“South Korea’s virtual asset market recorded a buoyant performance in H1 2023, reaching a market cap of $21.1 billion, a 46% increase from last year. Crypto exchanges enjoyed an 82% rise in operational profits, supported by an 11% growth in deposits. However, daily transaction value and the number of crypto traders experienced slight decreases. New legislation promises to enhance transparency and security in the crypto trade, signaling the increasing legitimization of cryptocurrencies.”

Search Results for: Optimism

Impending Bitcoin and Ether Options Expiry: Treading the Fine Line of Caution and Optimism

“A notable Bitcoin options expiry event involving roughly 14,000 contracts, valued around $400 million, is set for October 6. With a ‘max pain’ point at $27,000, and a near even split between long and short positions, this event could significantly influence the market. Alongside, 200,000 Ether options contracts also expire, potentially altering the market dynamics.”

Unraveling the Paradox of Increased Decentralization: The Optimism Network’s Stride and Binance’s Unexpected Move

The Optimism network has launched its testnet version of a fault-proof system aimed at increasing the efficiency and decentralization of the Superchain. Typically reliant on centralized sequencers, the new system offers modular options to prevent fraud. However, co-founder of Ethereum, Vitalik Buterin, asserts the importance of user-submitted fraud proofs to maintain true decentralization.

Optimism Navigates Through Financial Headwinds Ahead of Major Token Unlock

“Ethereum layer 2 network, Optimism, faces a financial downturn as its token, OP has dropped almost 10% in the run-up to its planned token unlock on September 30. This downward trajectory in prices reflects the increased supply’s impact on asset value.”

Impending Token Unlock for Optimism: A Balance of Growth and Uncertainty

The Ethereum layer 2 network, Optimism, anticipates a token unlock on September 30, posing some uncertainty for its native token. This unlock involves unwrapping 24.16 million tokens (around $31.1 million), representing a 3% sliver of total circulating supply. Preluding the unlock, Optimism announces a release of 570 million tokens for future airdrops, with allocations based on community participation and governance votes.

The Rain of Tokens: How Optimism’s 3rd Airdrop Fosters Blockchain Community Participation

“Layer 2 network Optimism launched a third airdrop of OP tokens, distributing 19.4 million tokens to over 31,000 wallets. The airdrop aimed to boost community involvement in the Optimism Collective’s delegation activity and to encourage users to vote in governance.”

Unraveling Optimism’s OP Token Value Decline and Celsius Bankruptcy Saga: A Tale of Strategic Market Moves

“Optimism’s native OP token experienced a significant 10% loss due to a large-scale token unblocking event that introduced an estimated $30 million worth of tokens into the market. Despite this, the token made a recovery, reflecting the inherent volatile nature of the crypto world.”

Parsing Katie Haun’s Crypto Optimism amid Regulatory Concerns: A Deep Dive into Crypto Market Evolution

Former a16z general partner Katie Haun maintains optimism about the cryptocurrency market despite recent corrections. She manages two investment funds translating to $1.5 billion, signaling her bullish sentiments. Haun highlighted regulatory issues, criticizing the SEC for overstepping its original jurisdiction, specifically in non-traditional areas like crypto.

Optimism Network’s Major OP Tokens Private Sale: Economic Genius or Price Plunge Catalyst?

“Optimism Network plans to sell 116 million OP tokens via a private sale, expected to generate $160 million. The tokens are drawn from the unreserved portion of the OP token treasury and are subjected to a two-year lock-up period. This strategic approach aims at expanding Optimism’s market reach responsibly without affecting the token’s value.”

Ethereum Co-Founder’s Optimism Amidst Crypto Regulation Uncertainties: A Balanced Future?

Joseph Lubin, co-founder of Ethereum and CEO of ConsenSys, maintains a positive outlook on cryptocurrency’s adoption in the US. He draws parallels to the country’s past approach to emerging technologies like the internet, insisting that “clear heads will prevail” amid industry unrest and regulatory ambiguities.

Blockchain Future in Nigeria: Regulatory Challenges and Optimism on the Road Ahead

The Digital Assets Summit by SIBAN discussed Nigeria’s regulatory stance on blockchain technology. Stakeholders addressed concerns over the Central Bank’s reluctance to adjust crypto policies. National IT Development Agency’s new Blockchain Policy shows government’s progressive stance, focusing on Web3 Education to improve blockchain’s penetration despite language barriers and regulatory uncertainties.

New Financial Regulations Tease Blockchain Future: Navigating the Dynamic Between Optimism and Ambiguity

“The United States Financial Accounting Standards Board (FASB) is implementing regulations in 2025 that let firms report their digital asset holdings quarterly, eliminating financial misperception caused by impairment losses. This provides optimism for tech firms and digital asset companies, despite existing ambiguity surrounding institutions like the SEC.”

Proposed Ether ETF Sparks Optimism Amid SEC Delays: Implications & Challenges for Crypto Markets

Amid delays from the SEC on Ark Invest’s spot Bitcoin ETF, Ark Invest and 21Shares have proposed an investment vehicle with Ether exposure, using Coinbase as the custodian. The proposal joins several crypto ETFs awaiting SEC scrutiny. The SEC’s upcoming November decision could have significant implications for the crypto market. Despite the uncertainty, there’s an optimistic sentiment within the crypto markets.

Crossing Bridges: USDC Expansion to Base & Optimism Networks – A Milestone or Misstep?

In a significant development, USD Coin (USDC) has expanded to Base and Optimism networks, allowing Coinbase and Circle account holders to directly transfer their USDC stablecoin to Base. However, the new native USDC struggles with full integration across networks, causing user confusion and scepticism. The future of this decentralized currency hinges on balancing innovation, competition, and user convenience.

Bitcoin Spot ETF Reconsideration: A Cause for Optimism or Premature Euphoria?

The U.S. Security and Exchange Commission’s reconsideration of Grayscale’s Bitcoin spot ETF has sparked optimism among market participants. Despite this, some remain cautious, warning that the decision doesn’t guarantee Grayscale an ETF listing. Further, the stagnation of digitized asset markets and potential negative effects of bitcoins held at short-term loss could impact faith in Bitcoin. However, the decision suggests possible future favorable decisions on regulatory reforms in the U.S. digital asset markets.

Divergent Behaviors of Bitcoin Holders: Upholding Optimism Amidst Market Instability

“In the fluctuating crypto-world, data showed a stunning 40% of Bitcoin remained untouched for over three years, marking a high metric of consensus. Contrarily, newer long-term Bitcoin holders displayed trepidation during the recent price drops. These opposite behaviors foreshadow an uncertain future for cryptocurrencies, influenced by both bullish and bearish forces.”

Blockchain Opportunities and Threats: Multichain Hack, Base-Optimism Collaboration and Shibarium’s Relaunch

Amid a $1.5 billion Multichain hack investigation and potential seizure of Multichain funds, Base and Optimism networks are expanding blockchain’s reach with initiatives in governance and revenue-sharing. Simultaneously, Quantstamp unveils a service to detect flash loan attack vulnerabilities, forwarding blockchain security.

Irony in Crypto: $7.3M Heist on ‘Optimism’-Based Exactly Protocol, a Call for Enhanced Regulation

“The Exactly Protocol, victim of a recent exploit resulting in a $7.3M loss, is offering a $700,000 bounty for information leading to the perpetrator’s capture. The hacker slipped through security measures, deploying a harmful contract and stealing deposited USDC. Following the hack, Exactly Protocol proposed a fix, alerting the community and attempting to negotiate with the hacker, who has not responded.”

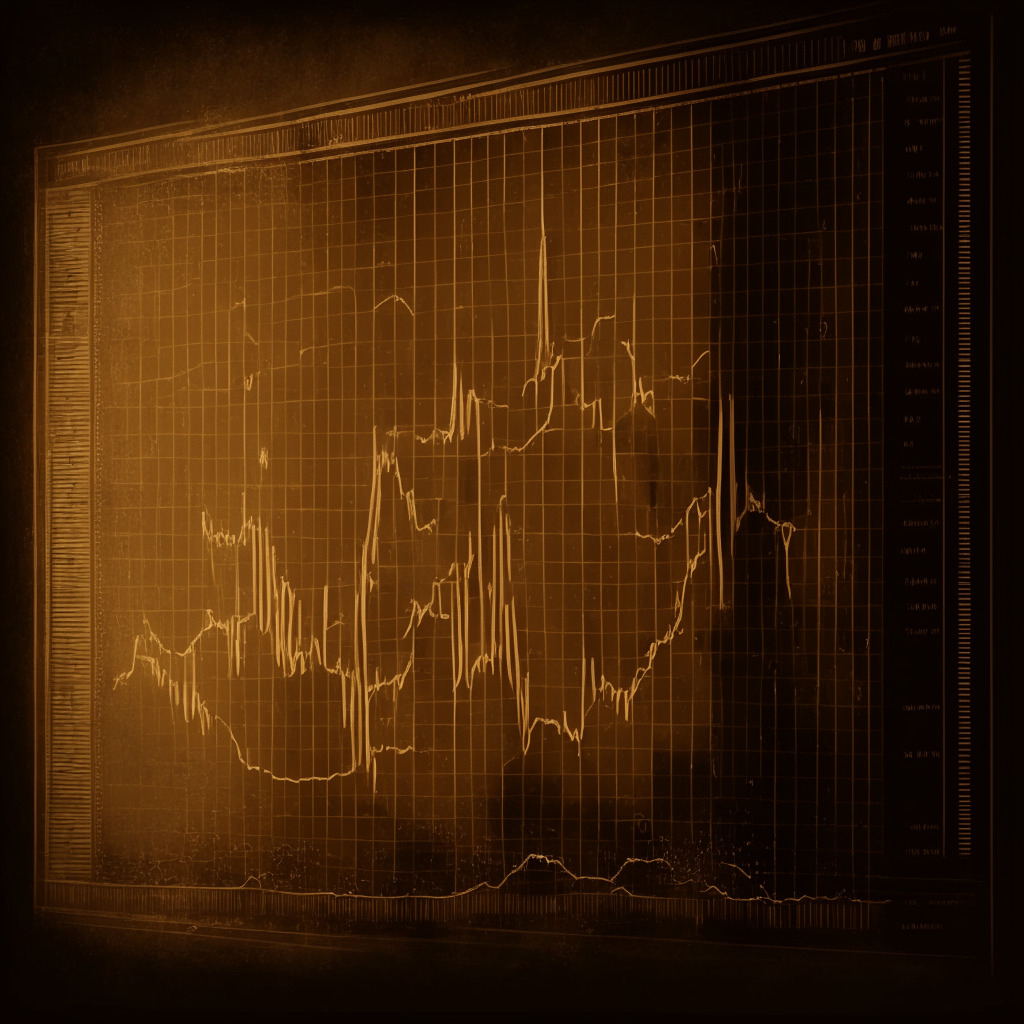

Ethereum’s Optimism Rally: A Glimpse of Hope or Looming Danger? Exploring LPX as an Alternative Strategy

“Optimism, an Ethereum layer-2 scaling solution, is experiencing a recovery rally. Despite a -28.5% slide since May, sentiments are bullish. However, impending resistance areas, particularly the 20DMA, may cause hurdles. It’s also at risk of a downturn if there are SMA rejections. The future could go either way, highlighting the 1.14 risk:reward ratio.”

Emerging Altcoins Defy Bearish Trends: The Thin Line Between Skepticism and Optimism

“In a bearish market, few altcoins like HBAR, OP, INJ, and RUNE show potential growth opportunities, displaying resilience. Despite declining Bitcoin value and broader market trends, these altcoins demonstrate strength through robust support levels or continued growth, indicating potential upside momentum.”

Emerging Ether Futures ETFs: A New Crypto Dawn or Blind Optimism?

The U.S. Securities and Exchange Commission (SEC) may give approval to Ether (ETH) futures ETFs, signaling a shift in regulatory stance towards cryptocurrency. However, while this introduces new investment opportunities, it doesn’t guarantee investor protection or diminish the crypto market’s volatility. Therefore, investors must independently understand the risks and rewards.

Bitcoin’s Future: The Battle between Bullish Optimism and Regulatory Uncertainty

Cryptocurrency markets, particularly Bitcoin, are seeing significant fluctuations, with predictions both optimistic and pessimistic. Some analysts express confidence due to an increase in Bitcoin adoption by major investors, while others cite regulatory ambiguity as a cause for potential prolonged market dips. Navigating these varying predictions requires careful research and expert advice.

The Diverging Pathways of Optimism Token and Emerging Challenger XRP20

“The Optimism token (OP) is seeing potential downward trend after losing support from the 20-Day Moving Average (20DMA). Despite a risk-reward ratio not in its favor, Optimism’s Relative Strength Index shows hope for upturn. In contrast, XRP20, an Ethereum-compliant ERC20 token offers new utility in the XRP space and enticing staking rewards, ahead of traditional XRP.”

Bitcoin Bull Run: Macroeconomic Factors, ETF Optimism, and Impending Risks

“Bitcoin’s value increased by 1.60%, influenced by key macroeconomic aspects including the expected CPI report and impending Federal Reserve interest rate decision. Rising hopes for a Bitcoin ETF approval also catalyze this strengthening. However, Bitcoin faces challenges in surpassing the $30,200 barrier according to technical indicators.”

Bitcoin Bouncing Back: Unfolding Drama between Optimism and Skepticism in Crypto Markets

Bitcoin’s price has demonstrated a strong recovery back above $29,000. Despite this, skeptics argue the Bitcoin bears are still in control. However, on-chain analytics suggest that Bitcoin is “close to being oversold”, indicating a potential forthcoming price rebound. Advocates and critics continue to debate the likely trend.

Inflation Data and its Impact on Bitcoin: Boat of Optimism or Iceberg of Risk?

The anticipation of further U.S. inflation data, such as July’s Consumer Price Index (CPI) report, has Bitcoin enthusiasts hopeful for positive impact. However, a surprise spike in inflation could potentially dampen Bitcoin’s progress by leading to further interest rate hikes.

Navigating Bitcoin’s 2023: Market Swings, Security Threats, and Cautious Optimism

Bitcoin is currently unstable due to recent U.S Federal Reserve’s lending rate hikes and a major security breach at Curve Finance affecting Ethereum pools. Despite this, experts still anticipate positive trends for bitcoin spurred by clearer global economic trends.

Crypto Investment Trends: A Cautious Optimism Amid a Downtick in Funding

“Crypto projects garnered a substantial $129 million from investors last week, dominated by infrastructure projects and early-stage deals – signals of cautious optimism within the fluctuating market. Despite a contraction in late-stage transactions, the continual investment indicates sustained interest in blockchain technology.”

Navigating Crypto-Investment Waves: Riding High on Novogratz’s Optimism Amid Regulatory Ambiguities

“Mike Novogratz, founder of Galaxy Digital, advocates for a diversified investment portfolio including Alibaba, silver, gold, and cryptocurrencies. He also expressed enthusiasm about Bitcoin’s prospects, especially following BlackRock’s application for a Bitcoin ETF, but also warned about crypto regulation uncertainties.”

Future BTC Fluctuations: Optimism or Caution Amid Declining U.S Inflation?

“Despite potentially favourable market conditions, Bitcoin’s price action only registered a slight boost. Reputed analysts suggest U.S inflation is under control, contributing to crypto market stability. However, Bitcoin’s volatility remains unaffected, stuck within the range of $29,000 to $29,500. Various successful traders predict a likely downturn. Hence, investors must make judicious decisions, understanding the associated risks.”

Unlocking the Future: Optimism’s Beam Wallet Redefines Crypto Transactions

“Step into the future with blockchain-based Beam wallet. This innovative application uses Twitter for login, eliminating the need to store seed words. Backed by top Web3 venture capitals, it aims to enhance user experience, increase adoption rate and ensure security by not landing passwords on a centralized server.”

The Blockchain Dance-Off: Optimism Outperforms Arbitrum in Transaction Volume Reversal

Optimism, a Layer-2 solution for Ethereum utilizing optimistic rollup technology, has surpassed its rival Arbitrum in terms of transaction volume for the first time in six months. This was largely driven by the launch of Worldcoin on Optimism and a reduction in transaction fees due to Optimism’s Bedrock upgrade. However, Optimism still trails Arbitrum considering the total value locked within contracts.