“AI developer Anthropic secured a $100 million investment from South Korean corporation, SK Telecom, to create a multilingual large language model for the Telco AI platform. This move represents SK Telecom’s aspirations to revolutionize the telecom industry leveraging AI technology.”

Search Results for: SK Telecom

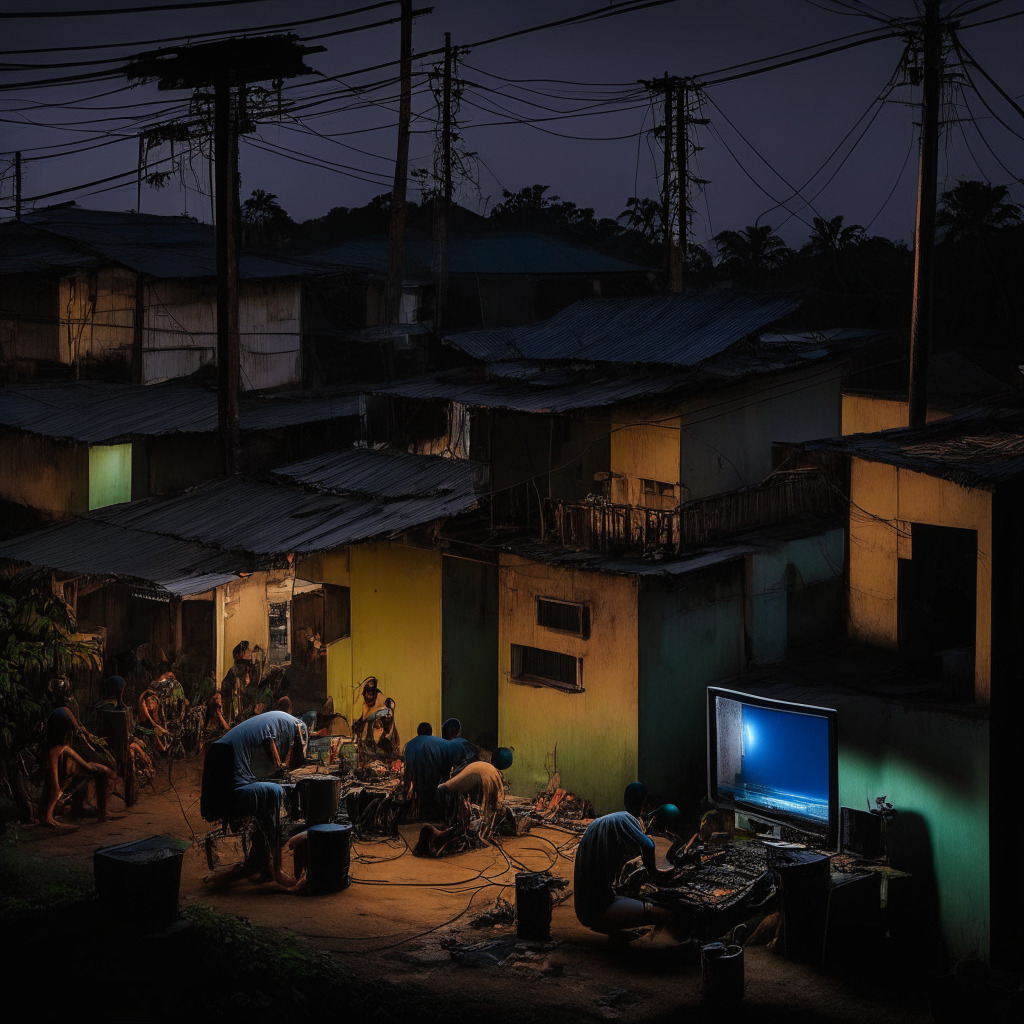

Illegal Crypto Mining in Sarawak: A Double-Edged Sword of Technological Advancement and Risk

“Illegal crypto mining operations in the residential areas of Sarawak, Malaysia, have resulted in recurrent power disruptions. Investigations revealed 74 unauthorised cryptocurrency mining servers connected to direct tapping cables, risking short circuits, fires, and even loss of life. Unrecorded consumption caused substantial economic damage, prompting utility firms, police, and anti-corruption agencies to develop new electricity theft detection methods.”

Exploring China’s Crypto Leap: Minsheng Bank’s Digital Yuan Initiative with JD.com and the Risks Involved

China’s Minsheng Bank, in alliance with e-commerce giant JD.com, is launching a digital yuan-based payment service. This enables Minsheng customers in the CBDC pilot zone to use digital yuan tokens for platform purchases. Minsheng differentiates as the first Chinese firm predominantly owned by private sector interests to support the nation’s digital yuan pilot.

Banks and Chainlink Team Up for Blockchain Interoperability: Possibilities and Security Risks

World’s largest banks, including Citi and BNP Paribas, are testing permissioned bank-owned blockchains under SWIFT’s guidance to enable communication with public blockchains like Ethereum. Chainlink’s technology will serve as the bridge, overcoming network fragmentation and ensuring secure information sharing across public and private chains.

AI-Powered Cryptocurrency: Booming Market Frontier or Security Risk?

AI’s rapid progress has led to a surge in AI-related cryptocurrencies, with projects like AiDoge and yPredict gaining attention. Despite facing challenges like market volatility and potential security risks, this intersection offers abundant potential for technological breakthroughs and investors in the long run.

Balancing Act: Blockchain Prospects, Challenges, and the Road to Mainstream Adoption

“The partnership between blockchain company Polygon Labs and SK Telecom aims to enhance SKT’s Web3 ecosystem. However, the practical use of incubated Web3 startups and efficient use of Polygon network is in question. Cybercrimes in the crypto industry and the legal controversies surrounding NFTs highlight the urgency for regulatory guidelines and improved security measures. The growth of blockchain technology and AI is promising but challenged by legal and user safety issues.”

South Korea’s Mirae Asset Securities Collabs with Polygon Labs to Tokenize Assets: Will this Disrupt the Traditional Financial Landscape?

Mirae Asset Securities collaborates with Polygon Labs to facilitate tokenization and Web3 integration with traditional finance. This alliance aims to create an infrastructure for issuing and transacting tokenized securities – translating tangible assets into blockchain-backed cryptographic tokens. The partnership anticipates reshaping capital markets by eliminating intermediaries, promising a more efficient, transparent, and inclusive global financial system.

Unveiling France’s AI Ambitions: Iliad’s $106m Investment and the Future of European AI

French telecom firm Iliad is investing around $106 million USD in the local artificial intelligence (AI) sector, creating a laboratory for cutting-edge AI research in Paris. The lab will design general AI while possibly making use of Europe’s ‘most powerful cloud-native Ai supercomputer’ created by NVIDIA.

Crypto World Featuring: The JPEX Scandal, Mt. Gox Delays, and DCS’ New Venture

Last week’s Token2049 conference saw Hong Kong cryptocurrency exchange JPEX staff flee amid arrest threats over a $166M scandal. The incident, which potentially affected 2,000 users, emphasized the need for trading platform awareness and regulatory measures to ensure safe trading.

Navigating Taiwan’s Unfolding Crypto Regulation: Certainty or Stifling Innovation?

“Taiwan is crafting restrictions for offshore cryptocurrency exchanges operating within its domains. The Financial Supervisory Commission (FSC) is formulating a guidebook to help virtual asset services providers establish regulatory norms, focusing on information disclosure, virtual asset listing standards, and secure division of corporate and customer assets.”

Decentralized Exchange Market Boom: The POW Token Phenomenon Vs Wall Street Memes Anticipation

“The decentralized exchange market (DEX) is experiencing a surge, with the POW token (“Pepe of Wall Street”) increasing in value by over +3,000%. This is part of a general upswing in on-chain trading activity called ‘On-Chain Summer’.”

Navigating the Stormy Seas of Digital Assets: Promising Advances and Regulatory Pitfalls

“The digital assets landscape is dynamic, but not insulated from regulatory scrutiny. Despite substantial backing, some ventures like Nifty’s struggle, while partnerships like Tel Aviv Stock Exchange and Fireblocks demonstrate promising blockchain confidence. However, the translation of tech potential to market reality presents challenges.”

Decoding Crypto Values: The Influence and Limitations of Metcalfe’s Law

Metcalfe’s Law is significant in the crypto realm, it suggests a direct correlation between a network’s participants and its value. This law can explain Bitcoin’s price formation, with increased users leading to a surge in its value. However, it doesn’t encapsulate all elements of this intricate landscape.

Indonesia’s Leaning into Crypto: A State-owned Crypto Exchange in the Making

Indonesia’s Commodity Futures Trading Supervisory Agency (Bappebti) is set to launch a national cryptocurrency exchange in July 2023. This presents potential integration of cryptocurrencies into Indonesia’s financial infrastructure as the exclusive platform for crypto transactions in the country. Balancing innovation and profit with market risks remains a challenge.

Russia’s Digital Ruble: A Revolution in Finance or A Step Towards Financial Monopoly?

“Russia’s parliament is moving towards legislation for the ‘digital ruble’, their prospective Central Bank Digital Currency (CBDC). The proposed law hands power to the Bank of Russia to manage the CBDC infrastructure, issue currency, and guarantee safety. This move opens opportunities for new payment avenues and cross-border solutions, despite an initial skepticism and ban on digital assets.”

The AI Conundrum: Embracing Progress While Ensuring Ethical Governance and Job Preservation

In a unique robot press conference at the AI for Good global summit, numerous AI topics were discussed. The humanoid robots highlighted the importance of AI-human collaboration and stressed on the need for transparency and ethical conduct in AI development. Concerns about job preservation and the potential effect of AI on labor markets also surfaced. These discussions underscore the need for a robust regulatory framework to ensure AI doesn’t infringe on human rights or sideline our workforce.

Expanding Crypto Trading on Tel Aviv Stock Exchange: Pros, Cons, and Global Regulation Debate

The Tel Aviv Stock Exchange plans to allow nonbanking member customers to trade cryptoassets, expanding authorized activities. Meanwhile, the IMF and FSB aim to develop a coordinated global crypto regulation approach. In other news, private investment firm ABO Digital launched, supporting the digital asset space, and Push Protocol revealed a group chat feature for its Web3 messaging app.

Bit2Me’s $15M Funding: A Latin American Expansion Dream or Regulatory Nightmare?

Spanish crypto exchange Bit2Me recently raised $15 million in a funding round led by Investcorp, with contributions from Telefónica Ventures, Stratminds VC, Cardano, and YGG fund. This investment will boost Bit2Me’s growth in Spain and accelerate its expansion in Latin America, targeting markets like Chile, Colombia, and Uruguay.

Regulating AI: Balancing Innovation with Generative Dangers and Global Cooperation

UN Secretary-General António Guterres joins the call for AI regulation, comparing its potential threat to humanity to nuclear war. European Parliament passes world’s first-ever AI legislation, while OpenAI CEO Sam Altman supports regulating AI through establishing a government office and standards for development.

Generative AI Adoption: Excitement, Concerns, and the Struggle to Keep Up

A recent KPMG U.S. survey shows that while 65% of executives predict significant generational AI impact on their organizations, challenges, including costs, business case clarity, and concerns about cybersecurity and data privacy, hinder immediate adoption, talent acquisition, and effective governance.

SWIFT and Chainlink Collaboration: Tokenizing Assets for a Unified Blockchain Future

SWIFT collaborates with major banks and Chainlink to trial connecting private and public permissionless blockchains using Chainlink’s Cross-Chain Interoperability Protocol (CCIP). This aims to enable tokenized asset transfers across public and private networks, potentially increasing the blockchain industry size significantly.

Deutsche Telekom Dives into Blockchain as Polygon Validator: Boon or Bane?

Deutsche Telekom has entered the blockchain space as a validator on Ethereum scaling solution, Polygon, providing staking services and enhancing the potential of blockchain technology. This move reflects their growing interest in the industry, attracting large-scale investors and driving innovation in decentralized finance.

Chinese Ethereum: Conflux Network’s Rise Amid Hong Kong Crypto Trading Decision

Conflux Network (CFX), known as the “Chinese Ethereum,” experienced a token price surge following Hong Kong’s decision to allow retail crypto trading. As the only regulatory-compliant public blockchain in China, Conflux has partnered on blockchain initiatives with major brands and government entities, and aims to help Hong Kong and mainland China expand in the Web3 area.

Pakistan’s AI Push Amidst Crypto Ban: Balancing Innovation and Regulation

Pakistan’s Ministry of IT & Telecom drafts national AI policy to transform into a knowledge-based economy by investing in AI and related technologies. However, a blanket ban on cryptocurrencies brings a debate if the country is missing out on blockchain potential in essential sectors.

Mexico Embraces Bitcoin Lightning Payments: Analyzing Potential Impact and Challenges

Mexico’s top internet service provider, Total Play, integrated Bitcoin Lightning payments, increasing transaction speed and efficiency. This significant step towards complete institutional adoption of cryptocurrency allows Mexican users to pay internet bills with BTC via Total Play’s Lightning-based payments.

Twitter Hack Mastermind Extradited: Analyzing Security Flaws and the Fight Against Cybercrime

The US Department of Justice recently extradited Joseph Hames O’Connor, responsible for the 2020 Twitter hack and theft of $794,000 in digital assets through sim-swap. The rise of such cybercrimes showcases the pressing need for companies to integrate industry-standard security protocols and strengthen cooperation with authorities.

Crypto Industry Lessons: Twitter Hack, SIM Swapping, and O’Connor’s Impact on Security

The recent extradition of Joseph O’Connor sheds light on vulnerabilities within the cryptocurrency industry, as he pleads guilty to multiple cybercrime offenses, including the notorious 2020 Twitter hack and SIM swapping attacks. Despite security advancements in the crypto ecosystem, this case highlights the need for continuous improvements and user vigilance.

US National Strategy: Embracing DLT and Digital Identity, Impact and Concerns

The White House’s national standards strategy identifies distributed ledger technology (DLT) and digital identity infrastructure as having significant economic impact potential. The strategy aims to bolster US leadership in developing international standards for emerging tech sectors and promote global standards through private sector synergies. DLT holds promise for cybersecurity and privacy-centered features and services.

Digitalization and Trust: How Central Bank Money Retains Dominance Amid Crypto Debate

Digitalization is shaping the future of money with new currencies emerging, but Moody’s report suggests traditional central bank money in commercial banks will remain dominant due to trust. Digital wallets, Central Bank Digital Currencies (CBDCs), and cryptocurrencies face challenges, including technical and policy complexities, while trust in central banks maintains their significance in the monetary landscape.