“Tether, the largest stablecoin issuer, has made a significant shift in its terms of service (ToS), restricting access for certain Singapore-based clients, causing anxiety among the crypto-user base. This may be a strategic adherence to regulatory compliance after a major Singaporean crypto scandal or a rebuttal against potential restrictions jeopardizing their operations.”

Search Results for: Tether Holdings

Tether’s Ascent: Top Holder of US Treasury Bills and What That Means for Crypto

“Tether, one of the world’s leading buyers of US Treasury bills, has increased its holdings to $72.5 billion. Despite the complexities expansion brings, this represents the growing mainstream acceptance of digital currencies and their incorporation into the traditional financial world.”

Tether’s New Link with Bahamas-Based Britannia Bank: A Boon or Bane for the Crypto Industry?

Tether, the issuer of popular stablecoin USDT, has established banking relations with Britannia Bank & Trust. This connection could streamline dollar transfers, improving Tether’s functioning within the traditional financial network. Britannia’s recent acquisitions and positive stance on crypto suggest this relationship is strategic for both entities, impacting the future of the crypto industry.

Unveiling Tether’s Billion Dollar Liquidity Cushion Amidst Crypto Security Concerns

“Tether maintains a $3.3 billion liquidity cushion across 15 blockchain ecosystems, bolstering its stablecoin ecosystem. However, concerns about the currency’s liquidity and asset backing persist. Other Tether stablecoins lack the same liquidity cushion, failing to sustain the 1-1 peg in crisis times.”

Exploring Tether’s Financial Dance: A Dip Below 1:1 Peg Puzzles Market Analysts

The USD-pegged stablecoin, Tether (USDT), recently dropped slightly under its 1:1 peg against the US dollar on the DEX Curve Finance, upsetting the primary stablecoin liquidity pool balance. Despite concerns, Tether continues to boost transparency by publishing the value of its reserves daily, helping maintain confidence in its stablecoin’s backing by USD or liquid-equivalent reserves.

Tether’s Billion-Dollar Quarterly Profits: Financial Health or Cause for Concern?

“Tether’s self-reported asset value of over $86 billion surpasses the market cap of its USDT stablecoin. While the brand boasts a $1 billion profit, skepticism arose from its financial history and reduced cash holdings, opening conversations about the need for a full-fledged audit.”

Tether’s Billion-Dollar Profits vs. Transparency Concerns: The Trust Deficit Dilemma in Crypto Markets

“Tether, the issuer of the USDT stablecoin, announced over $3.3 billion in reserve assets and $72.5 billion exposure to U.S. Treasuries in its Q2 attestation. The firm’s operational profits surpassed $1 billion, increasing its Bitcoin holdings to $1.67 billion. However, despite enticing figures, Tether’s opacity raises scepticism regarding its reserve management.”

Tether’s Rising Treasury Reserves: A Balancing Act between Expansion and Security

“Tether recently disclosed a Q2 attestation, revealing a $3.3 billion jump in its excess reserves. Despite raising market concerns due to increasing U.S. Treasury bill holdings, Tether maintains 100% reserves for USDT tokens and continues growing financially. Transparency around reinvested profits becomes key to investor confidence.”

Tether and Kava Partnership: Stablecoin Expansion Amid Reserve Concerns

Tether plans to launch USDT tokens on Kava, a scalable layer-1 blockchain, providing Kava’s community access to the dependable stablecoin. Despite concerns about USDT’s stability and reserves, this partnership strengthens Tether’s position as a market-leading stablecoin.

Tether Account Deactivations: Investigating the Mystery and Its Impact on Crypto Trust

Tether Holdings deactivates 29 major cryptocurrency firm accounts, including MoonPay, BlockFi, CMS Holdings, and Galois Capital, without disclosing explicit reasons. The NYAG investigation reveals this, sparking concerns about transparency and communication in the growing crypto space.

Revelations on Tether’s Reserves: Chinese Securities, Stability & Regulatory Scrutiny

Tether Holdings Ltd. is under scrutiny as findings reveal it may have held securities issued by Chinese firms in its reserves backing USDT stablecoin. Regulators question the underlying assets providing USDT’s stability, raising concerns about potential regulatory risks and the stablecoin’s overall reliability.

Chinese Securities, Stablecoin Reserves & Media Outlets: Tether’s Reputation at Stake

Tether addresses reports of backing USDT with Chinese securities, stating the cited materials are outdated and their exposure to Chinese commercial papers was liquidated last year. The company emphasizes the importance of accurate and balanced information for the healthy development of the crypto industry.

Tether’s Chinese Securities Exposure: Unveiling the Mystery and Its Market Impact

Newly disclosed documents reveal that Tether Holdings Ltd., issuer of the largest stablecoin USDT, previously held reserves in Chinese company-issued securities, short-term loans to Chinese companies, and a loan to crypto platform Celsius Network. Concerns arise over Tether’s $5.1 billion lending program, underpinning USDT’s importance for liquidity and stability in cryptocurrency markets.

Depegging Dilemma: Tether’s Turbulent Times Amid Loan Saga and NYAG Revelations

The depegging of stablecoin Tether (USDT) is linked to the loan saga on DeFi platform Curve. Tether Holdings Ltd reveals concerns over sensitive commercial information shared by the Office of the New York Attorney General to Coindesk. The crypto community now fears potential implications from the released documents.

USDT Sell-off Raises Concerns: Exploring Alternatives and Tether’s Unwavering Commitment

Millions worth of USDT stablecoins sold off on Uniswap and Curve pools, raising concerns among traders and suggesting a preference for DAI and USDC over Tether. This could indicate a diverse and competitive stablecoin market, benefiting users while reflecting potential regulatory concerns.

Tether Leverages Uruguay’s Renewable Energy for Bitcoin Mining: Eco-Friendly Progress or Not Enough?

Tether expands into Bitcoin mining in Uruguay, leveraging the country’s 94% renewable energy sources. While reducing ecological footprint, it also raises environmental concerns and emphasizes the importance of balancing innovation with ecological impact.

Bitcoin Struggles at $27,500: Tether’s Impact, Korea’s Regulations, and Pakistan’s Ban

Bitcoin struggles to overcome the $27,500 resistance level amid a downward trendline, while Tether plans to purchase Bitcoin to diversify its reserve holdings backing USDT. Meanwhile, Korean politicians unite for crypto regulations, and Pakistan enforces a ban on cryptocurrency services due to FATF requirements.

Tether’s Bitcoin Investment Strategy and Emerging Crypto Projects: Navigating a Dynamic Market

Tether announces plans to allocate up to 15% of its reserves to invest in Bitcoin, citing its robustness and growing popularity. Meanwhile, innovative projects like AiDoge, Conflux, and ecoterra reflect the dynamic nature of the cryptocurrency market. Investors must stay vigilant and make informed decisions to capitalize on this growth.

Ripple Acquires Metaco, Tether’s New Strategy, and the Latest in Crypto Markets and Regulations

Ripple acquires Swiss-based Metaco for $250 million, expanding enterprise offerings and accelerating Metaco’s growth. Tether announces 15% net realized operating profits to be allocated towards Bitcoin purchase for reserve diversification. Meanwhile, Coinbase expands services in Singapore and China issues guidelines for NFT treatment.

Tether Boosts Reserves with Bitcoin: Bold Move or Risky Strategy?

Tether plans to strengthen its reserves by investing in Bitcoin (BTC), moving away from US-based government debts. The stablecoin issuer will regularly allocate up to 15% of its net realized operating profits towards purchasing Bitcoin, citing its limited supply, decentralized nature, and widespread adoption as key factors for the decision. Tether’s approach is similar to Microstrategy’s strategy of replacing the U.S. dollar with Bitcoin in its reserves.

Tether’s Bold Bitcoin Investment Strategy: A Wise Choice or Risky Gamble?

Stablecoin issuer Tether plans to allocate up to 15% of realized earnings for Bitcoin acquisition, diversifying its reserves. Skepticism arises over Tether’s choice to self-custody its holdings. The company’s continued investments signal confidence in cryptocurrency’s success and growth, but self-custody concerns persist.

Tether’s $4.5B Bank Withdrawal: Reducing Risk & Boosting Crypto Stability

Tether Holdings strategically reduced bank deposits by 90%, withdrawing $4.5 billion and increasing holdings in US Treasury bills. This resulted in an 85% backing for USDT through cash and short-term deposits, while improving transparency and demonstrating the potential of stablecoins in the crypto space.

Soaring Profits for Tether: Stablecoin Industry Boom and USDT Token Holder Concerns

Tether reported a record profit of $1.48 billion in Q1 2021, attributed to rising interest rates and diversifying its reserves with physical gold and Bitcoin. The stablecoin issuer sees a 20% increase in token circulation, reflecting growing customer trust. However, concerns arise as USDT token holders receive no interest, and companies need to balance profits and customer interests for sustainable growth.

Tether’s Bitcoin and Precious Metals Investments: Transparency Boost or Market Risk?

Tether’s recent attestation report reveals approximately $1.5 billion worth of Bitcoin, accounting for nearly 2% of its total reserves. The inclusion of Bitcoin and precious metals, totaling $3.4 billion, aims to enhance transparency for USDT stablecoin holders. However, concerns arise about potential risks due to market fluctuations.

Tether’s $1.48B Q1 Profit: Can Success Amid Transparency Concerns Sustain?

Tether reported a $1.48 billion net profit in Q1 2021 and disclosed its $1.5 billion Bitcoin and $3.4 billion gold holdings. Despite scrutiny, Tether’s USDT stablecoin remains a market leader. Increased transparency efforts include reducing secured loans in reserves and providing clearer information on reserve assets.

Tether’s Soaring Reserves: Sign of Trust or Reminder of Controversies?

Tether Holding Limited reported a significant increase in reserves, reaching an all-time high of $2.44 billion in Q1 2023. Despite past controversies surrounding transparency, Tether has enhanced efforts to provide regular attestations and maintain stability, emphasizing the importance of thorough market research before investing in cryptocurrencies.

Bitcoin’s Surge: Factors Driving Growth and Challenges Ahead in the Crypto Ecosystem

The recent 19.04% surge in Bitcoin price has brought hope to investors, as the cryptocurrency stabilizes around $29,000-$30,000 range. Key factors driving growth include Tether Holdings announcing Bitcoin mining investment plans, potential approval of a Bitcoin ETF, and the upcoming Bitcoin Halving event.

Coin Cafe’s Hidden Fees Debacle: Balancing Crypto Regulation and Industry Growth

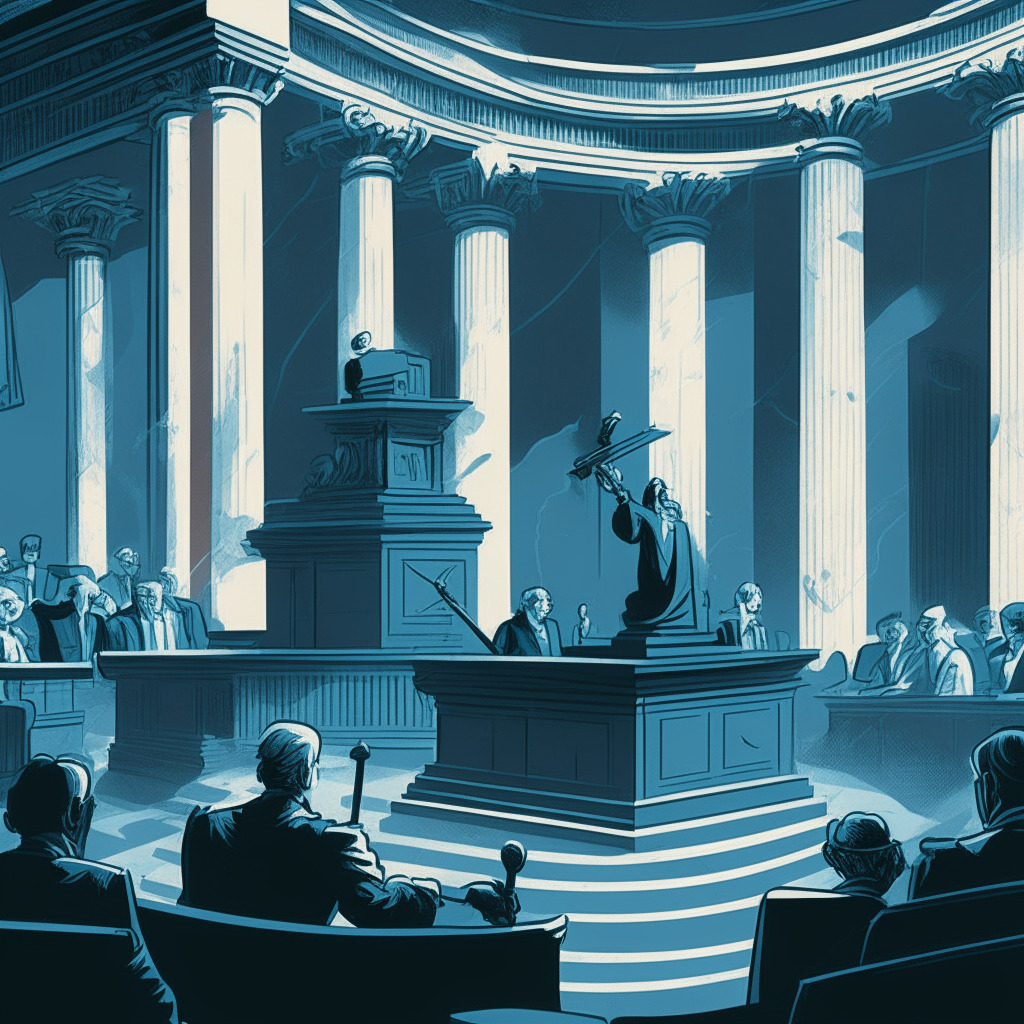

New York Attorney General Letitia James secured $4.3 million from Coin Cafe, a Brooklyn-based digital currency service provider, for charging undisclosed, exorbitant fees for its “free” wallet storage services. This case highlights the importance of effective regulation in ensuring investor safety and combating deceptive marketing practices in the growing cryptocurrency industry.

Regulatory Grip Tightens on Crypto: Analyzing the Ripple Case and Crypto Wallets Sanctions

Recently, a motion by the SEC against Ripple hit a roadblock in court due to the regulatory body’s failure to address substantial legal questions. This highlights the complex legal environment surrounding crypto assets. These developments, including new sanctions on crypto wallets, suggest that the road to comprehensive blockchain regulations is fraught with controversy and challenges.

Bankruptcy of Haru Invest: Impacts on Crypto Lending and The Future of Stablecoins

South Korean CeFi firm Haru Invest, recently filed for bankruptcy following fraud allegations. This incident affected fellow crypto lender, Delio, leading to a suspension of deposits and withdrawals in June. Despite bankruptcy, Haru set a phased asset recovery plan aiming to return investments equally to its users.

Stablecoins: Revolution in Progress or Ticking Time Bomb? Unraveling the Crypto Quandary

“In the world of digital assets, the role and impact of stablecoins is increasingly complex. Despite declining holdings in exchanges and concerns about their potential financial instability, Tether-based stablecoin loans have increased in 2023. The place of stablecoins in crypto markets presents an intricate web of contradictions and uncertainties.”

Binance vs. Paysafe: The Euro Conversion Crunch and Its Implications for Crypto Users

Binance, facing debanking difficulties, has urged its European users to convert Euros to Tether (USDT) due to unilateral action by banking partner, Paysafe. The latter halted processing EUR deposits for Binance users, requiring the alternative stablecoin transformation to maintain liquidity while seeking new banking solutions. This reflects the strategic challenges crypto exchanges face amidst tightening regulatory landscapes.