The Indian Ministry of Home Affairs is developing a Cryptocurrency Intelligence and Analysis Tool (CIAT) to combat crypto fraud. CIAT will monitor dark net crypto wallet addresses, compiling transaction records to detect irregular crypto activities. However, concerns surround its effectiveness given the dark web’s anonymity and the potential for false positives.

Search Results for: Strike

Debating the Pace of Euro’s Digitization: A Tactical Strike or Slow Rollout?

The EU financial services chief, Mairead McGuinness, emphasizes a cautious approach to the digitization of the euro, advocating strategic decision-making post the 2024 EU elections. Amid declining cash usage and rising e-commerce, the need for a digital currency alternative is expressed. Nevertheless, the transition could necessitate compromises some might resist, thereby requiring careful planning to not disrupt our financial foundations.

Lone Bitcoin Miner Strikes Gold: Examining The Underdog Win in Crypto’s Expansive Arena

On August 18, a solo Bitcoin miner, with an estimated hash power of 1 PH/s, successfully claimed the complete reward of 6.25 Bitcoins for solving block 803,821 using Solo CKpool mining service. This relatively low-power miner striking it big, despite the dominance of behemoth mining pools, emphasizes the importance of platforms like Solo CKpool that provide opportunities for individual miners.

Lightning Strikes Binance: Speedy Transactions vs. Increased Complexity and a New Stablecoin on the Block

“Cryptocurrency exchange Binance has successfully incorporated the Bitcoin Lightning Network, enhancing Bitcoin transactions by enabling faster, cheaper off-chain transaction channels. In related news, decentralized finance protocol Aave has launched GHO, a dollar-pegged stablecoin, introducing a transparent, verifiable, over-collateralized asset into the crypto market.”

Web3 Music Platform Strikes a $20M Chord: Blockchain Reshaping the Music Industry

“Sound, a Web3 music platform, raises $20 million for its innovative solution in reshaping the music industry using blockchain technology. It enables music creators to mint their songs as NFTs and sell them directly to fans, eliminating intermediaries and ensuring 100% revenue retention for artists. With active backing from notable music industry figures, this initiative marks a significant stride in blockchain adoption in entertainment.”

Crypto Exchange Founder’s Hefty Fine: A Strike for Regulation or Blow for Innovation?

Adam Todd, founder of Digitex, was accused by the U.S. Commodity Futures Trading Commission (CFTC) of running an illicit platform and manipulating its token, DGTX. The court mandated Todd to pay $16 million, reflecting poor practice in the decentralized finance landscape. Todd’s case underlines regulators’ emphasis on transparency and legality within the digital asset market, raising questions about the impact on innovative startups.

Strike Shifts to In-House Custody: Reducing Risks and Enhancing User Experience

Strike has moved all customers’ bitcoin and US dollar assets to its in-house infrastructure, reducing counterparty risk and improving performance. The change allows Strike users to send bitcoin P2P and choose to receive funds as cash or bitcoin, while enabling direct on-chain payments and increased deposit limits.

AI vs. Actors: SAG-AFTRA Strikes, Demanding Fair Play in the Age of Generative AI

The Screen Actor Guild (SAG) is focusing on generative AI’s impact on the entertainment industry, emphasizing the need for clear boundaries concerning individuals’ images, informed consent, and fair compensation. SAG-AFTRA’s national executive director advocates a human-centered approach to AI implementation, balancing technology’s incorporation while respecting performers’ rights and livelihoods.

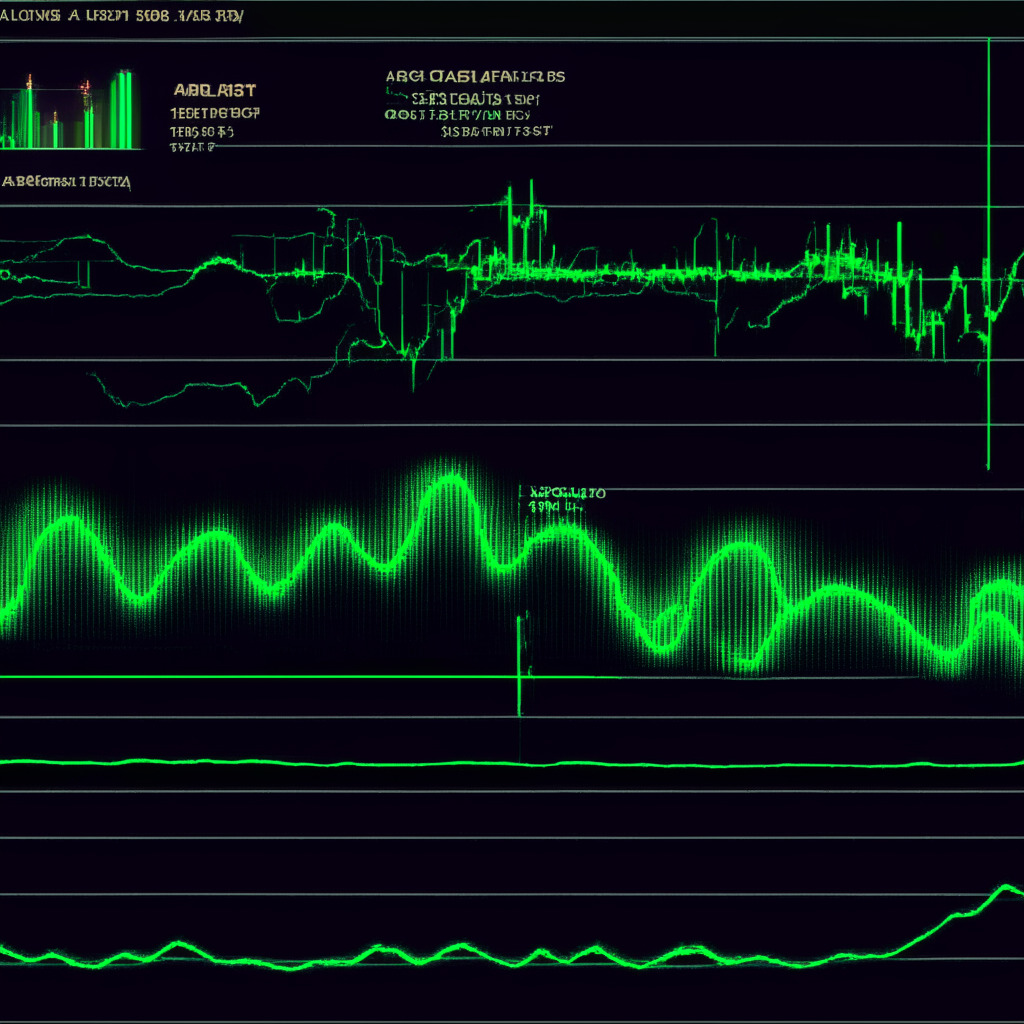

AGIX Price Forecast: Bullish Breakout in Sight or Market Volatility Poised to Strike?

AGIX price has recently experienced a bullish breakout from its downsloping channel pattern, indicating a possible trend reversal. With sustained buying momentum, the price rally could reach targets of $0.366, $0.45, or even $0.588. Technical indicators, such as RSI and Bollinger Bands, support this projection. However, market conditions can change rapidly, making thorough research crucial before investing.

Strike’s El Salvador Move: Growth or US Regulatory Uncertainty Escape?

Strike establishes its international headquarters in El Salvador, highlighting the country’s friendly crypto atmosphere compared to the uncertain regulatory climate in the United States. The move showcases the importance of a favorable regulatory environment for the growth of the global crypto ecosystem.

Strike’s Tether Integration: Bridging the Gap Between Traditional Finance and Crypto

Strike, a leading digital payments platform using Bitcoin’s Lightning Network, recently integrated Tether (USDT) to offer users enhanced financial capabilities. This enables seamless USDT transactions and provides reliability while bridging the gap between traditional financial systems and cryptocurrencies and fostering widespread digital currency adoption.

Crypto Provider Strike Expands to 65 Countries, Moves to El Salvador: A New Era or Risky Venture?

Bitcoin payment provider Strike expands services to 65 countries and relocates global headquarters to crypto-friendly El Salvador. This move combats complexities in the crypto landscape and the growing anti-crypto regulatory sentiments in the U.S., while promoting innovation and financial freedom in the emerging digital asset market.

Strike’s Global Expansion: Pros, Cons and Challenges in the Blockchain Revolution

Strike plans to expand its Bitcoin-based payment app from the US, El Salvador, and Argentina to over 65 countries, aiming to provide global payment and remittance services to a wider audience. However, potential challenges include varying regulatory environments and consumer skepticism.

Stagnation Strikes: Fed Rate Hikes, Alleged Token Manipulation, and Kennedy’s Crypto Conspiracy

This week in crypto: Stagnation due to the Fed’s interest rate hike, Binance’s “CZ” Zhao flags Tron CEO’s suspicious token transfer, crypto-based conspiracies from 2024 Presidential hopeful, reports of Amazon’s possible NFT marketplace launch, and El Salvador incentivizes tech innovation.

WGA Writers’ Strike: Debating AI’s Role in Writing and Preserving Humanity within Content Creation

The Writers Guild of America West (WGA) strike highlights the growing concerns over the use of artificial intelligence in content creation. The WGA aims to preserve writers’ rooms, secure employment duration, enhance residuals, and minimize AI’s role in the entertainment sector, while addressing the legal ramifications and challenges surrounding AI-generated works.

Facing False Statements Allegations: Ex-Celsius CEO Strikes Back in NY Court Case

Alex Mashinsky, former CEO of the bankrupt crypto lending platform Celsius Network, is pushing back against allegations of defrauding investors in response to New York Attorney General Letitia James’ suit. The case highlights pivotal questions surrounding securities regulations in the crypto industry and may set precedents for future actions against crypto companies and executives.

AI in Entertainment: WGA Strike and Regulation Demands Fuel Ongoing Debate

The Writers Guild of America (WGA) has called for regulations on AI usage in the entertainment sector, demanding prohibition of AI in writing or rewriting literary materials, and barring its use as source material. Hollywood studios, however, have rejected these demands. The ongoing WGA strike highlights the contentious issue of AI’s potential benefits and pitfalls in the creative industries.

Binance’s Freeze on Hamas-linked Accounts: A Complex Crypto Dilemma

“Binance, a cryptocurrency exchange, has frozen accounts linked to Hamas at the request of Israeli law enforcement. This action highlights the potential role of crypto exchanges in enforcing international laws and curbing illegal activities, and raises questions about the balance between accessibility and security in blockchain tech and cryptocurrencies.”

The Unraveling of FTX Saga: Insider Revelations and the Need for Crypto Regulation

The legal proceedings against Cryptocurrency trader, Sam Bankman-Fried, highlight the unpredictable nature of venture capital investments. In a twist, the trial may unravel insider information involving unauthorized withdrawals and underhanded dealings. These reveal the urgent need for reliable regulatory framework in the crypto universe to protect investor funds and ensure transparency.

Security Storm Hits Stars Arena: Analyzing the $2.85 Million Avalanche Blockchain Breach

Stars Arena, a platform powered by Avalanche’s Contract Chain, suffered a major security breach leading hackers to successfully takeaway 266,103 AVAX. The aftermath caused the AVAX price to tremble, dropping from $11.56 to $10.78. Securing the platform’s functionality and user funds is now their primary focus.

Coercing Cyber Criminals: The Dilemma of Crypto Bounty for Stolen Assets Recovery

“In the evolving blockchain technology landscape, securing crypto platforms against cyber breaches remains a pressing task. Instances like HTX using bounties to recover stolen funds hint at innovative strategies, but also present a dangerous precedent. Persistent advancements in blockchain security are therefore essential.”

Navigating Web3’s Growing Pains: Analyzing Security Challenges Amid Crypto Innovations

“The Galxe protocol recently suffered a DNS attack, causing significant losses and posing questions about the feasibility of security in Web3 platforms. The incident highlights growing security challenges, with Web3-related security faults causing an astounding $686 million loss in the third quarter this year. The future of the blockchain space depends on balancing innovation and risk.”

Taiwan’s Upcoming Crypto Legislation: Progressive Regulation or Stifling Clampdown?

Taiwan plans to propose a special law to regulate emerging crypto businesses by November 2023, driven by concerns over offshore markets’ activities. There’s consensus on needing unique legislation for crypto, dissimilar to traditional financial instruments. Taiwan’s Financial Supervisory Commission is helping, releasing guidelines for investors’ protection, including complete segregation between exchange treasuries and customers’ assets. Critics argue that over-regulation might hinder organic growth and innovation.

Balancing Act: Supervising AI Vs. Regulating Cryptocurrencies – Who Gets the Upper Hand?

This article discusses a project launched by UNESCO and the Dutch government to study AI supervision across Europe, aiming to develop guidelines from best practices. It also highlights the contrast of some nations focusing heavily on AI regulations, while cryptocurrency protocols, such as for stablecoin transactions, are being neglected. The importance is stressed of striking a balance between embracing technological advances and ensuring proper regulation for consumer protection.

Navigating the Tightrope: FTX Trial Sparks Debate over Crypto Regulations and Business Risks

The unfolding FTX crypto exchange saga, involving ex-CEO Sam Bankman-Fried facing numerous charges related to misuse of customer funds, highlights the complex nature of crypto regulations and the precarious relationship between crypto companies and their users. This case emphasizes the urgent need for robust crypto regulations to protect investors and preempt misuse, while allowing room for innovation.

Unraveling the Paradox of Increased Decentralization: The Optimism Network’s Stride and Binance’s Unexpected Move

The Optimism network has launched its testnet version of a fault-proof system aimed at increasing the efficiency and decentralization of the Superchain. Typically reliant on centralized sequencers, the new system offers modular options to prevent fraud. However, co-founder of Ethereum, Vitalik Buterin, asserts the importance of user-submitted fraud proofs to maintain true decentralization.

Navigating the Future of Payments: Visa’s $100M AI Venture & Crypto Integration

“Visa plans to invest $100 million in generative AI ventures, a technology that can generate various content forms and add dynamism to the industry. The firm’s AI-based solutions have been effective in fraud prevention, highlighting AI’s critical role in enhancing payment systems. However, successful AI implementation requires a robust regulatory framework.”

Exploring Singapore’s Regulatory Leap towards Blockchain: A Swift Transformation or a Risky Venture?

The Monetary Authority of Singapore has granted a Major Payment Institution Licence to Sygnum Singapore, enabling it to extend its services to the Asia–Pacific market. However, the recent downfall of Silvergate Bank, due to high-risk crypto activities, underscores the need for balancing growth and safety in blockchain adoption.

Navigating the Regulatory Maze: Driving Stablecoin Legislation Under Biden’s Administration

Chair Patrick McHenry of the US House of Representatives’ Financial Services Committee affirms his commitment to regulate stablecoins. He steers two digital asset bills targeted at stablecoin regulation, and bringing clarity to the role between the CFTC and SEC. McHenry highlights potential bipartisan support and the global influence of dollar-denominated stablecoins, emphasizing complex power dynamics beyond the digital asset scope.

Crypto King’s Failed $5 Billion Bid to Block Trump’s Political Return: A Suspect Love Affair with Power

“In a shocking revelation, FTX founder considered offering $5 billion to dissuade former U.S. President Donald Trump from re-running. This idea fell apart due to FTX’s financial crisis. Now, significant fraud charges against FTX’s founder await trial, causing huge uncertainty in the crypto industry.”

AI Market Saturation: An Ideal Breeding Ground for Innovation or an Overheating Bubble?

“The AI era differs fundamentally from its predecessors, displaying practicality and capacity to enhance multiple industries. Despite high valuations and growth, concern surrounds possible AI market overheating. Contrasting views argue market saturation serves as a birthplace for future innovations, thus ensuring industry advancement.”

Crypto Giant’s Fall: Regulating for Safety or Stifling Innovation?

The arrest of 3AC’s co-founder, Su Zhu, following the fund’s dramatic collapse, evidences the power regulators hold over cryptocurrency activities. For some, it confirms the need for regulatory frameworks in the volatile crypto world, protecting against violations and malpractice, whilst critics argue against measures that could stifle crypto market innovation.