Crypto exchange Gemini is expanding in India with a $24 million investment, intended to enhance its operational infrastructure. They’re focusing on enlarging their Gurgaon engineering center and hiring Sachin Ranglani, ex-Paytm exec, as their India subsidiary head. This move reflects their commitment to progress within India’s burgeoning crypto market.

Search Results for: India

Crypto Catastrophe: The $24 Million Fraud Case Rattling India’s Blockchain Landscape

An elaborate $24 million cryptocurrency fraud case has been revealed in India, implicating an individual named Subhash Sharma. Numerous investors were defrauded through deceptive cryptocurrencies like “Korvio Coin”, “DGT Coin”, and “BTPP Token”. The situation highlights increasing cryptocurrency scams in India, with victims caught in regulatory voids.

Gemini’s $24 Million Bet on India’s Potential as a Web3 Innovator: Motives and Challenges

Gemini’s APAC CEO and Global CTO, Pravjit Tiwana, highlights India’s potential as a key innovator in the Web3 arena, backed by a $24 million investment plan from Gemini. Tiwana cites India’s digital transformation history and unparalleled software development talent as factors for its potential leading role in shaping the Web3 landscape.

India’s Stride Towards a Global Crypto Database: A Revolution or Big Brother Surveillance?

India is reportedly building a global database for all cryptocurrency exchanges to assist law enforcement agencies in crypto-related crime investigations. This tool could enhance their investigation proficiency in cases like money laundering, a crime primarily increasing worldwide due to cryptocurrency.

Gemini’s Indian Expansion: Blockchain’s Untapped Potential and Hidden Quicksand

Gemini, a cryptocurrency exchange, recently affirmed a $24 million investment for its expansion in India, a country teeming with technological innovation. Gemini’s ambitions of infrastructural growth are boosted by India’s growing status as a hub for technological development. Yet, the unpredictability of cryptocurrency and the volatile nature of regulations pose potential challenges.

Gemini’s Cryptocurrency Expansion into India: Boon or Bane Amid Regulatory Ambiguity?

“The cryptocurrency exchange, Gemini, is planning a $24 million expansion into India’s tech market over the next two years. This move aligns with the opening of their new office in Gurgaon, India, which contributes to worldwide operations. Despite the current ambiguous regulatory environment for cryptocurrencies in India, Gemini sees potential in the country’s supportive framework for startups and its global reputation as a hub for tech advancement.”

Navigating the Shadows: The Challenge of Crypto Fraud Prevention in India

Amid a rise in crypto-related scams in India, the absence of clear cryptocurrency regulations becomes alarming. This regulatory gap encourages criminal activity and leaves scam victims feeling helpless and vulnerable. The situation complicates the categorization of cryptocurrencies for legal proceedings and discourages the reporting of fraud, but robust regulatory actions could help address these issues.

India’s Strike Against Crypto Fraud: A Blockchain Paradox Unfolds

The Indian Ministry of Home Affairs is developing a Cryptocurrency Intelligence and Analysis Tool (CIAT) to combat crypto fraud. CIAT will monitor dark net crypto wallet addresses, compiling transaction records to detect irregular crypto activities. However, concerns surround its effectiveness given the dark web’s anonymity and the potential for false positives.

Indian Crypto Woes: Waiting, Losing Traders, and Fumbling with Tax Rules

“The Indian crypto industry faces a long wait for a softer crypto tax structure due to a 1% Tax Deducted at Source (TDS) on crypto deals enforced by authorities. This tax led to reduced trading volumes, pushing investors to foreign platforms. Despite lack of formal discourse with legislative players, WazirX CEO, Nischal Shetty, remains optimistic about India moving towards more crypto-friendly policy.”

Navigating the Future of Crypto Regulation in India: An Emerging Hope Amid Taxation Concerns

G20 members’ drive for global crypto regulation sparks hope among Indian crypto firms haunted by ambiguity. While the idea of self-regulation has its critics, Japan’s successful implementation bolsters confidence. Despite high taxes from the Indian government, India leads in crypto adoption, with investors increasingly using foreign platforms to avoid heavy tax impositions.

India’s Paradoxical Supremacy in Global Crypto Index: High-Tax-Averse or Accelerator?

“India has topped the Global Crypto Adoption Index 2023, despite strict tax regulations on crypto trades. The tax schemes paradoxically stimulating a shift in transaction methods, thus driving the adoption of digital currencies, particularly in struggling economies like India, Nigeria, and Vietnam.”

Navigating the Seas of Global Crypto Regulation: G20’s Role and India’s Stance Unveiled

“The G20 summit in India recently started a comprehensive global regulation on crypto assets, revealing global recognition of cryptocurrencies’ potential. Despite some disapproval, even India’s Reserve Bank permitted banks to service crypto companies, marking a significant shift towards global acceptance of cryptocurrency.”

Navigating Uncertainty: The Rocky Road of Coinbase’s Operations in India

Coinbase suspended exchange services in India but continues its technology hub and wallet services. Despite conflicts with regulatory pressures and market volatility, Coinbase upholds its commitment to India, viewing it as an opportunity despite local constraints.

Crypto Regulation Reforms: India’s Bold Stride for Blockchain Market Accountability

“India, a G20 summit member, is adopting robust regulations for cryptocurrencies instead of an outright ban. The proposed five-point crypto ordinance includes stricter Know Your Customer standards aligned with international anti-money laundering and FATCA regulations, real-time Proof-of-reserve audits, harmonised tax policy, and elevating crypto exchanges to authorised dealers.”

Emerging Crypto Regulations in India: A Step Towards Global Crypto Governance or an End to Cyberspace Freedom?

India hints at creating its unique legal framework for cryptocurrencies. Despite previous strict taxation and anti-money laundering rules against major crypto platforms, India might deviate from a ban on crypto, offering comprehensive global implications for the future of digital currencies.

India’s Ambitious Plan: One Million CBDC Transactions by 2023 with Digital Rupee and UPI Integration

The Reserve Bank of India (RBI) is planning to increase daily retail Central Bank Digital Currency (CBDC) transactions from an average of 18,000 to one million by the end of 2023. RBI is also encouraging banks to facilitate e-rupee compatibility with Unified Payments Interface via QR codes for seamless transactions.

Navigating the Indian Crypto Market: Coinbase’s Struggles and Opportunities

Coinbase’s pursuit of the vast Indian crypto market is hampered by regulatory hurdles and authority negotiations. Despite termination of its service for some customers, it continues to operate. With high-profile exits and a confrontation with the Reserve Bank of India, the crypto giant faces challenges in adapting to the country’s market standards. Nonetheless, India’s advocacy for global crypto regulatory structures might signal a shift in the tides.

OKX’s Ambitious Plan to Penetrate Tech-Savvy Indian Market Amidst Regulatory Ambiguity

Crypto exchange, OKX, plans to penetrate India’s tech-savvy market by scaling general Web3 products, despite the regulatory ambiguity within the country. OKX’s Global CMO, Haider Rafique, believes India’s youth provides fertile ground for innovative crypto adoption and utilizes this opportunity in their strategic planning.

Global Push for Cryptocurrency Regulations: The G20’s Unified Front and India’s Leadership Role

“Under India’s G20 presidency, efforts are increasing to develop global cryptocurrency regulations. The dialogue includes both viewing cryptocurrency as a threat and an opportunity. The aim is to harness the potential of cryptocurrencies while mitigating inherent risks through unified global cooperation.”

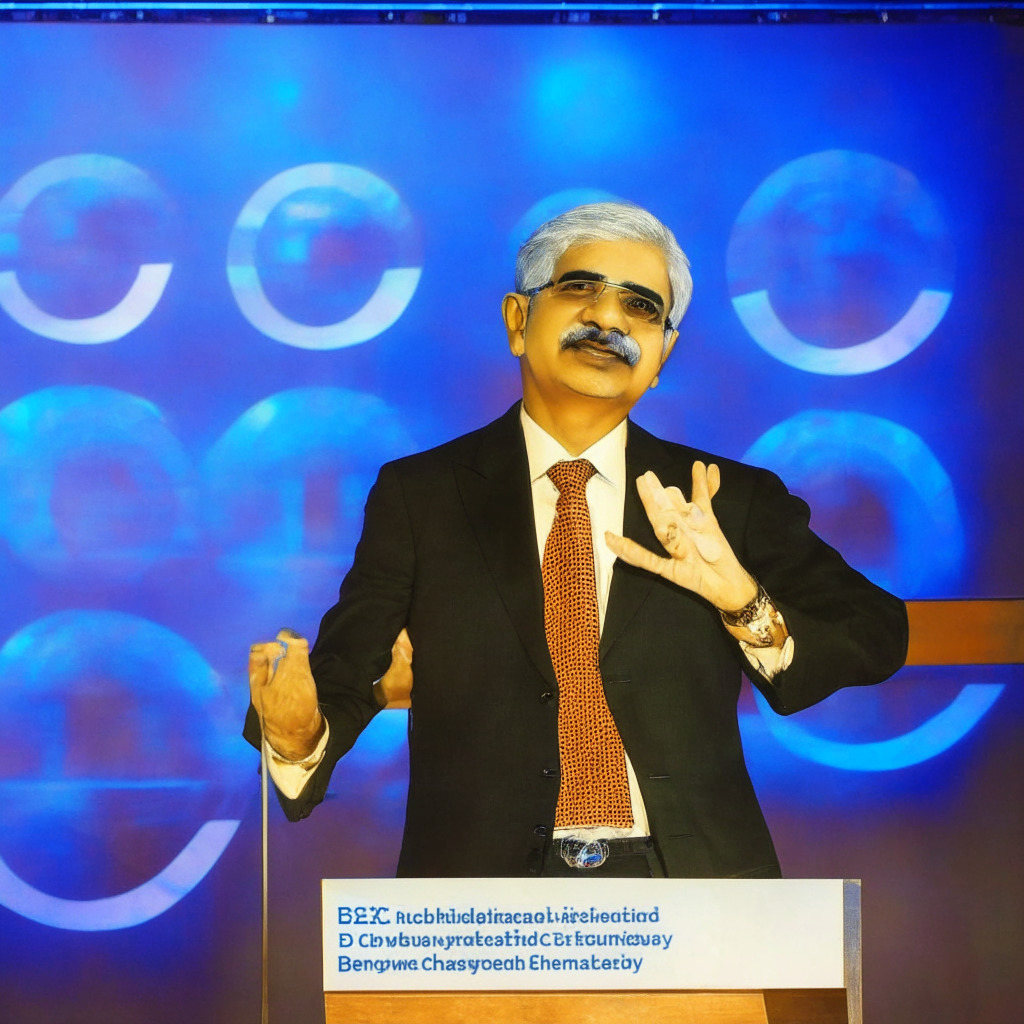

Unleashing the Power of CBDCs: India’s Approach to Revolutionizing Global Finance

Reserve Bank of India’s Governor, Shaktikanta Das, emphasized the transformative potential of Central Bank Digital Currencies (CBDCs) in a recent G20 TechSprint Finale address. He outlined their potential to revolutionize international payment landscape by reducing costs and increasing transparency. India, currently testing its own CBDC, engages in comprehensive data collection and analysis for future policies. They also invite innovative solutions for cross-border CBDC platforms.

Navigating Regulatory Storms: WazirX VP Menon on India’s Crypto Landscape and Global Guidelines

“Rajagopal Menon, VP of WazirX, discusses India’s crypto regulation journey from suspicion to acceptance, stimulated by public campaigns and talks with policymakers. Despite taxing complications, WazirX is committed to user protection and education, striving for regulations reflecting India’s diverse consumer base while maintaining global standards.”

India’s SBI Leaps into Digital Realm: UPI Integration with Digital Rupee, A Step into the Future

“India’s largest public sector bank, SBI, has integrated UPI with the Digital Rupee, enabling 300 million UPI users and 500 million merchants to enhance their digital transactions. The ‘eRupee by SBI’ application potentially fuels secure and rapid exchanges, increasing national digital currency usage in regular transactions. However, the excitement around cryptocurrencies remains muted within the Indian government.”

Blockchain’s Rising Star in Global Finance: A Glimpse at India’s NPCI and London Stock Exchange Group’s Approach

“India’s National Payments Corporation is recruiting a blockchain expert, indicating a growing faith in blockchain’s potential in finance. Concurrently, the London Stock Exchange Group is leveraging blockchain to create a platform for traditional financial assets, possibly becoming the first major global exchange to establish a blockchain-powered ecosystem.”

OKX’s Ambitious Expansion into India: A Gamble in the Unregulated Cryptocurrency Terrain

Cryptocurrency exchange OKX is aiming to penetrate India’s crypto market, focusing on Web3 applications. Not intending to establish a physical presence, the company plans to hire local employees to expand its wallet services. Despite India’s lack of a formal regulatory framework for crypto trading, OKX is optimistic about being the front-runners once regulations are in place.

OKX’s Bold Exploration into India’s Crypto Space Amid Array of Regulatory Hazards

Crypto exchange OKX is venturing into India’s web3 space despite regulatory uncertainties. The firm aims to engage and collaborate with India’s developer community, even as the authorities focus on stringent tax measures and anti-money laundering protocols for cryptocurrency. OKX’s strategy showcases an approach of cautious audacity towards the Indian market.

Crypto Giant OKX’s Strategic Venture into India’s Promising Yet Uncertain Crypto Landscape

“Top crypto exchange OKX is preparing to venture into India’s digital space, tapping into the burgeoning Web3 developer community. Despite India’s uncertain regulatory environment, OKX plans to focus on community growth and adoption, partnering with local experts, and working towards value addition.”

Crypto Giant Exodus: India’s Tax Reform and Market Downturn Impact on CoinSwitch and CoinDCX

“Two of India’s leading crypto exchanges, CoinSwitch and CoinDCX, have started reducing their teams due to the cryptocurrency market downturn. CoinSwitch has let go 44 employees and CoinDCX has reduced its workforce by about 12%. The restructuring is a response to decreased customer queries and the impact of new tax reforms on overall business performance.”

Indian Crypto Unrest: The Tale of CoinSwitch and Blockchain’s Uncertain Future

The Indian cryptocurrency sector, currently undergoing upheaval, sees major job cuts at crypto unicorns CoinSwitch and CoinDCX due to decreasing trading volumes and strict crypto taxation. This situation reflects an uncertain future for blockchain technology and markets in regions with vigorous crypto tax regimes.

India’s Blockchain Future: Ambani’s Gamble on Blockchain and CBDCs – Opportunities and Pitfalls

Mukesh Ambani’s Jio Financial Services (JFS) is promoting blockchain adoption and exploring central bank digital currencies (CBDCs) to aid digital inclusivity and financial growth in India. JFS aims to deliver blockchain-based products while ensuring utmost security, regulatory compliance, and customer data protection.

Navigating the Crypto Paradox: India’s Call for Global Regulations Amidst Local Regulatory Hurdles

“India’s Prime Minister Narendra Modi calls for global collaboration in cryptocurrency regulation at the G20 summit. India, holding the G20 presidency, advocates for a global framework for managing cryptocurrencies, mirroring the universal guideline strategies of the aviation industry.”

CoinDCX Layoffs Amid India’s Crypto Tax Pressure: Analyzing the Tough Road Ahead for Indian Crypto Startups

CoinDCX, an Indian Crypto exchange, has laid off 12% of its workforce due to macroeconomic pressures and the recent implementation of tax deducted at source on crypto transactions. This decision comes amid struggles for crypto startups navigating India’s complex regulatory environment, declining trading volumes, and high crypto tax rates.

India’s Plan for Crypto Tokens on Native Web Browser: Progress or Roadblock?

India plans to integrate crypto tokens into its upcoming native web browser, a move propelled by its Ministry of Electronics & Information Technology. This initiative aims to foster developer ingenuity and wider crypto adoption, despite facing regulatory challenges. A prominent feature will be digitally signing documents using crypto tokens within the browser.