“The FTX debacle shed light on the murkiness of crypto regulations following accusations made against the former CEO, Sam Bankman-Fried. Charles Hoskinson, Cardano’s founder, raised concerns over the media’s leniency towards Bankman-Fried, comparing him to Bernie Madoff. This case emphasizes the need for transparent and accountable media and robust crypto regulations.”

Search Results for: HEC

NFT Market’s Brutal Reality Check: From Glory to Near Worthlessness

“The majority (over 95%) of NFT collections are currently viewed as devoid of worth, reflecting the dramatic deflation of the NFT bubble. Amongst the top 8,850 collections, 18% are deemed worthless with a further 41% priced between $5 to $10.”

NFT Ventures Facing Reality Check: Shattered Dreams and Future Prospects

“Non-Fungible Tokens (NFTs) offer a digital link to reality in the Blockchain universe. However, the attempt to introduce an NFT-linked restaurant in San Francisco stalled amidst labor shortages, supply chain disruptions and inflation. Interestingly, all investors received refunds, indicating a unique ethics in this crypto domain.”

Bitcoin’s Race to $100,000: An Optimistic Prophecy or Fantasy Among Fraught Skepticism?

“Hut 8 VP, Sue Ennis, predicts Bitcoin could reach $100,000 by snaring 2%-5% of gold’s market cap. Despite political turbulence and Bitcoin’s dismal performance, she maintains that diversifying mining revenue and approval of a Bitcoin ETF could drive Bitcoin’s surge.”

The Closing of Clockwork: A Reality Check for Blockchain Ambitions or a Miscalculation of Market Potential?

“Clockwork, a Solana-based startup, announced its closure, citing limited commercial upside. Despite the promising goal of revolutionizing blockchain with payroll technology, the project was halted. However, founder Nick Garfield has encouraged users to fork the code, potentially spawning multiple new projects.”

Regulatory Compliance and Crypto Exchange: Binance, Checkout.com, and the Premature Contract Termination

“Binance, the world’s largest cryptocurrency exchange, faced contract termination from payment processing giant Checkout.com due to regulatory concerns. Checkout had facilitated billions in crypto transactions for Binance. This termination underscores the impact of regulatory scrutiny on even the most lucrative partnerships within the crypto industry.”

Breaking Down the Binance-Checkout.com Fallout: Regulatory Complexities in the Blockchain World

“Binance considers suing Checkout.com after their abrupt partnership termination, affecting Binance’s operations and the blockchain world. The case shows challenges in legislating innovative tech, yet accentuates blockchain’s potential, advancing towards a decentralized, secure financial system.”

Wyoming’s Revolutionary Leap: State-backed Stablecoin Project and a Hefty Paycheck Higher than the Governor’s

The US state of Wyoming plans to hire an executive director for a groundbreaking stablecoin project, a commission introduced after the Wyoming Stable Token Act was recently approved. The commission’s authority allows it to issue a US dollar-pegged stablecoin in Wyoming, redeemable for dollars in the state’s bank account. With desired qualifications including blockchain expertise and understanding of Wyoming’s legislative operations, the Commission aims to issue a stablecoin by end of 2023.

The Reality Check: Quantstamp Penalization and the Regulation Challenge in Blockchain

Quantstamp, a blockchain security firm, faced a $28 million SEC penalty for conducting an unregistered ICO for QSP tokens in 2017. Incurring additional fines for trading these tokens on third-party platforms, Quantstamp had to establish a “Fair Fund” to reimburse investors, potentially leading to permanent disablement or destruction of QSP tokens. This incident underscores the tension between deregulation and regulatory compliance in blockchain technology.

The Unraveling of Hector Network: Decentralization Predicament and the Illusion of Quick Exits

The formerly $100 million treasury of stablecoin project, Hector Network, has collapsed to $16m following the Multichain bridge’s demise. The DAO’s liquidation process is causing community frustration given its complexity and projected 6 to 12-month timeframe. Hector’s endeavors beyond stablecoin, including a token launchpad and NFT marketplace, might have diluted its focus and deepened the treasury situation.

Checks Elements NFTs at Christie’s: Evaluating Art, Rarity, and Investment Risks

Jack Butcher’s Checks Elements, a generative art collection featuring Twitter checkmarks, will be showcased and auctioned at Christie’s in both physical and digital components. Building upon the original Checks project, the collection incorporates earth, fire, water, and air motifs, rewarding existing collectors through gamified elements and utility.

Hector Network HIP 40: Balancing Legal Protection and Token Holder Rights – A Complex Conflict

Hector Network’s future is uncertain as it hosts a vote on Hector Improvement Proposal 40 (HIP 40), which could dilute token holders’ rights. The proposal aims to clear legal uncertainties for the decentralized autonomous organization (DAO) but grants significant governance power to Hector Network employees, receiving backlash for potentially undermining its community-run status.

Crypto Paychecks: A Growing Trend Among Millennials and Gen Z Workers

Millennials and Gen Z workers show increasing interest in receiving salaries in digital assets. Ohio-based startup Rise offers a unique service, allowing companies and employees to choose between fiat and cryptocurrency payments. Leveraging smart contracts, Rise provides instant payments and flexibility for users, while also exploring opportunities in decentralized finance.

Blurring the Lines: Checks Elements Combines NFTs and Hand-Drawn Art – A Harmonious Future?

Jack Butcher launches Checks Elements, combining generative art with hand-drawn physical prints in a 152-piece collection inspired by earth, fire, water, and air. Bridging digital and physical art, the collection connects Ethereum-based NFTs with Butcher’s authenticated monoprints.

Crypto’s Hectic Week: Inflation Impact, Adoption Surge, and Regulatory Debate

This week, Tether reported $1.48 billion profit and increased crypto adoption by institutions like PayPal and Goldman Sachs. However, the Central Bank of Ireland Governor likened cryptocurrencies to a “Ponzi scheme.” US lawmakers are considering crypto regulations under SEC and CFTC supervision.

Miami’s Cooling Crypto Enthusiasm: A Reality Check or Missed Opportunities?

Amid a bearish crypto market, Miami and Mayor Francis Suarez appear to be losing enthusiasm for cryptocurrencies and blockchain technology. Once aiming to make Miami a leading crypto hub, recent events like the MiamiCoin trading halt, FTX Arena renaming, and Blockchain.com canceling its office relocation reflect a shift in the city’s crypto landscape.

Crypto Lending Crisis: Rehypothecation Dangers and the Road to Sustainable Solutions

The centralization of crypto lending and the rehypothecation of customer assets create significant risks in the cryptocurrency industry. As the nature of cryptocurrencies differs fundamentally from traditional financial assets, a more sustainable future requires educating borrowers about rehypothecation, adapting lending practices, and offering alternative loan options.

Binance vs ChatGPT: AI Spreading False Info on CEO’s CCP Ties, Fact-Checking, and Crypto Integrity

The Binance network raised concerns over AI ChatGPT spreading false information about CEO Changpeng Zhao’s alleged link to the Chinese Communist Party. This highlights potential AI misuse for malicious purposes and emphasizes the importance of fact-checking AI-generated content, focusing on striking a balance between utilizing AI for good and preventing exploitation.

Rand Paul’s Dollar Warning: A Reality Check or Fear Mongering of a Currency Apocalypse?

U.S. Senator Rand Paul recently warned that the U.S. dollar could lose its status as […]

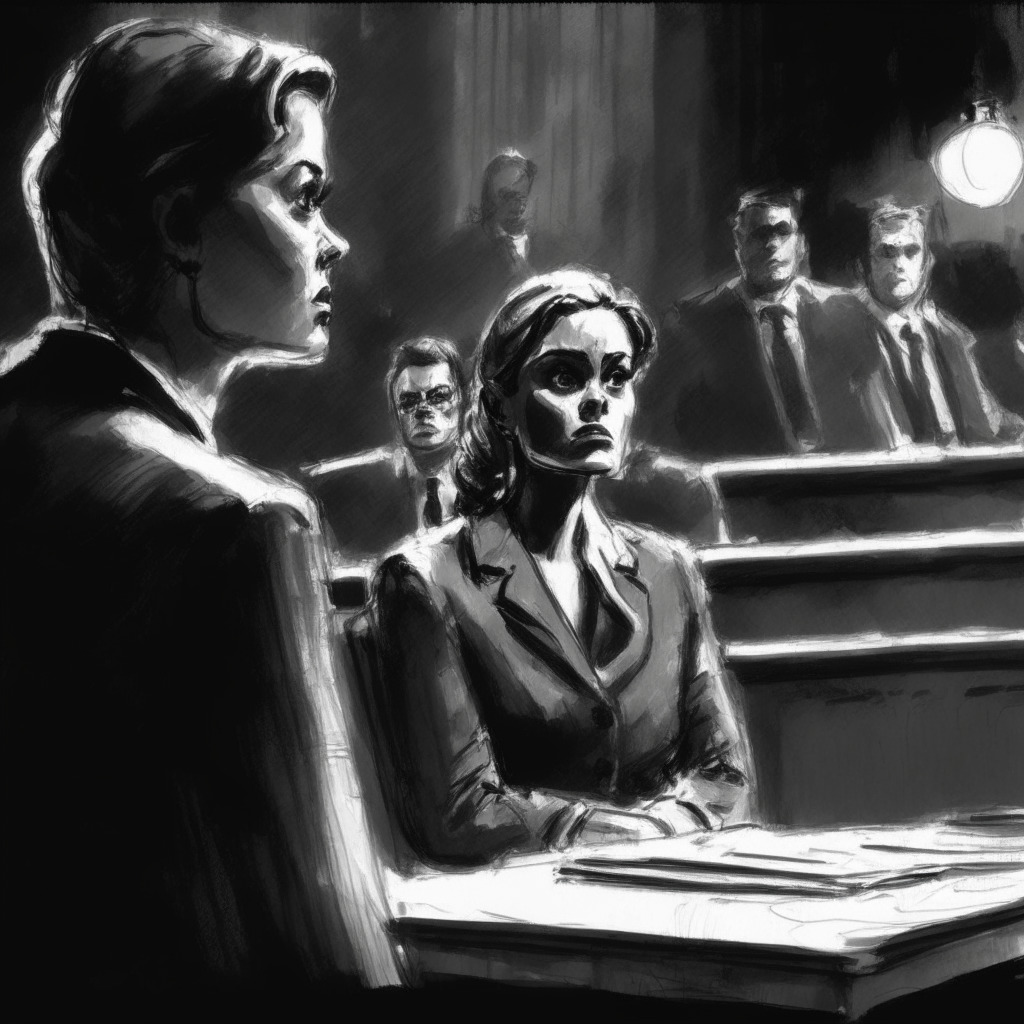

The Fall of FTX: A Tale of Fraud, Billion-Dollar Losses, and the Uncertain Future of Crypto

“In a recent blockchain trial, Sam Bankman-Fried is accused of misuse of FTX user funds. His ex-business partner alleges that under his direction, she fraudulently withdrew and invested billions from Alameda. This highlights ongoing concerns over crypto regulation, security, and transparency.”

Unraveling FTX- Alameda Loan Debacle: Scrutiny over Lawyer Involvement and the Cry for Regulation

“Questions arise around FTX lawyers’ involvement in a $200M loan transaction from Alameda, increasing need for robust legislation in the crypto space. Moves from Europe, particularly Cyprus, towards tightening crypto regulations highlight the crucial role of checks and balances in the industry.”

Navigating Murky Waters: The Saudi-Chinese AI- Blockchain Venture and Binance’s IRI Commitment Review

Saudi Arabia and China are collaborating to create AceGPT, an Arabic-based AI system designed for Arabic queries. Despite its potential, concerns arise over misuse of sensitive information and neglect of safety checks. Meanwhile, the blockchain Industry Recovery Initiative receives criticism for lack of funding transparency amid falling crypto venture funding.

Binance Scam in Hong Kong: A $450K Lesson in Crypto-Security Vulnerabilities

“Despite the security prowess that blockchain technology is renowned for, a recent wave of cyber-crime caused 11 Binance users in Hong Kong to lose over $446k. This demonstrates the ongoing struggle between the technology’s versatility and inherent vulnerabilities, highlighting shortcomings in existing security frameworks and the urgent need for comprehensive solutions.”

Smart Contracts on Bitcoin: The Future of Blockchain or an Overreaching Gamble?

The recent “BitVM: Compute Anything on Bitcoin” white paper by ZeroSync’s project lead, Robin Linus, proposes a new way to implement complex off-chain smart contracts on Bitcoin. Based on a Turing Complete system, this method would broaden Bitcoin’s operations to include applications like tactical games verification, bridging BTC to foreign chains, and constructing prediction markets.

China Daily Ventures into NFT: An Ambitious Leap or A Trepid Path?

“China Daily, a CCP-owned newspaper, intends to launch an NFT platform in collaboration with a third-party blockchain firm. With a fund amounting to 2.813 million yuan, the aim is to foster Chinese civilizational influence through tech including Blockchain, AR/VR, NFTs, cloud computing and big data.”

Navigating the Waters of Real-World Asset Tokenization: Insights from Backed’s Latest Launch

“Swiss entity Backed has launched its latest product, bIB01, on the Base blockchain, offering a digital engagement tool for traditional finance enthusiasts. Backed’s tokenized securities, or bTokens, represent real-world assets like corporate bond ETFs and treasury ETFs. Despite limitations for US-based investors, this marks an intriguing merger of traditional assets with digital technology.”

Ethereum Staking Surge: Exploring Centralization Risks and Shrinking Yields

The rising staking of ether due to Ethereum upgrades sparks concerns over centralisation and lowered staking yields, according to a JPMorgan report. Despite decentralized platforms like Lido, risks tied to centralization and rehypothecation present security issues. This trend impacts the appeal of ether investment and emphasizes the evolving crypto market.

Guaranteed Income Trials: A Potential Surge in Crypto Trading and Its Implications

As U.S. cities and organizations initiate basic income pilot programs, a potential surge in crypto trading is predicted. A 2020 study showed a rise in Bitcoin trades after distribution of economic stimulus checks. Upcoming trials providing unconditional cash transfers may lead to increased trading in cryptocurrencies including AVAX, Bitcoin Minetrix, Rollbit Coin, Meme Kombat, and ADA.

The Intricate Web of Illicit Fentanyl Trade Powered by Cryptocurrency

The U.S Treasury’s Office of Foreign Assets Control (OFAC) has targeted several cryptocurrency wallets involved in the illicit trade of fentanyl. Most transactions were conducted via Stablecoins on Ethereum and Tron networks. These wallets, save for one, were hosted on a centralized crypto exchange, allowing the illicit flow of hundreds of thousands of dollars worth of cryptocurrency.

CFTC Eyes Former Voyager CEO: Disruption in Crypto Industry or Need for Stronger Regulation?

“The Enforcement Division of the U.S. Commodity Futures Trading Commission (CFTC) may charge ex-CEO of Voyager, Stephen Ehrlich, over a suspected ICO scam. Ehrlich allegedly violated CFTC regulations by not ensuring their customers’ assets’ security. The CFTC is contemplating imposing fines and other non-criminal penalties.”

European Crypto Regulation: Balancing Sustainability, Transparency and Freedom

The European Securities and Markets Authority (ESMA) has published its second consultation paper on cryptocurrency regulations, focusing on sustainable indicators for distributed ledgers, disclosure of insider information, technicalities within white papers, transparency measures and record-keeping for Crypto asset service providers. ESMA’s move aims to encourage a more sustainable, transparent, and accountable crypto-market.

Blockchain Boundaries: Telecom Titan NTT Docomo Joins Forces with Crypto Exchange Monex

“In a recent breakthrough, NTT Docomo and crypto exchange Monex announced a strategic partnership to develop new asset formation services, aiming to expand individual wealth formation in Japan. The alliance shows Monex’s increasing footprint in the crypto world, indicating potential domestic and international expansion.”