Republican Representatives Michael McCaul and Mike Gallagher have appealed for stricter enforcement of export controls toward China, concerning advanced chips and their manufacturing tools. Their concern follows the launch of Huawei’s Mate 60 Pro, which uses advanced chips created by China’s SMIC, despite existing U.S. sanctions. They argue that current regulations insufficiently track China’s industrial strategy and military objectives.

Search Results for: National

Harnessing Digital Yuan and Hong Kong’s FPS: A Leap Towards International Financial Synchronization or Concern for Economic Autonomy?

The digital currency research division of People’s Bank of China (PBoC) has interlinked its CBDC platform with Hong Kong’s Fast Payment System (FPS), to expedite cross-border digital yuan transactions and enhance system compatibility with international payment networks. However, this convergence of global currency networks may risk homogenizing diverse economic systems.

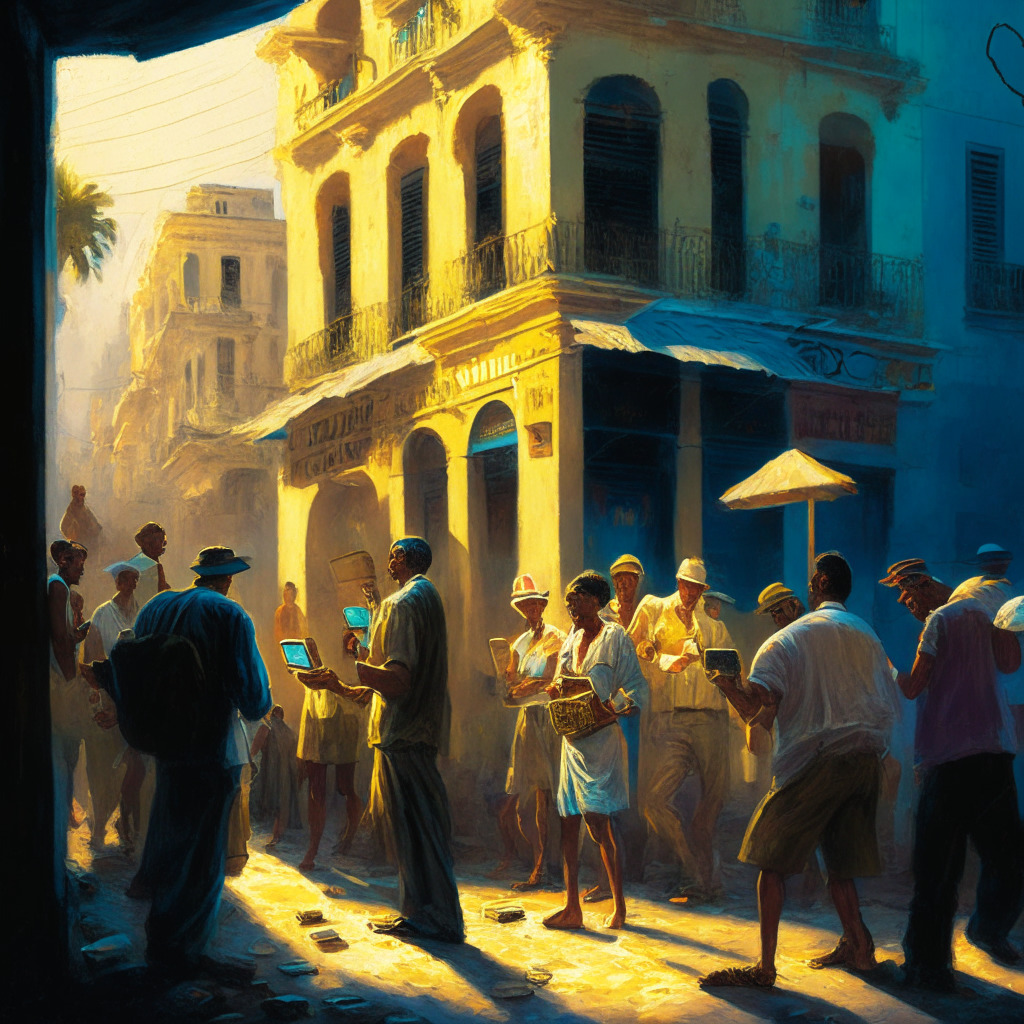

Bitcoin Awareness Rises in Cuba amid Fears of National Currency Decline

Amid devaluation of the Cuban peso and inflation, the crypto community in Havana, Cuba is turning to Bitcoin due to its relative financial stability. Despite governmental restrictions, Cubans have developed ways to buy and sell Bitcoin, hoping for a more economically secure future.

CBDCs: A Cornerstone for Future International Monetary System & the Tokenization of Finance

The Banque de France views central bank digital currency (CBDC) as a crucial component for the new international monetary system, enhancing cross-border payments. It’s being considered from an international perspective right from the outset. Two potential development pathways include building interoperability with legacy systems and creating regional or international platforms for CBDCs.

Kazakhstan’s Crypto Woes: Mining Dilemmas and National Resource Strains

“Crypto miners in Kazakhstan, the third-largest global market for Bitcoin mining hash rate, warn of extinction due to high energy prices. This situation highlights the balance between promoting growth in the crypto industry and its role in contributing to national resources and taxes.”

Russian Legislator Predicts Global Foray of Digital Ruble by 2025, Possible Shift in International Trade

A high-ranking Russian legislitor, Anatoly Aksakov, predicts that domestic corporations will utilize the nation’s digital ruble, a Central Bank Digital Currency (CBDC), by 2025, especially in Latin American nations. He also suggested potential usage could transform “mutual settlements” among these nations.

Brazil’s Blockchain Revolution: Tokenizing National Identity with Cause and Concern

Brazil is planning to tokenize the identities of over 214 million citizens through digital documents, using blockchain technology. This initiative, aiming for complete coverage by November 6, promises enhanced security against fraud and improved inter-government collaboration and service accessibility.

Blockchain Revolution in Brazil: National ID & the Prospects and Predicaments of Drex

Brazil plans to incorporate a blockchain-based system for identity verification across three states, with potential to combat crime, streamline services, and protect individual data. However, concerns remain regarding the balance of enhanced security and potential misuse risks.

Coinbase’s Expansion Emphasizes Need for International Crypto Regulations

Coinbase, a leading US-based crypto exchange, has secured approval from the Bermuda Monetary Authority to offer perpetual futures trading services outside the US. This move aims to tap into the growing retail sector interest in cryptocurrency trading, which constitutes three-quarters of the global crypto trading volumes. With a global expansion strategy covering 24 countries, Coinbase also plans to advocate for standardized cryptocurrency regulations at the G20 forum in Brazil.

Modernizing Investor Protection: Blockchain, AI, and a National Financial Fraud Registry

“CFTC Commissioner Christy Goldsmith Romero aims to modernize investor protection through technological advances. Acknowledging the need to understand FinTech, cryptocurrency, blockchain and cybersecurity, she urges the implementation of KYC and AML protocols in decentralized finance. She believes federal regulators should utilize social media for tracing funds, crypto activities and issuing necessary warnings against scams.”

Decoding the Potential of a National Fraud Registry: A Shield Against Crypto Scams?

CFTC Commissioner, AdobeChristy Goldsmith Romero proposes a centralized national fraud registry, a one-stop database for regulators to cross-reference misconduct, benefiting investors, law enforcement, and administrations. This registry aims to be a robust deterrent to potential fraudsters and a means to effectively recognize serial offenders.

International Success in Cryptocurrency Fraud Prevention: A Detailed Analysis

In a joint international effort, law enforcement bodies have successfully taken down a fraudulent investment scheme, BCH Global Ltd. Thai authorities and Homeland Security Investigation apprehended five individuals behind this scam, which cheated around 3,280 investors of approximately $76 million. The fraudulent scheme promised swift, substantial returns through investments in gold and digital tokens, USDT.

Dark Banker of London: The Ups and Downs of the Crypto Scene Amidst International Crime Allegations

“London-based fintech magnate, Caio Marchesani, is accused of laundering money for criminals through a cryptocurrency exchange. His operation allegedly utilized the anonymity provided by the crypto arena, shuffling funds to hide their illegal origin. Meanwhile, Binance cooperates with the investigation, highlighting crypto’s susceptibility to misuse and the growing intersectionality of tech and regulation.”

Global Sting Operation Exposes Cryptocurrency Scam: A Milestone in International Cyber Crime Cooperation

A multinational sting operation uncovers a company’s malicious software facilitating the theft of millions from crypto investors. Successful collaboration among international authorities was essential in arresting this operation, underlining the need for global coordination to combat cybercrime. This demonstrates the importance of vigilance and responsiveness in securing the future of cryptocurrency.

VISA Leverages Solana Blockchain and USDC Stablecoin for Faster International Payments

“VISA has enhanced its stablecoin settlement ability with Circle’s USDC stablecoin on the high-speed Solana blockchain, making it one of the first financial institutions to harness Solana for scaled settlements. VISA’s integration of stablecoins like USDC on global blockchain networks aims to improve international settlements speed and give clients a modern option to conveniently transact funds.”

International Legal Drama Unfolds: How FTX’s Sam Bankman-Fried’s Fraud Case Could Impact Crypto Cities

Sam Bankman-Fried, founder and former CEO of crypto exchange FTX, is facing a fraud trial with allegations including wire fraud. The U.S Department of Justice questions the blurred lines between FTX’s international and U.S. operations, which Bankman-Fried’s defence argues to be legally separate. The fallout of the case could significantly impact the crypto landscape.

Bitcoin City Attraction: Balancing International Appeal with Social Impact and Economic Integration

American Bitcoin enthusiast, Corbin Keegan, has reportedly relocated to Conchagua, future site of El Salvador’s continuing Bitcoin City project. However, Keegan’s relocation has highlighted potential dilemmas like integration of cryptocurrency into daily life and the risk of new residents bringing undesirable attributes.

Binance Controversy: Balancing Digital Freedom and International Sanctions Compliance

Binance, a popular cryptocurrency exchange, circumvented sanctions on two Russian banks by renaming them for local payment options. Critics argue this move may increase regulatory control over crypto markets. Meanwhile, supporters believe it demonstrates crypto’s independence from traditional financial systems and governmental interference. Binance’s actions have raised questions about crypto exchanges’ responsibility to respect international regulations.

Surge in Stablecoin Use Amid Argentina’s Political Turmoil: A Deep Dive into Crypto’s Role in National Economy

Amidst Argentina’s economic crisis and hyperinflation, Argentinians are significantly increasing their purchase of stablecoins as a viable way to protect their savings. The trend, spurred by government restrictions on foreign currency buying and a depreciating peso, also sees an increasing number of transactions and salaries being paid in cryptocurrencies. The upsurge coincides with the rise of presidential candidate, Javier Milei, who holds a positive stance towards cryptocurrencies.

Unveiling Nigeria’s Blockchain Revolution: Rethinking National Youth Service Certification

The Nigerian government is leveraging blockchain technology to counter certificate forgery in their National Youth Service Scheme. This marks a transformation towards digital certification, potentially optimizing hiring practices by ensuring document legitimacy. The country’s adoption of blockchain aims to bolster transparency and promote sustainable economic growth.

US-China AI Tug-of-War: National Security or Economic Coercion?

“The US aims to control investments in semiconductors, quantum computing, and AI technologies, leading to global effects. The friction is impacting global trade, with criticism of potential divergence from market principles. In response, China controls export of AI chip-making materials, while other countries contemplate the implications.”

Hong Kong’s Ambitious Leap Towards Becoming an International Crypto Hub: Opportunities and Challenges

“Hong Kong has begun issuing licenses to crypto companies like OSL and HashKey under new rules, expanding the city’s crypto market past professional traders. Despite interest from over 80 companies, skepticism and the complexities of adequately addressing domains like non-fungible tokens and decentralized finance hinder significant financial commitment and decisive investments.”

UK National Crime Agency Strengthens Battle Against Crypto-Crime: Promising Development or Taxpayer Burden?

The UK’s National Crime Agency (NCA) plans to hire four senior investigators to combat crypto-related crimes, particularly the activities of organised criminal syndicates. This move comes in response to an alarming rise in crypto fraud, with $287 million reportedly stolen in 2022. The initiative signifies the government’s prioritisation of digital assets security, although concerns remain about potential intrusions of privacy associated with crypto asset regulation.

India’s Place in Outlining International Crypto Regulations: Innovation or Instability?

India, currently leading the G20, reveals strategic notes on cryptocurrencies in preparation for global regulations. The initiative, involving cooperation from IMF and FSB, marks India proposing rules for crypto. The gist, expected in August, aims to highlight potential risks of the crypto world in emerging markets.

Digital Dollar Race: Wyoming’s State Stablecoin and the National Push Towards Blockchain Adoption

“Wyoming seeks to establish a state stablecoin, with the state posting a job opening for a Stable Token Commission head to create legislative frameworks for the project. Meanwhile, Texas lawmakers aim to create a gold-backed digital currency, indicating an emerging inter-state rivalry in digital currency initiatives.”

The DOJ’s Vigilance in the Crypto Environment: Unveiling the Prospects of the National Crypto Enforcement Team

The U.S Department of Justice intends to enhance vigilance in the crypto space with the National Crypto Enforcement Team (NCET). Coupled with other computer crime divisions, the NCET plans to combat digital asset-related transgressions more efficiently through larger structures and enhanced resources. The team has displayed remarkable tenacity handling cases such as FTX incidents and other crypto infringements. The focus now lies in fostering understanding of this new “digital battlefield.”

Indonesia’s National Crypto Exchange: A Pioneer Move Towards Regulated Trading or Restriction to Global Trends?

Indonesia has launched its national cryptocurrency exchange and clearing house, overseen by the Commodity Futures Trading Supervisory Agency (CFTRA). The exchange is Indonesia’s exclusive legal zone for digital asset trading. Strategic decisions by the CFTRA and Indonesia’s Ministry of Trade have shaped the country’s digital currency platform, emphasizing domestic participation and the need for international and national regulations that safeguard consumer interests.

The Digital Ruble’s Accelerated Path: CBDC Advancements amidst International Intrigue

“Russia’s CBDC project, a centralized Digital Ruble, is projected for completion by 2025-2027. The Central Bank aims for the digital ruble to coexist with traditional cash, fostering a flexible transaction ecosystem. Despite potential losses, legislation outlines a framework for the digital ruble ecosystem that ensures high-level cybersecurity and reliability in a balanced, meticulously designed solution.”

National Australia Bank Blocks Certain Exchanges: A Necessary Safeguard or Hindrance to Crypto Progress

The National Australia Bank (NAB) announced blocks on certain “high-risk” crypto exchanges to prevent scams and protect customers. Critics argue this could limit the crypto industry’s growth. NAB claims about 50% of scam funds reported in Australia are linked to cryptocurrency, emphasizing the need for a balance between efficiency and security in financial transactions.

The Rising Tide of Crypto: BlackRock, Regulation, and the Future of International Finance

“Cryptocurrencies, according to BlackRock’s CEO, Larry Fink, are poised to reshape international finance, offering unique portfolio diversification that transcends traditional currency borders. However, he subtly highlights that cryptocurrencies aren’t exempt from regulatory and safety challenges in the financial landscape.”

Cross-Border Potency of Digital Rubles and Yuan: Boon or Bane for International Trade?

The dialogue between Russia and China’s central banks is accelerating speculation around Central Bank Digital Currencies (CBDCs). While Russia aims for early initiation with domestic commercial banks, China is progressing with offline and CBDC wallet tests. Meanwhile, Russia’s new legislation permits “non-residents” to own digital ruble wallets, establishing the digital ruble as an international trading tool. These developments challenge traditional banking norms and raise questions concerning international trade norms, regulations, and digital security.

Bakkt Aims for International Expansion Amidst Unclear US Regulatory Landscape

Bakkt, a crypto-economy firm, expresses interest in expanding its operations to Hong Kong, the United Kingdom, and some European Union regions due to favorable regulatory environments. This follows Bakkt’s acquisition of Apex Crypto, leveraging partners like Webull, Public.com, and Stash to facilitate global growth. However, pesky regulatory uncertainties in the U.S. complicate alliances and force delisting of certain cryptocurrencies.