertheless, Bitcoin’s robust YTD performance of a 65% increase provides hope for its future despite recent hurdles. Future geopolitical events might also trigger favorable trends for Bitcoin.

Search Results for: Global Coin Research

Unveiling the Future of Bitcoin: OpenAI’s Endorsement, Putin’s Dollar Shift Concerns and Price Trends

The CEO of OpenAI, Sam Altman, praises Bitcoin for its potential to combat corruption due to its independence from government control. He and Joe Rogan express concern over US handling of cryptocurrency regulation and central bank digital currencies. Despite recent price dips, Altman and Rogan remain hopeful for Bitcoin’s future due to its limited supply and decentralized mining. However, they caution that like all investments, cryptocurrencies are volatile and risky and require careful research and strategy.

Bitcoin’s Market Momentum: Bold Forecasts, El Salvador’s Mining Move and the Potential of ETFs

“Former BitMEX CEO foresees Bitcoin’s price surging to approximately $70,000 in 2024, propelled by potential financial disruptions and an anticipated Bitcoin halving event. Meanwhile, El Salvador launches its maiden sustainable Bitcoin mining pool, and BlackRock nears approval of a Bitcoin ETF – potentially triggering a $650 billion surge in crypto asset management.”

Ethereum Futures ETFs Stumbling: Are Investors Leaning towards Bitcoin?

The subdued performances of new Ethereum futures ETFs suggest shifting investor interest back to Bitcoin. Initial trading volume was significantly lower than anticipated, indicating lackluster interest in Ether ETFs. This hints that increased institutional access will only boost buying pressure if significant demand exists, which currently doesn’t seem the case for Ether.

Introducing DRAM: Dirham-Backed Stablecoin Aims for Global Impact Amidst Regional Restrictions

Swiss company DTR presents a Dirham-supported stablecoin, DRAM, aiming to facilitate global value transfer. Despite its non-availability in UAE and Hong Kong, the token, developed by Dram Trust is listed on decentralized exchanges like Uniswap, PancakeSwap trading with Binance Coin.

Crypto Market Mirage: Bitcoin’s Dance on the $28,000 Line – Hope or Despair?

Bitcoin, following a triumphant surge past the $28,000 mark, succumbed to market volatility and slid down to $27,500. This displays a profound market unpredictability with imminent oscillatory patterns that can potentially steer investors towards safety, driving capital away from cryptocurrencies. However, a symmetrical triangle pattern suggests a possible bullish momentum.

Navigating Bitcoin’s High Seas: Unraveling the Global Bull-Market Phenomenon and Its Consequences

“Bitcoin recently experienced an 8% rise, fuelling speculation of a new bull market. The finite supply of Bitcoin, near to its limit of 21 million, makes its future intriguing. Support and resistance levels indicate potential for further momentum, despite indications of an overbought market.”

Bullish Moves: Top Altcoins Poised to Break Resistance; A Detailed Crypto Market Outlook

“The crypto market outlook brightens as major altcoins like BTC, ETH, BNB, ADA, and SOL attract attention. However, while trading these digitized assets, crypto pioneers suggest ensuring safety, conducting meticulous research before making investment or trading moves.”

Unraveling Bitcoin Mining: Environmental Hazard or Green Energy Catalyst?

“Fascinating revelations suggest that Bitcoin mining now leads as the most sustainably-powered global industry, with over half of its energy from renewable sources. Despite criticism, research shows a 38% increase in sustainable energy adoption, surpassing other sectors, including banking.”

Coinbase Obtain AML Compliance in Spain: Striking Balance between Global Expansion and Regulatory Challenges

Coinbase has secured an Anti-Money Laundering compliance registration from Spain’s central bank, enabling crypto services in the country. As Coinbase expands globally, it faces possible complications from varying regulatory frameworks and is urged to prioritize asset security as skeptical holders consider withdrawing assets.

Bitcoin’s Bright Future: Prospective Global Payment Facilitator and ICE’s Asia-Pacific Expansion

“David Marcus of Lightspark views Bitcoin as a global payment network, with potential to transform the remnants of a ‘fax era’ payment scenario. Meanwhile, CoinDesk Indices partners with ICE, marking entry into the Asia-Pacific region, thus expanding cryptoverse boundaries.”

Stablecoin De-Pegging: A Deep-Dive into USDC and DAI Performance versus USDT and BUSD

“Analysts reveal ‘de-pegging’ is more common in stablecoins USDC and DAI compared to Tether and Binance USD. While stability ideally requires good governance, collateral and reserves, market confidence and adoption, USDT has shown steadiness despite mainstream scrutiny.”

Navigating the Seas of Global Crypto Regulation: G20’s Role and India’s Stance Unveiled

“The G20 summit in India recently started a comprehensive global regulation on crypto assets, revealing global recognition of cryptocurrencies’ potential. Despite some disapproval, even India’s Reserve Bank permitted banks to service crypto companies, marking a significant shift towards global acceptance of cryptocurrency.”

Binance Coin’s Rocky Road: Signs of Recovery Amidst Executive Exodus and Emerging Altcoins

“Binance Coin (BNB) sees a 0.5% decline, dropping to $213.55, but reclaims its position as the fifth-largest cryptocurrency. Despite a 12% drop over 30 days, indicators suggest possible recovery. However, Binance’s regulatory struggles and concerns over China’s economy could hinder its growth.”

Riding the Bitcoin Rollercoaster: The Struggle, The Surprises, and The Underdogs on the Rise

Bitcoin’s journey hasn’t been smooth lately, facing potential dips and a declining interest from whales. However, lesser-known cryptocurrencies like XELON, PMR, and EMOTI are outperforming their peers, with significant gains on DEXTools. Cryptonews.com analysts are highlighting promising presale opportunities, though caution and market research are advised.

VISA Leverages Solana Blockchain and USDC Stablecoin for Faster International Payments

“VISA has enhanced its stablecoin settlement ability with Circle’s USDC stablecoin on the high-speed Solana blockchain, making it one of the first financial institutions to harness Solana for scaled settlements. VISA’s integration of stablecoins like USDC on global blockchain networks aims to improve international settlements speed and give clients a modern option to conveniently transact funds.”

Debunking the Myth: The Real Energy Consumption of Bitcoin Mining

“The Bitcoin Electricity Consumption Index (CBECI) has significantly adjusted its original estimates of cryptocurrency’s energy appetite. It now suggests Bitcoin network’s total energy consumption is more comparable to US tumble dryers usage. This shift is due to the realization that older mining machines are being decommissioned quicker than predicted.”

UK’s Vision for Global AI Safety: Tackling Risks and Encouraging Development

The UK government focuses on the risks and policy support for AI at the upcoming global AI safety summit. The discussions will address the risks posed by AI systems, fostering AI development for public good, and establishing international consensus on AI safety.

Controversy Clouds Genesis Global Capital’s Bankruptcy Settlement with FTX

Bankrupt crypto lender, Genesis Global Capital, is under scrutiny regarding its proposed $175 million settlement with FTX, accused of manipulating the bankruptcy process through vote-buying. Genesis’s future, and the recovery of creditors’ funds, now lies in the hands of Bankruptcy Judge Sean Lane.

Exploring the Forces Shaping Bitcoin’s Spiraling Rise Above $27,000: A Market, Technical, and Global Outlook

“Bitcoin (BTC) has surged above $27,000, a jump many credit to Grayscale’s recent legal victory to turn its Bitcoin Trust into an ETF. Global cryptocurrency market capital grew roughly $50 billion in a day, raising hopes for future growth. Factors such as increasing acceptance of crypto by countries like Netherlands and endorsements by US figures further strengthen the market’s legitimacy.”

Nigeria’s Bold AI Leap: Contributing to Global Progress while Navigating Ethical Quandaries

“Nigeria is shaping its National Artificial Intelligence Strategy, seeking global experts to contribute their knowledge. AI, forecasted to contribute $15.7 trillion to the world economy by 2030, could transform Nigeria’s production, services, and economy. However, ethical considerations like data privacy, job displacement, and misuse exist alongside its transformative potential.”

Diving Deep into Bitcoin’s Prospective Price Floor: A Look at $23,000 as Rock Solid Support

Capriole Investments founder, Charles Edwards, hints at a probable Bitcoin (BTC) price fall to $24,000 but sees solid support at $23,000. Edwards’ confidence in this “rock-solid support” and “incredible long-term opportunity” is based on the ‘Electrical Price’ (EP), a concept reflecting the global average miner’s electrical bill per BTC, which currently matches the $23,000 mark. However, potential market uncertainties should not be overlooked.

Shiba Inu Poised to Rally Beyond Bitcoin: Can SHIB Reach $1?

“AI, ChatGPT predicts SHIB could potentially reach $1 per token in the next 5-10 years, indicating massive gains for current holders. Such a rally could surpass Bitcoin’s return and Shiba Inu’s market cap would near a staggering $600 trillion.”

Emerging Altcoins Defy Bearish Trends: The Thin Line Between Skepticism and Optimism

“In a bearish market, few altcoins like HBAR, OP, INJ, and RUNE show potential growth opportunities, displaying resilience. Despite declining Bitcoin value and broader market trends, these altcoins demonstrate strength through robust support levels or continued growth, indicating potential upside momentum.”

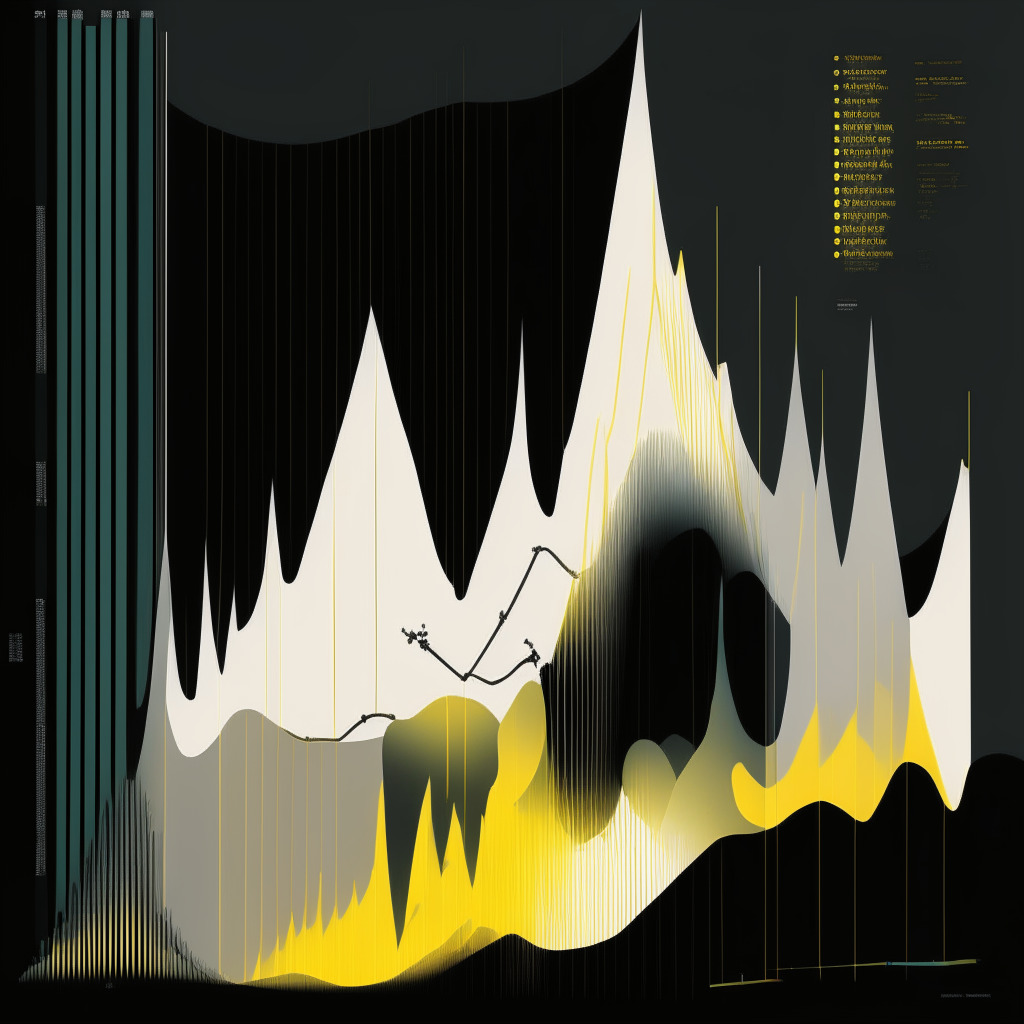

Navigating the Stormy Seas of Cryptocurrency: Future of Bitcoin amidst Heavy Price Swings

“The Bitcoin price, currently around $25,882, exhibits potent bearish sentiment, indicated by ‘Three Black Crows’ candlestick patterns and oversold RSI and MACD oscillators. The 50-day EMA, resistance at $26,200, and other technical pointers suggest further potential declines.”

Bitcoin’s Future: The Battle between Bullish Optimism and Regulatory Uncertainty

Cryptocurrency markets, particularly Bitcoin, are seeing significant fluctuations, with predictions both optimistic and pessimistic. Some analysts express confidence due to an increase in Bitcoin adoption by major investors, while others cite regulatory ambiguity as a cause for potential prolonged market dips. Navigating these varying predictions requires careful research and expert advice.

Surprise in Crypto Territory: Bitcoin and Ethereum Less Volatile than Oil

“The new study by Kaiko reveals surprising reduction in volatility of Bitcoin and Ethereum, now lower than that of oil. Current market trends suggest a maturing cryptocurrency market, with global developments and increased adoption reducing volatility. Regulatory scrutiny and potential approval of a spot ETF could further influence this dynamic.”

Surprising Shift in Market Dynamics: Oil Now More Volatile than Bitcoin and Ethereum

“Cryptocurrency markets are seeing a surprising shift with Bitcoin and Ethereum becoming less volatile than oil. A factor of this decreased volatility is attributed to geopolitical tensions, economic echoes, and maturation of Bitcoin as market adoption increases.”

Bitcoin’s Fate on a Knife’s Edge: The Game-Changing Impact of ETF Approval or Rejection

“The spark that could ignite Bitcoin’s economic explosion is the acceptance of exchange-traded funds (ETFs) by the U.S. This could lead to Bitcoin advancing towards a $150K mark. The opposite scenario, rejection of the ETF proposal, won’t dampen Bitcoin’s shine completely as it still expects a sizable price surge. This optimism is buoyed by Bitcoin’s halving event scheduled for 2024. The decision on Bitcoin spot ETF applications could stir a seismic shift in the crypto landscape.”

Navigating the Summer Trading Lull: A Closer Look at Bitcoin, Ether, and Altcoins Amid Slowdown

“Bitcoin is clinging to the $29,000 mark, with Ether also experiencing a downfall. However, Tom Lee of Fundstrat Global Advisors predicts a potential surge for Bitcoin if the SEC greenlights a spot Bitcoin ETF, catapulting Bitcoin’s price over $150,000.”

Navigating the Crypto Market: How Current BTC Ownership Trends Influence Global Finance

“Bitcoin speculators currently own the least BTC since its historic high of $69K, indicating market exhaustion. A decrease in BTC price could push short-term holders into a negative balance. Despite risks, long-term investor commitment in Bitcoin remains high, and El Salvador’s adoption of Bitcoin has boosted investor confidence.”

Decoding Global Markets: Fluctuating Ruble, Peso and Unexpected Stagnancy of Bitcoin and Gold

The Russian ruble and Argentina’s peso’s recent turbulence exposes potential global market weaknesses. However, Bitcoin and gold have not seen the anticipated safe-haven investment surge. Possible reasons include the rise in U.S. government bond yields, which may reveal more systemic vulnerabilities.