Crypto enthusiast Richard Heart, real name Richard Schueler, is accused by the SEC of raising $1 billion in unregistered securities offerings and misusing funds intended for his projects, Hex, PulseChain, and PulseX. His alleged luxury purchases with investor funds violated federal securities laws. Amidst this, the SEC is pushing for heightened crypto industry oversight in 2023.

Search Results for: Richard Ma

Deribit’s Expansion: Trading Options for SOL, MATIC, XRP amidst Market Volatility

Deribit, the largest cryptocurrency options exchange, announced plans to introduce options trading for altcoins Solana, Polygon, and Ripple. Despite tumbling prices and regulatory uncertainties, this move could boost liquidity, enable risk management, and strengthen Deribit’s position in the volatile market.

Unmasking Binance: Differentiating from FTX Collapse and Navigating Regulatory Challenges

“Richard Teng, head of regional markets at Binance, clarified that unlike the collapsed FTX, Binance’s assets are backed one-to-one, offering a safety net for users. He also revealed commitment to international norms, including MiCA regulation, and tackling regulatory hurdles to maintain complete compliance.”

Dismissal of Lawsuit Against Curve Finance’s CEO: An Unfolding Legal Drama in Decentralized Finance

A lawsuit against Curve Finance’s CEO, Michael Egorov, alleging fraud and misappropriation of trade secrets was dismissed by a California judge due to procedural technicality. Egorov’s lawyers argued the case belongs in Switzerland, where both Egorov and his company, Swiss Stake resides.

Unmasking the Impact of FASB’s Proposed Accounting Rule for Cryptocurrency

The Financial Accounting Standards Board (FASB) is proposing the first U.S. specific accounting rule for cryptocurrency, endorsing a fair-value approach for measuring digital assets. This could lead to wider crypto adoption, requiring businesses to report crypto dealings in quarterly income statements, promoting increased visibility and scrutiny. However, it’s uncertain if this will accelerate or slow corporate crypto adoption.

Navigating the Tempest: The SEC, Richard Heart, and Allegations of Crypto Deception

The U.S. Securities and Exchange Commission (SEC) is pressing charges against Richard Heart, the backer of projects Hex, PulseChain and PulseX, accusing him of fraudulent practices. Heart allegedly recycled investment funds during Hex’s inception phase, effectively inflating initial investment, attracting more victims, and misleading investors with a fictitious “staking” program. This serves as a warning to evaluate the underlying technology and financial models of investment targets.

Surfing the Crypto Wave: An Analysis of Recent Market Volatility and Opportunities

“Bitcoin climbed back near $29,200 amidst market volatility following Curve’s recent exploit, while Tron founder stabilizes the troubled CRV token. Despite chaos, investors are drawing strength from Sun’s relief efforts, hinting at market’s increasing sophistication. However, market sentiment remains jittery.”

Navigating the Risks and Rewards of Meme Coins Amidst Crypto Market Turbulence

Cryptocurrency world is undergoing some unease due to recent security breaches and lawsuits. Despite the risk, investors remain attracted to meme coins for short-term profits. However, these coins lack substantial utility, making their long-term value questionable. Caution and discretion are advised in this high stake investment realm.

Navigating Volatility: A Peek into the Risk, Reward, and Resilience of Cryptocurrency Markets

“Cryptocurrency including Bitcoin is on a downward trend, significantly influenced by second quarter performance. This dynamic market, subject to influence from major investors and legal issues, relies on indicators like market depth to predict behavior. The potential impact of large-scale liquidations further complicates this unpredictable field.”

Crypto Market Flux: Regulatory Tremors, Political Shocks, and IRS Intrusions

The crypto market recently experienced a plunge, with Bitcoin dipping around 2%, amidst political and lawsuit shocks. The SEC has accused Richard Heart, Hex creator, of selling unregistered securities worth $1 billion, causing the HEX price to plummet. This has led to increased anxiety in the crypto community, with investors also watching out for potential regulations. Meanwhile, the IRS has issued a ruling requiring US taxpayers to add crypto staking rewards to their annual income. Despite the challenges, crypto enthusiasts see potential in the top 15 digital assets for 2023, but caution and thorough research are advised.

Binance Expansion Into Japan – A Cryptocurrency Leap or Regulatory Nightmare?

“August 2023 sees Binance confirm the rollout of its full services in Japan. This follows the May 2023 announcement of the platform and its acquisition of Sakura Exchange Bitcoin as an entry point into the Japanese market. Despite regulatory challenges globally, Binance remains hopeful about expansion.”

Decoding the Bullish Sentiment in Bitcoin’s Options Market amidst Choppy Pricing Trajectory

“Despite recent volatility and speculative downturn in cryptocurrency, the options market remains optimistic, with a palpable, positive call-put skew signaling a persistently bullish sentiment. Significant trading action indicates market expectations for Bitcoin values to breach the $31,000 barrier, potentially revitalizing the rally.”

Breaking Down The AI Training Ethical Dilemma: Copyright Claims Against Meta Platforms and OpenAI

Authors Sarah Silverman, Richard Kadrey, and Christopher Golden accuse Meta Platforms and OpenAI of copyright infringement, claiming that their copyrighted content was used without permission for AI training. The lawsuit highlights the ethical boundaries around incorporating copyrighted material into AI technology development and could have significant implications for the blockchain and AI industry.

Deciphering the Crypto Market: The Rising Whale Holdings and Their Absence from Exchanges

“Despite an upward trend in large bitcoin holders, known as whales, there was a significant reluctance to move these assets onto centralized exchanges according to Glassnode data. This could potentially point to a bullish sentiment amongst investors, influencing their behaviour due to factors such as exchange risks and regulatory hindrances.”

Peter McCormack’s Love-Hate Relationship with Twitter: The Impact on His Bitcoin Podcast

Peter McCormack’s podcast, What Bitcoin Did, gained success and over a million listeners per month through Twitter promotion. Despite benefiting from the platform, McCormack also acknowledges Twitter’s tendency to elevate negative behavior and conflicts, blurring its overall impact.

Meta’s Controversial Release of LLaMA AI: Examining Security Risks and Ethical Implications

U.S. Senators Blumenthal and Hawley criticize Meta’s “unrestrained and permissive” release of AI model LLaMA, fearing its potential misuse in cybercrime and harmful content generation. They question Mark Zuckerberg about risk assessments and mitigation efforts prior to LLaMA’s release, emphasizing the importance of responsible AI development and oversight.

Meta’s LLaMA Drama: Senators Scrutinize Leak and Potential Misuse of AI Model

U.S senators raise concerns over Meta’s large language model (LLaMA) potential misuse in harmful activities, questioning Meta’s risk assessment and preventive steps. LLaMA’s leak increased accessibility to high-quality AI models, prompting scrutiny on the balance between innovation and risk.

Richard Teng: The Key to Binance’s Regulatory Future or a Mere Illusion?

Binance, facing numerous regulatory challenges, may find a way forward with potential CEO successor Richard Teng, a civil servant-turned-crypto executive. Teng’s background in Singapore’s central bank and Abu Dhabi’s free-trade zone makes him an exceptional candidate to guide Binance through its regulatory storm and help the company navigate complex regulatory landscapes.

Richard Teng’s Role in Binance’s Future: Bridging the Gap with Regulators and Expanding Globally

Richard Teng’s appointment as overseer of Binance’s regional markets outside the U.S. signals a potential management shift, with founder Changpeng Zhou aiming to reduce his Binance.US ownership to appease regulators. Teng’s extensive regulatory experience will aid Binance in addressing enforcement actions and improving compliance. The company is also showing interest in crypto-friendly regions like Hong Kong, Dubai, and Europe.

Binance’s Contradictory Moves: Richard Teng’s Promotion Amid Layoffs and Regulatory Challenges

Binance appoints Richard Teng as Head of Regional Markets while facing regulatory scrutiny and staff layoffs. The exchange is restructuring amid global challenges and market turbulence, reflecting the uncertain future of the cryptocurrency industry.

Binance Australia’s Crypto Discounts: Uncovering the PayID Cut-off Impact on Local Markets

Binance Australia faces a cut-off from PayID service, causing traders to trade Bitcoin and other cryptos at discounted prices. From June 1, users will no longer withdraw AUD via PayID, following recent difficulties with financial service providers. Binance Australia seeks alternative providers to continue offering AUD services.

Gulf Binance and Thailand’s Cautious Crypto Endeavors: A Balancing Act in the Making

Gulf Binance, a collaboration between crypto exchange Binance and Gulf Energy’s Gulf Innova, has received a digital asset operator license in Thailand, enabling the launch of a regulated cryptocurrency exchange and broker. Amid a cautious and balanced approach to crypto adoption, Thailand’s government aims to showcase the potential of blockchain technology and emerge as an Asian crypto hub.

Binance Acquires Thai Licenses: Booming Crypto Market & Regulatory Shifts Explained

Binance acquires Digital Asset Operator Licenses in Thailand, partnering with Gulf Innova Co., Ltd. to establish Gulf Binance. This joint venture plans to launch a crypto trading platform in the flourishing Thai market by Q4 2023, signaling increasing cryptocurrency acceptance and growth in the country.

EU’s MiCA Framework: Boon or Bane for Crypto Industry? Debating Pros, Cons & Market Impact

The EU’s landmark crypto regulation, Markets in Crypto Assets (MiCA), set to become law in July, aims to govern crypto transactions and has increased VC investment in European crypto projects. While attracting attention and investment, potential downsides include resistance from industry players and risk of bubbles due to excessive investment.

WGA Writers’ Strike: Debating AI’s Role in Writing and Preserving Humanity within Content Creation

The Writers Guild of America West (WGA) strike highlights the growing concerns over the use of artificial intelligence in content creation. The WGA aims to preserve writers’ rooms, secure employment duration, enhance residuals, and minimize AI’s role in the entertainment sector, while addressing the legal ramifications and challenges surrounding AI-generated works.

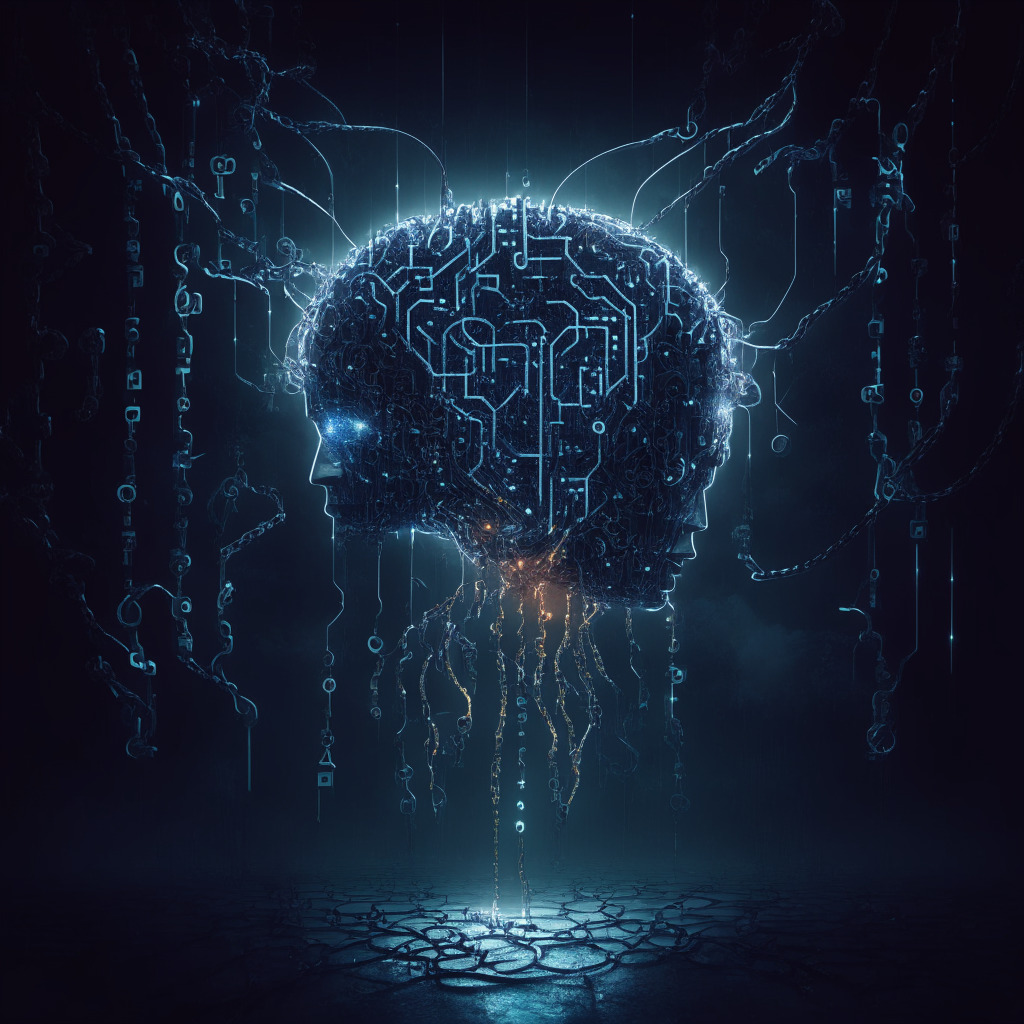

AI-Powered Scams: The New Era of Cyber Threats Plaguing the Crypto World

“Artificial intelligence (AI) is driving increasingly sophisticated digital scams threatening cryptocurrency organizations, warns Richard Ma, co-founder of Web3 security firm, Quantstamp. By mimicking corporate functions and engaging in credible dialogues, AI aids in successfully executing large-scale scams, particularly posing a high risk for the crypto sectors. Constant vigilance and secure internal communication platforms are key for cybersecurity.”

AI in Blockchain: A Boost for Efficiency or a Recipe for Disaster?

“AI is revolutionising blockchain and cryptocurrency but its adoption in writing smart contracts could be risky. The inexperienced programmers using AI tools could generate more bugs than they identify. While AI aids in code analysis and reverse engineering, it shouldn’t be relied upon to write code, especially by novices. It’s a double-edged sword presenting potential and scalability, but posing significant security challenges.”

Binance’s Uplift Amid Regulatory Scrutiny: Balancing Decentralization and Standardization

“Binance regional markets head Richard Teng insists that despite facing regulatory scrutiny, the exchange remains financially secure and welcomes said scrutiny. Teng expresses support for harmonized standards for the cryptocurrency industry, like the European Union’s Markets in Crypto-Assets (MiCA) regulation. This standardization, however, could challenge the decentralization ethos of blockchain technology.”

Senator-Proposed AI Regulation: Balance between Safeguarding Innovation and Ensuring Accountability

Senators Richard Blumenthal and Josh Hawley released a cross-party plan for comprehensive AI regulation, proposing mandatory licensing for AI firms and enforceable AI safeguards. The framework also aims to balance potential benefits and risks of AI technology through corporate transparency, consumer protection, and national security safeguards.

The Paradoxical Rise of Liquid Staking: A Shift in DeFi Amid Regulatory Pressures and Yield Quests

“Liquid staking protocols, particularly Lido, have seen a massive rise recently despite an overall downturn in the DeFi industry. The popularity of liquid staking, driven by regulatory pressures and attractive yield returns, suggests a potential shift within the DeFi ecosystem.”

Navigating the Cryptosphere: The Courting of Controversy and Confidence by Crypto Lawyer Heaver

Irina Heaver, a prominent crypto lawyer, faces scrutiny and threats due to her outspoken critique of certain altcoins and their founders. Despite these challenges, Heaver insists on informing her followers about potential lawsuits in the crypto industry and exposing questionable projects.

Regulating AI: Struggling Copyright Laws in the Era of Generative AI Models

The U.S. Copyright Office seeks insight on copyright concerns related to Artificial Intelligence (AI), particularly the use of copyrighted works to train AI and issues around AI-generated content. Pressing issues include AI’s capacity to mimic human artists. Media and entertainment industries grapple with unauthorised use of copyrighted materials for AI training. This discourse on AI, copyright, and regulation intertwines ethics, transparency, and surveillance matters.