“Num Finance has launched nCOP, a token pegged to the Colombian peso, utilizing the Polygon framework for transfer, payment, saving, and earning through blockchain. Stablecoins offer flexibility and can be used for remittances, store of value, and potentially yield profit.”

Search Results for: Num Finance

The Balancing Act of Tokenization: Bridging Blockchain and Traditional Finance Amid Regulatory Challenges

“Tokenization, or representing real-world assets as blockchain tokens, offers advantages like easier asset management. However, firms must comply with regulation standards, understand duties linked to tokenized assets’ public offerings, and regularly audit assets. An adaptable compliance solution is crucial, given the evolving nature of token regulation.”

Heartening Rise of $WSM: Outpacing Iconic Meme Coins & Aspiring to Democratize Finance

Wall Street Meme’s $WSM meme coin is rapidly gaining traction in the crypto landscape, with a 183% price surge giving presale buyers nearly 3x returns. The coin’s high trading volume and a potential October launch of a major product are contributing to growing anticipation in the market.

DeFi Dip or Adjustment: Analyzing Recent Drop in Decentralized Finance Activity

“The DeFi sector experienced a 15.5% drop in August, leading to speculations of losing steam. Despite this, investor interest remains strong with blockchain infrastructure and DeFi investments totalling $580 million. The growth of DApp ecosystems offers optimism, but recent security breaches cause concern.”

Traditional Finance Players Diving into Crypto: Progress or Path to Centralization?

“The recent trend of traditional finance players entering the cryptocurrency market has the potential to disrupt norms, increase flexibility, and power the underbanked. However, it also presents challenges, such as volatility, fraud, and security issues. Moreover, there’s a debate surrounding if this move could lead to centralization in an inherently decentralized space.”

Harnessing Blockchain and Cryptocurrency Statistics in Traditional Finance Institutions

“Cryptocurrency and blockchain statistics offer critical insights into the health of the crypto industry for traditional finance institutions. Key metrics such as realized cap, Bitcoin’s halving, hash rate, and growth in wallets storing significant BTC quantities provide invaluable data for strategic decision-making in the ever-evolving cryptocurrency market.”

Dismissal of Lawsuit Against Curve Finance’s CEO: An Unfolding Legal Drama in Decentralized Finance

A lawsuit against Curve Finance’s CEO, Michael Egorov, alleging fraud and misappropriation of trade secrets was dismissed by a California judge due to procedural technicality. Egorov’s lawyers argued the case belongs in Switzerland, where both Egorov and his company, Swiss Stake resides.

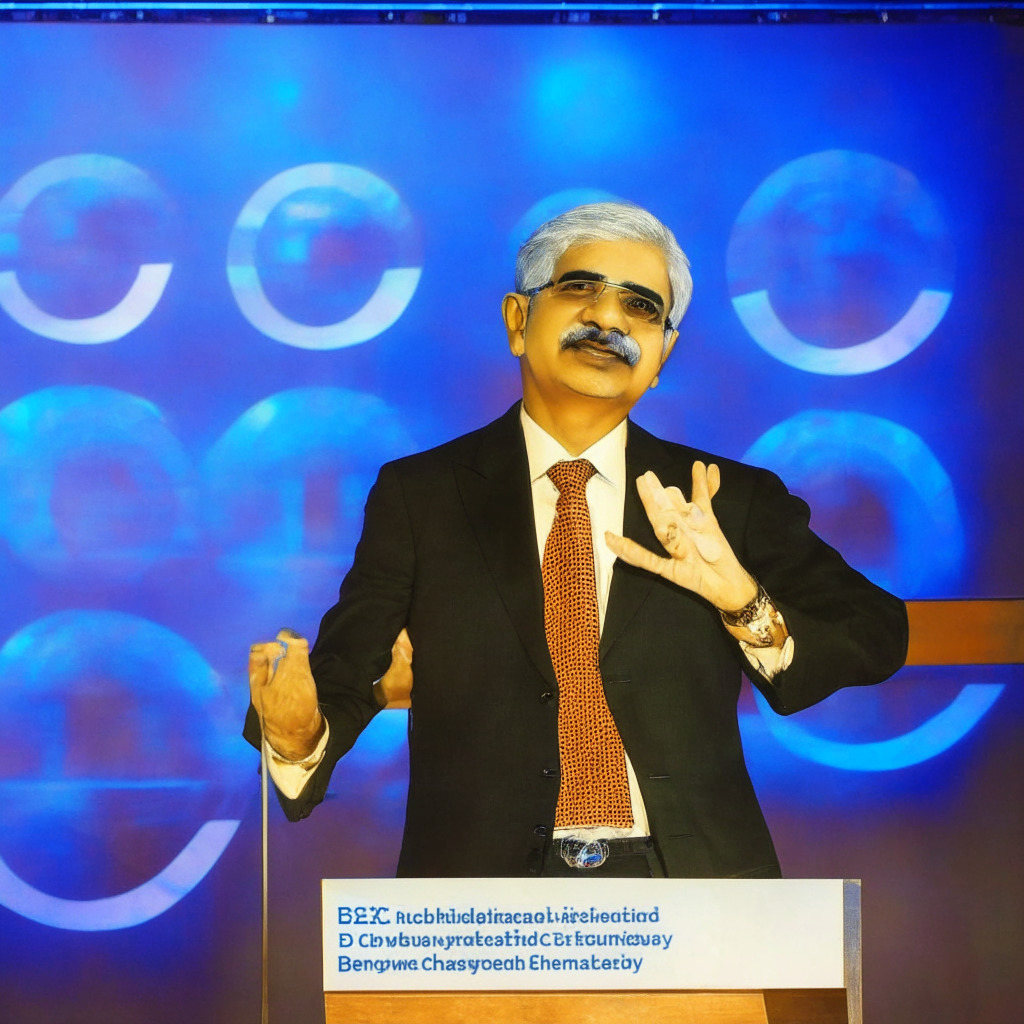

Unleashing the Power of CBDCs: India’s Approach to Revolutionizing Global Finance

Reserve Bank of India’s Governor, Shaktikanta Das, emphasized the transformative potential of Central Bank Digital Currencies (CBDCs) in a recent G20 TechSprint Finale address. He outlined their potential to revolutionize international payment landscape by reducing costs and increasing transparency. India, currently testing its own CBDC, engages in comprehensive data collection and analysis for future policies. They also invite innovative solutions for cross-border CBDC platforms.

Merging Finance and Blockchain: eToro’s Radical Shift versus Elon Musk’s Risky Maneuvers

“Yoni Assia, eToro’s co-founder, embraced financial technologies to democratize trading. eToro, under his steer, simplified brokerage account set up, enabling users to start trading swiftly. Influenced by programmer Vitalik Buterin, eToro introduced Bitcoin trading, aiding in a blockchain industry transformation.”

European Premier: The Launch of Bitcoin ETF and What It Means for Global Finance

Jacobi Asset Management has launched Europe’s first Bitcoin exchange traded fund (ETF), listed on EuroNext Amsterdam Exchange. The product aims to drive Bitcoin adoption among institutional investors, levying a 1.5% annual management fee. The ETF also represents a move from Europe’s prevalent Exchange Traded Notes (ETNs), while committing to minimizing Bitcoin’s carbon footprint.

Crypto Wallets Under Siege: Unpacking Security Testing & Vulnerability in Digital Finance

“A recent report by CER revealed that only six out of 45 reviewed crypto wallets conducted penetration testing to identify security vulnerabilities. Despite the alarming number, some wallet brands are using alternative methods like bug bounties to uncover vulnerabilities, thereby raising questions about the effectiveness of current security strategies in protecting digital assets.”

Saddle Finance Shutdown: A Portentous Shift in Blockchain dynamics or a Necessary Precaution?

“The recent announcement of Saddle Finance, an Ethereum-based crypto trading protocol, to cease operations and disburse its treasury to its investors, paints an intriguing picture of the changes in the blockchain space. This incident, following a major hack on Curve, serves as a stark reminder of the ever-present threat of exploitable bugs in the blockchain universe, and stresses the importance of investor vigilance.”

Crypto Market Crossroads: DeFi Security Woes, Regulatory Uncertainty, and Ethereum’s Monumental Growth

“Recent DeFi security incident, leading to $61 million theft, raises questions about security robustness in this sector. HashKey and OSL’s milestones signify Hong Kong’s evolving crypto scene. As US DoJ weighs charges against Binance, CoinBase counters delisting reports, while Ethereum celebrates its 8th birthday amid tumultuous times in crypto market.”

Decentralized Finance’s Future: Evaluating the Potential and Challenges of Velvet Capital

“Emerging from obscurity, DeFi is gaining influence in finance as enterprises and individuals pivot from centralized bodies to decentralized alternatives. Velvet Capital, backed by Binance Labs, offers on-chain digital asset management. Yet, concerns linger about security risks and skepticism towards its approach remains.”

Navigating the Crisis: Curve Finance Founder’s Struggle with $80 Million On-Chain Debts

Michael Egorov, the founder of Curve Finance, faces a potential crisis due to approximately $80 million on-chain debts to several lending platforms. Despite selling 72 million CRV tokens to mobilize funds, the risk remains high, especially if the CRV price drops dramatically.

Decoding Term Finance: Navigating Loan Volatility in the DeFi Landscape

“Term Finance, gaining traction in the decentralized finance (DeFi) realm, offers short-term, fixed-interest rate loans on the Ethereum mainnet. This innovative model provides a solution to variable-rate crypto loans’ unpredictability, with assurances for borrowers and lenders through a weekly auction model.”

Shibie Coin: Mixing Fandom and Finance in the Blockchain Era

Introducing Shibie Coin, an enchanting fusion of the Shiba Inu and Barbie’s iconic aura, disrupting the crypto realm. This token promises potential sky-rocketing gains with its dedicated marketing, DEX and CEX listings, and engaging advancements like an AI-driven Shibie bot. Ensure due diligence due to crypto investments’ high-risk nature.

Navigating the Splendid Yet Dicey Intersection of Metaverse, NFTs and Web3 Finance

“Animoca Brands has invested $30 million into a Web3 payments application called ‘hi’, which aims to enable non-fungible token functionality within a broader Web3 ecosystem. This strategic alliance, seeks to expand into global markets, raises questions about regulation, privacy, and accessibility.”

Crypto Heist Chronicles: The $888,000 Rodeo Finance Exploit – Unraveling the Clever Labyrinth

“Rodeo Finance on the Arbitrum network lost 472 ether ($888,000) in a crypto exploit. The hacker utilized Oracle manipulation techniques to adjust price feeds and exchange stolen tokens into diverse assets, before converting them back into ether. Such incidents highlight the increasing risk and vulnerability in the DeFi domain.”

15 Central Bank Digital Currencies by End of Decade: A New Era of Finance or Privacy Threat?

By the end of this decade, around 15 retail central bank digital currencies (CBDCs) could be globally available, covering nearly 95% of the world economy according to BIS. This emerging technology can offer significant benefits, but also brings challenges like privacy concerns.

JPM Coin’s Blockchain Milestone: Changing Finance Landscape and Challenging Skeptics

JP Morgan marked a milestone by conducting its first blockchain-based transaction using JPM Coin for corporate clients in Europe, with Siemens AG leveraging the system for a euro-denominated payment. This highlights the growing adoption of blockchain technology for secure and efficient financial operations, as traditional institutions increasingly explore its potential for their businesses.

SAP Tests USDC for Cross-Border Payments: A Glimpse into Blockchain’s Future in Finance

German software giant SAP plans to utilize the US Dollar Coin (USDC) for testing cross-border payments, aiming to resolve complications faced by SMEs. If successful, this could lead to increased Ethereum-based cryptocurrency adoption and highlight the potential of decentralized finance (DeFi) in the payments industry.

Valkyrie Bitcoin Fund: Bridging Traditional and Crypto Finance – Pros, Cons, and Conflicts

Valkyrie Digital Assets updated its filing for the Valkyrie Bitcoin Fund, aiming to provide investors an affordable way to invest in Bitcoin. The fund would reflect the price of CME CF Bitcoin Reference Rate – New York Variant (BRRNY). Valkyrie’s potential success hinges on overcoming regulatory challenges and market sentiment.

Finance Giants Enter Crypto: EDX Markets’ Regulated Approach vs Innovation Potential

EDX Markets, a crypto exchange backed by major finance players, recently launched targeting institutional investors. With close collaboration with US securities regulators, it avoids regulatory hurdles and takes a cautious approach by offering only four cryptocurrencies – Bitcoin, Ether, Litecoin, and Bitcoin Cash – for trading. The platform’s focus on regulation may impact innovation potential in the crypto world.

Tokenization’s Future: Balancing Decentralization, Security, and Scale in Finance

Michael Hsu, acting head of the U.S. OCC, acknowledges tokenization’s potential in transforming finance but expresses concerns over decentralized blockchains. He suggests that centrally operated, trusted blockchains can achieve security and scalability, emphasizing the importance of a legal framework to support tokenization and interoperability with existing financial systems.

Tokenization Revolution: Taurus, Polygon & the Future of Mainstream Finance

The partnership between Swiss digital asset infrastructure provider Taurus and Ethereum scaling network Polygon highlights the growing traction of blockchain technology and tokenization within mainstream finance. With numerous financial institutions seeking blockchain-agnostic and token-agnostic infrastructure, the landscape will continue to evolve, attracting players from various sectors and revolutionizing asset management solutions while addressing security, scalability, and compliance concerns.

Decentralized Finance: Revolutionizing the Future or Breeding Ground for Risks?

Blockchain technology promises to revolutionize finance with decentralization, transparency, and reduced fees. However, concerns about security, regulation, anonymity, environmental impact, and resistance from traditional financial institutions must be addressed for its broader adoption and success.

Ethereum vs Visa: Battle of Transaction Giants and the Future of Finance

Ethereum’s $3.01 trillion in transaction processing approaches Visa’s $3.08 trillion, showcasing mainstream adoption of the versatile blockchain technology. With solutions like DeFi, staking, and lending, Ethereum challenges traditional payment giants and revolutionizes the global finance market.

Exploring the Future of Traditional Finance Assets on Blockchain: Possibilities and Challenges

Don Wilson, founder of DRW and co-founder of Digital Asset Holdings, discussed the potential future of traditional finance assets on the blockchain, emphasizing its growing capacity for digitization. Canton Network’s permissioned blockchain technology enables real-time value movement and 24/7 access, potentially improving clearinghouse resilience.

Bitcoin: Future Monetary Dominance or Trapped in Traditional Finance’s Shadow?

Bitcoin’s growing number of “wholecoiners,” or addresses holding at least 1 BTC, indicates potential shift towards hyperbitcoinization, where Bitcoin replaces traditional financial institutions as the dominant value system. However, debates persist on the superiority of centralized fiat systems for everyday transactions and challenges including cybersecurity remain in the crypto market.

Integrating DeFi and Traditional Finance: Galaxy’s OTC Options Trade Shifts the Game

Galaxy Digital’s first over-the-counter (OTC) option trade marks a significant stride towards integrating traditional finance and decentralized finance (DeFi). This development follows the collapse of FTX and several crypto lenders, highlighting risks associated with centralized finance practices. DeFi continues to gain momentum as market participants recognize its potential in reducing inherent vulnerabilities in traditional bilateral options trading.

Compound Finance on Arbitrum: Evolving DeFi Ecosystem and Layer-2 Scaling Debate

Cryptocurrency platform Compound Finance is deploying its latest iteration on scaling solution Arbitrum, focusing on selected cryptocurrencies like ETH and WBTC. This development represents a commitment to optimizing technology and making lending and borrowing idle digital assets more affordable.