“Telegram’s Open Network (TON) has received major investment from MEXC exchange, aiming to enhance TON’s role in shaping Telegram’s journey towards becoming a Web3 super-app. However, concerns over security measures are being raised given the potential risks posed by blockchain platforms and crypto transactions.”

Search Results for: telegram

TG.Casino’s Debut on Telegram: The Future of Web3 Gambling or a Risky Bet?

TG.Casino, a new web3 gambling venture, has debuted on Telegram, gathering $250,000 in just one week for its presale event. Combining user-friendly features like instant deposits, no-KYC transactions and Telegram automation, they aim to democratize next-generation GambleFi, just as Unibot democratized advanced crypto trading.

Exploring the Boom of Telegram Bot Tokens: Opportunities, Risks, and The Role of TON Space

“A recent revelation by crypto security firm, Certik, suggests that over 40% of Telegram Bot tokens may be exit scams. The rise in such tokens, some with dubious utility, was triggered by initial successes like UNIBOT. However, at the same time, Telegram announced their new self-custodial wallet, TON Space, introducing another variable in the evolving landscape of blockchain.”

Unpacking Telegram & Coinbase’s Crypto Integration: Boost or Bottleneck for Blockchain?

Messaging app, Telegram integrates a crypto wallet, available to its 800 million global users, potentially positioning it as a mainstream blockchain platform. Simultaneously, crypto exchange Coinbase integrates Bitcoin’s layer 2 payment protocol, Lightning Network, promising faster transactions. Despite apparent benefits, the integration process and exclusions pose potential drawbacks.

Telegram’s Intertwined Saga with TON: Scandal, Redemption, and a Future in Balance

“Telegram has extended support for the TON network, boosting its token price by 7%. Once abandoned amid legal issues with the U.S. Securities and Exchange Commission, the TON blockchain was redeemed by community members who formed the TON Foundation.”

Unmasking Telegram Trading Bots: Unprecedented Crypto Marketplace or Security Nightmare?

“Telegram trading bots have ignited interest in the crypto marketplace, but they also bring significant security concerns. Questions arise around their storage of private keys and centralization. If a user’s Telegram gets hacked, they risk losing their funds.”

Crypto Casinos on Messenger Apps: Mega Dice Leads the Charge on Telegram

“Mega Dice, the world’s first licensed crypto casino on the Telegram app, is innovating the online gambling industry. Capitalizing on Telegram’s powerful bots and user-friendliness, it allows crypto enthusiasts to enjoy casino games without undergoing typical registration. Besides, its instant withdrawals enable speedy access to winnings.”

Soaring Popularity of Telegram Crypto Bots: A Boon or a Security Threat?

“Telegram crypto bots are gaining traction with daily volumes of trades exceeding $10 million in July, according to Binance Research. Despite surge in activity, potential users should approach with caution due to potential security risks linked to asset safety and smart contracts.”

Riding the Disruptive Wave: The Emergence and Impact of Telegram-Based Crypto Trading Bots

Unibot, a Telegram-based trading bot, is disrupting crypto trading with its simple interface compared to decentralized exchanges like Uniswap. The bot, launched in May, has seen a 54% increase in token values and a steadily growing user base. The aggregate trading via Unibot has reached $54 million, distributing $1 million in revenues back to users. Other emerging token platforms like Wagiebot, 0xSniper, and Bridge have also experienced trading surges. While such platforms simplify trading, the inherent volatility in these budding markets is high.

Bitcoin ETPs’ Surge, SG Forge’s Crypto License, and Telegram’s Bond Issuance: July’s Crypto Highlights

“Market research reveals a surge in crypto investors’ funding into Bitcoin ETPs, leading to a $757 million increase. Concurrently, Societe Generale’s SG Forge becomes the first company in France licensed for crypto services. Additionally, Telegram issues $270 million in bonds amid massive growth, while the newly launched stablecoin GHO by Aave indicates market receptivity towards new crypto offerings.”

Navigating Telegram’s Bold $270 Million Bonds Move: Gearing Up for a Blockchain Social Media Merge

Recognizing the potential of combining social media and blockchain, Telegram raised $270 million in bonds. Despite the platform gaining 2.5 million new users daily, profitability remains a challenge. The funds will support Telegram’s evolution until it becomes financially stable or reaches the break-even point.

Crypto Telegram Bots: Revolutionizing Trading or Risky Business? Pros and Cons Explored

Crypto Telegram bots automate various cryptocurrency trading tasks, enhancing trading profitability, and offering efficiency and risk reduction. While advantageous for advanced traders, beginners may face potential security concerns and need constant monitoring due to market volatility.

Telegram Exploit Exposes macOS Camera: Focusing on Apple’s Security & Blockchain Implications

Telegram encountered an exploit allowing access to macOS user cameras but downplayed its severity, stating the vulnerability lies in Apple’s permission security. This raises questions about potential security compromises in blockchain-based systems, highlighting the importance of ongoing advancements in blockchain technology for enhancing user privacy and protection.

Gold Versus GambleFi: The Battle for a Safe Haven in Uncertain Economic Times

In the midst of global economic uncertainty, gold’s reliability shines while a gold token, XAUT, experiences a market rise implying a bullish sentiment. Emerging prospects like the TG.Casino, a GambleFi project, blending blockchain’s decentralised advantages with casino gaming, are gaining traction.

The Harrowing Fall of Terra Luna Classic vs the Rising Star of TG.Casino

“Terra Luna Classic’s value has seen a sharp decrease over recent times, raising skepticism around the token’s viability. Indicators signal the decline might not improve soon. However, altcoins like TG.Casino (TGC) are gaining traction, offering a decentralized casino platform and an enticing community for crypto-enthusiasts.”

Crypto Correction or Opportunity? Examining Volatility, Presale Prospects and Market Risks

“Key market players Bitcoin and Ether witnessed a slump possibly due to inflation fears inspired by the Israel/Palestine conflict affecting oil producers. Amidst this, Ethereum Foundation’s substantial ETH token sale stirred the market. With rising uncertainty towards blue chip cryptocurrencies, crypto presale projects are emerging as high-risk-high-reward strategies attracting early investors.”

Surging Trust Wallet Token and the Exciting Blockchain Casino Evolution

Trust Wallet’s native TWT token has seen a 30% increase due to development activity on the Binance Smart Chain. Despite indications of a possible retracement, TWT exhibits strong momentum ahead of a major release announcement. Meanwhile, TG.Casino, a Telegram-based casino with a strong blockchain ecosystem, is getting attention with a staggering staking APY of 3,446%.

Swinging DOGE Trends: A Dance between Rebounds and Depreciation, and a Look at Rising TG.Casino

Dogecoin (DOGE) has seen a 14% dip in prices since the start of the year, with its 30-day EMA lingering beneath its 200-day average, indicating a period of decline. Although its community remains hopeful for integration into cryptocurrency payment by a former Twitter-owned company, speculation about future spikes in value remains uncertain. Meanwhile, potential investors are exploring other coins with tangible use-cases, such as TG.Casino’s native TGC token.

From Micro-Cents to Magnates: Terra Luna Classic (LUNC) and TG.Casino’s (TGC) Potential Uplift

“In this digital assets world, Terra Luna Classic’s LUNC stands out with its current price of $0.00006 and potential leap to $3 in two years. Its symmetrical triangle formation and possible bearish break hint at market volatility, making resistance and support levels important to monitor. In contrast, new altcoin TG.Casino’s TGC showcases utility and staking capabilities in a decentralized casino platform.”

Mega Dice’s Million Dollar Boom: A Blessing or a Curse for Decentralized Casino Future?

The casino Mega Dice has recently attracted attention with a player winning $1 million. This is promoting the potential of the decentralized gaming industry and rationalizing the benefits over traditional counterparts. However, some concerns arise over potential problem gambling due to the platform’s ease of play and minimal KYC protocols. Mega Dice offers assurances with strict EU Anti-Money Laundering rules and constant user assistance.

Navigating XRP’s Potential Market Resurgence Amid Emerging Crypto Opportunities

XRP, the cryptocurrency standing at rank #5 based on the CoinMarketCap, is prompting speculation of bouncing back as its trading volume surpasses the $500 million mark daily, with its price at $0.52255. Despite appearing bearish, the technical indicators hint at a likely bullish trend continuation at the $0.5200 marker.

XRP’s Viability Continues to Surge Despite Market Instability: An Optimistic Foreseeable Future

“XRP demonstrates resilience amidst market challenges, showing a 2% weekly rise and 4% gains in the last 30 days. Positive trends are attributed to Judge Torres denying the SEC’s bid to re-appeal against Ripple, causing a 53% surge since the year’s start. Ripple’s expansion of its cross-border transfer business and new partnerships could further strengthen XRP’s position.”

Nervous Wait: Bitcoin Stalls Ahead of US Jobs Data, Meme Coins Grab Spotlight

“Bitcoin (BTC) deflected from the $28,000 mark once again, as the US jobs data release this Friday looms. Higher yields on risk-free assets could impart pressure on crypto prices. Amidst this, traders are exploring less liquid meme coin markets for better trading opportunities.”

Skyrocketing DeFi Tokens BDOGE and FROGGY: Rollercoaster Rides and the Rising Star of GambleFi

DeFi exchanged tokens, BDOGE and FROGGY, showed significant growth in October. BDOGE saw a +5,383% rise due to a $1 million influx in trading volume, but later saw an -89.60% slump. FROGGY, another token, rallied +4,204%, then +643%, hinting at a possible second rally. TG Casino, a GambleFi project leveraging blockchain’s decentralization, also gains attention. Any investment decisions in cryptocurrency, including TG Casino, however, necessitate detailed research.

Cardano (ADA) on a Steady Climb: An In-depth Look at its Performance and Future Scope

“Cardano’s value marked a modest 1% surge within the last 24 hours, its week-by-week growth reveals an encouraging 6% uptick. Stellar fundamentals of Cardano hint towards potential gains and an overdue recovery rally. The total value locked (TVL) in Cardano escalated by 220% since this year, indicating increased usage. Ada might hit $0.30 in the fortnight and $0.40 by year’s end.”

Bitcoin’s Resurgence and Emergence of TG.Casino: A Double Whammy in the Crypto World

“Polygon has seen a 17% increase in high-value transactions, in line with the unveiling of key governance proposals. However, its Relative Strength Index indicates potential need for consolidation. Additionally, TG.Casino emerges as an exciting entity, linking casino industry with decentralized blockchain capabilities, offering both opportunities and challenges in the cryptocurrency future.”

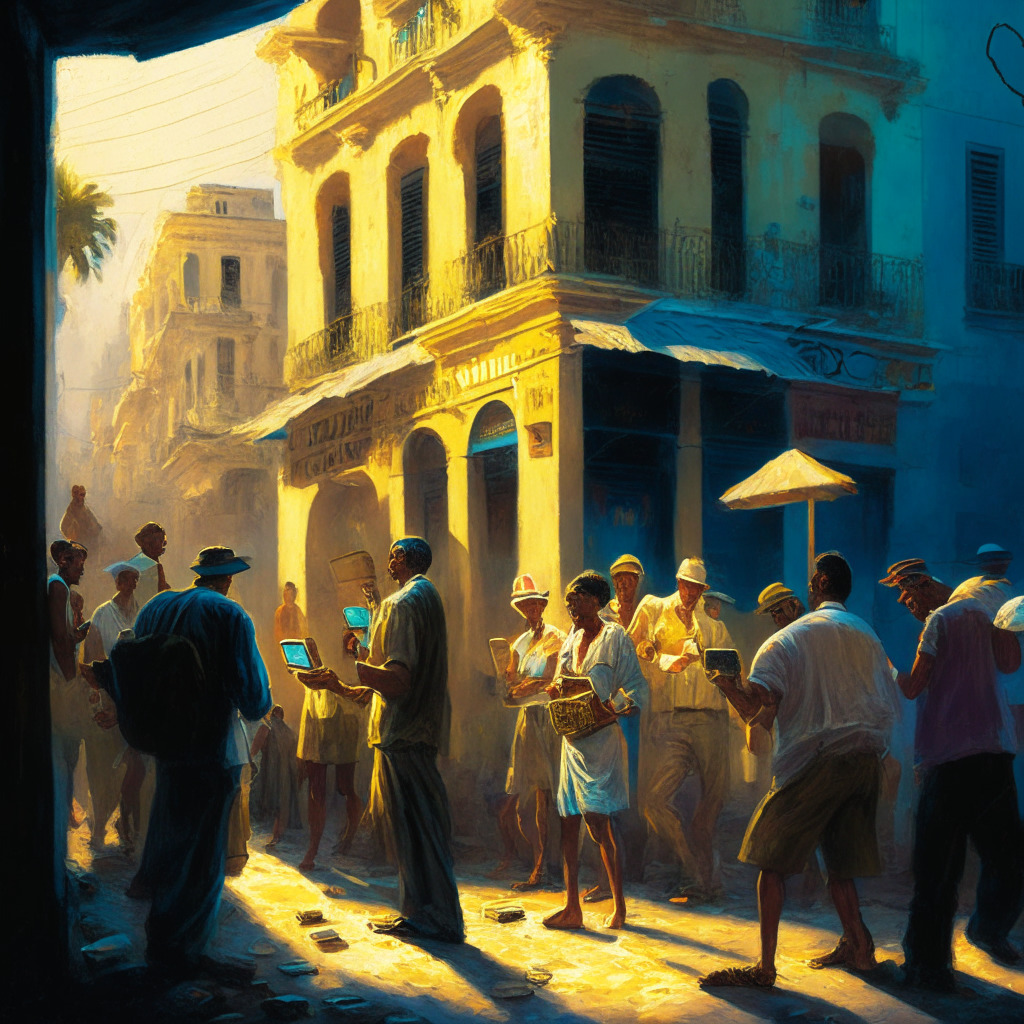

Bitcoin Awareness Rises in Cuba amid Fears of National Currency Decline

Amid devaluation of the Cuban peso and inflation, the crypto community in Havana, Cuba is turning to Bitcoin due to its relative financial stability. Despite governmental restrictions, Cubans have developed ways to buy and sell Bitcoin, hoping for a more economically secure future.

Navigating the High-Stakes Landscape: The Bold Moves of DWF Labs in Crypto Venture Capitalism

“DWF Labs, a crypto investment firm, has made significant strides in token investing, changing industry norms by focusing on token value to projects. Their strategy targets nine macro-categories for risk diversification, concentrating on potential market adoptions and project team success. Investments include TON, EOS, and recent addition, Crypto GPT, as part of their risk mitigation strategy.”

Navigating the Crypto Seas: The Tale of Meme Token PEPE and TG.Casino’s Promising Ascent

“While meme token PEPE’s decline mirrors the struggling market sentiment, TG.Casino (TGC), an Ethereum-based casino platform, makes a strong case with its unique blend of online gaming and social networking. Despite crypto’s high-risk nature, emerging opportunities allow well-versed traders to navigate the market’s intriguing possibilities.”

Navigating the Crypto Seas: Ethereum ETFs, Bullish Coins, and Unexplored Opportunities

Despite a lukewarm reception for recently introduced Ethereum-based ETFs, the crypto market, albeit volatile, offers promise in certain digital assets like GALA, Meme Kombat, Polygon, TG.Casino, and EOS. Meme Kombat, merging memes, crypto, gaming, and gambling, could refresh the crypto gaming sphere with its growing popularity.

Rollbit Coin Rockets Amid Market Surge: A Buying Opportunity or Risky Bet?

“A 24% surge has shaken the crypto market thanks to a refreshing wave of network growth and rising GambleFi revenue, with Rollbit (RLB) at the epicenter. However, a rapidly intensifying Relative Strength Index could necessitate further consolidation. Meanwhile, TG.Casino ($TGC) is causing ripples in the gambling industry, integrating casino games with blockchain decentralization.”

Litecoin’s Flux Versus TG.Casino’s Potential: Navigating Altcoin Investment Opportunities

Over the week, Litecoin’s price showed a slight uptick of 2.5% despite a fundamental lack of significant updates or adoption news. Its 30-day average has flattened, indicating possible growth for the altcoin. Meanwhile, TG.Casino, a new and promising altcoin, attracted over $350,000 in its opening weeks, suggesting interesting investment opportunities.